Presentation Title - Casualty Actuarial Society

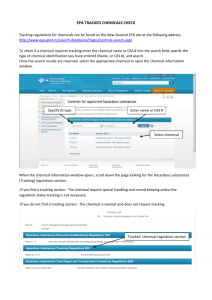

advertisement

Current CAS Issues and Directions Tom Myers, CAS Chairman of the Board Casualty Actuaries of Europe May 22, 2008 Agenda CAS Centennial Goal CAS Membership by Geography ERM Initiatives New CAS Basic Education Structure Professionalism Issues Upcoming Events A New Seminar for 2009 Your Input CAS Centennial Goal The CAS will be recognized globally as a leading resource in educating casualty actuaries and conducting research in casualty actuarial science. CAS members will advance their expertise in pricing, reserving, and capital modeling; and leverage their skills in risk analysis to become recognized as experts in the evaluation of enterprise risks, particularly for the property and casualty insurance industry. Geographic Distribution of CAS Membership 4000 3500 3000 2500 2000 1500 1000 500 0 2008 U.S. Canada Bermuda Europe Other Europe Breakdown 40 40 35 30 26 25 20 15 10 7 4 5 4 3 2 1 0 Nation U.K. Ireland Switzerland Sweden Germany Netherlands France Spain CAS Enterprise Risk Management Initiatives CAS ERM Vision – Actuaries are qualified CAS Risk Management Committee 2008 ERM Symposium (SOA/CAS and others) Online Course: Introduction to ERM ERM2 (Enterprise Risk Management and Modeling) Sessions at CAS Meetings and Seminars The ERM Actuary CAS is focused on enhancing our role in ERM by: Providing continuing education on ERM; Conducting research to address unanswered ERM questions (e.g., operational risks, risk aggregation) Promoting Exploring actuarial skills in addressing ERM issues; changes to the CAS syllabus. CAS has not created an ERM designation (i.e., the CERA created by the SOA) Revised CAS Basic Education Structure March 2008 CAS Board Meeting: Approved changes to the CAS basic education structure that will affect current Exams 5-9. Implementation will occur no sooner than 2011 sittings. Revised CAS Basic Education Structure Features of the Revised Basic Education System: No change to Validation by Educational Experience (VEE) Preliminary Actuarial Exams – Probability, Financial Mathematics, Financial Economics, Life Contingencies and Statistics, and Construction and Evaluation of Actuarial Models Revised CAS Basic Education Structure Features of the Revised Basic Education System: Two module self-paced internet based course: Introduction to P&C Insurance, Insurance Operations, Specialized Lines of Business, Miscellaneous Ratemaking Topics, Actuarial Control Cycle. Insurance Accounting Principles, Reinsurance, Background Law, Regulation of Insurance (Canadian and U.S. versions). Revised CAS Basic Education Structure Features of the Revised Basic Education System: A four-hour exam covering Basic Ratemaking and Basic Reserving. A four-hour (nation specific) exam covering Regulation and Financial Reporting. Course on Professionalism. Associateship Criteria Revised CAS Basic Education Structure Features of the Revised Basic Education System: Advanced Ratemaking exam. Advanced Reserving, Reinsurance and ERM exam. Investment and Rate of Return exam. Fellowship Criteria Revised CAS Basic Education Structure Changes From the Current System: Internet-based course in two modules consisting of parts of current Exams 5, 6 and 7 Material only tested at the familiarity level is moved to an online format. Reduction of the upper level exam hours Currently 5 exams x 4 hours = 20 hours Will be 17 hours, 2 four-hour exams and 3 three-hour exams. Revised CAS Basic Education Structure Changes From the Current System: Additions Deletion Stochastic Reserving and Reserve Ranges to the Advanced Reserving Exam and Actuarial Control Cycle to the internet-based modules. redundant elements of the current Exam 8 which have been moved to the preliminary exams. Reduction of volume of study material. Revised CAS Basic Education Structure Rationale for the revisions: Leveraging the use of technology. Testing material needing only familiarity can be more efficiently done online as self-paced units. This MAY provide for a more timely achievement of ACAS and FCAS designations. Revised CAS Basic Education Structure Board is aware of the need to provide a transition process to minimize the disruption for candidates. Approved options facilitate the conversion: If a candidate has credit for only one of the required exams (either Exam 5 or Exam 6), the candidate will be allowed to take just the part of the new exam for which he/she is missing credit in order to obtain credit for the new exam. This half-exam option will be available for multiple sittings after the official conversion to the new education structure, which will occur no sooner than 2011. Revised CAS Basic Education Structure Transition Rules: Current Exam 5 – Credit for Half Exam on Basic Ratemaking and Internet Module 1. Current Exam 6 – Credit for Half Exam on Basic Reserving and Exam on Advanced Reserving, Reinsurance and ERM. Current Exam 7 – Credit for Exam on Regulation and Financial Reporting and Internet Module 2. Current Exam 8 – Credit for Exam on Investments and Rate of Return. Current Exam 9 – Credit for Exam on Advanced Ratemaking. New Educational Materials Two consultants engaged to prepare an entire set of materials for the ratemaking and reserving portions of current CAS Exams 5 and 6. Implementation Task Forces working closely with authors. Final publications due by December 31, 2008. Expected to be included on 2010 Syllabus of Exams. Candidate Code of Conduct Board approved adoption of a Code of Professional Ethics for Candidates, and Rules of Procedure for Disciplinary Actions Involving Candidates Requires Actuarial Candidates to adhere to the high standards of conduct, practice, and qualifications of the actuarial profession. Effective with registration for the 2008 Spring exam sitting. Professionalism Code of Professional Conduct PRECEPT 2. An Actuary shall perform Actuarial Services only when the Actuary is qualified to do so on the basis of basic and continuing education and experience and only when the Actuary satisfies applicable qualification standards. ANNOTATION 2-1. It is the professional responsibility of an Actuary to observe applicable qualification standards that have been promulgated by a Recognized Actuarial Organization for the jurisdictions in which the Actuary renders Actuarial Services and to keep current regarding changes in these standards. Professionalism Code of Professional Conduct PRECEPT 3. An Actuary shall ensure that Actuarial Services performed by or under the direction of the Actuary satisfy applicable standards of practice. ANNOTATION 3-1. It is the professional responsibility of an Actuary to observe applicable standards of practice that have been promulgated by a Recognized Actuarial Organization for the jurisdictions in which the Actuary renders Actuarial Services and to keep current regarding changes in these standards. Professionalism Actuaries practicing in the United States: Must follow standards promulgated by the American Academy of Actuaries and Actuarial Standards Board. Actuaries practicing in other countries: Responsible for determining the standards that apply in their country of practice. U.S. Qualification Standard (Who Do They Apply to?) The new Qualification Standards apply to all actuaries performing Actuarial Services, which includes opinions, intended by that actuary to be relied upon by the person or organization to which the opinions are provided. Such opinions are now considered to be Statements of Actuarial Opinion (SAO’s) – basically any professional opinion expressed by an actuary in the course of performing Actuarial Services. U.S. Qualification Standard (Who is a Qualified Actuary?) An actuary who meets the following criteria: Member of the Academy, or Fellow or Associate of the CAS or the SOA, Fellow of the CCA, or Member or Fellow of ASPPA, or Fully qualified member of another IAAmember organization; and Three years of responsible actuarial experience U.S. Qualification Standard (Specialty Track Requirements) An actuary is also required to: Have Responsible Actuarial Experience in Specific Area of Actuarial Practice Relevant to the subject of Actuarial Opinion U.S. Qualification Standard (New CE Requirements) Annual continuing education requirements will increase to 30 hours per year Minimum three hours on professionalism topics Minimum six hours from “organized” activities A credit hour is 50 minutes 2008 is a transition year (24 hours required) SOA CE Requirements March 2007 – SOA Board approved a motion establishing a Continuing Professional Development Requirement for SOA members. Nov 2007 – Released exposure draft to allow members to comment on the provisions; comment deadline February 2008. June 2008 – Board will approve a final implementation plan. Jan 2009 – SOA requirement effective. Future Events CAS Spring Meeting, June 15-18, Quebec – Joint Meeting Day with CIA and SOA 2008 ASTIN Colloquium, July 13-16, Manchester, UK Casualty Loss Reserve Seminar, September 18-19, Washington, D.C. CAS Annual Meeting, November 16-19, Seattle Look for announcements regarding upcoming webinars. Changes to Professional Education In 2007, a Task Force considered ways to restructure the Ratemaking Seminar and Predictive Modeling Seminar. The Executive Council approved building a new Seminar that will draw on the best aspects of the Traditional Ratemaking Seminar and the newer Predictive Modeling Seminar. Changes to Professional Education New Seminar will recognize and reflect how the role of the actuary has expanded over the past twenty years. Integrated seminar that covers: Product development Product management Pricing Underwriting Marketing Changes to Professional Education There will be a Predictive Modeling Seminar in October 2008. In 2009, the CAS will not offer a Ratemaking Seminar or a Predictive Modeling Seminar These offerings will be replaced by the new Seminar. The dates of the new Seminar in 2009 have not yet been finalized. Strategic Planning Committee welcomes your input regarding: Catastrophe availability and cost issues – How are these actuarial issues? For example, coverage where it was not intended (Katrina). Communications Skills – More crucial than EVER for actuaries. Should the CAS provide communication training? Rapid Advance of Technology and Science – How does the actuary balance rapid technological changes and expanding data availability with an equal skill for analysis and judgment? (More information/less data) Outsourcing/offshoring – Competition from lower cost qualified “offshore” actuaries – threat or expansion? Merge the North American Actuarial Organizations? WHAT ELSE? Thank You! Tom Myers Casualty Actuarial Society Chairman of the Board Casualty Actuaries of Europe May 22, 2008