How to Make Your Estate Plan EPIC

<Advisor Name>

Financial Advisor

<Firm Name>

<Registered Branch Address>

This information may contain a general discussion of the

relevant federal tax laws. It is not intended for, nor can it be used

by any taxpayer for the purpose of avoiding federal tax penalties.

This information is provided to support the promotion or

marketing of ideas that may benefit a taxpayer.

Taxpayers should seek the advice of their own tax and legal

advisors regarding any tax and legal issues applicable to their

specific circumstances.

What is EPIC estate planning?

Your Life. Your Legacy. Your EPIC.

Your estate planning concerns

How much

should I give

to my kids?

Can I protect

them?

Is my estate

plan up-todate?

Do I have

enough life

insurance?

How much

should I give to

my community?

What about

taxes?

Traditional estate planning

• Traditional estate planning

– Discussions centered on:

• What is the status of estate taxes?

• What is the newest estate planning strategies?

• Is estate planning just planning after your death?

– These discussions are important but they may miss the

central objective

• How to help maximize your estate

• During life and at death

Estate planning decisions

Faced with the repression of the “OR”

Do I live less today, in order to give more tomorrow?

OR

Do I live more today, and simply give less tomorrow?

What is EPIC estate planning?

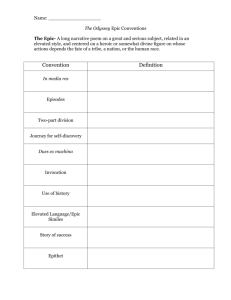

• One definition of epic is:

Ep·ic adjective \ˈe-pik\ “extending beyond the usual or

ordinary”

• EPIC estate planning

– Process of helping make your estate plan extend beyond

traditional estate planning

Source: www.merriam-webster.com/dictionary/epic

EPIC estate planning decisions

EPIC embraces the brilliance of the AND

I want to maximize how i live today

and

I want to maximize what I give tomorrow

What is EPIC estate planning?

• Stands for Estate Planning Individually Centered

– Planning centers around you

• Maximizing the EPIC Circles

• Minimizing the four estate planning threats

– An EPIC approach for EPIC Team:

• You

• Your advisor/agent/CPA/tax professional

• Your estate planning attorney

The EPIC Circles

Your Life. Your Legacy. Your EPIC.

It begins with…

Next, comes…

Your Descendants

Children

Children with

Special Needs

“… person should

leave his kids enough

to do anything but not

enough to do nothing.”

Warren Buffet

Other

beneficiaries

Grandchildren

It ends with…

Government

Federal

State

Local

Community

Foundations

EPIC circle

However, not all families are the same…

•

•

•

•

Single parents

Blended families

Non-citizen spouses

Partners (unmarried couples)

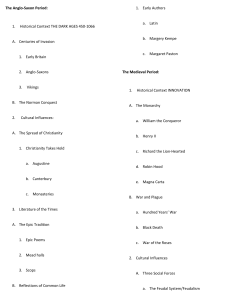

Four Estate Planning Threats

Your Life. Your Legacy. Your EPIC.

Taxes

Taxes

Old paradigm – get it out

• Large gap between federal transfer and income tax rates

• In 2001:

– Unified credit was $675,000 and top tax rate was 55%

– Long term capital gains was 20%

Gap is 35%

Source: Internal Revenue Service

Estate Tax

55%

Capital Gains

Tax 20%

New paradigm – tax basis opportunities

• Smaller gap between federal transfer and income tax rates

• In 2014:

– Basic exclusion is $5.34 M and top tax rate was 40%

– Long term capital gains was 20% + 3.8% Health Care Surtax

Gap is 16.2%

Source: Internal Revenue Service

Estate Tax

40%

Capital Gains

Tax 23.8%

Creditors

Taxes

Creditors

Protections

Three areas of protections

1.Client

– Retirement income, long term care costs, asset protection

2.Spouse or Partner

– Income replacement, remarriage, retirement income, asset

protection

3.Descendants

– Asset protection, divorce, spending, special needs, blended

families

Spending

Taxes

Spending

Creditors

Three buckets of assets

Capital

assets

Retirement

income

assets

Legacy

assets

Capital asset taxation

Timing

Tax consequences

Purchase

After tax

Income generated

Ordinary income

Sale

Capital gains

• Long term

• Short term

Disposition at death

Fair market value at date of death

• Can get a step-up or step-down in

basis

Retirement income assets

Timing

Tax consequences

Contribution

Qualified - before tax

Non-qualified - after tax

Growth

Tax-deferred

Distributions

Ordinary income

• Qualified – all ordinary income

• Non-qualified – exclusion ratio

Disposition at death

No step-up

Legacy assets

Timing

Tax consequences

Purchase

After tax

Growth

Tax-deferred

Distributions

Tax-preferred

Dispositions at death

Automatic step-up in basis

EPIC retirement spending

• Use retirement income assets

• Efficient use of capital assets

• Efficient use of legacy assets

EPIC estate planning

• Use retirement income assets as an income

source for the surviving spouse

• Maximize capital assets at death with estate

inclusion to receive step-up in basis

• Use legacy assets for income tax-free death

benefit

Death

Taxes

Spending

Creditors

Death

Why is life insurance important?

• Periodic small gift transfers of premium can provide larger

death benefits

• Income tax-free financial support for clients’ families upon

their death

• Cash value – valuable tool if client needs to withdraw a

portion for any reason

• Additional agreements may enhance the life insurance

policy

Agreements may be subject to additional costs and restrictions. Policy loans and withdrawals may

create an adverse tax result in the event of a lapse or policy surrender, and will reduce both the

cash value and death benefit.

EPIC

Taxes

Spending

Creditors

Death

Definition of an EPIC estate plan

• I want to maximize how live today

– By tax-efficient spending

• In order to maximize what I give tomorrow

– By protecting my family if an unexpected event happens

– By passing my estate in the most tax-efficient manner

possible

– By protecting my legacy for my descendants

– By turning tax dollars into charitable dollars

Other side of EPIC Estate Planning

• Another definition of an epic

Ep·ic noun\ˈe-pik\ “a narrative poem in elevated language

celebrating the adventures and achievements of a legendary

or traditional hero.”

• The other side of EPIC estate planning is:

– Estate planning is more than passing material wealth

– It’s your values, hopes, and dreams

– It’s the memories you create

Source: www.merriam-webster.com/dictionary/epic

Next Step

• Please take our EPIC fact finder

• Take some time to reflect and answer the questions

• Set up an initial meeting with your advisor(s) to start the

EPIC process

Make it EPIC!

Any questions?

Please keep in mind that the primary reason to purchase a life insurance product is the death benefit.

Life insurance products contain fees, such as mortality and expense charges, and may contain

restrictions, such as surrender periods. One can lose money in this product.

Guarantees are based on the claims-paying ability of the issuing insurance company.

Securian Financial Group, Inc.

www.securian.com

400 Robert Street North, St. Paul, MN 55101-2098

1-800-820-4205

Insurance products are issued by Minnesota Life Insurance Company in all states except New York. In New York, products are issued by Securian Life Insurance

Company, a New York authorized insurer. Both companies are headquartered in Saint Paul, MN. Product availability and features may vary by state. Each insurer

is solely responsible for the financial obligations under the policies or contracts it issues. 400 Robert Street North, St. Paul, MN 55101-2098 • 1-800-820-4205

2014 Securian Financial Group, Inc. All rights reserved.

A04764-0914 DOFU 12-2014