Microeconomics Qn: Apply the concepts of scarcity, opportunity cost

advertisement

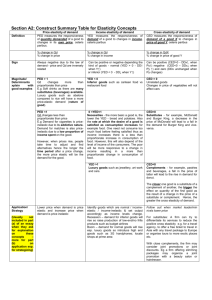

Microeconomics Qn: Apply the concepts of scarcity, opportunity cost and the PPC curve to welfare economics issues. The welfare of a society is maximised when it consumes the largest amount of goods and services its available resources can possibly produce. But because human resources are unlimited while resources are limited, scarcity arises and it becomes necessary to have more of one good only by having less of another. The best combination of goods and services must be achieved for a society to maximise its well-being. Choosing the best combination involves listing of goods according to their importance. Hence basic necessities such as food, clothing and shelter come first, followed by public and then merit goods. Due to scarcity of resources, opportunity costs, which measure the cost of making a choice in terms of the next best alternative foregone, are incurred. In the short run, a society’s well-being is maximised at full employment level. That means all available resources are fully employed given the level of technology. But over a longer period of time, welfare is further increased by expanding one’s productivity, that is, the given level of resources produces more output than before. If an economy uses its resources to produce capital and consumer goods, then by increasing production of capital goods, the country expands its capacity to produce all goods in the future. However, more capital goods involves an opportunity cost; consumer goods. Thus, in order to increase future standards of living, it is necessary to accept a lower one in the present. Capital goods A B The Production Possibility Curve (PPC) shows the different maximum attainable combinations of two goods or services. Shifting the curve from B to A means producing more capital goods at the expense of consumer goods. Consumer goods Qn: ‘Prices tell us what goods and services to produce and consume.’ (Southern Africa Economist, January 1991) Describe and explain the economic principles on which this statement is based. The combination of the analysis of demand and supply will give the equilibrium price and quantity. For each good, there is a supply schedule and a demand schedule. If the two are brought together, we find that the quantity demanded and quantity supplied will be equal at one and only one market price. This is the equilibrium price, P, and the quantity demanded will be at the equilibrium level, Q. Refer to Fig. 1. (sorry, too lazy to draw 2 graphs to show change/comparison etc.) Microeconomics Price If demand increases, meaning consumers are more willing and able to consume a product or service, quantity demanded exceeds quantity supplied, hence the good often goes to the highest bidder. Ceteris Paribus, this pushes the price of the good up, and suppliers are more willing to increase quantity supplied at the higher prices. Ss P Dd Q Quantity With the higher price however, quantity demanded decreases along the demand curve and a new equilibrium is reached where quantity demanded equals quantity supplied Therefore, the price P tells us what goods and services to produce (using the supply curve) and consume (using the demand curve), ie. the level Q. Qn: a) Compare price elasticity of demand, income elasticity of demand and cross elasticity of demand PED Definition PED measures the degree of responsiveness of quantity demanded of a good to a change in its own price, ceteris paribus % change in qty demanded Formula % change in price Sign Always negative Price 1 <|PED|< ∞ Normal goods Elastic Price Inelastic Perfectly Price Inelastic Unit Price Elastic Perfectly Price Elastic 0 <|PED|< 1 Necessities YED YED measures the degree of responsiveness of quantity demanded to a change in the income of consumers, ceteris paribus % change in qty demanded % change in income Can be positive or negative YED > 1 Normal goods/Luxury goods YED < 0 Inferior goods 0 < YED < 1 Necessities PED = 0 eg. Antiques YED = 0 Inferior Goods |PED|= 1 YED = 1 |PED|= ∞ CED CED measures the degree of responsiveness of quantity demanded of a good to a change in the price of another good, ceteris paribus % change in qty demanded of good X % change in price of good Y Can be positive or negative CED > 0 Substitutes CED <0 Complements CED = 0 Unrelated goods, sales independent of each other Microeconomics b) What are the limitations of these concepts? Firstly, Ceteris paribus assumption is a fundamental drawback in terms of real world application as it assumes no factors except the price (PED); income (YED); price of a related good (CED) respectively changes. However, in the real world, at any particular point in time, many factors such as the price of a related good, or the income level of consumers may be changing simultaneously. (give an example) In other words, demand may not behave as predicted by elasticity concepts. Secondly, the cost-side of the profits equation is ignored as the concepts are only useful to help firms increase revenue. PED concept helps businesses decide on appropriate pricing strategies. YED helps businesses decide on output strategies and CED helps businesses to decide on joint and reactionary-marketing strategies. However, none of these elasticity concepts deal with the cost-side of the equation, and do not help with cost-cutting strategies or productivity enhancing strategies. In short, the concepts are unable to help firms maximise profits as costs are not taken into consideration since profits = total revenue minus total costs Thirdly, the validity of applying elasticity concepts in formulating business marketing strategies rest on the crucial assumption that all information pertaining to elasticity concepts are available to firms. It is assumed that firms have perfect information to make rational business decisions. However, in reality, it is not possible to attain such perfect information. With imperfect or incomplete information, strategies adopted by firms may not be as successful. Lastly, the supply side of the market is ignored. When strategising, firms should also take price elasticity of supply into consideration – whether they can respond fast to the change in demand. It is simply assumed that supply can easily cope with changes in demand, though in reality cutting prices to stimulate demand may not be successful in raising sales and revenue if supply cannot cope with the increased demand. c) With reference to PED, discuss the likely effects of increasing the general level of indirect taxes on goods and services. Indirect taxes are imposed on items of expenditure, that is, goods and services, for example sales tax, tariffs etc. When there is an increase in the general level of indirect taxation on goods and services, the likely effects will depend on the price elasticity of the demand curve in question. Microeconomics Price Relatively Price inelastic Demand Relatively Price elastic Demand S1 P1 P0 P2 E1 C S1 S0 E0 D S0 P1 Po P2 E1 C D O Q1 E0 D0 D0 O Q1 Q0 Quantity Q0 Quantity From the figures, the initial equilibrium is at E0, with demand D0, and supply S0. The revenue is OP0E0Q0. With an increase in indirect tax, price increases from OP0 to OP1. The new revenue is OP1E1Q1. The burden borne by consumers is represented by the area P 0P1E1C, and the burden borne by suppliers is P2P0CD. It can be seen that when price elasticity of demand is more than zero, consumers’ share of the increase in indirect tax is smaller than that by producers. However, when price elasticity is between 0 and 1, consumers bear a bigger burden of the tax. (perfectly inelastic/elastic can be mentioned too, though not much point) (too lazy to mention deadweight loss) In conclusion, the more inelastic the demand curve, the higher the incidence of tax on consumers. Similarly, the more elastic the demand curve, the lower the incidence of tax on consumers. The overall effect of tax is that price is pushed up and quantity exchanged is reduced.

![Microeconomics [Determinants of Elasticity] - 12S7F-note](http://s3.studylib.net/store/data/009642837_1-570a4583f5a1f1b52d35c25c52455fce-300x300.png)