Financial Reporting and Analysis (6th Ed.)

Chapter 2 Solutions

Accrual Accounting and Income Determination

Exercises

Exercises

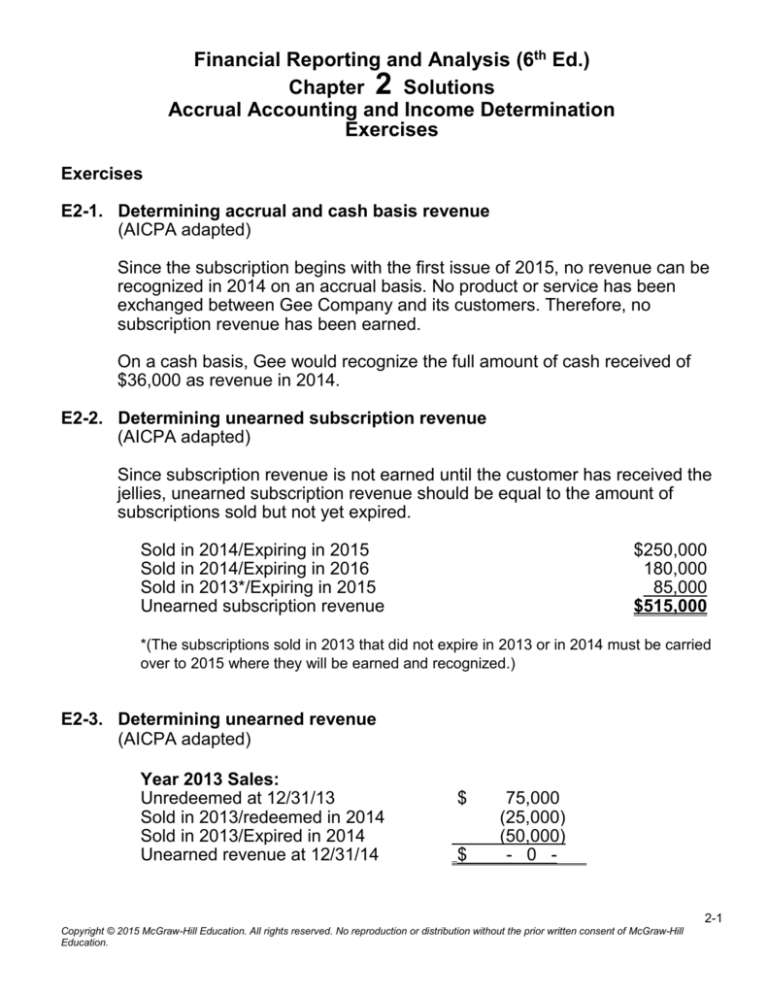

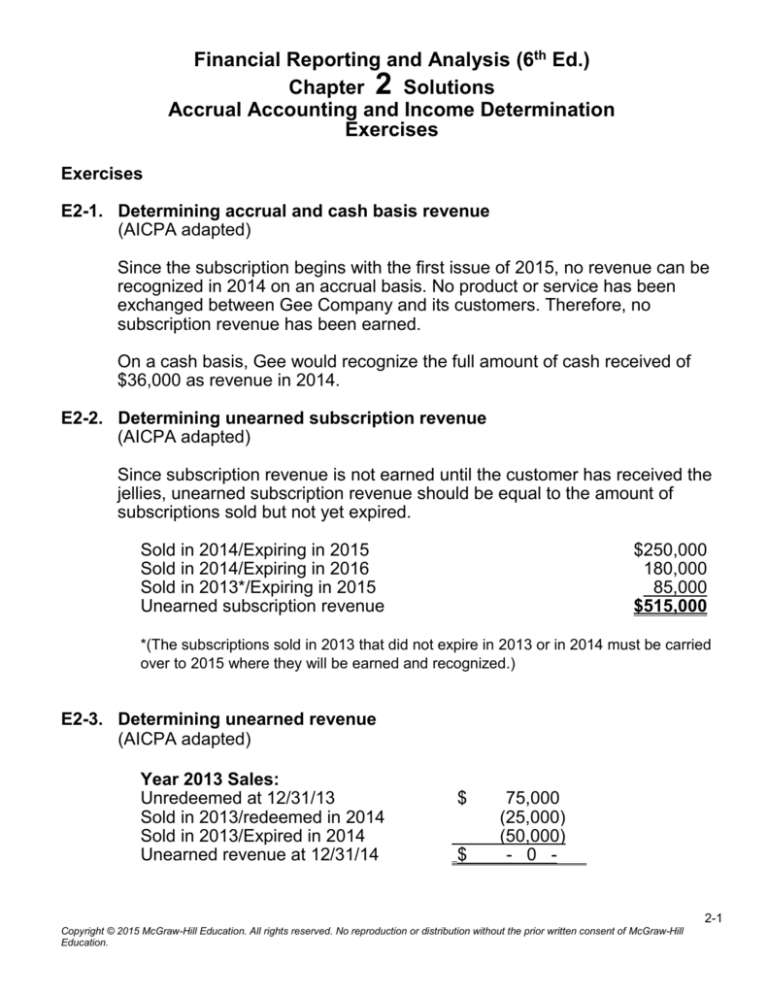

E2-1. Determining accrual and cash basis revenue

(AICPA adapted)

Since the subscription begins with the first issue of 2015, no revenue can be

recognized in 2014 on an accrual basis. No product or service has been

exchanged between Gee Company and its customers. Therefore, no

subscription revenue has been earned.

On a cash basis, Gee would recognize the full amount of cash received of

$36,000 as revenue in 2014.

E2-2. Determining unearned subscription revenue

(AICPA adapted)

Since subscription revenue is not earned until the customer has received the

jellies, unearned subscription revenue should be equal to the amount of

subscriptions sold but not yet expired.

Sold in 2014/Expiring in 2015

Sold in 2014/Expiring in 2016

Sold in 2013*/Expiring in 2015

Unearned subscription revenue

$250,000

180,000

85,000

$515,000

*(The subscriptions sold in 2013 that did not expire in 2013 or in 2014 must be carried

over to 2015 where they will be earned and recognized.)

E2-3. Determining unearned revenue

(AICPA adapted)

Year 2013 Sales:

Unredeemed at 12/31/13

Sold in 2013/redeemed in 2014

Sold in 2013/Expired in 2014

Unearned revenue at 12/31/14

$

$

75,000

(25,000)

(50,000)

- 0 -

2-1

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

2-2

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Year 2014 Sales:

Sales of gift certificates

Less: 10% not to be redeemed

Sold in 2014/redeemed in 2014

Unearned revenue at 12/31/14

$

$

250,000

(25,000)

(175,000)

50,000

Total unearned revenue at 12/31/14 is $50,000.

E2-4. Determining when to recognize revenue

(AICPA adapted)

Generally, sales revenue is recognized at the date of delivery, because that

generally is the time at which a sale (title has passed) has occurred. At that

point the two criteria for revenue recognition were met; the revenue is (1)

realized or realizable and (2) it is earned. Therefore, the amount of sales

revenue recognized in 2014 is $600,000 (200,000 gallons x $3 = $600,000).

E2-5. Converting from accrual to cash basis revenue

(AICPA adapted)

Under the cash basis of income determination, the company would not regard

its ending accounts receivable as revenue but it would include beginning

accounts receivable that are assured to be collected in cash during the

current year( except for accounts written off). To find cash basis revenue, we

have to subtract the increase in accounts receivable from the revenue figure:

Accrual basis revenue

$1,750,000

+ Beginning accounts receivable balance

375,000

- Ending accounts receivable balance

(505,000)

- Write-offs of accounts receivable

(20,000)

Cash basis revenue (cash collections on accounts receivable) $1,600,000

Alternate Solution:

Accounts Receivable

Beginning balance

Sales on account

(Accrual basis

revenue)

$375,000

1,750,000

$20,000 Accounts receivable write-off

$1,600,000 Solve for: Cash collections

Ending balance

$505,000

$375,000 + $1,750,000 - $20,000 - X = $505,000

X = $1,600,000

2-3

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-6. Converting from cash to accrual basis revenue

(AICPA adapted)

To change Dr. Hamilton’s revenue from cash basis to an accrual basis, we

have to add the earned but uncollected accounts receivable and subtract the

beginning accounts receivable collected in 2014 but earned in 2013. We also

need to subtract fees collected in 2014 but not earned until 2015 (unearned

fees on 12/31/14):

Cash basis revenue

- Beginning accounts receivable (12/31/13)

+ Ending accounts receivable (12/31/14)

- Unearned fees on 12/31/14

Accrual basis revenue

$200,000

(18,000)

25,000

(8,000)

$199,000

E2-7. Converting from accrual to cash basis expense

(AICPA adapted)

The total amount of insurance premiums paid in 2014 is equal to the

insurance expense for 2014 plus the ending balance in prepaid insurance and

less the beginning balance in prepaid insurance.

2014 Insurance expense

+ Ending balance in prepaid insurance 12/31/14

- Beginning balance in prepaid insurance 12/31/13

Insurance premiums paid in 2014

$875,000

245,000

(210,000)

$910,000

Alternate Solution:

The amount of premiums paid can be determined from a T-account analysis

of prepaid insurance.

Prepaid Insurance

Beginning

balance

Premiums paid

$210,000

X $875,000

Ending balance

$245,000

Amounts charged to insurance

expense

$210,000 + X - $875,000 = $245,000

X = $875,000 + $245,000 - $210,000

X = $910,000

2-4

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-8. Determining Gain (loss) from discontinued operations

Munnster Corporation

Partial Income Statement

For the Years Ended December 31

2014

2013

**Income from continuing operations,

before taxes

$ 1,405,000 $ 920,000

Income tax expenses

421,500

276,000

Income from continuing operations after

983,500

644,000

taxes

Discontinued operations:

Loss from discontinued division, net of

tax benefits of $151,500 in 2014 and

$51,000 in 2013

(353,500)

(119,000)

Gain from sale of discontinued division,

net of taxes expense of $105,000

245,000

-0Net income

$

875,000 $ 525,000

**Income from continuing operations, before taxes excludes the losses from

discontinued division and is calculated as follows:

2014

2013

Income from continuing operations, before

taxes

$

900,000 $ 750,000

Loss from discontinued division, before taxes

505,000

170,000

Income from continuing operations, before taxes

(excluding losses from discontinued division): $ 1,405,000 $ 920,000

2-5

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-9. Determining loss on discontinued operations

Under, results of operations on an operating segment or component of an

entity classified as held for sale are to be reported in discontinued operations

in the periods in which they occur (net of tax effects). For Revsine, the loss

from operations for the discontinued segment would be $350,000 determined

as follows:

Loss from 1/1/14 to 8/31/14

Loss from 9/1/14 to 12/31/14

Total pre-tax loss

Tax benefit at 30%

Operating loss, net of tax effects

($300,000)

($200,000)

($500,000)

150,000

($350,000)

None of the expected profit from operating the segment or component for

Revsine in 2015 or the estimated gain on sale is recognized in 2014. These

amounts will be recognized in 2015 as they occur.

E2-10. Determining period vs. product costs

Period Cost

Product Cost

Matched

with

sales

as inventory

cost

Depreciation on office building

X

Insurance expense for factory building

Product liability insurance premium

X

X

Transportation charges for raw materials

X

Factory repairs and maintenance

X

Rent for inventory warehouse*

X

Cost of raw materials

X

Factory wages

X

Salary to chief executive officer

X

Depreciation on factory

X

Bonus to factory workers

X

Salary to marketing staff

X

2-6

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Administrative expenses

X

Bad debt expense**

X

Advertising expense

X

Research and development

X

Warranty expense***

X

Electricity for plant

X

*Rent for inventory warehousing can be argued to be product costs and

included as part of inventory costs. However, many companies expense this

cost as a period expense because of materiality considerations.

** Bad debt expense is typically deducted from sales to arrive at Net Sales.

We show it as a period cost because it is not shown as an inventory cost that

is shown as part of Cost of goods sold.

***Warranty expense is matched against sales in the period in which the

products subject to warranties are sold, not when the warranty costs are

incurred. However, it is not an inventory cost that becomes part of cost of

goods sold. Therefore, we show it as a period expense.

E2-11. Cash versus accrual analysis

To report Kelly Plumbing Supply’s revenues on an accrual basis, we need

to subtract the accounts receivable collected in December but earned in

November and add the sales on account made during December to the

cash received from customers during December 2014.

To report Kelly Plumbing’s expenses on an accrual basis, we have to subtract

the cash paid to suppliers in December for inventory purchased and used in

November and add inventory that was purchased in November and used in

December to the cash paid to suppliers for inventory during December 2014.

Cash received from customers during December 2014

$387,000

Cash received in December for November accounts receivable (139,000)

December sales made on account-collected in January

141,000

Accrual basis revenues

$389,000

Cash paid to suppliers for inventory during December 2014

Payments for inventory purchased and used in November

Inventory purchased in November but used in December

Accrual basis expenses

$131,000

(19,000)

39,000

$151,000

Accrual basis revenues

Less: Accrual basis expenses

$389,000

(151,000)

2-7

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Gross profit for the month of December

$238,000

E2-12. Determining effect of omitting year-end adjusting entries

OS = overstated

US = understated

NE = no effect

Item

1. Supplies Inventory

Direction of effect

Dollar amount of effect

1Expense

OS

$9,0001

NE

OS

$9,000

OS

$6,0002

US

$6,000

NE

NE

US

$2,5003

OS

$2,500

US

$4,5004

OS

$4,500

expense not recorded = $2,500

4. Interest Expense

Direction of effect

Dollar amount of effect

4Interest

Liabilities

not recorded = $6,000 from July 1, 2014 to December 31, 2014

3. Gasoline Expense

Direction of effect

Dollar amount of effect

3Gasoline

Assets

not recorded = $12,000 - $3,000

2. Unearned Revenue

Direction of effect

Dollar amount of effect

2Revenue

Net

Income

NE

expense for 9 months not accrued = $50,000 x 0.12 x 9/12 = $4,500

5. Depreciation Expense

Direction of effect

Dollar amount of effect

5Depreciation

OS

$10,0005

NE

OS

$10,000

expense not recorded = $30,000/3 = $10,000

2-8

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-13. Preparing a multiple-step income statement

Hardrock Mining Co.

Income Statement

Year Ended December 31, 2014

($ in 000)

Net sales

Cost of products sold

Gross Profit

Marketing, administrative and other expenses

Interest expense

Investment losses*

Restructuring charges

Earnings before income taxes

Provision for income taxes

Income before extraordinary item

Extraordinary gain, net of income tax effect of $3,600**

Net income

Earnings per common share:

Income before extraordinary item

Extraordinary gain, net of income tax effect

Net income

$5,281,954

(4,765,505)

$516,449

(193,147)

(17,143)

(57,752)

(8,777)

$239,630

(71,889)

$167,741

8,400

$176,141

$16.77

0.84

$17.61

The “Other, net” caption as originally reported is broken down as follows:

* “Other, net” as originally reported ($ in 000)

Less: Restructuring charge

Plus: Extraordinary gain

Investment losses

$54,529

(8,777)

12,000

$57,752

The gain related to the property taken by the government under its “eminent

domain” rights qualifies for extraordinary gain treatment because such takings

meet the unusual and infrequent test. Extraordinary items are presented “net

of tax” as calculated below. The “restructuring loss” may be infrequent, but

would not be considered unusual, thus it is not extraordinary and should be

separately disclosed as a component of operating income. Removing these

two items from “Other, net” leaves only the investment losses in the original

caption, which should be relabeled “investment losses.”

** Extraordinary item

Income taxes on extraordinary item (30% tax rate)

$12,000

3,600

2-9

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Extraordinary item net of taxes

$8,400

The foreign currency loss ($55,000) does not surpass any reasonable

materiality threshold (e.g., greater than 1% of net income) so it may remain in

“marketing, administrative and other expenses.” Had this loss been material,

separate disclosure as a component of operating income would be warranted.

Per share disclosures are required on the face of the income statement for

income from operations and items that follow on the income statement.

E2-14. Preparing income statement with irregular items

KEW Corporation

Partial Income Statement

For the Year Ended December 31, 2014

Income from continuing operations

before income taxes

$ 4,344,000**

Income tax expense

(1,520,400)

Income from continuing operations

$ 2,823,600

Discontinued operations:

Loss from operation of discontinued

division, net of tax benefit of $227,500

(422,500)

Loss from disposal of discontinued

division, net of tax benefit of $84,000

(156,000)

Income before extraordinary item

$ 2,245,100

Extraordinary loss, net of income tax

benefit of $138,250

(256,750)

Net income

$ 1,988,350

Earnings per common share:

Income from continuing operations

Discontinued operations:

Loss from operation of discontinued

division

Loss from disposal of discontinued

division

Income before extraordinary item

Extraordinary loss

Net income

*Cost of machinery sold during 2014

Less: Accumulated depreciation

Book value of machinery

$

5.65

$

(0.85)

$

$

$

$

(0.31)

4.49

(0.51)

3.98

$

300,000

(225,000)

$

75,000

2-10

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

continued

Selling price of machinery

Less: Book value of machinery

Gain on sale of machinery

$

**Income from continuing operations as reported

Write off uncollectible note

Gain on sale of machinery

Income from continuing operations before taxes

4,350,000

(16,000)

10,000*

$ 4,344,000

$

85,000

(75,000)

10,000

Note to the instructor: Because KEW occasionally sells used machinery, the

machinery sale described in the problem should be separately disclosed as a

component of operating income, not as an irregular item. The expropriation

loss is among the items cited in the text as typically being extraordinary items.

The stated fact that KEW had no other foreign operations reinforces—from

KEW’s perspective—the unusual and infrequent nature of this loss.

E2-15. Change in inventory methods

Requirement 1:

Retained earnings balance at January 1, 2014,

using LIFO

Increased pretax income prior to 2014 using

FIFO

Less: income tax at 30%

Cumulative net income and thus retained

earnings would have been higher by

Retained earnings balance at January 1, 2014,

using FIFO

$1,750,000

$80,000

(24,000)

Requirement 2:

1/1/2014 To record a change in inventory method

DR Inventory (increase inventory to FIFO)

$80,000

CR Retained earnings (additional income

If FIFO had been used)

CR Deferred tax liability (30% x $80,000)

56,000

$1,806,000

$56,000

24,000

E2-16. Income statement presentation

2-11

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Event 1 is a discontinued operation and would appear on the income

statement below income from continuing operations. To qualify for

discontinued operation treatment, the sold component must be separable,

both operationally and financially, from the rest of the operation. Further,

Krewatch cannot have any significant continuing involvement in the

operations of the sold component. These conditions appear to be met..

Event 2 would be reported as a special, nonrecurring or unusual item and

thus would be included in income from continuing operations. Restructurings

may be infrequent, but they are not that unusual in today’s business

environment so this event is not an extraordinary item.

Event 3 is an extraordinary item and would appear on the income statement

below income from continuing operations. To qualify for extraordinary

treatment, an extinguishment now must meet the unusual and infrequent test.

Given that the retired bonds were the only ones issued in the company’s

history, this test appears to be met.

Event 4 is a change in accounting principle and would require retrospective

application (i.e., prior year income statement numbers presented for

comparative purposes would be restated to reflect the average cost method

of inventory costing. The current year income statement numbers would be

based on applying the average cost method. The effect of the accounting

principle change on the current period income numbers would be disclosed in

a note to the financial statements explaining the accounting change.

Event 5 is a change in accounting estimate and thus would be included in

income from continuing operations. No special income statement disclosure

of this event is required. Depreciation expense in 2014 (and beyond) will be

calculated using the (new) shorter lives. The range of equipment lives used

for depreciation purposes may need to be adjusted in the notes to Krewatch’s

financial statements.

Event 6 is a special, nonrecurring or unusual item and thus would be included

in income from continuing operations. Inventory write-offs may be infrequent,

but they are not unusual so this event is not an extraordinary item.

Event 7 is a special, nonrecurring or unusual item and thus would be included

in income from continuing operations. Equipment sales are considered a

normal part of ongoing business activity.

2-12

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-17. Comprehensive income

JDW Corporation

Income Statement and Statement

of Comprehensive Income

For the Year Ended December 31, 2014

Sales

$ 2,929,500

Cost of goods sold

(1,786,995)

Gross profit

1,142,505

Selling and administrative expenses

(585,900)

Income from operations, before income taxes

556,605

Income taxes

(166,982)

Net income

$ 389,623

Net income

Unrealized holding loss, net of tax of $6,600

Foreign currency translation adjustment

Unrealized loss from pension adjustment, net

of tax of $2,100

Comprehensive income

$

$

389,623

(15,400)

26,250

(4,900)

395,573

E 2-18. Reporting of Revaluations in OCI.

1. Revaluations occur when the company hires and then receives a valuation

report from a professional appraiser. The company has no current interest in

selling the land or property, plant, and equipment, so any changes in value are

unrealized. Because these changes in value are unrealized and the company

has no current interest in realizing them through a sales transaction, the

changes in value are reported in Other Comprehensive Income. If the

company were to actually sell the property to realize the changes in value, then

the changes would appear in Net Income.

2. The values of land and property, plant, and equipment went up because the

company reports the Revaluation changes as a positive increase in Other

Comprehensive Income.

3. U.S. GAAP does not allow for upward Revaluation of land or property, plant,

and equipment. Therefore there would be no entry observed for Revaluation in

Other Comprehensive Income.

2-13

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

E2-19. Calculating EPS

1. Net income – Preferred stock dividend = $10.5 - $2 = $8.5 million

2. Weighted Average number of common shares

= 0.25 x 20 + 0.75 x 26 = 24.5 million shares

3. EPS = $8.5/24.5 = $0.347 per share

2-14

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Financial Reporting and Analysis (6th Ed.)

Chapter 2 Solutions

Accrual Accounting and Income Determination

Problems

Problems

P2-1. Determining royalty revenue

(AICPA adapted)

Royalty revenue should be recognized when earned, regardless of when the

cash is collected. Royalty revenue earned from 12/1/13 to 5/31/14 is

$240,000 (30% x $800,000). Since 12/31/13 Royalties receivable was

$40,000, that portion of the $240,000 was earned in 2013. Therefore, royalty

revenue earned from 1/1/14 to 5/31/14 is $200,000 ($240,000 - $40,000).

Royalty revenues earned from 6/1/14 to 11/30/14 were $180,000

(30% x 600,000), and the amount earned from 12/1/14 to 12/31/14 was

$30,000 (30% x 100,000). The total 2014 revenue is $410,000 as

shown below.

Earned 12/1/13 to 5/31/14 (30% x $800,000)

Less amount earned 12/1/13 to 12/31/13

Earned 1/1/14 to 5/31/14

Earned 6/1/14 to 11/30/14 (30% x $600,000)

Earned 12/1/14 to 12/31/14 (30% x $100,000)

Amount earned in 2014

$240,000

(40,000)

200,000

180,000

30,000

$410,000

P2-2. Preparing Journal entries and statement

Requirement 1: Journal Entries

1/1/14: To record entry for cash contributed by owners

DR Cash

$200,000

CR Contributed capital

$200,000

1/1/14: To record entry for rent paid in advance

DR Prepaid rent

$24,000

CR Cash

$24,000

3/1/14: No entry upon signing of contract

2-15

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

7/1/14: To record entry for purchase of office equipment

DR Equipment

$100,000

CR Cash

$100,000

11/30/14: To record entry for salary paid to employees

DR Salaries expense

$66,000

CR Cash

$66,000

12/31/14: To record entry for advance-consulting fees received from Norbert Corp.

which are unearned at year-end.

DR Cash

$20,000

CR Advances from customer

$20,000

Requirement 2: Adjusting Entries

DR Rent expense

CR Prepaid rent

$12,000

$12,000

Only one year’s rent is expensed in the income statement for 2014. The

balance will be expensed in next year’s income statement.

DR Accounts receivable

$150,000

CR Revenue from services rendered

$150,000

The income was earned this year because Frances Corp. has completed its

obligation.

DR Depreciation expense

CR Accumulated depreciation

$10,000

$10,000

Annual depreciation is $100,000/5 = $20,000. Since the equipment was used

for only 6 months, the depreciation charge for this year is only $20,000/2 =

$10,000.

DR Salaries expense

CR Salaries payable

$6,000

$6,000

To accrue salaries expense for December 2014.

2-16

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Requirement 3: Income statement

Frances Corporation

Income Statement

For Year Ended December 31, 2014

Revenue from services rendered

$150,000

Less: Expenses

Salaries

($72,000)

Rent

(12,000)

Depreciation

(10,000)

(94,000)

$56,000

Net income

Requirement 4: Balance sheet

Frances Corporation

Balance Sheet

December 31, 2014

Assets

Cash

Accounts receivable

Prepaid rent

Equipment

Less: Accumulated depr.

Net equipment

Total assets

$30,000

150,000

12,000

$100,000

(10,000)

Liabilities

Salaries payable

Advances from customers

Stockholders’ Equity

Capital stock

Retained earnings

Total liabilities and stockholders’ equity

__90,000

$282,000

$6,000

20,000

200,000

__56,000

$282,000

2-17

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

P2-3. Converting accounting records from cash basis to accrual basis

(AICPA adapted)

Requirement 1:

Stein Flowers

Conversion from Cash basis to Accrual basis

December 31, 2014

Cash basis

Dr.

Cash

Adjustments

Cr.

Dr.

Cr.

$23,200

Accrual basis

Dr.

Accounts receivable

16,200

$11,300 (1)

27,500

Inventory

58,000

13,900 (4)

71,900

Furniture and fixtures

Land improvements

128,500

128,500

50,000

50,000

Accumulated depreciation and amortization

Accounts payable

$32,400

$14,875 (6)

$47,275

21,000

12,500 (3)

33,500

Stein, drawings

73,000 (9)

Stein, capital

Cr.

$23,200

124,900

2,000 (7)

Allowance for uncollectibles

73,000

2,900 (5)

125,800

2,800 (2)

Prepaid insurance

3,000 (5)

Contingent liability

2,800

3,000

40,000 (8)

40,000

Utilities payable

1,500 (7)

1,500

Payroll taxes payable

1,600 (7)

1,600

Sales

660,000

Purchases

307,300

Salaries

174,000

Payroll taxes

Insurance expense

11,300 (1)

12,500 (3)

60,000 (9)

12,400

500 (7)

9,000

2,900 (5)

Rent expense

34,200

Utilities expense

12,500

Living expense

13,000

671,300

319,800

114,000

12,900

3,000 (5)

8,900

34,200

600 (7)

13,100

13,000 (9)

Bad debt expense

2,800 (2)

2,800

Amortization for land improvement

1,875 (6)

1,875

Depreciation expense

13,000 (6)

13,000

Loss pending litigation

40,000 (8)

40,000

Cost of goods sold

________ ________ ________

$838,300 $838,300

$177,375

__

13,900 (4)_______ _

$177,375

_13,900

$937,675 $937,675

Journal entries:

1)

2)

DR Accounts receivable

CR Sales

To adjust accounts receivable to $27,500

DR Bad debt expense

$11,300

$11,300

$2,800

2-18

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

CR Allowance for uncollectibles

To record adjustment for uncollectable accounts

3)

4)

5)

$2,800

DR Purchases

CR Accounts payable

To adjust accounts payable to $33,500

$12,500

DR Inventory

CR Cost of goods sold

To adjust inventory to $71,900

$13,900

DR Prepaid insurance1 ($9,000 x 4/12)

DR Insurance expense2

CR Insurance expense

CR Stein, capital

$12,500

$13,900

$3,000

2,900

$3,000

2,900

1To

allocate $9,000 insurance between this year and next.

record the first 4 months of expense for 2014 ($8,700/12 mos. =

$725/mo. x 4 = $2,900).

2To

6)

DR Amortization of land improvements

$1,875

DR Depreciation expense

13,000

CR Accumulated depreciation and amortization

To record depreciation and amortization expense

$14,875

7)

DR Stein, capital

$2,000

DR Payroll taxes

500

DR Utilities

600

CR Utilities payable

$1,500

CR Payroll taxes payable

1,600

To record year-end accrual expenses and adjust expenses and capital

at the beginning of the year

8)

DR Loss from pending litigation

CR Contingent liability

To accrue a contingent liability

9)

$40,000

DR Stein, drawings

$73,000

CR Salaries

CR Living expenses

To adjust drawings account for personal expenses

$40,000

$60,000

13,000

2-19

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Requirement 2:

To: Stein Flowers

Re: Reconciliation from cash to accrual basis

When acquiring information about a potential debtor, a lending bank will often

request financial statements prepared under the accrual basis. In comparison

with cash-basis financial statements, accrual-basis financial statements

provide a bank with more relevant information about a potential debtor’s

ability to meet its obligations as they become due. The accrual basis of

accounting attempts to match expenses with their related revenues. Thus,

revenues and expenses are recognized when earned or incurred rather than

when cash is received or paid. Financial statements based on the accrual

basis of accounting provide a better indication of a company’s performance.

In addition, the accrual basis of accounting provides information that allows

more reliable comparisons to be made from period to period.

Accrual-basis financial statements also provide information that would not be

recognized under the cash basis, such as noncash expenses or accrued

liabilities. The contingent liability arising from the pending litigation against

Stein is relevant information that would not have been reflected in cash-basis

financial statements. The accrual of this contingency alerts the bank to a

future cash outflow that may affect Stein’s ability to meet principal or interest

payments in the future.

P2-4. Adjusting entries and statement preparation

Requirement 1:

DR Advance to employee

CR Salaries expense

$5,000

$5,000

DR Prepaid insurance

CR Insurance expense

$5,000

DR Bad debt expense

CR Allowance for doubtful accounts

$2,950

DR Dividends

CR Dividends payable

$5,000

$2,950

$20,000

$20,000

Note: It is customary for companies to record dividends declared after

the fiscal year end. This is typically the case with fourth quarter dividends,

i.e., the fourth quarter dividends are declared in the 1st quarter of the

following year.

2-20

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Before preparing the financial statements, let us re-construct the trial balance

after incorporating all the adjusting entries:

Ralph Retailers, Inc.

Adjusted Trial Balance

As of December 31, 2014

Cash

Accounts receivable

Prepaid rent

Inventory

Equipment

Building

Allowance for doubtful accounts

Accumulated depreciation—equipment

Accumulated depreciation—building

Advance from customers

Accounts payable

Salaries payable

Capital stock

Retained earnings 1/1/14

Sales revenue

Cost of goods sold

Salaries expense

Bad debt expense

Rent expense

Insurance expense

Depreciation expense—building

Depreciation expense—equipment

Dividends

Advance to employee

Prepaid insurance

Dividends payable

Debit

$38,700

71,600

12,000

125,000

50,000

125,000

Credit

$5,950

40,000

12,000

18,000

26,000

5,500

70,000

264,850

425,000

276,250

55,000

21,250

40,000

10,000

6,000

3,000

43,500

5,000

5,000

$887,300

20,000

$887,300

2-21

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Requirement 2:

Ralph Retailers, Inc.

Income Statement

For Year Ended December 31, 2014

Sales revenue

Less: Cost of goods sold

Gross margin

Less: Operating expenses

Salaries expense

Bad debt expense

Rent expense

Insurance expense

Depreciation expense—building

Depreciation expense—equipment

$425,000

276,250

148,750

$55,000

21,250

40,000

10,000

6,000

3,000

135,250

$13,500

Net income

Requirement 3:

Ralph Retailers, Inc.

Balance Sheet

December 31, 2014

Assets

Cash

Accounts receivable

Less: Allowance for doubtful accounts

Net accounts receivable

Prepaid rent

Prepaid insurance

Advance to employee

Inventory

$38,700

$71,600

(5,950)

65,650

12,000

5,000

5,000

125,000

Equipment

Less: Accumulated depreciation

Net equipment

50,000

(40,000)

Building

Less: Accumulated depreciation

Net building

Total assets

125,000

(12,000)

10,000

113,000

$374,350

continued

2-22

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Liabilities

Advance from customers

Accounts payable

Salaries payable

Dividends payable

Total liabilities

Shareholders’ equity

Common stock

Retained earnings

Total liabilities and stockholders’ equity

$18,000

26,000

5,500

20,000

69,500

70,000

234,850

$374,350

P2-5. Understanding the accounting equation

Flaps Inc.

Balance Sheet

2013

Assets

Current assets

Non-current assets

Total assets

$

Liabilities

Current liabilities

Non-current liabilities

Total liabilities

Stockholders’ Equity

Common stock

Additional paid-in capital

Contributed capital

Retained earnings

Total stockholders’ equity

Total liabilities and equity

$

5,098

8,667

13,765

Year

2015

2014

$

5,130

8,721

13,851

$

5,200

8,840

14,040

2016

$

5,275

8,968

14,243

2017

$

5,315

9,036

14,351

3,399

5,231

8,630

3,420

5,263

8,683

3,467

5,335

8,802

3,517

5,412

8,929

3,543

5,454

8,997

138

2,202

2,340

2,795

5,135

13,765

139

2,216

2,355

2,813

5,168

$ 13,851

140

2,247

2,387

2,851

5,238

14,040

142

2,280

2,422

2,892

5,314

14,243

144

2,296

2,440

2,914

5,354

14,351

$

$

$

Items in bold are unknowns solved below.

Requirement 1:

Recasting the December 31, 2014 balance sheet. The following steps are

needed to calculate the unknowns. The correct balance sheet appears above.

(Note that there are other possible ways of determining the correct answer for

these solutions.)

2-23

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Item A: 2013 Current liabilities:

Current liabilities plus noncurrent liabilities equals total liabilities.

Therefore, total liabilities ($8,630) less noncurrent liabilities ($5,231)

equals current liabilities ($3,399).

Item B: 2013 Total assets:

Total assets are equal to total liabilities and stockholders’ equity

($13,765).

Item C: 2013 Additional paid-in capital:

Common stock plus additional paid-in capital is equal to contributed

capital. Therefore, contributed capital ($2,340) less common stock

($138) equals additional paid-in capital ($2,202).

Item D: 2013 Current assets:

Current assets plus noncurrent assets equals total assets. So total

assets ($13,765) less noncurrent assets ($8,667) equals current assets

($5,098).

Item E: 2013 Total stockholders’ equity:

Contributed capital ($2,340) plus retained earnings ($2,795) equals total

stockholders’ equity ($5,135).

Item F: 2014 Total liabilities and stockholders’ equity:

Total liabilities ($8,683) plus total stockholders’ equity ($5,168) equals

total liabilities and stockholders’ equity ($13,851).

Item G: 2014 Contributed capital:

Common stock ($139) plus additional paid-in capital ($2,216) equals

contributed capital ($2,355).

Item H: 2014 Total assets:

Total assets are equal to total liabilities and stockholders’ equity

($13,851) which was solved in (F).

Item I: 2014 Noncurrent liabilities:

Current liabilities plus noncurrent liabilities is equal to total liabilities.

Therefore, total liabilities ($8,683) less current liabilities ($3,420) is

equal to non-current liabilities ($5,263).

Item J: 2014 Current assets:

Current assets plus noncurrent assets equals total assets.

Accordingly, total assets ($13,851) less noncurrent assets ($8,721)

equals current assets ($5,130).

2-24

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Item K: 2015 Total liabilities and stockholders’ equity:

Total liabilities and stockholders’ equity is equal to total assets

($14,040).

Item L: 2015 Common stock:

Common stock plus additional paid-in capital equals contributed capital.

So contributed capital ($2,387) less additional paid-in capital ($2,247)

equals common stock ($140).

Item M: 2015 Noncurrent assets:

Current assets plus noncurrent assets equals total assets. Therefore,

total assets ($14,040) less current assets ($5,200) equals non-current

assets ($8,840).

Item N: 2015 Total liabilities:

Current liabilities ($3,467) plus noncurrent liabilities ($5,335) equals

total liabilities ($8,802).

Item O: 2015 Total stockholders’ equity:

Contributed capital ($2,387) plus retained earnings ($2,851) equals total

stockholders’ equity ($5,238).

Item P: 2016 Total liabilities and stockholders’ equity:

Total liabilities ($8,929) plus total stockholders’ equity ($5,314) equals

total liabilities and stockholders’ equity ($14,243).

Item Q: 2016 Retained earnings:

Contributed capital plus retained earnings equals total stockholders’

equity. Accordingly, total stockholders’ equity ($5,314) less contributed

capital ($2,422) equals retained earnings ($2,892).

Item R: 2016 Total assets:

Total assets are equal to total liabilities and stockholders’ equity

($14,243) which was solved in (P).

Item S: 2016 Noncurrent liabilities:

Current liabilities plus noncurrent liabilities is equal to total liabilities.

Therefore, total liabilities ($8,929) less current liabilities ($3,517) is

equal to non-current liabilities ($5,412).

Item T: 2016 Additional paid-in capital:

Common stock plus additional paid-in capital is equal to contributed

capital. Therefore, contributed capital ($2,422) less common stock

($142) equals additional paid-in capital ($2,280).

2-25

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Item U: 2017 Total liabilities and stockholders’ equity:

Total liabilities and stockholders’ equity is equal to total assets

($14,351).

Item V: 2017 Current liabilities:

Take total liabilities and stockholders’ equity ($14,351) which was

calculated in (U), less total stockholders’ equity ($5,354). This equals

total liabilities ($8,997). Total liabilities ($8,997) less noncurrent

liabilities ($5,454) equals current liabilities ($3,543).

Item W: 2017 Contributed Capital:

Common stock ($144) plus additional paid-in capital ($2,296) equals

contributed capital ($2,440).

Item X: 2017 Noncurrent assets:

Current assets plus noncurrent assets equals total assets. Then total

assets ($14,351) less current assets ($5,315) equals noncurrent assets

($9,036).

Item Y: 2017 Retained earnings:

Contributed capital plus retained earnings equals total stockholders’

equity. Accordingly, total stockholders’ equity ($5,354) less contributed

capital ($2,440) equals retained earnings ($2,914).

Item Z: 2017 Total liabilities:

Take total liabilities and stockholders’ equity ($14,351) which was

calculated in (U), less total stockholders’ equity ($5,354). This equals

total liabilities ($8,997).

2-26

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

P2-6. Understanding the accounting equation

Bob Touret, Inc.

Select Information from Financial Statements

2013

2014

Year

2015

$ 2,746

4,002

$ 6,748

$ 2,736

4,501

$ 7,237

$ 3,016

3,900

$ 6,916

$ 2,778

4,230

$ 7,008

$ 2,234

4,805

$ 7,039

1,536

2,212

3,748

1,801

2,345

4,146

1,685

2,175

3,860

1,701

2,206

3,907

1,463

2,252

3,715

Stockholders’ Equity

Contributed capital

Retained earnings

Total stockholders’ equity

Total liabilities and equity

1,250

1,250

1,750

3,000

$ 6,748

1,250

1,841

3,091

$ 7,237

1,300

1,756

3,056

$ 6,916

1,300

1,801

3,101

$ 7,008

1,400

1,924

3,324

$ 7,039

Other Information

Beginning retained earnings

Net income (loss)

Dividends

Ending retained earnings

$ NA

NA

125

NA

$ 1,750

$ 1,750

105

(14)

$ 1,841

$ 1,841 $ 1,756

(76)

55

(9)

(10)

$ 1,756 $ 1,801

$ 1,801

135

(12)

$ 1,924

Working capital

$ 1,210

$

$ 1,331

$

Assets

Current assets

Non-current assets

Total assets

Liabilities

Current liabilities

Non-current liabilities

Total liabilities

935

2016

2017

$ 1,077

771

Items in bold are unknowns solved below.

Requirement 1:

Following are the steps needed to calculate the unknowns. The correct

information appears above. Note that there are other possible ways of

determining the correct answer for these solutions.

Item A: 2013 Current assets:

Current assets plus noncurrent assets equals total assets. Therefore,

total assets ($6,748) less non-current assets ($4,002) equals current

assets ($2,746).

Item B: 2013 Noncurrent liabilities:

2-27

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

First we must solve for (C) total stockholders’ equity. We know that

Total liabilities and stockholders’ equity is equal to Total assets

($6,748). Therefore, total liabilities and stockholders’ equity ($6,748)

less total stockholders equity ($3,000) is equal to total liabilities

($3,748). Current liabilities plus noncurrent liabilities is equal to total

liabilities. Therefore, total liabilities ($3,748) less current liabilities

($1,536) is equal to noncurrent liabilities ($2,212).

Item C: 2013 Total stockholders’ equity:

Contributed capital ($1,250) plus retained earnings ($1,750) equals

total stockholders’ equity ($3,000).

Item D: 2013 Total liabilities and stockholders’ equity:

Total liabilities and stockholders’ equity is equal to total assets

($6,748).

Item E: 2013 Working capital:

Current assets ($2,746) less current liabilities ($1,536) equals working

capital ($1,210).

Item F: 2014 Noncurrent assets:

Solve for (G) total assets first. Current assets plus noncurrent assets

equals total assets. Then total assets ($7,237) less current assets

($2,736) equals noncurrent assets ($4,501).

Item G: 2014 Total assets:

First we need to solve for (H) current liabilities. We then can determine

that current liabilities ($1,801) plus noncurrent liabilities ($2,345) is

equal to total liabilities ($4,146). Total liabilities ($4,146) plus total

stockholders’ equity ($3,091) is equal to total liabilities and

stockholders’ equity ($7,237). Total liabilities and stockholders’ equity

is equal to total assets ($7,237).

Item H: 2014 Current liabilities:

Current assets less current liabilities equals working capital. Hence,

current assets ($2,736) less working capital ($935) equals current

liabilities ($1,801).

Item I: 2014 Contributed capital:

First we need to solve for (J) retained earnings. Contributed capital

plus retained earnings equals total stockholders’ equity. Accordingly,

total stockholders’ equity ($3,091) less retained earnings ($1,841)

equals contributed capital ($1,250).

Item J: 2014 Retained earnings:

2-28

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Beginning of the year retained earnings ($1,750) plus net income

($105) less dividends ($14) equals end of the year retained earnings

($1,841).

Item K: 2014 Total liabilities and stockholders’ equity:

Current liabilities ($1,801) plus noncurrent liabilities ($2,345) is equal to

total liabilities ($4,146). Total liabilities ($4,146) plus total stockholders’

equity ($3,091) is equal to total liabilities and stockholders’ equity

($7,237).

Item L: 2015 Current assets:

First solve for (M) total assets. Current assets plus noncurrent assets

equals total assets. Therefore, total assets ($6,916) less noncurrent

assets ($3,900) equals current assets ($3,016).

Item M: 2015 Total assets:

Total assets are equal to total liabilities and stockholders’ equity

($6,916).

Item N: 2015 Current liabilities:

Current assets less current liabilities equals working capital. Hence,

current assets ($3,016) less working capital ($1,331) equals current

liabilities ($1,685).

Item O: 2015 Noncurrent liabilities:

First solve for total liabilities. Total liabilities and stockholders’ equity

($6,916) less total stockholders’ equity ($3,056) equals total liabilities

($3,860). Current liabilities plus noncurrent liabilities equals total

liabilities. So total liabilities ($3,860) less current liabilities ($1,685)

equals noncurrent liabilities ($2,175).

Item P: 2015 Contributed capital:

Contributed capital plus retained earnings equals total stockholders’

equity. Therefore, total stockholders’ equity ($3,056) less retained

earnings ($1,756) equals contributed capital ($1,300).

Item Q: 2015 Net income (loss):

Beginning of the year retained earnings plus net income less dividends

equals end of the year retained earnings. Therefore, end of the year

retained earnings ($1,756) plus dividends ($9) less beginning of the

year retained earnings ($1,841) equals net loss ($76).

Item R: 2016 Noncurrent assets:

Current assets plus noncurrent assets equals total assets. Therefore,

total assets ($7,008) less current assets ($2,778) equals noncurrent

assets ($4,230).

2-29

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Item S: 2016 Current liabilities:

First solve for (U) total stockholders’ equity. Total liabilities and

stockholders’ equity ($7,008) less total stockholders’ equity ($3,101)

equals total liabilities ($3,907). Current liabilities plus noncurrent

liabilities equals total liabilities. Therefore, total liabilities ($3,907) less

noncurrent liabilities ($2,206) equals current liabilities ($1,701).

Item T: 2016 Retained earnings:

Beginning of the year retained earnings plus net income less dividends

equals end of the year retained earnings. Therefore, end of the year

retained earnings from 2014 ($1,924) plus dividends from 2014 ($12)

less net income from 2014 ($135) equals beginning of the year

retained earnings ($1,801) which is also the end of the year retained

earnings for 2016.

Item U: 2016 Total stockholders’ equity:

Contributed capital ($1,300) plus retained earnings ($1,801) equals

total stockholders’ equity ($3,101).

Item V: 2016 Working capital:

Current assets ($2,778) less current liabilities ($1,701) equals working

capital ($1,077).

Item W: 2016 Dividends:

Beginning of the year retained earnings plus net income, less

dividends, equals end of the year retained earnings. Accordingly, end

of the year retained earnings ($1,801) less net income ($55) and

beginning of the year retained earnings ($1,756) equals dividends

($10).

Item X: 2017 Current assets:

Current assets less current liabilities equals working capital. So

working capital ($771) plus current liabilities ($1,463) equals current

assets ($2,234).

Item Y: 2017 Total assets:

Current assets ($2,234) plus noncurrent assets ($4,805) equals total

assets ($7,039).

Item Z: 2017 Contributed capital:

First solve for (AA) total stockholders’ equity. Contributed capital plus

retained earnings equals total stockholders’ equity. Therefore, total

stockholders’ equity ($3,324) less retained earnings ($1,924) equals

contributed capital ($1,400).

2-30

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Item AA: 2017 Total stockholders’ equity:

First solve for (BB) total liabilities and stockholders equity. Next solve

for total liabilities. Current liabilities ($1,463) plus noncurrent liabilities

($2,252) equals total liabilities ($3,715). Total liabilities and

stockholders’ equity ($7,039) less total liabilities ($3,715) equals total

stockholders’ equity ($3,324).

Item BB: 2017 Total liabilities and stockholders’ equity:

Total liabilities and stockholders’ equity is equal to total assets

($7,039).

P2-7. Converting from cash to accrual

Requirement 1:

Accounts receivable

Beginning accounts

receivable

$128,000

$319,000 Cash received on account

Solve for:

sales on account

$326,000

Ending accounts receivable

$135,000

$128,000 + X - $319,000 = $135,000

X = $326,000

Requirement 2:

Salaries payable

$8,000 Beginning salaries payable

Cash paid for salaries

$47,000

Solve for:

$44,000 salary expense

$5,000 Ending salaries payable

$8,000 + X - $47,000 = $5,000

X = $44,000

2-31

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Requirement 3:

To solve for cost of goods sold we must first determine what our purchases

for August were by analyzing Accounts payable.

Accounts payable

$21,000 Beginning accounts payable

Cash paid to suppliers

$130,000

$134,000 Solve for: purchases on account

$25,000 Ending accounts payable

$21,000 + X - $130,000 = $25,000

X = $134,000

We can now solve for Cost of good sold by plugging the purchases into the

Inventory account.

Inventory

Beginning inventory

purchases (solved above)

$33,000

$134,000

$142,000 Solve for: cost of goods sold

Ending inventory

$25,000

$33,000 + $134,000 - X = $25,000

X = $142,000

P2-8. Journal entries and statement preparation

Requirement 1:

a. DR Cash

CR Contributed Capital

b. DR Equipment

CR Cash

DR Depreciation expense

CR Accumulated depreciation

($30,000 - $5,000/ 60 months)

$90,000

$90,000

$30,000

$30,000

$

417

$

417

2-32

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

c. DR Inventory

CR Accounts payable

DR Accounts payable

CR Cash

$15,000

$15,000

$10,000

$10,000

d. DR Rent expense

DR Prepaid rent

CR Cash

$

e. DR Utilities expense

CR Cash

$ 800

f. DR Accounts receivable

CR Revenue

DR Cash

CR Accounts receivable

500

1,000

$ 1,500

$

800

$35,000

$35,000

$26,000

$26,000

DR Cost of goods sold

CR Inventory

($15,000 x .60 = $9,000)

$9,000

g. DR Wages expense

CR Wages payable

CR Cash

$ 5,600

h. DR Cash

CR Notes payable

$12,000

$ 9,000

$

400

5,200

$12,000

DR Notes payable

CR Cash

$ 3,000

DR Interest expense

CR Interest payable

$

$ 3,000

450

$

450

2-33

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Bob’s Chocolate Chips and More

Income Statement

For Month Ended October 31, 2014

Sales revenue

Less: Cost of goods sold

Gross margin

Less: Operating expenses

Wage expense

Rent expense

Utility expense

Depreciation expense

Interest expense

Net income

$

$ 5,600

500

800

417

450

$

35,000

9,000

26,000

7,767

18,233

Bob’s Chocolate Chips and More

Balance Sheet

October 31, 2014

Assets

Cash

Accounts receivable

Inventory

Prepaid rent

Equipment

Less: Accumulated depreciation

Net equipment

Total assets

Liabilities

Accounts payable

Interest payable

Wages payable

Notes payable

Total liabilities

Shareholders’ equity

Contributed capital

Retained earnings

Total liabilities and shareholders’ equity

$

$

77,500

9,000

6,000

1,000

30,000

417

$

$

$

29,583

123,083

5,000

450

400

9,000

14,850

90,000

18,233

123,083

2-34

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

P2-9. Determining missing amounts on income statement

AJAX Corporation

Income Statement

For the Year Ended December 31, Year 1

($ in thousands)

Net revenues

Cost of goods sold

Gross profit

Operating expenses

Selling

General and administrative

Research and development

Amortization of intangible assets

Restructuring costs and asset write-downs

Total operating expenses

Operating income

Interest income

Interest expense

Other income, net

Income from continuing operations before taxes

Provision for income taxes

Income from continuing operations

Income from discontinued operations, net of taxes

Income before extraordinary item

Extraordinary gain on extinguishment of debt, net of taxes

Net income

$ 1,275,700

793,358

482,342

159,016

176,868

97,230

7,346

24,444

464,904

17,438

23,944

(13,714)

41,660

69,328

(20,094)

49,234

97,808

147,042

2,242

$ 149,284

Requirement 1:

Recasting the Year 1 income statement. Following are the steps needed to

calculate the unknowns. The correct income statement appears above.

a) Net revenue:

Gross profit and gross profit percentage are given as $482,342 and

37.81%, respectively. Therefore, net revenue equals gross profit divided

by the gross profit percentage, or $482,342 / 37.81% = $1,275,700.

b) Costs of goods sold:

Net revenues less cost of goods sold equals gross profit ($482,342).

Therefore, cost of goods sold equals’ net revenues ($1,275,700) less

gross profit ($482,342) or cost of goods sold equals $793,358.

2-35

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

c) Amortization of intangible assets:

Amortization of intangible assets can be determined by subtracting the

known operating expenses from total operating expenses of $464,904.

Known operating expenses are: selling ($159,016), general and

administrative ($176,868), research and development ($97,230), and

restructuring costs and asset write-downs ($24,444). Or amortization

equals $7,346 ($464,904 – $457,558).

d) Operating income:

Is simply gross profit ($482,342) less total operating expenses ($464,904)

or $17,348.

e) Interest expense:

Income from continuing operations before income taxes ($69,328) equals

operating income ($17,438) plus interest income ($23,944), plus other

income ($41,660) less interest expense. Interest expense is $13,714

($69,328 - $17,438 - $23,944 - $41,660).

f) Income from continuing operations:

Income from continuing operations before income taxes ($69,328) less the

provision for income taxes ($20,094) equals income from continuing

operations, or $69,328 - $20,094 = $49,234.

g) Income before extraordinary:

Net income is given as $149,284 less extraordinary gain on

extinguishment of debt given as $2,242, or $147,042.

Requirement 2:

While it may not be immediately obvious to students, this item had no direct

impact on AJAX’s Year 1 cash flows. This item represents the accrual of

various expenses that AJAX expects to incur in the future. Examples include

severance pay and health-care benefits for employees that left the firm as

part of the restructuring, plant closing costs, etc.

A copy of AJAX’s Year 1 cash flow statement is included as part of the

solution so that students can see that the restructuring charge had no impact

on its cash flows.

Requirement 3:

Agree: If you agree, you might suggest that R&D costs be carried on the

balance sheet as an asset and be charged (i.e., expensed or written off) in

2-36

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

future periods as the new products they produce are brought to market. The

idea behind this approach is the matching principle. Moreover, since these

expenditures are made to benefit future operations and sales, they should be

charged to the future periods that benefit.

Disagree: If you disagree, you might argue that many R&D projects fail, while

only a small number succeed. If all R&D costs were carried on the balance

sheet as an asset, then assets would likely be overstated because some of

the projects will fail, and the projected increase in future sales once expected

because of them may never materialize. The idea behind this approach is

that future benefits to current R&D expenditures are so uncertain, they cannot

be reliably measured and reported on the balance sheet.

Requirement 4:

To forecast next period’s earnings you need to examine what has transpired

during the current period. Any unusual and non-recurring gains (revenues)

and or expenses (losses) should be disregarded, since they are not

expected to be repeated.

Utilizing AJAX’s Year 1 income statement we can make the following

observations:

Assuming that Net revenues and normal operating expenses will remain

constant, then projected Year 2 operating income would be $40,982. (Year

1 operating income of $17,438 plus restructuring costs (considered a

special or unusual charge that would normally not be repeated) of

$24,444.)

Interest income and expense and other income would be analyzed and

revised if necessary and added to operating income. Projected tax rates

would be applied to estimate Year 2 net earnings.

All items below AJAX’s Year 1 Income from continuing operations line

would be considered unusual and non-recurring and therefore not

included in Year 2 projected net earnings.

AJAX Corporation’s Statement of Cash Flows for the year ending December

31, Year 1 follows:

2-37

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

AJAX Corporation

Statement of Consolidated Cash Flows

Year Ending December 31, Year 1

($ in thousands)

Cash Flows from Operating Activities

Net income

Adjustments to reconcile net income to net cash

provided by operating activities:

Restructuring costs and asset write-downs

Depreciation and amortization

Deferred tax provision

Provision for allowance for doubtful accounts

Minority interest

Gain on sale of product rights

Losses on disposal of assets, net

Gains on extinguishment of debt

Income from discontinued operations

Changes in assets and liabilities:

Increase in accounts receivables

Decrease in inventories

Increase in other current assets

Decrease in other assets

Decrease in accounts payable, accrued expenses

and other current liabilities

Increase in other long-term liabilities

Other, net

Net cash provided by operating activities of

discontinued operations

Net cash provided by operating activities

Cash Flows from Investing Activities

Proceeds from divestitures

Capital expenditures

Proceeds from sales of assets

Acquisition of intangibles

Net investing activities of discontinued operations

Net cash provided by investing activities

$ 149,284

24,444

65,104

7,246

15,300

(806)

(30,000)

1,688

(2,242)

(97,808)

(19,172)

27,398

(21,134)

16,000

(5,734)

1,814

1,782

10,056

$ 143,220

175,770

(129,244)

44,318

(35,086)

(404)

$ 55,354

2-38

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

continued

Cash Flows from Financing Activities

Borrowings on long-term debt and loans payable

Payments on long-term debt and loans payable

Issuance of common stock

Repurchase of common stock

Net financing activities of discontinued operations

Net cash used for financing activities

Effect of Exchange Rate changes on Cash

Net Increase in Cash and Cash Equivalents

Cash and Cash Equivalents at Beginning of Year

Cash and Cash Equivalents at End of Year

7,790

(58,304)

5,916

(131,862)

20

($176,440)

(3,418)

18,716

398,470

$ 417,186

P2-10. Determining income from continuing operations and gain (loss) from

discontinued operations

(AICPA adapted)

Requirements:

Helen Corporation

Partial Income Statement

For the Years Ended December 31

1) The amounts to be reported for income from continuing operations

after taxes excludes the losses from operation of discontinued

division and is calculated as follows:

2014

2013

Income from continuing operations,

$ 1,600,000 $ 1,200,000

before taxes

Loss from operation of discontinued

640,000

500,000

division, before taxes, added back

Income from continuing operations,

before taxes (excluding discontinued

division):

$ 2,240,000 $ 1,700,000

Income tax expenses

1,120,000

850,000

Income from continuing operations,

1,120,000

850,000

after taxes

continued

2-39

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

2-40

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

2)

2014

2013

Income from continuing operations,

$ 1,120,000 $ 850,000

after taxes

Discontinued operations:

Loss from operation of discontinued

division, net of taxes benefits of

$320,000 in 2014 and $250,000 in

(320,000)

(250,000)

2013

Gain from sale of discontinued division,

450,000

-0net of taxes expense of $450,000

Net income

$ 1,250,000 $ 600,000

2-41

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

P2-11 Income statement preparation with irregular items

Jordan Wing, Inc.

Partial Income Statement

For the Year Ended December 31, 2014

Income from continuing operations

before income taxes

Income tax expense

Income from continuing operations

Discontinued operations:

Loss from discontinued operations, net of

tax benefit of $120,750

Income before extraordinary item

Extraordinary loss, net of tax benefit of $29,225

Net income

$ 5,184,900 **

(1,814,715)

$ 3,370,185

(224,250)

$ 3,145,935

(54,275)

$ 3,091,660

Earnings per common share:

Income from continuing operations

Discontinued operations:

Loss from discontinued operations, not of

net of tax

Income before extraordinary item

Extraordinary loss, net of income tax effect

Net income

**Net income

Pretax income = (Net income / (1 - tax rate)

Add: Loss on discontinued operations

Add: Extraordinary loss

Income from continuing operations before taxes

$ 22.47

(1.50)

20.97

(0.36)

$ 20.61

$

$

3,091,660

4,756,400

345,000

83,500

5,184,900

Note to the instructor: Several items are described in the problem data that should

not be separately disclosed among the irregular items that follow income from

continuing operations. These include:

The trademark infringement gain, while infrequent, is not unusual so the

gain should be included in income from continuing operations and

separately disclosed.

2-42

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

The gain from selling Xerox stock should be among the items comprising

income from continuing operations and separately disclosed.

The unrecorded impairment loss (although discovered in 2014) constitutes

an error in a prior year’s financial statements, and thus, is reported as a

prior period adjustment by restating the 2013 financial statements if

presented. If 2013 financial statements are not presented, the opening

balance of retained earnings should be adjusted.

In accordance with GAAP, the change in depreciation method is treated as

a change in accounting estimate effected by a change in accounting

principle. Thus, income from continuing operations (correctly in 2014)

reflects the new method; no restatement or retrospective adjustment of

amounts reported in prior years is permitted.

P2-12. Components held for sale

Silvertip Construction, Inc.

Partial Income Statement

For the Year Ended December 31, 2014

Income from continuing operations

$ 1,650,000

Discontinued operations:

Loss from operation of held for sale business

component, net of tax benefit of $33,250

*(61,750)

Impairment loss on held for sale component,

net of tax benefit of $24,185

**(44,915)

Net income

$ 1,543,335

Earnings per share:

Income from continuing operations

Discontinued operations:

Loss from operation of held for sale business

component, net of tax

Impairment loss on held for sale component,

net of tax

Net income

Fair value of component

-Expected cost to sell component (FV x .06)

Fair value of component minus cost to sell

-Book value of component

Impairment loss on held for sale component

$

1.65

(0.06)

$

(0.04)

1.54

$

735,000

(44,100)

690,900

(760,000)

$

(69,100)

* Operating loss on component

= pretax loss x (1 – tax rate) = $95,000 x (1 – .35) = $61,750

2-43

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

** Impairment loss on component

= pretax loss x (1 – tax rate) = $69,100 x (1 – .35) = $44,915

P2-13. Preparing comprehensive income under single-step format

Liz’s Theatrical Supplies, Inc.

Statement of Income and Comprehensive Income

For the Year Ended December 31, 2014

Revenues and gains:

Net sales

$ 791,650

Rent revenue

16,000

Interest income

4,650

Total revenue and gains

812,300

Expenses and losses:

Cost of goods sold

Selling and administrative

Loss on write-off of obsolete inventory

Total expenses

Income from continuing operations, before taxes

Income taxes

Income from continuing operations

Discontinued operations:

Income from discontinued operations, net of tax

Loss from disposal of discontinued component,

net of tax

Income before extraordinary item

Extraordinary loss, net of tax

Net income

Other comprehensive income (loss), net of tax:

Unrealized holding loss on available-for-sale

securities, net of tax

Comprehensive income

(490,823)

(158,330)

(23,500)

(672,653)

139,647

(53,066)

86,581

43,400

(58,900)

71,081

(31,000)

40,081

(9,300)

$ 30,781

Income taxes = $139,647 x .38 = $53,066

Income from discontinued operations

= $70,000 x (1 – tax rate) = $70,000 x .62 = $43,400

Loss from disposal of discontinued component

= $95,000 x (1 – tax rate) = $95,000 x .62 = $58,900

2-44

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill

Education.

Extraordinary loss = $50,000 x (1 – tax rate) = $50,000 x .62 = $31,000

Unrealized holding loss on available-for-sale securities

= $15,000 x (1 – tax rate) = $15,000 x .62 = $9,300

P2-14. Extinguishing debt early

Requirement 1:

When management makes early debt extinguishment a part of the company’s

risk management strategy, such extinguishments are deemed to be part of

the company’s ongoing operations. Accordingly, Smithfield should separately

disclose the gain as a component of income from operations. Only earnings

per share on net income need be presented.

Requirement 2:

The stated facts strongly imply that Smithfield does not regularly retire debt

before it matures. Doing so once in 65 years would make this extinguishment

a prime candidate for extraordinary item treatment as it appears to meet the

“unusual and infrequent” test. Accordingly, an “income before extraordinary

item” subtotal would be inserted before net income, to be followed by the

extraordinary item (presented net of income taxes). Earnings per share would

be presented on the new subtotal, the extraordinary item, and net income.

P2-15. Reporting discontinued operations

**Income from continuing operations, before taxes

Income taxes

Income from continuing operations

Discontinued operations:

Income from operations of discontinued residential

service component, net of taxes of $64,890

Gain from sale of discontinued residential service

component, net of taxes of $8,050

Income from operations of held-for-sale commercial