NASCAR 2013 Sales Objectives

advertisement

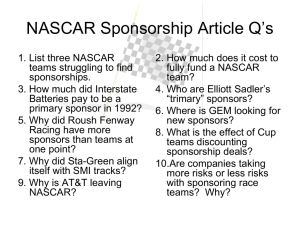

Date Document Created: May 31, 2012 Content Owner: Richard McCann Delivery Date and/or In-Store Activation Date: January 14, 2013 Version number: 1.0 If new version, what’s changed since last version (bullet points are fine): Table of Contents Sales Materials Included: Distribution and Merchandising Objectives Selling Story Nvision Catalog Customer Collaboration One Page Presentation Sheet 2 NASCAR 2013 Distribution & Merchandising Objectives FOR INTERNAL USE ONLY NASCAR 2013 Sales Objectives NASCAR 2013 is expected to generate $81.3M Item # Items Summary 2013 Voume Cases/PLLTS 275573 Mixed Singles Shipper/Powerwing 264CT $5,364,440 36,285 FULL YEAR 210542 Mixed King Size Shipper/ Powerwing 168CT $8,142,778 48,959 FULL YEAR 276428 Mixed Singles Split Pallet 2676CT $4,000,000 2,669 FULL YEAR 275727 $23,140,189 39,130 FULL YEAR 275786 Mixed Singles 1/4 Pallet 1056 CT (tear pad) Mixed King Quarter Pallet - 360CT $1,351,112 3,791 FULL YEAR 261352 168ct Pre- Priced KS Mixed NASCAR Shipper Q1 $2,197,942 13,215 Q1 ONLY 275828 72ct M&M's Mixed Singles CU (2/Ca) $1,350,000 16,741 FULL YEAR 277195 Mixed KS PDQ Pallet $1,200,000 722 FULL YEAR IC TOTAL $46,746,461 277186 Mixed Minis Quarter Pallet 156 CT $2,975,546 6,646 FULL YEAR 265938 M&M's Milk 19.2oz DRC 24/CA $3,540,000 36,967 FULL YEAR 265591 M&M's Peanut 19.2oz DRC 24/CA $4,450,000 46,470 FULL YEAR 265842 M&M's Peanut Butter 18.4oz DRC 24/CA $2,650,000 27,673 FULL YEAR 275894 32ct Milk & Peanut Large Bag Gravity Fed* $1,000,000 7,832 Q1 ONLY 277298 M&Ms 40oz/FB 40oz SUP 264ct pallet $20,000,000 9,618 FULL YEAR *Note: Final Sales Objective 4 NOTES FC TOTAL $34,615,546 Total Channel Volume $81,362,007 on Item # 275894 still TBD. Needs to be minimum $1M GSV, otherwise item will not be offered. NASCAR 2013 Sales Objectives by Channel Item # Items Future Drug Walmart C-Store Value 2013 Final 2013 Final 2013 Final 2013 Final 2013 Final 2013 Final GRAND TOTAL Cases/PLLTS 275573 Mixed Singles Shipper/Powerwing 264CT Mixed King Size Shipper/ Powerwing 210542 168CT $2,810,858 $600,000 $0 $1,953,582 $0 $5,364,440 36,285 $2,416,847 $600,000 $0 $5,125,931 $0 $8,142,778 48,959 276428 Mixed Singles Split Pallet 2676CT Mixed Singles 1/4 Pallet 1056 CT (tear 275727 pad) $4,000,000 $0 $0 $0 $0 $4,000,000 2,669 $18,060,938 $50,000 $0 $5,029,252 $0 $23,140,189 39,130 $898,484 $0 $0 $452,628 $0 $1,351,112 3,791 $0 $0 $0 $2,197,942 $0 $2,197,942 13,215 $0 $0 $350,000 $1,000,000 $1,350,000 16,741 $1,200,000 722 275786 Mixed King Quarter Pallet - 360CT 168ct Pre- Priced KS Mixed NASCAR Shipper 261352 275828 72ct M&M's Mixed Singles CU (2/Ca) 277195 Mixed KS PDQ Pallet $1,200,000 IC TOTAL $28,187,127 277186 Mixed Minis Quarter Pallet 156 CT $1,250,000 $0 $15,109,334 $1,000,000 $46,746,461 $2,975,546 $0 $2,975,546 6,646 265938 M&M's Milk 19.2oz DRC 24/CA $540,000 $3,000,000 $3,540,000 36,967 265591 M&M's Peanut 19.2oz DRC 24/CA $700,000 $3,750,000 $4,450,000 46,470 265842 M&M's Peanut Butter 18.4oz DRC 24/CA $400,000 $2,250,000 $2,650,000 27,673 $1,000,000 7,832 $20,000,000 9,618 275894 32ct Milk & Peanut Large BaG Gravity Fed 277298 M&Ms 40oz/FB 40oz SUP 264ct pallet FC TOTAL 5 Total $1,000,000 $20,000,000 $5,615,546 $0 $29,000,000 $0 $0 $34,615,546 Total Channel Volume $33,802,673 $1,250,000 $29,000,000 $15,109,334 $1,000,000 $81,362,007 FOR INTERNAL USE ONLY Objectives: 2013 Sponsorship Merchandising Objectives and Insights 1. Grow share and physical availability 2. Gain secondary merchandising locations via the use of displays in high-traffic areas 3. Leverage open stock items for secondary display on front end caps or promotional aisle Insights: Confectionery is a very emotionally driven category . The in-store environment currently does not deliver the imagery which could lead to more impulsive behavior, but eye-catching displays placed in high traffic areas do deliver! 79% of shoppers said they had been tempted to buy confection at the spur of the moment Use displays to tempt the passionate fan and trigger impulsivity by making chocolate more mentally available in-store 98% of shoppers cover less than half the store. Placing confectionery in high traffic locations such as lobby, perimeter and front end cap can drive incremental sales by capturing “impulse” purchases. (Lifts range from 12.6% to 55.8%) Arrival (lobby) and departure (front end) are crucial points of display – as 100% of shoppers making a purchase MUST pass through these areas. Upon entering, shoppers are most positive about confectionery and their visual recall of communication is highest. Focus on future consumption in lobby when shoppers are purchasing for others and immediate consumption on front end when shoppers are purchasing for themselves NASCAR 2013 Selling Story Selling Story Table of Contents 8 Executive Summary Segment Opportunity Consumer Target & Trends Program Details Available Display & POS Advertising & Marketing Support Merchandising Recommendations Appendix Executive Summary The 2013 Mars NASCAR Program is designed to capture the valuable NASCAR snacking community with a flexible range of displays and a comprehensive marketing campaign to drive off-take year round. Why NASCAR? • NASCAR is the #1 spectator sport in America, drawing a large and geographically diverse audience throughout the year. • NASCAR fans consume more snacks than non-fans and their purchase decisions are highly influenced by sponsorship of their sport. Why Mars? • As the official chocolates of NASCAR, M&M’S, SNICKERS, MILKY WAY, 3MUSKETEERS and TWIX are sought and chosen by fans for their everyday, and race day snacking needs. • M&M’S are the #1 mentioned sweet snack consumed by fans on race day. Why 2013 Mars NASCAR Program is Perfect for You! • In 2013, Mars NASCAR Program theme is “Race Day is Better with M” to remind fans how M&M’S® makes race day better – adding colorful chocolate fun to race day whether fans are at home or at the track. • An expanded range of displays offered to meet the snacking needs of NASCAR fans, including new IC and FC displays. • New POP and retail-tainment options will drive excitement and traffic in store and incent purchase. 9 NASCAR 2013 Segment Opportunity FOR INTERNAL USE ONLY HAS A LARGE AND DIVERSE FAN BASE • NASCAR is the #1 spectator sport • NASCAR is the #1 sport in fan brand loyalty • NASCAR is the #2-rated regular-season sport on television • NASCAR has over 75M fans. • NASCAR fans are 3 times as likely to try and purchase NASCAR sponsors’ products and services. • NASCAR has broad fan demographics: of NASCAR® fans, 60% are male, 40% female • M&M’S BRAND is the 4th most recognized brand among NASCAR® fans (unaided awareness) • 91% of Consumers know that the M&M’S® BRAND sponsors NASCAR Source: Ipsos, 2010 NASCAR ® Brand Tracker NASCAR has a National Reach 12 Occasions Span the Year Providing Opportunities for In-Store Display Events Q1 Key Race Feb. 26 Daytona MMs March 4 Phoenix MMs March 11 Las Vegas MMs Brown March 18 Bristol MMs March 25 California Interstate April 1 MartinsvilleMMs April 14 (Sat.) Texas Interstate April 22 Kansas Wrigley April 29 Richmond MMs Daytona Las Vegas Bristol Q2 Q3 May 5 Talladega MMs May 12 Darlington Wrigley May 19 All Star RaceMMs May 27 Charlotte MMs RWB June 3 Dover MMs June 10 Pocono MMs June 17 Michigan Snickers June 24 Sonoma MMs June 30 (Sat.) Kentucky MM RWB July 7 (Sat.)Daytona Interstate July 15 New Hampshire Interstate July 29 IndianapolisMMs Aug. 5 Pocono MMs Aug. 12 Watkins Glen MMs Aug. 19 Michigan Interstate Aug. 25 (Sat.) Bristol MMs Sept. 2 Atlanta Wrigley Sept. 8 Richmond MMs All Star Race Charlotte Kentucky Indianapolis Bristol Atlanta Q4 Sept. 16 Chicago Wrigley Sept. 23 New Hampshire MMs Sept. 30 Dover Interstate Oct. 7 Talladega MMs Oct. 13 (Sat.) Charlotte MMs Oct. 21 Kansas MMs Halloween Oct. 28 MartinsvilleMMs Halloween Nov. 4 Texas Snickers Nov. 11 Phoenix MMs Nov. 18 Miami MMs Chicago New Hampshire Texas Key Events When We Win, You Win National Promotion Red White & Blue/ M Prove America Race for Chase Halloween Chase/Championship Kickoff Plan to Win: Display NASCAR All Year, All Markets!! NASCAR 2013 Consumer Target, Trends & Insights FOR INTERNAL USE ONLY Consumer Target and Key Trends • The Mars NASCAR Program targets the large and geographically diverse casual and avid fan base – approximately 75M consumers • Approximately 60% of NASCAR fans are casual fans; 40% Avids; Most NASCAR fans have never attended a race. • Casual NASCAR fans are typically big sports fans who watch NASCAR as part of their sports programming consumption. • NASCAR Viewership has increased since 2009 • Loyalty to sponsor products is increased steadily since 2004 15 Consumer Insights & Implications • NASCAR fans are loyal, with over 70% of fans stating that sponsoring NASCAR is a strong influence on their purchase decisions. • NASCAR fans recall and purchase sponsor brands more than fans of any other sport. • NASCAR fans make more trips to purchase snacks and candy than non-fans. • When watching at home, fans mostly consume what is on hand • NASCAR fans are on-the-go much more so than non-fans • M&M’S®, SNICKERS, MILKY WAY, 3MUSKETEERS and TWIX are the official chocolates of NASCAR. Fans seek and purchase brands that support NASCAR. • MARS invests to drive awareness and recall among fans so it translates to off-take in store. • Interrupt trips with off-shelf displays to keep MARS NASCAR products top of mind on fan trips. • It’s critical to display product for pantry-load trips • It’s critical to have immediate consumption displays to capture the 16 impulse purchase NASCAR 2013 Program Details FOR INTERNAL USE ONLY Vision Leverage the excitement and power of winning with a top NASCAR team to engage our consumers and to drive sales and display with all our retail customers 18 2013 Strategic Approach Continued focus on reaching casual NASCAR® Fan base with “Race Day is Better with M”™ Message With over 75M Fans, NASCAR® is relevant to all customers nationwide Increased focus on the home viewer to encourage fans to incorporate MARS brands into race day traditions Additional advertising during races Expanded range of products for home viewing parties & events Continued consumer engagement with “When We Win, You Win” platform, linking M&M’S® Racing Team performance with chances of winning great prizes New mobile entry will allow for in-store winning; local content delivery and further consumer engagement IN 2013, NASCAR IS PART OF A YEAR-LONG BRAND INITIATIVE “CHOCOLATE IS BETTER WITH M” 2013 NASCAR Program •In 2013, Race Day is Better with M! Leveraging the power and excitement of a top-winning team, Mars will offer an enhanced engagement program giving consumers the chance to win free cars and thousands of great prizes instantly through the “When We Win You Win” promotion. •NASCAR pack and display range will expand to support the strategy and give maximum merchandising flexibility, including new lower count IC and FC displays. •New sweepstakes enhancement with use of SnapTag technology to engage shoppers by awarding prizes and pushing content instantly through mobile technology. •M&M’S® will provide national advertising and PR support as well as regional and local consumer promotion to drive off-take throughout the 2013 season. Promotion Overview • National promotion launching in February will allow consumers the chance to win a car and other valuable prizes • A minimum number of cars will be awarded regardless of whether M&M’S® Team wins • Engages consumers by linking their winning with M&M’S Racing wins • Secondary Instant Win Prizes including NASCAR® Merchandise, Gas Cards and Cash Cards • Season-long execution gives customers flexibility to execute in calendar • New mobile entry technology captures NASCAR fans on-the-go and enables content to be pushed to shoppers, instantly 22 Promotional Details • How It Works: – Consumers are directed to grab a pack of M&M’S® and other MARS products on specially marked displays in-store – Consumers snap the tag on the display with their cell phone camera (smart phone not required) and text in to see if they’ve won, instantly – Consumers have a chance to win a new car (grand prize) and instantly win secondary prizes with each entry – Consumers will receive a link to get free updates and content whether they win or not – Sweepstakes are held after the #18 M&M’S® Racing Team wins a race. – Promotion runs from February – November 23 SOCIAL MEDIA: • Year Long NASCAR® Content on M&M’S® Face book Page • Unique Social Support for “When We Win, You Win” promo DIGITAL ONLINE DISPLAY ADS TV: One TV spot within key NASCAR® Sprint Cup races of the Season RADIO: National &Regional Promotional Radio PUBLIC RELATIONS: •PR launch of “When We Win, You Win” promotion •Full Season Team/Brand PR Support PRINT: Print ads in key weekly, monthly and or special interest publications WEBSITE: “Race Day is Better with M” content for year long support SHOPPER MARKETING: Custom programs at key retailers executed thru year IN STORE Show Car Driver Appearances 2013 Mars NASCAR Promotional Support 2013 NASCAR® Marketing Support Calendar* Q1 TV** Digital Radio Regional Radio** Print Social Media Public Relations * Final timing for TV, Digital, Radio and Print to be communicated Q3 2012 **TV Support may include a mix of M&M’S NASCAR and Core spots 25 Q2 Q3 Q4 2013 Season Activation Calendar Q1 2013 Q2 2013 Q3 2013 Q4 2013 Races (Daytona 500) (Coke 600) (Chase Begins) (Championship) Retail Support (TV) (Show Car/Driver Appearances) (TV) Communications (Radio) (NASCAR Displays & Pallets In Store) Merchandising (IC) (FC) (Launch PR) (Sustaining PR) Engagement (Social Media) (Sweepstakes) (TV) Delivery/Performance Dates For All IC & FC Displays Unless Noted Otherwise LOD FDD LDD Performance Pd Checkpoint Date 3/22/2013 1/14/2013 3/29/2013 1/13/2013 - 3/31/2013 Cycle 12 10/31/2012 LOD FDD LDD Performance Pd Checkpoint Date 6/21/2013 4/1/2013 6/28/2013 4/7/2013 - 6/30/2013 Cycle 2 1/23/2013 LOD FDD LDD Performance Pd Checkpoint Date 9/20/2013 7/1/2013 9/27/2013 7/7/2013 - 9/29/2013 Cycle 5 4/17/2013 LOD FDD LDD Performance Pd Checkpoint Date 12/20/2013 9/30/2013 12/27/2013 10/6/2013 - 12/29/2013 Cycle 9 8/7/2013 NASCAR Displays Immediate Consumption New! • 275828 – M&M’S® 72 ct Mixed Singles Counter Unit 2/CA – UCC: 100-40000-42181-5 – Mix: • 36 M&M’S® Milk Chocolate Singles • 36 M&M’S® Peanut Singles – 2 units per master case – Dimensions: 15.5” x 9.2” x 13.1” 29 Mixed Singles Power Wing Mixed King Size Power Wing 264 Ct. ZREP 275573 UCC 000-40000-42154-2 168 Ct. ZREP 210542 UCC 000-40000-25028-9 Mix: Mix: •96 Ct. Bar, 2.07 oz. ® •48 Ct. M&M’S Brand Milk Chocolate Candies, 1.69 oz. •48 Ct. M&M’S® Brand Peanut Chocolate Candies, 1.74 oz. •36 Ct. MILKY WAY® Bar, 2.05 oz. •36 Ct. TWIX® Caramel Cookie Bars, 1.79 oz. SNICKERS® Dimensions: 39.9” x 15.2” x 5.5” •48 Ct. M&M’S® Brand Peanut Chocolate Candies Sharing Size, 3.27 oz. •48 Ct. SNICKERS® 2-To-Go Bars, 3.29 oz. •24 Ct. M&M’S® Brand Milk Chocolate Candies Sharing Size, 3.14 oz. •24 Ct. MILKY WAY® 2-To-Go Bars, 3.63 oz. •24 Ct. TWIX® Caramel Cookie Bars 4To-Go, 3.02 oz. Dimensions: 23.5” x 11.1” x 14.6” 30 • 275727– Mixed Singles Quarter Pallet 1056 ct – UCC: 000-40000-42167-2 – Mix: • 288 Ct. SNICKERS® Bar, 2.07 oz. • 192 Ct. M&M’S® Brand Peanut Chocolate Candies, 1.74 oz. • 144 Ct. M&M’S® Brand Milk Chocolate Candies, 1.69 oz. • 144 Ct. TWIX® Caramel Cookie Bars, 1.79 oz. • 108 Ct. MILKY WAY® Bar, 2.05 oz. • 108 Ct. 3 MUSKETEERS® Bar, 2.13 oz. • 72 Ct. SNICKERS® Almond Bar 1.76 oz. – Dimensions: 24’’ x 20’’ x 44.25’’ – Tearpad: 2 pads @ 75 sheets per; Offer is $0.50 off 2* 31 *While supplies last • 261352– Mixed King Size Pre-Priced (2/$3.00) Power Wing 168 Ct. – UCC: 000-40000-44165-6 – Mix: • 72 Ct. M&M’S® Brand Peanut Chocolate Candies Sharing Size, 3.27 oz. • 48 Ct. SNICKERS® 2-To-Go Bars, 3.29 oz. • 24 Ct. M&M’S® Brand Milk Chocolate Candies Sharing Size, 3.14 oz. • 24 Ct. TWIX® Caramel Cookie Bars 4-To-Go, 3.02 oz. New! Dimensions: 23.5” x 11.1” x 14.6” NOTE: Account Trade funds to be used to fund 2/$3 promotion Delivery Dates 32 LOD FDD LDD Performance Pd Checkpoint Date 3/22/2013 1/14/2013 3/29/2013 1/13/2013 3/31/2013 10/31/2012 © • 276428 – Mixed Singles Split Pallet 2676 Ct. – UCC: 000-40000-42232-7 – Mix: • • • • • • • • 720 Ct. SNICKERS® Bar, 2.07 oz. 528 Ct. M&M’S® Brand Peanut Chocolate Candies, 1.74 oz. 384 Ct. M&M’S® Brand Milk Chocolate Candies, 1.69 oz. 288 Ct. TWIX® Caramel Cookie Bars, 1.79 oz. 180 Ct. 3 MUSKETEERS® Bar, 2.13 oz. 180 Ct. MILKY WAY® Bar, 2.05 oz. 192 Ct. M&M’S® Brand Pretzel Chocolate Candies, 1.14 oz. 96 Ct. SNICKERS® Almond Bar, 1.76 oz. • 108 Ct. SNICKERS® Peanut Butter Squared Bar, 1.78 oz. – Dimensions: 40” x 24’’ x 46.38’’ 33 © • 275786– Mixed King Size Quarter Pallet 360 Ct. – UCC: 000-40000-42176-4 – Mix: • 120 Ct. SNICKERS® Bar 2-To-Go, 3.29 oz. • 72 Ct. M&M’S® Brand Peanut Chocolate Candies Sharing Size, 3.27 oz. • 48 Ct. M&M’S® Brand Milk Chocolate Candies Sharing Size, 3.14 oz. • 72 Ct. TWIX® Caramel Cookie Bars 4-To-Go, 3.02 oz. • 48 Ct. MILKY WAY® 2 to Go – Dimensions: 24” x 20” x 44.3” 34 • 277195– Mixed King Size PDQ Pallet 1680 Ct. – UCC: 000-40000-48066-2 – Mix: • • • • • • • • 168 M&M'S MC Sharing Size 192 M&M'S MINIS MEGA TUBE 144 M&M'S PRETZEL Sharing Size 288 M&M's PEANUT Sharing Size 144 MILKY WAY 2 to Go 336 SNICKERS 2 to Go 144 SNICKERS PB SQ 4 to Go 264 TWIX 4 to Go – Dimensions: 48’’ x 40’’ x 48.8’’ NASCAR Displays Future Consumption 8.5” • 265938 – M&M’S® Milk Chocolate DRC 19.2 oz 24/CA – UCC: 000-40000-45971-2 – Dimensions: 18” x 11.9” x 11” • 265591 – M&M’S® Peanut DRC 19.2 oz 24/CA – UCC: 000-40000-45970-5 – Dimensions: 18” x 11.9” x 11” • 265842 – M&M’S® Peanut Butter DRC 19.2 oz 24/CA – UCC: 000-40000-45972-9 – Dimensions: 18.5” x 11.9” x 10.9” 37 8.5” • 275894 – Mixed M&M’S® Large Bag Floorstand Display 32Ct. – UCC: 000-40000-42189-4 – Mix: • 16 M&M’S® Milk Chocolate 19.2 oz • 16 M&M’S® Peanut 19.2 oz – Dimensions: 19.6” x 15.8” x 10.9” Delivery Dates 38 NOTE: Size are approximate and SRP will vary by account. LOD FDD LDD Performance Pd Checkpoint Date 3/22/2013 1/14/2013 3/29/2013 1/13/2013 3/31/2013 10/31/2012 © Filled Bar Mixed Minis Quarter Pallet 156 Ct. ZREP 277186 UCC: 000-40000-48062-4 Quarter Pallet contains: •48 Ct. SNICKERS® Brand Miniatures 11.5 oz. •32 Ct. MINIS MIX™ 10.5 oz. •32 Ct. SNICKERS® Brand MINIS MIX™ 10.5 oz. •16 Ct. MILKY WAY® Brand Miniatures 11.5 oz. •16 Ct. TWIX® Brand Miniatures 11.5 oz. •12 Ct. 3 MUSKETEERS® Brand Miniatures 10 oz. Dimensions: 20” x 24” x 47.5” 39 • 277298 – Mixed XL SUP Pallet 264 Ct – UCC: 000-40000-48078-5 – Mix: • • • • 84 Ct. M&M’S® Brand Peanut Chocolate Candies 42 oz. 60 Ct. M&M’S® Brand Milk Chocolate Candies 42 oz. 60 Ct. SNICKERS® MINIS 40 oz 60 Ct. MIXED MINIS 40 oz – Dimensions: 48’’ x 40’’ x 40.5’’ NASCAR 2013 Support Materials for Launch NASCAR Pennant Flags (each) Item #: 50145 NVISION Date: 10/3/12 Size: 3”Long X 11”H NASCAR Stack Case (each) Item #: 50151 NVISION Date: 10/3/12 Size: 24”W X 12”H X 12”D NASCAR Poster (each) Item #: 50142 NVISION Date: 10/3/12 12”W X 24”H NASCAR Dump Bin w/ Header (each) Item #:50148 NVISION Date: 10/3/12 Size: 18”W X 30”H NASCAR Pallet WRAP (10/Pack) Item #: NVISION Date: 10/3/2012 Size: 10”H X 15’ Long NASCAR Pallet Display (each) Item #: 50213 NVISION Date: 10/3/12 Size: 16’ X 8” X 4” NASCAR Adjustable End Cap Item #: 50160 NVISION Date: 10/3/12 Size: 30-42”W X 68-87”H X 14”D NASCAR Hero Card (each) Item #:50143 NVISION Date: 10/3/12 Size: 10”W X 8”H NOTE: All merchandising elements are FPO and subject to change contingent on budget FPO NASCAR CFB Dangler Item #: 50152 NVISION Date: 10/3/12 Size: 4.5”W X 7.5”H NASCAR CCU (Corrugated Counter Unit) Item #: 50155 NVISION Date: 10/3/12 Size: 11.5”W X 11.5”H X 7.5”D NASCAR Generic Dangler Item #: 50149 NVISION Date: 10/3/12 Size: Size: 4.5”W X 7.5”H NASCAR Balloons Item #: 50144 NVISION Date: 10/3/12 Size: 18” Diameter NASCAR Dump Bin w/ Header (each) Item #: 50150 NVISION Date: 10/3/12 Size: 24”W X 53”H NASCAR Inflatable Item #: 50154 NVISION Date: 10/3/12 Size: 28” X 33” NASCAR Ms. Brown Dump Bin (each) NASCAR Mod Pod Item #: 50153 Item #: 50156 Kyle Busch Dump Bin w/ Header (each) NVISION Date: 10/3/12 NVISION Date: 10/3/12 Item #: 50147 Size: 42”W X 50”H Size: 5.25”W X 2.5”D X NVISION Date: 10/3/12 4.5”H NOTE: All merchandising elements are FPO and are subject to change contingent on budget AVAILABLE ASSETS: MARSSPONSORSHIPS.com Logo on Back of Car At Track Customer Engagement Luxury Suites Grandstand Tickets VIP Access Logo/Image/NASCAR Media Rights Premiums/Autographed Items Partner Benefits/Discounts Sales Incentive & Consumer Promotions Showcar & Simpod Appearances Kyle Busch Appearances Joe Gibbs Racing Tours NASCAR SHOW CAR PROGRAM •Race Car driven by Kyle Busch (18’ x 7’) •Portable Branded Simulator Pod (3’ x 6’) •Small enough to be used in store •Actual Win Trophy Display (3’ x 3’) •Branded Trailer including: •M&M’S Racing merchandise window option •Satellite TV airing airing live racing during all NASCAR activity •M&M’S branded awning •2 JGR staff members to run simulator and interact with consumers •Kyle Busch Hero Cards and Poster giveaways Support Materials for Launch The following materials will be available on SALESFORCE.COM for Launch: 46 Sell Sheet UPC Guide Retail Coverage Mars Chocolate retail team will visit the top stores closest to the NASCAR® race track to set up Mars NASCAR® displays and POP. The retail team will set up POP, fill dump bins, and move shippers/displays together to create a NASCAR® section in store. If your account does not allow display activity unless authorization from their division manager or HQ, please obtain retail authorization for our retail team to set up displays in your retailers stores around the race tracks. Customer Collaboration Overview One Page Overview Appendix NASCAR Vision & Strategy One Sheet Key Research Results/Charts Key Channel Data NASCAR 2013 Race Schedule (Oct. 2012) Race Day is Better with M! Associate Engagement – Crowd Vision – Spotter Location • Leverage the excitement and power of winning with a top • NASCAR® Day NASCAR team to engage our • Fantasy Racing with Weekly customers, consumers and prizes • Weekly communications to associates Associates via dot Mars, HKT Happenings, Video Monitors GSV 100 MM © 90 MM 80 MM Mental Availability – Pit Road 70 MM 60 MM • Best in class communications leveraging the power and unique equities of our brands: 50 MM • National media for mass reach Metrics – Leader board 30 MM 20 MM • Region communications to support race-market executions © 40 MM Colorful, Chocolate Candy FUN; Characters v Physical Availability – Cars on Track 10 MM • GSV • Big Wins • NQC • B2B • ROI • Merchandising • Best in Class Merchandising for all Channels of Trade • Right Packs for Race Day Occasions • Signature Item leveraging team marks and M&M’S® technology ®/TM trademarks ©Mars, Incorporated 2012 Sponsorship Awareness A NASCAR Study Spring 2012 Unaided NASCAR Sponsor Awareness Top 10 Mentions [Fans Only] b b b b b b b b b Total NASCAR Sponsor Awareness Top 11 Aware NET Responses [Fans Only] b b b b b b b b b b b Sponsor Loyalty [Fans Only] Given the choice of two products of a similar price, how likely are you to choose the brand that is affiliated with NASCAR racing over one that is not? b b a a Impact Of NASCAR Sponsorship On Impression Of M&M’s [Fans Only] b b a b Impact Of NASCAR Sponsorship M&M Purchase Likelihood [Fans Only] How much does M&M's sponsorship in NASCAR influence you to purchase M&M's over other brands of candy? b b a Snacking Preferences Top Snacks While Watching A NASCAR Race Top 10 Mentions [Fans] When thinking about snacks you may eat while watching a NASCAR race, what brands of snacks, either salty or sweet, or candy type, are most often eaten at your house during a race? [Multiple Responses] a a Favorite Sweet Snacks & Candies Top 7 Mentions [Fans & Non-Fans] Which brands of sweet snacks and candy would you say are your three favorites? [Multiple Responses] c c c a, c b a a NASCAR Race Snack Shopping / Preparation [Fans] How do you typically select the snacks that you eat while watching a race on TV? *MR Snack and Candy Category Usage and Consumption On average, NASCAR fans make 25+ trips per year to purchase snacks – nearly 2 more trips than non-fans. On average, NASCAR fans make nearly 20 trips per year to purchase candy – about 1 more than non-fans. NASCAR Fan Households Non-Fan Households Difference: NASCAR Fans vs. Non-Fans Snacks 25.4 trips per year 23.8 trips per year +1.6 Candy 19.1 trips per year 18.2 trips per year +0.9 Category Examples: Number of Annual Item Trips Approximately 20%-25% of NASCAR fan households purchase Mars brand chocolate candies, making multiple trips per year to purchase these items. Proportion of NASCAR Fan Households that Purchase the Item Number of NASCAR Fan Item Purchase Trips Per Year M&M’s Milk Chocolate Candies 26% 2.3 M&M’s Peanut Chocolate Candies 26% 2.4 Snickers Bar 22% 2.4 3 Musketeers Bar 19% 2.0 Brand Usage and Item Trips Per Year IMPORTANT NOTE: NASCAR fandom in this source is determined through the use of the following question: “Using a scale of 1 to 7, where 1 is “not at all interested”, 4 is “moderately 62 interested”, and 7 is “extremely interested”, how interested would you say you are in NASCAR?” NASCAR fans are those respondents who are at least moderately interested in NASCAR. Source: The Nielsen Company, Homescan FANLinks 2010 NASCAR Fans Shop Multiple Retail Channels Retail channels shopped in past month Index NASCAR Fans vs. Non-Fans NASCAR Fans Non-Fans Supermarkets 96% 93% 103 * Drug stores 75% 73% 103 * Mass retailers 72% 62% 116 * Convenience stores 69% 52% 133 * Home improvement stores 65% 48% 135 * Automotive specialty retailers^ 55% 42% 131 * Shopping malls 52% 51% 102 Department stores 47% 44% 107 * Strip malls 45% 38% 118 * Home electronics retailers 34% 27% 126 * Warehouse clubs 31% 27% 115 * Office supply retailers 24% 22% 109 Sporting goods 18% 10% 180 * Read: 72% of NASCAR fans have shopped at a mass retailer in the past month compared to 62% of non-fans, a 116 index. In other words, NASCAR fans are +16% more likely than non-fans to shop at a mass retailer. ^ indicates past year results Source: Experian Consumer Research, Simmons National Consumer Survey, Fall Full Year 2010. The asterisk (*) indicates statistical significance at the 95% confidence level. 63 NASCAR fandom is determined through the use of the following question: “How interested are you in NASCAR?” Respondents may indicate “very”, “somewhat”, “a little bit”, or “not at all” interested. NASCAR fans are those people who are at least a little bit interested in the sport. Thank You!