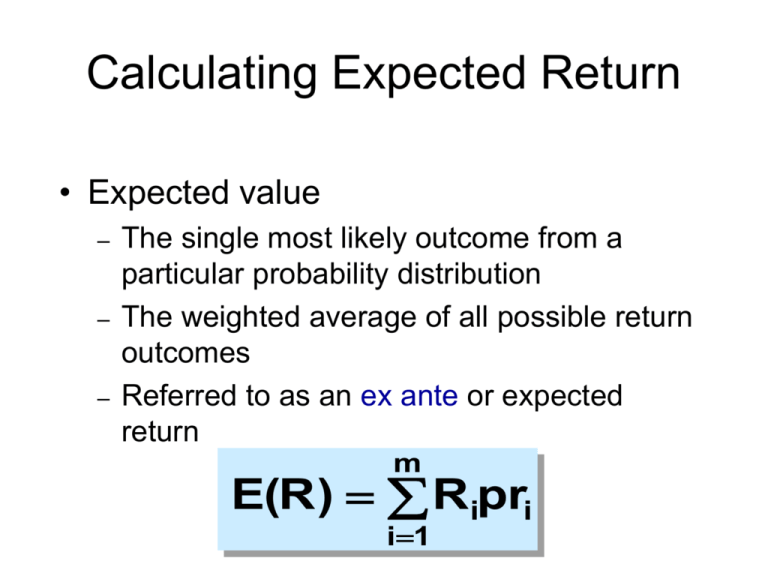

Calculating Expected Return

advertisement

Calculating Expected Return • Expected value – – – The single most likely outcome from a particular probability distribution The weighted average of all possible return outcomes Referred to as an ex ante or expected return m E(R ) Ripri i1 Calculating Risk • Variance and standard deviation used to quantify and measure risk – – – – Measures the spread in the probability distribution Variance of returns: 2 = (Ri - E(R))2pri Standard deviation of returns: =(2)1/2 Ex ante rather than ex post relevant Risk and Return for a portfolio Two-asset portfolio: Asset A Asset B Ri Ri Pi -.05 .25 .30 .10 .10 .40 .25 -.05 .30 E(Ri) .10 .10 .1161895 .1161895 Risk and Return for a portfolio Wi = % of money invested in asset i. WA = .5 WB = .5 Pi -.05 X.5 + .25 X .5 = .10 .30 .10 X .5 + .10 X .5 = .10 .40 .25 X .5 + -.05 X .5 = .10 .30 E(Rp) = .10 p = 0 Covariance m COV AB [ RA,i E ( RA )][ RB ,i E ( RB )] pi i 1 Covariance COVAB =(-.05 - .10)(.25 - .10)(.30)+ (.10 - .10)(.10 - .10)(.40) + (.25 - .10)(-.05 - .10)(.30) = -.0135 Assets A and b are negatively covary. Correlation Coefficient AB AB A B AB .0135 / .1161895 x.1161895 1 Correlation Coefficient Statistical measure of relative comovements between security returns AB = correlation coefficient between securities m and n AB = +1.0 = perfect positive correlation AB = -1.0 = perfect negative (inverse) correlation AB = 0.0 = zero correlation Portfolio Expected Return • Weighted average of the individual security expected returns – – Each portfolio asset has a weight, w, which represents the percent of the total portfolio value The expected return on any portfolio can be calculated as: n E(Rp ) w iE(Ri ) i1 Portfolio Expected Return WA = .5 and WB =.5 E(Rp) = (.5)(.1) + (.5)(.10) = .10 Portfolio Risk • Measured by the variance or standard deviation of the portfolio’s return – Portfolio risk is not a weighted average of the risk of the individual securities in the portfolio 2 nw 2 p i i 1 i Risk Reduction in Portfolios • Assume all risk sources for a portfolio of securities are independent • The larger the number of securities, the smaller the exposure to any particular risk – “Insurance principle” • Only issue is how many securities to hold Risk Reduction in Portfolios • Random diversification – – Diversifying without looking at relevant investment characteristics Marginal risk reduction gets smaller and smaller as more securities are added • A large number of securities is not required for significant risk reduction • International diversification is beneficial Portfolio Risk and Diversification p % Total Portfolio Risk 35 20 Market Risk 0 10 20 30 40 ...... Number of securities in portfolio 100+ Random Diversification • Act of randomly diversifying without regard to relevant investment characteristics • 15 or 20 stocks provide adequate diversification Calculating Portfolio Risk • Two-Security Case: p (w w 2wA wBCovAB ) 2 A 2 A 2 B 2 B 1/ 2 • N-Security Case: n n n ( w wi w j ij ) (i j ) P i 1 2 i 2 i 1/ 2 i 1 j 1 Calculating Portfolio Risk σp =[(.5)2(.1161895)2 +(.5)2(.1161895)2 +2(.5)(.5)(-.0135)]1/2 = 0 The Single-Index Model measures the sensitivity of a stock to stock – market movements If securities are only related in their common response to the market • • Securities covary together only because of their common relationship to the market index Security covariances depend only on market risk and can be written as: ij i j 2 M