HW4 - Taskin

E CON 102I NTRODUCTION TO ECONOMICS II

D EPARTMENT OF E CONOMICS

B İLKENT U NIVERSITY

Fall 2015

Homework Questions 4

I WOULD LIKE TO GIVE YOU THE OPTION TO SUBMIT, ON TUESDAY, ANSWERS TO THIS

HOMEWORK TO BE GRADED.

THE GRADE WILL BE USED AS EXTRA POINTS FOR YOUR QUIZZES.

PLEASE SUBMIT THE ANSWERS WRITTEN ON A A4 PAPER FOR ONLY THE QUESTIONS 2, 3

AND 4

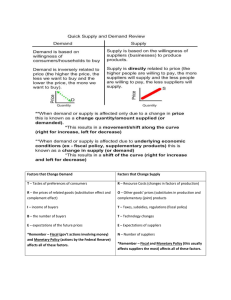

Question 1- Definitions:

Define the following concepts and illustrate either in an equation or a graph or use in an explanation: a) “Open market operations” b) “IS and LM curves” c)

“Real money supply” d)

“Aggregate demand schedule” e)

“Full employment income-potential income- income at natural rate of unemployment”

Question 2-Evaluate the following statement

The White House on Tuesday issued a veto threat for a Republican-backed bill to make the

Federal Reserve set interest rate policy using a mathematical rule, a proposal Fed Chair

Janet Yellen said would "severely damage" the U.S. economy.

The Obama administration opposes the proposal because it would hinder the Fed's ability to help the economy, the White House said in a statement.

"If the president were presented with (the legislation), his senior advisors would recommend that he veto the bill," the statement said

The above statement is the suggestion for an alternative monetary policy rule. Discuss the impact of this new rule on the effectiveness of monetary policy. If this policy rule had been the rule during 2008, how would have been the outcome of economic crisis?

Question 3- Bit Coins a) What are Bit-Coins? b) How can you get Bit-Coins? c) Evaluate the following statement by Senior deputy governor Carolyn Wilkins spoke about

innovation and the changing face of central banking in a post-financial crisis world

"This would create a new dynamic in the global monetary order, one in which central banks would struggle to implement monetary policy. And, central banks couldn’t act as

lenders of last resort as they do for their own currencies. This means that households

and businesses could suffer important losses if such an e-money were to crash.”

.

Question 4- IS & LM curves:

Assume that in the Simplite economy, desired consumption, taxes, government spending, investment and net exports are given as follows:

C d

=700+0.7 YD ,

T=0,

G=300,

I d

=400- 5i,

NX d =0, where the notation follows one used in class.

(b) Find the equation of the aggregate expenditure line. (The variable interest rate will be in this equation.)

(c) State the equilibrium condition and incorporate this into the AE function. (the equation should be in terms of Y and i variables.)

(d) There is also a money market in Simplite economy and the real money demand and money supply are given by the following functions:

M d

=500+0.3Y – 3i and

M s /P=1100

Find the equation that represents the money market equilibrium. (This will also be a function of Y and i variables)

(e) Graphically draw the Goods market equilibrium curve (IS curve) and Money market equilibrium (LM curve) and show the equilibrium point graphically.

(f) Compute the equilibrium income and interest rates.

(g) Assume that Government expenditure increases to G=400 as part of an expansionary fiscal policy, how do you think the IS curve changes. Show graphically the new equilibrium income and interest rate.

(h) Can you compute the new IS curve? What is the size of the horizontal shift between the old and the new IS curve? Is this related to the government expenditure multiplier that you have previously learned?

(i) Compute the new equilibrium Y and i rate. Is the change in the equilibrium income more or less than the horizontal shift of the IS curve? Can you explain why is this so?