Managing Human Resource Requirements

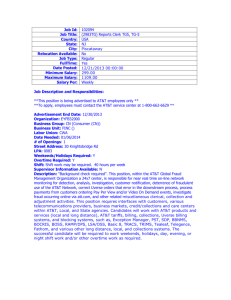

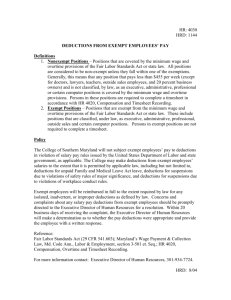

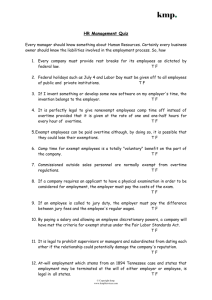

advertisement

Managing Human Resource Requirements for Texas ASC Society Presented by: Donna Meek, Staff One Director of Business Development PPACA Certified Professional 1 HR Compliance • Companies face more rules concerning the employer/employee relationship than in any time in history. Every aspect of workplace life seems to be covered by one law or another – or, to make things even more complicated, multiple overlapping statutes. • Under Obama care there are 854 new regulations. ... it contains provisions that could have a significant impact on nearly every business . Non-Exempt vs. Exempt • Definition of non-exempt employee Most employees are entitled to overtime pay under the Fair Labor Standards Act. They are called non-exempt employees. Employers must pay them one-and-a-half times their regular rate of pay when they work more than 40 hours in a week. The biggest problem most employers have with nonexempt employees is miscalculating how much overtime workers are owed. • Definition of exempt employee The Fair Labor Standards Act contains dozens of exemptions under which specific categories of employers and employees are exempted from overtime requirements. The most common exemptions are the white-collar exemptions for administrative, executive, and professional employees, computer professionals, and outside sales employees. There is a also a lesser known exemption for certain retail or service organizations. The primary advantages of classifying employees as exempt are that you don’t have to track their hours or pay them overtime, no matter how many hours they work. Tracking Exempt Duties 1. Current detailed records of day to day activities of exempt employees 2. Performance appraisals that ask employees to describe and assess their own performance. 3. Detailed job descriptions with responsibilities defined. Allowable Deductions for Exempt Employees • • • • • • • Proportional deductions for whole-day absences due to personal reasons other than sickness or disability. Proportional deductions for whole-day absences due to sickness or disability (including workrelated accidents) if this is done in accordance with a bona fide plan, policy or practice providing compensation for salary loss due to such sickness or disability. Offsets against the salary for any amounts received by the employee as jury fees, witness fees or military pay for the particular workweek. Salary deductions made as penalties imposed in good faith for infractions of safety rules of major significance. Salary deductions made for unpaid disciplinary suspensions of one or more full days imposed in good faith for infractions of workplace conduct rules. This encompasses suspensions imposed under written policies applicable to all employees regarding serious work-related misconduct such as sexual harassment, violence, drug or alcohol violations or violations of the law. Paying a proportionate part of the employee’s full salary for the time actually worked in the first workweek of employment or in the last workweek of employment. Paying a proportionate part of the employee’s full salary for the time actually worked in the workweek when the employee takes unpaid leave under the federal Family and Medical Leave Act. Independent Contractors Some of the factors courts will consider when deciding whether someone is an independent contractor or employee : – who controls the manner in which the job is done? – Who sets the worker’s hours? – Whether the work is performed on the employer’s property during regular business hours? – How long the company’s relationship with the worker lasts? – The method of payment? – Is the work part of a company’s regular business? – Who provides the tools necessary to perform the job? Misclassifying Workers • Misclassifying workers Incorrectly classifying workers as independent contractors can be a costly mistake. If a court decides they’re really regular employees, a company can incur significant liabilities. Misclassified workers are entitled to the benefits they would have received if they had been classified correctly. This could include health insurance, retirement benefits, and stock options. • Discrimination and harassment Employees, unlike independent contractors, are protected by discrimination and harassment laws, including an employer’s duty to accommodate any disabilities. But, if a company’s employees harass or discriminate against an independent contractor because of his race, the company can be liable under Section 1981 of the Civil Rights Act of 1866 (yes, 1866). The law protects minorities’ right to enter contracts, including an independent contractor’s agreement to perform work for a company. • Overtime and minimum wage Employers might also have to reimburse misclassified workers for wages they should have paid them under the Fair Labor Standards Act (FLSA). That includes overtime and minimum wage. • Tax ramifications for misclassifying workers If an independent contractor turns out to be an employee, the company might have to pay back taxes and/or penalties for federal and state income taxes, FICA, and unemployment Misclassifying Workers • Misclassifying workers Incorrectly classifying workers as independent contractors can be a costly mistake. If a court decides they’re really regular employees, a company can incur significant liabilities. Misclassified workers are entitled to the benefits they would have received if they had been classified correctly. This could include health insurance, retirement benefits, and stock options. • Discrimination and harassment Employees, unlike independent contractors, are protected by discrimination and harassment laws, including an employer’s duty to accommodate any disabilities. But, if a company’s employees harass or discriminate against an independent contractor because of his race, the company can be liable under Section 1981 of the Civil Rights Act of 1866 (yes, 1866). The law protects minorities’ right to enter contracts, including an independent contractor’s agreement to perform work for a company. • Overtime and minimum wage Employers might also have to reimburse misclassified workers for wages they should have paid them under the Fair Labor Standards Act (FLSA). That includes overtime and minimum wage. • Tax ramifications for misclassifying workers If an independent contractor turns out to be an employee, the company might have to pay back taxes and/or penalties for federal and state income taxes, FICA, and unemployment Health Care Reform Compliance 1 #1 Communication Strategy • Summary of Benefits and Coverage (SBC) Required for any renewal since September 23, 2012. Penalties and fines can be $1000 per employee. • Exchange notice Deadline October 1, 2013. You must provide current employees with notice describing the availability of Exchange coverage. • W-2 Requirements Employers must report the value of employer-sponsored health coverage on the employee's W-2 excluding salary reduction amounts to health flexible savings accounts (FSAs), health spending accounts (HSAs), and medical savings accounts (MSAs). #2 Record Keeping Requirement • Optimize labor management so you can maintain record keeping requirements Track actual hours paid (including worked and non-worked) Report total hours paid by date range Determine who will be considered Full-time Consult with your tax accountant or CPA for timing and how often to track information for their records. #3 Plan Administration • Understanding how to properly administer, document and tax Medical Loss Ratio (MLR)Rebates. • Non-discrimination Testing on your plan • Compliance and efficiency methods for administering benefit administration • Utilize technology (including mobile) to increase education and support. #4 Financial Implications to Evaluate • Current Plan Design Renewal Date, Eligibility Period (can not exceed 90 days), Out of Pocket Maximum, Deductible, Grandfathered Status) • Participation and Contribution Amounts • Medical Cost Calculators • Small Business Tax Credits #5 What Will Impact Health Cost? • Community Rating – Gender is no longer a criteria – Age Rating • 3:1 Ratio – Tobacco Use • 1.5:1 Ratio • Composite Rates VS Age Banded Rates • Grandfathered Plans • Self Insured Plans Additional Changes • Individual Mandate (Not Delayed) Penalty Amount: – Greater of $ amount or a % of income • 2014 = $95 or 1% (cap for bronze plan) • 2015 = $325 or 2% • 2016 = $695 or 2.5% #6 Develop High Value Benefits Strategy • Current Carrier Renewal Date Strategies • Change plan design • ERISA Fully funded Plans • Defined Contribution Plans #6 Develop High Value Benefits Strategy (Continued) Questions to Consider: • Should I renew my group on 12/1/2013 or 1/1/2014? • How will my carrier look at participation in 2014? – (Nondiscrimination 105h) • • • • • • Does making my plan unaffordable help my employees? Does the current method of premium sharing with my employees still work? Who will educate my employees on the exchange, subsidy and enrollment choices? Change plan design? Frequently Asked Questions 1. 2. How will Healthcare Reform impact our budget over the next 1-3 years? What changes have we made to the new hire on-boarding process due to HCR? 3. What are the financial effects of our lower paid workers leaving our Health Plan for the public exchange? 4. Have we determined the consequence to our plan for waivers coming back to our benefits? 5. Are the plans we offer “grandfathered”? 6. Will our plan be subject to community rating? 7. Is our plan design considered Minimum Essential Coverage? 8. Does our current contribution strategy protect us from penalties? 9. When do we have to begin reporting the value of the benefits to our employees on the W-2 form? 10. What process are we going to use to communicate the availability of the public exchange and the individual mandate penalty to our employees? Are You Ready for an Audit? 1 Human Resource Audit Checklist Compensation and Benefits During an HR audit of compensation and benefits, how pay for each position is determined and whether pay is consistent among employees in the same position are important. The quality and price of the benefits plan, as well as which employees qualify for it, may also be evaluated. Paid time off for vacation and illness and appropriate compensation for overtime work are other issues to evaluate. Recruiting and hiring Job descriptions for each position should be evaluated for clarity and currency. Interviewing practices and policies can also be reviewed. Other practices that may be evaluated are whether all job applicants submit the same required materials such as resumes and application forms, whether references and backgrounds are checked before hiring and whether all applicants are interviewed equally and appropriately. The application itself may be evaluated for clarity, thoroughness and its appropriateness to the position Human Resource Audit Checklist Performance Evaluation The current performance evaluation system should be reviewed, including how evaluation criteria are determined, whether they are appropriate for each position and how often employees are evaluated. Disciplinary actions for poor performance can also be reviewed for effectiveness and fairness. Education and Training The amount and type of training given, as well as how the education program is managed, are important factors in an audit. Are staff development and education programs developed and held on-site, or outsourced? Do only employees in certain positions receive training or do all employees receive the same development opportunities? Overall, what does the education and training plan achieve and how might it be improved? Human Resource Audit Checklist HR Departmental Practices In addition to auditing specific areas of your human resources department, review the HR function in its totality and in relationship to other departments. -Employee Records such as benefit files, I-9’s, Compliance notices, etc. If you have any questions or would like to inquire about outsourcing your HR compliance, payroll, benefit administration including PPACA compliance and risk management please contact Donna Meek 405-8300115