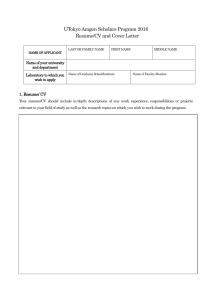

Long Range Capital Planning May 18, 2006

advertisement

Long Range Capital Planning

May 18, 2006

Long Range Capital Planning

Facilitator:

Vic Warren, Architect, bioTechure

Panelists :

Patricia Turney

Director of R&D Strategic Operations, Amgen

Jim Andrews

Associate Director, Nektar Therapeutics

Bubba Brueil

Chief Financial Officer, Codexis

Lid Sodbinow

Director of Capital Projects, Engineering, Novartis

Long Range Capital Planning

Some facts

• The combined “market cap” of Amgen,

Novartis, Nektar & Codexis is > $250B

• From 1982 through December 2005

254 Drugs Approved for 385 Indications

source: www.BIO.org

Long Range Capital Planning

Long Range Capital Planning

Patricia Turney

Strategic Planning

Jim Andrews

Translating the Strategic > Long Range Capital Plan

Bubba Breuil

Internal Project Financing

Lid Sodbinow

The effectiveness & accuracy of Long Range Capital Planning

Strategic Planning

Patricia Turney

Director of R&D Strategic Operations, Amgen

Strategic Planning

Overview

Patricia Turney

May 18, 2006

Amgen’s Global Presence

Cambridge, MA (410)

Toronto (260)

West Greenwich, RI (1,895)

Washington, DC (46)

Bothell, WA

Seattle, WA

Copenhagen (9)

Oslo (17)

Lucerne (198)

Helsinki (19)

Breda (536)

Stockholm (79)

Brussels (83)

> (1,195)

Cambridge (762)

Prague (30)

Paris (248)

Warsaw (69)

Budapest (29)

Tokyo (109)

Longmont, CO

Boulder, CO

> (1,803)

Vienna (104)

Regensburg (17)

Thousand Oaks, CA (10,021)

San Francisco, CA (395)

Louisville, KY (52)

Munich (263)

Milan (211)

Barcelona (163)

Juncos, Puerto Rico (2,295)

Lisbon (58)

(#) represents number of staff

(includes RFT and contingent staff, data collected 5/23/05 from Core Database)

8

Melbourne (64)

Sydney (83)

South San Francisco – R&D Site Growth

Amgen

Bldgs 1 & 2

Bldg E

Gateway Bldgs

9

Phase 2

10

R&D Global Expansion Planning

Growth at a global level is iterative and multi-faceted

– Planning vs. a “Plan” – never complete

– It will change as information becomes available

– External factors are important

Planning leads to implementation

– A plan is only as good as the implementation

– Process is important

– Control mechanisms

Corporate support is required

– Actions by R&D affect other functions

– Key strategies towards commercialization

– Buy-in by all of Amgen

11

Master Planning and Development

Charter: Execute against developed strategies, with reasonable flexibility, to

allow for necessary business changes

Acquisitions

Pipeline

Business Drivers

LRP / LE

Full-Time

Site Impacts

Contingent

Headcount

ILM / CRC

EVP Reviews

Capital

Expense

Spend

12

Expansion Planning Process

Define “Engine Size”

– Where do we want to be in five, ten years?

– Balance of top-down & bottom–up approaches

– Assumptions Model

Refine Location

– Criteria to determine location

– Key factors

– Strategies to fully enable – critical mass, etc…

Match Demand to Existing Capacity – Gap Analysis

– Refined by space typology, Modality, organizational structure

– Baseline of Long Range Plan

– M&A / In-license factors

Define timing necessary to initiate decision-making

– Time to fund, design, and construct

– Decision points for “Go / No-Go”

Scope definition

– Short-term / long-term – rate defined

– Specific space typology

– Means to implement

13

Capital Investment Process

Project Origination

PreProject Planning

Originate through Master

Planning & Development

All projects must be fully

scoped before execution

Money can not move

between projects

BOD approved

LRP/Budget is basis for

all new projects

All projects must have

independent cost &

schedule assessment

All projects must have

strong, clear business

justification

Results in a not-to-exceed

cost estimate

Scope changes must follow Forced close-out at

the Project Change

[180] days after

Notification (PCN) process occupancy

(and should be minimal)

Project Execution

Project Closeout

Closeout will be driven

by a definitive process

– Re-start ILM if change of

business case or add’l

funding required

Scope: Any project > $600k or any project which has

strategic implications

Clear ownership and control points for all phases

14

A permanent Capital Review Committee oversees

the Capital Investment Process

$

$

15

Strategic Planning and Execution Process

Partners

Executive Management – Ownership of Strategy, Champion

–

–

–

–

Where do we want to be in five, ten years?

Assumptions Model

Location Approval

Strategies to fully enable – critical mass, etc…

Finance

– Ownership of demand model

– Financial Long Range Plan

– Financial analysis support

Human Resources

– Intellectual Capital factors – location , availability, cost

– Attract and retain the best and brightest

Capital Projects

– Execution of building

– On-time / On-budget

Standards and Training

– Ensure quick effectiveness of new staff

– Compliance adherence

16

Translating the Strategic > Long Range Capital Plan

Jim Andrews

Associate Director, Nektar Therapeutics

Translating the Strategic Plan into a Capital Plan

The Strategic Plan broadly defines what Management

wants the future to look like and certain milestones for

getting there

Strategic Plan must be consistently communicated across the

organization from the top down

To develop the Capital Plan, we

need to identify the building

blocks required to reach this

goal

May 18, 2006

Doing the Research

The next step is to determine the pieces required to

assemble the ultimate picture

– Interview the customer groups

– Catalog requests for space, equipment, personnel

– Identify key drivers for each need

Customer representatives

must be on-board with

the Strategic Plan

May 18, 2006

Customer representatives

must have visibility of the

tactical operations and

out to the future

Building a Plan

The information gathered must be distilled into a consistent

and coherent picture

– Assemble the information and reconcile inconsistencies and

conflicts

– Tie capital to product or business milestones

– Define prerequisite items

– Identify “non-scalable” projects

Take the tenor of the

customer into

consideration

Rely on the Law of

Averages to help smooth

out projections

May 18, 2006

Identifying Capital

A “Capital Report Estimate” should be developed for each

customer need.

– Work with the Financial group to determine level of accuracy

required over time

– Access outside parties to develop factor estimates or identify

comparable benchmarks

– Link infrastructure and other prerequisites to driver projects

– Estimate durations and

expenditure profiles

Given the absence of

scope definition, wide

bands should be

maintained around

budgets and durations

May 18, 2006

Communicating the Need

• Include assumptions with the assembled Capital Reports.

• Due to “typical” durations, the reviewing and initiating

processes need to be ongoing.

• Identify exposures or risks for each project.

In the long run, a “Living

Plan” is much easier to

manage than a series of

one-time efforts.

May 18, 2006

Internal Project Financing

Bubba Brueil

Chief Financial Officer, Codexis

Internal Project Financing

Where Academia Collides with Reality

Robert S. Breuil

Chief Financial Officer

Codexis,, Inc.

What they taught me…

{Net

Present Value

{Hurdle Rate

{Weighted Average Cost of Capital

{Monte Carlo Simulation

{Decision Trees

{Option Pricing

What I learned…

{Personal

P&Ls

{Earnings Management

{Execution Risk

{M&A Synergies

{Silos

{Fiefdoms

{Capital Sources vs. ROI

…and RE-learned:

{Crystal Ball/@Risk

{Law of Large Numbers

Personal P&Ls

{What

motivates project funding decision-makers?

zEarnings

growth

zStock appreciation

zDivisional earnings

zEgo/Passion

{How

risk tolerant are they?

zTrack

record

zCareer maturity

{What

are their potential rewards & downsides?

Where are you?

Earnings Lifecycle/

Investors

NYSE + Dividends/

Income Funds

IPO to Nasdaq/

Growth Funds

Private/

VCs

Execution Risk

{What

are the consequences for NOT investing?

zWhat

products might be delayed?

zWhat would be the lost revenues/profits?

zAre there weaknesses in earnings/growth?

zHow might competitors leapfrog you?

zWhat regulatory/safety risks could arise?

zIs there an FTO angle?

zWho could get fired?

M&A Synergies

{Will

this make us more attractive to acquire?

zWho

might acquire us?

zWhat is their earnings outlook?

zWill this put them at a competitive disadvantage?

zDoes this redundantly duplicate their capacity?

{Will

this improve our ability to acquire others?

zIs

it complementary to what they have?

zIs their’s nearing obsolescence?

zDoes ours combined with theirs = critical mass?

= dominance?

Silos vs. Fiefdoms

{Does

this project require:

zCooperation

across distinct chains of command?

zFunding from different business segments?

zOne division bear risk, another to reap rewards?

{Do

critical decision makers/responsible parties:

zHave

similar/compatible egos (Myers-Briggs)?

zShare vision of corporate future?

zFeel fully valued/respected?

zSee opportunities as half-full vs. half-empty?

zHave a balance of:

authority/responsibility/accountability

Sources of Capital

{Is

this project funded by:

zGeneral

corporate funds?

zExcess earnings?

zProject-specific debt?

zPublic debt?

zPublic equity?

zPrivate equity?

Modeling Techniques

{Probability-enhanced

zSequential,

independent

zDistribution (@ Risk)

zSimulation (Monte Carlo)

{Option-based

zQuantitative

zQualitative

{Law

of Large Numbers

zPortfolio

method

zBinary/exogenous risk

The effectiveness & accuracy of Long Range Capital Planning

Lid Sodbinow

Director of Capital Projects, Engineering, Novartis

•

•

•

The size of the Company directly correlates to the Planning

approach

– Example:

• Chiron – (smaller than AMGEN or Genentech)

• Objective –

– Speed to market

– Commercial Success

Constraints –

– Financially driven vs. Clear Understanding of

Manufacturing Operations required to support commercial

products

“What does Manufacturing really need?

35

•

The result is limited manufacturing Capacity and Flexibility

•

The benefit is robust financial controls…but projects are

“justified” many times during the approval process

•

Is this the right model?

•

Does this process encumber manufacturing’s capabilities?

36

Long Range Capital Planning

Long Range Capital Planning

• The ISPE SF Bay Area Chapter

expresses their gratitude to the

panelists

•Q&A