Amgen, INC

advertisement

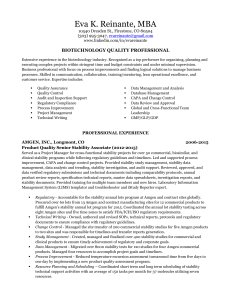

Investment Analyses – AMGEN, INC. Ticker Overview AMGEN, Inc. a biotechnology company that discovers, develops, manufactures, and distributes human medicines worldwide. It is classified as Brand Name Pharmaceutical Manufacturing in the US (NAICS code: 32541a). The company serves pharmaceutical wholesale distributors, healthcare providers, hospitals, and pharmacies, as well as consumers. The company was founded in 1980 and is headquartered in Thousand Oaks, California (Yahoo!Finance). As of the Spring of 2015, Amgen, Inc. holds approximately 9.8% of industry market share. Industry Outlook Due to growth in consumer demand, this industry is expected to grow at an annual rate of 1.5% per year for the next 20 years. Part of this is due to an aging population with reliance on prescription drugs and the large federal funding in Medicare and Medicaid. AMGN Market $146,140.75 Value of Investment Investment Student Group Equity Management Industry Biotechnology IVA Rating BB ESG Related Issues The key issues within the Biotechnology and for companies like Amgen are toxic emissions and waste, human capital development, product safety and quality, access to healthcare, and corporate governance. According to MSCI’s Intangible Value Assessment (IVA) on Amgen, Inc. product safety and quality are at the forefront of their ESG concerns. Amgen is one of the largest companies in the biotechnology industry sect, and therefore is exposed to more opportunities for incidents to occur in the companies supply chain or manufacturing processes. Despite having a fairly low level of product recalls (2 in 2014) Amgen has received regulatory warnings and eight Form 483’s (documenting concerns over facility inspections) from the FDA since 2012. There was also an incident in 2013 where Amgen was issued a warning letter from the FDA documenting misleading marketing for the anemia drug Aranesp, this is part of a larger story that saw Amgen paying out $762 million (criminal penalty of $150 million) to resolve criminal and civil liability for promoting drugs for uses not approved by the FDA and offering illegal kickbacks to influence healthcare providers to use its products. Overall, Amgen ranked in the 11th percentile of this industry for product safety and quality, scoring a 4.0 compared to an industry average of 5.4 on MSCI’s IVA rating. Amgen, being the largest company in this sect, has a large amount of labor that it needs to care for. The company has strong compensation and training programs, but announced lay offs affecting 15% of its workforce in 2014. In comparison to its peers, Amgen on lags behind in employee engagement programs. Any manufacturing industry is going to be exposed to waste and byproducts that come from production. The drug industry is no different. Amgen specifically is rated as average for its environmental strategy, but has numerous initiatives worldwide that make it stand out. It was given an 8.5 by MSCI compared to an industry average of 5.5, which puts it in the 94th percentile. Corporate governance issues at Amgen are circled around the board at the company. The roles of chairman of this board and CEO are combined, and an executive officer at the company serves on numerous board committees. There is also an individual who’s past service on boards of other companies is questionable. - Thomas Hays for the Sustainable Investing Advisory Committee September 2015 References Amgen, Inc. (AMGN) (2015). Profile, business summary. Yahoo!Finance. Retrieved from http://finance.yahoo.com/q/pr?s=MSFT. Turk, S. (2015, April) Brand Name Pharmaceutical Manufacturing in the US Industry Profile. Retrieved from www.ibisworld.com MSCI Intangible Value Assessment (2014, October), Amgen, Inc. Retrieved from www.esgoncampus.msci.com