Innovation - staff.stir.ac.uk

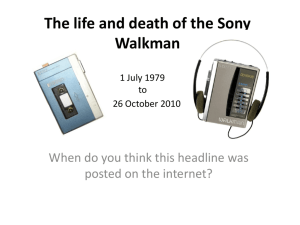

advertisement

L6: Managing Risk in a Turbulent Environment EC10: Innovation & Commercialisation Uncertainty and how to make decisions that build competitive advantage Marcus Thompson wmt1@stir.ac.uk L6 Managing Risk Outline Managing Uncertainty Games Theory Change Management Opportunity Mapping 6 Managing Risk 2 1. Managing Uncertainty EC10 Innovation & Commercialisation Dictionary Definition Innovation "making changes to something established". Oxford English Invention, by contrast, is the act of "coming upon or finding: discovery". Whereas inventors stumble across or make new things, "innovators try to change the status quo". 6 Managing Risk 4 Disruptive Innovation New technological innovation, product or service that eventually overturns the existing dominant technology in the market, despite the fact that the technology is both radically different than the leading technology and that it often initially performs worse than the leading technology according to existing measures of performance. Source(http://en.wikipedia.org/wiki/Disruptive_Technology) Any technology that rapidly leapfrogs over the competition by performing the tasks of an existing technology but in a much 5 6 Managing Risk improved manner.Source: http://wistechnology.com/article.php?id=518 Low end disruption occurs when the rate at which products improve exceeds the rate at which customers can learn and adopt the new performance New market disruption occurs when a product that is inferior by most measures of performance fits a new or emerging market segment Source(http://en.wikipedia.org/wiki/Disruptive_Technology) 6 Managing Risk 6 Examples of Disruptive Innovation Sinclair Micro FM 1965 1st pocket size fm tuner receiver Sony Walkman 1979 1st walkman = $500 (today’s money) 150 million sold & over 300 models – sony alone (‘95) Sony Discman 1984 Transition from cassette tape to CD for better sound quality Sony Minidisc 1992 Smaller than CD with better sound quality MP3 player 1998 RIO 300, 1st portable MP3 player Invented by Digital Network N.America Apple iPod 2001 Sources: http://www.digitalmusicmuseum.com/history/history-of-portable-music.php http://pocketcalculatorshow.com/walkman/history.html http://en.wikipedia.org/wiki/Rio_PMP300 6 Managing Risk http://www.nvg.ntnu.no/sinclair/audio/micro-fm.htm http://tingilinde.typepad.com/starstuff/2003/10/sony_walkman_hi.html 7 Why is it Disruptive? Change of data storage medium Technological innovation From tape cassette to compact disc & minidisc (magneto optical disc) Now Audio file format(mp3,AVI,wma) Using flash drive (most MP3 players) and hard disk (iPod) From tangible devices to digital file Imagine what will happen to music stores, CD manufactures, way of selling music? (copyrights, recording companies) 6 Managing Risk Source: http://en.wikipedia.org/wiki/compact_audio_cassette 8 The Challenge of Discontinuity Growing sense of unease – what’s around the corner? Lessons of history – shifts in the rules of the game = shift in key players Wisdom of hindsight - not invented here, etc. But do we learn? ‘Disruptive innovation’ and other studies Problems go deep – cognitive and emotional problems John Bessant, Cranfield University/ Advanced Institute for Management Multiple triggers for discontinuity Research 6 Managing Risk 9 Discontinuity Smart firms fail, existing incumbents fall Good practice routines may be part of the problem, not the solution Don’t have much practice at ‘do different’ innovation so don’t develop routines for it Increasingly frequent emergence ( technologies, markets, politics, etc.) so a priority management issue Need to think about managing beyond the steady state 6 Managing Risk 10 Steady state vs. discontinuous Degree of uncertainty Uncover Co-evolve Exploit Flex John Bessant, Cranfield University/ Advanced Institute for Management Research Degree of instability 6 Managing Risk 11 Adapting to Industry Changes What are the sector external forces transforming industry? What is the vision for achieving industry leadership what will be our differential advantage, core competences and new channels of distribution? How will the core competences necessary to achieve our vision of world-class competitiveness be built? What strategies must be developed to implement the vision? What are the leadership qualities required from the management team to spearhead the transformation process?” Doyle, 20036 Managing Risk 12 Trade-offs Short-term profit versus long term growth Profit margin versus competitive advantage Direct sales versus market development Penetration of the existing versus new markets Profit versus long-term goals Growth versus stability Riskless versus risky approach to business development. Carson, 2000 6 Managing Risk 13 2. Game Theory EC10 Innovation & Commercialisation Themes of Decision Theories “No man is an island, entire of itself; every man is a piece of the continent.” John Doune “For every action there is NOT an equal and opposite equal reaction” (Newton’s Third Law) Decision theories apply to understanding the firms or6 Managing its consumers Risk 15 The Art of War On the importance of collecting strategic information about your competitors and your company: – Know the enemy and know yourself; in 100 battles you will never be in peril. On the importance of understanding the competition: – Therefore, determine the enemy's plans and you will know which strategy will be successful and which will not. On the need to war-game strategies: – To rely on rustics and not prepare is the greatest of crimes; to be prepared beforehand for any contingency is the greatest of virtues. On the value of being able to react to changes in circumstances: – The general must rely on his ability to control the situation to his advantage as opportunity dictates. He is not bound by established procedures. A general prizes opportune changes in circumstances. Sun Tzu and the Art of Business. Six Strategic Principles by Mark McNeilly. ©1996 by Oxford University Press Inc., used by permission of Oxford University Press, Inc 6 Managing Risk 16 Diffusion Theory diffusion as the process by which an innovation is communicated through certain channels over time among the members of a social system. – innovation - an idea, practices, or objects that is perceived as knew by an individual or other unit of adoption. – communication channels - the means by which messages get from one individual to another. time - the three time factors are: innovation-decision process relative time with which an innovation is adopted by an individual or group. innovation's rate of adoption. – social system - a set of interrelated that are engaged in joint problem solving to accomplish a common goal Rogers, 1962 6 Managing Risk 17 The Contradiction Make a better mousetrap, and the world will beat a path to our door. (?) -Ralph Waldo Emerson 6 Managing Risk 18 Commandments Understand the game you are in Note that the rules are flexible Anticipate your opponents reaction Understand the assumptions Recognise that not everyone understands the rules - or plays to them. 6 Managing Risk 19 The Golden Rule of Competitive Advantage COMMANDMENT Never assume that your competitors behavior is fixed. Predict their reaction to your behavior. 6 Managing Risk 20 Rules of the “Game” Games are Played Simultaneously Anticipating rival’s moves Sequential games Looking forward – reasoning back Mixed strategies Sensibility of being unpredictable Repeated games Cooperation and agreeing to agree against a rival. 6 Managing Risk 21 Techniques For Winning Commitment Credibility, threats, and promises Information Strategic use of information Bargaining Gaining the upper hand in negotiation Auctions Design and Participation 6 Managing Risk 22 Definition of a Competitive Game Must consider the strategic environment Who are the PLAYERS? (Decision makers) What STRATEGIES are available? (Feasible actions) What are the PAYOFFS? (Objectives) Rules of the game What is the time-frame for decisions? What is the nature of the conflict? What is the nature of interaction? What information is available? 6 Managing Risk 23 Dominance & First Leader Advantage CAVEAT Predict opponents’ reaction to your behavior. BUT Be sure you understand who your opponents are. (Do you know everyone who may react to your decisions?) 6 Managing Risk 24 Issues Are the threats by the parties credible? Can cooperation be sustained? Are there informational advantages? 6 Managing Risk 25 Dominance COMMANDMENT If you have a dominant strategy, use it. Expect your opponent to use her dominant strategy if she has one. 6 Managing Risk 26 Equilibrium = Stability Nash Equilibrium: Within an industry sector, assume that a set of strategies has evolved, such that each player’s strategy is best for his or forms given that all other players are playing their equilibrium strategies Best Response: The best strategy I can play given the strategy choices of all other players Everybody is playing a best response No incentive to unilaterally change my strategy 6 Managing Risk 27 Dominance CAVEAT Expect your opponent to use her dominant strategy if she has one. BUT Be sure you understand your opponents’ true payoffs. (Do you know what really motivates them?) 6 Managing Risk 28 Successive Deletion of Dominated Strategies Rational players … – Should play dominant strategies – Should not play dominated strategies – Should not expect others to play dominated strategies – Thus, dominated strategies may be eliminated from consideration – This may be done iteratively 6 Managing Risk 29 3. Change Management EC10 Innovation & Commercialisation Evolution & Economics “It is not the strongest of the species that survives, nor the most intelligent, but the ones most responsive to change.” Charles Darwin, Theory of Evolution based on Theory of Economics 6 Managing Risk 31 Change Management Address the “human side” systematically. Start at the top Involve every layer of the organisation. Make the Business Case Create ownership. Communicate the message. Address culture explicitly. Prepare for the unexpected. Jones & Aguirre, 2004 6 Managing Risk 32 Heuristic Decisions: Goal Formulation Bias / Process Adapted from Schwenk 1984:115 Effect (1) Prior hypothesis bias Evidence ignored, gaps not perceived (2) Adjustment and anchoring Evidence under used, gaps not perceived (3) Escalating commitment Significance of gap minimized, strategy not revised (4) Reasoning by analogy Problem mis-defined (oversimplified), inappropriate strategy revision 6 Managing Risk 33 Heuristic Decisions Bias / Process Effect (1) Single outcome calculation Restricts alternatives to a single one (2) Inferences of impossibility Premature rejection of alternatives (3) Denying value trade-offs Biased use of evaluation criteria (4) Problem sets Alternatives restricted 6 Managing Risk 34 Heuristic Decisions Bias / Process Effect (1) Representativeness a. insensitivity to predictability b. insensitivity to sample size c. illusion of validity Inaccurate prediction of consequences of alternatives. (2) Illusion of control Inaccurate assessment of risks of alternatives. (3) Devaluation or partially described alternatives. Rejection of strong but poorly presented alternatives. 6 Managing Risk 35 Type of Bias Search for supportive evidence – Willingness to gather facts that lead towards certain conclusions and to disregard other facts that threaten them. Inconsistency – Inability to apply the same decision criteria in similar situations. Conservatism Adapte d from Makrida kis, 1990 – Failure to change (or change slowly) one’s own mind in light of new information. Recency – The most recent events dominate those in less recent past, which are downgraded or ignored. Availability – Reliance upon specific events easily recalled from memory, to the exclusion of other pertinent information. Anchoring – Predictions are unduly influenced by initial information which is given more weight in the forecasting process 6 Managing Risk 36 Bias Of Decision Making Illusory correlations – Belief that patterns are evident and/or two variables are causally related when they are not. Selective Perception – People tend to see problems in terms of their own background and experience. Insensitivity to regression effects / misconceptions of regression – Persistent increases in some phenomenon might be due to random reasons, which would raise the chance of a subsequent decrease and vice versa. Bias in attribution of success and failure – Success is attributed to one’s skills while failure to bad luck or someone else’s error. This inhibits learning from mistakes. Optimism or wishful thinking – People’s preferences for future outcomes affect their forecast of such outcomes. Underestimating uncertainty – Excessive optimism, illusory correlation, and the need to reduce anxiety result in underestimation of future uncertainty 6 Managing Risk 37 Integrated Framework 1) Prior hypothesis and focusing on limited targets – Decision makers are likely to bring prior hypotheses into decisionmaking situations, e.g. they may have prior hypotheses about the relationships between variables, and they therefore may overlook or fail to look for evidence which may not support their hypotheses. Managers focus their attention on those key objectives that appeal to their interest and tend to ignore information about other worthwhile objectives. 2) Exposure to limited alternatives – Decision-makers expose themselves to only a limited number of options that can achieve a goal due to incomplete information. Rather than attempting to specify all relevant goals and values and generate a number of courses of action (as normative theory would suggest), decision-makers are exposed to limited options. Adapted from Makridakis, 6 Managing Risk 38 3) Insensitivity to outcome probabilities – Decision-makers tend not to use or understand estimates of outcome probabilities, and are more influenced by the value of possible outcomes than by the magnitude of the probabilities. Decision-makers tend to feel their problems are unique. This is another reason why they do not use outcome probabilities. Decision-makers are characterised by their insensitivity to the validity of estimates. 4) Illusion of manageability. – Decision-makers may inappropriately perceive a success probability higher than the objective probability would warrant, and they then have an illusion of control. Decision-makers may also overestimate the extent to which an outcome is under their control, believing that risk can be reduced by using their professional skills. Managers also have the illusion that consequences of decisions are manageable and this eases managers’ anxiety over such outcomes. 6 Managing Risk 39 Modes of Decision Making Rational Mode – Decision-making is a comprehensive and normative process, in which decision-makers are assumed to be rational and are assumed to enter decision situations with known objectives. Decision-makers gather information (from both the internal and external environment), develop alternatives and objectively select the optimal alternative. Their organisations employ formal, comprehensive analyses to deal with uncertainties in decision making. Avoidance Mode – The avoidance mode is concerned with the fact that strategic decisionmaking processes often lead to a resistance to change. Organisations tend to avoid uncertainty (Cyert & March, 1963). – Maintaining the status quo is a desirable objective. Decision-makers tend to avoid strategic change and avoid identification of new problems. Logic Incrementalist Mode – Strategic decision-making is a step-by-step incremental process. The process is incremental and no dramatic decision is made at any time. It is a consistent movement towards a broad global goal. The purpose of moving incrementally is to gather more information and feedback from the initial action. – In this mode goals are broad and relatively vague, so that they can be modified when more information becomes available. 6 Managing Risk 40 Modes of Decision Making Political Mode – Decision-makers are often unable to attain even a broad consensus on organisational objective. This mode assumes that groups of individuals in the organisation have conflicting interests and fight for a decision favourable to them. Therefore the outcome is decided by who can form the most powerful coalition. The strategic decision process in this mode is a power struggle and the most powerful win. Garbage Can Mode – This is the most uncertain and fluid mode of strategic decision-making. As organisations are viewed as ‘organised anarchies’ there is no particular rationale for making a strategic choice. The decision process consists of four components: 1) choice opportunities 2) solutions, 3) participants and 4) problems. What accounts for the outcome is only timing and chance. 6 Managing Risk 41 Personal Construct Theory the individual creates his or her own ways of seeing the world in which he lives; the world does not create them for him; (s)he builds constructs and tries them on for size; After theKelly constructs are sometimes organized into systems, 1955 group of constructs which embody subordinate and superordinate relationships; the same events can often be viewed in the light of two or more systems, yet the events do not belong to any system; and the individual's practical systems have particular foci and limited ranges of convenience. 6 Managing Risk 42 Alternative Constructs “We assume that all of our present interpretations of the universe are subject to revision or replacement... There are always some alternative constructions available to choose among in dealing with the world." Kelly 1955 "Constructive alternativism argues for an open society in which the pursuit of alternatives is central to the way in which we live. Political doctrines favoring authoritarian forms of social structure require the acceptance of indisputable truths, indisputable 'realities.'" Bannister (1981) 6 Managing Risk 43 Different Aspects of Reality Individuality – "persons differ from each other in their construction of events." Communality – "to the extent one person employs a construction of experience which is similar to that employed by another, his psychological processes are similar to those of the other person." Socialty – "to the extent that one person construes the construction processes of another, he may play a role in a social process involving the other person." 6 Managing Risk 44 4. Opportunity Mapping EC10 Innovation & Commercialisation Adaptive Decision making Normative Decision Making Problem definition Information gathering Identification of solutions Evaluation of solutions Choice of ideal solution Implementation Factors Distorting Decision-Making Management Experience Skills Style Intuition Judgement Motives Resources Information Time Access Analysis Decision making Uncertainty Impact Structure Complexity Formality Routine Review of effectiveness Source: Adapted from Marketing & Entrepreneurship, Carson Et al, 1995, p115 & 117 6 Managing Risk 46 Fuzzy front-end (FFE) of innovation is the period between when an opportunity is first considered and when it is judged ready for development. a clear, well-defined product concept; clear development requirements; a business plan aligned with corporate strategy. 6 Managing Risk 47 Managing a Portfolio An organisation should have a number of projects running simultaneously. Allocating resources is a challenge. Value. Which projects are worth doing Balance Which group (portfolio) fits together. Portfolio Management is dynamic 6 Managing Risk 48 Elements of a Good Portfolio Valuation Criteria Each project should represent good value. The collection of projects must make efficient use of (scarce) resources. Portfolio Balance High risk projects should be balanced by lowrisk Innovation portfolio should fit to strategic need. Goffin, Mitchell, Innovation Management, p189, 2005 6 Managing Risk 49 Opportunity Mapping Stages Build a market-technology map to identify current & future market & technology trends within the competitive landscape. Define product/technology specifications (or main parameters of value) and optimum innovation paths required for achieving growth goals, including time horizons for each path. Opportunity Matchmaking & Identification Identifying the set of potential technology opportunities based upon the product/technology specifications and optimum innovation paths. 6 Managing Risk 50 Opportunity Mapping Opportunity Evaluation & Targeting Systematically evaluating the set of potential opportunities, based upon your business goals, needs, and requirements, resulting in a set of singular opportunities. Product & Technology Road-Mapping Developing and recommending a detailed roadmap for pursuing the identified opportunities. 6 Managing Risk 51 Solutions Identification Leading to . . . Product/Process Cost Reduction Product/Process Function & Feature Improvement New Product/Process Development Identifying & Leveraging Technology Platforms External Technology Sourcing 6 Managing Risk 52 Scenario Planning Drivers for Change Create framework to judge viability & relevance Produce initial scenarios Reduce to two or three scenarios Write Scenarios into Strategic Plan Mercier, 1997 6 Managing Risk 53