Homework 4

advertisement

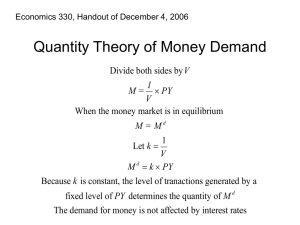

ECON 102- INTRODUCTION TO ECONOMICS II DEPARTMENT OF ECONOMICS BİLKENT UNIVERSITY Fall 2014 Homework Questions 4 Question 1- Definitions: Define the following concepts and illustrate either in an equation or a graph or use in an explanation: a) “Money market multiplier” b) “Open market operations” c) “IS and LM curves” d) “Real money supply” e) “Aggregate demand schedule” f) “Full employment income-potential income- income at natural rate of unemployment” Question 2- IS & LM curves: Assume that in the Simplite economy, desired consumption, taxes, government spending, investment and net exports are given as follows: Cd=700+0.7 YD, T=0, G=300, Id=400- 5i, NXd=0, where the notation follows one used in class. (b) Find the equation of the aggregate expenditure line. (The variable interest rate will be in this equation.) (c) State the equilibrium condition and incorporate this into the AE function. (the equation should be in terms of Y and i variables.) (d) There is also a money market in Simplite economy and the real money demand and money supply are given by the following functions: Md=500+0.3Y – 3i and Ms/P=1100 Find the equation that represents the money market equilibrium. (This will also be a function of Y and i variables) (e) Graphically draw the Goods market equilibrium curve (IS curve) and Money market equilibrium (LM curve) and show the equilibrium point graphically. (f) Compute the equilibrium income and interest rates. (g) Assume that Government expenditure increases to G=400 as part of an expansionary fiscal policy, how do you think the IS curve changes. Show graphically the new equilibrium income and interest rate. (h) Can you compute the new IS curve? What is the size of the horizontal shift between the old and the new IS curve? Is this related to the government expenditure multiplier that you have previously learned? (i) Compute the new equilibrium Y and i rate. Is the change in the equilibrium income more or less than the horizontal shift of the IS curve? Can you explain why is this so? Question 3 – Monetary policy and money market equilibrium: Explain the impact on the following events on the money market equilibrium and equilibrium interest rates using graphical analysis: (a) Increase in the discount rate. (b) Decrease in the minimum reserve requirement ratio. (c) Central Bank buys government bonds in the private financial markets. (d) (This is not a monetary policy but describe the effect on money market equilibrium) All of a sudden the price level doubles in the economy.