SecReg - Module II (Materiality)

advertisement

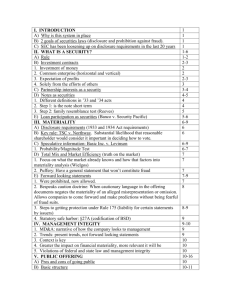

Spring 2013 Securities Regulation William Daughtrey Module II Notes - Materiality January 17th Why is Basic the most important case in the course? - In part b/c it defines materiality - But mainly b/c it resolves the question of whether individual investors in a securities fraud class action have to show individual reliance o Efficient market theory – a lie to one person is a lie to everyone o Enables class action without proving individualized reliance Framework for Basic and the Second Part of the Course - Parties in a Private Lawsuit o Plaintiff (purchasers or sellers) Existing shareholders who sold Basic – Levinson, who is the lead plaintiff for the class action o Defendant (primary violator / including company) Basic – Basic, Inc. Why not sue the CEO – He doesn’t have the money Respondeat Superior Could the executives have been sued – Yes - Elements o Material o Misrepresentation or Omission o Scienter The heart of common law fraud Def. – the person speaking knows the true state of affairs and in specking falsely, expects that the listener will believe him or her Compared to recklessness – Recklessness can be the basis of a 10b-5 action USSC has not addressed issue specifically, but Congress may have spoken o Reliance Basic – just show that the market relied on the information Proof that stock analysts relied – movement of the share price o Causation Fraud (misstatement) must have caused the loss E.g. – if you rely on the odometer in buying a used car and get in wreck the next day, then the wreck caused the damage, not the fraud of the mileage o Damages - Required Nexus o Jurisdictional nexus (federal court) o Transactional nexus (“in connection with purchase or sale of securities”) Spring 2013 Securities Regulation Materiality “Test” - What information investors would want to know - Borrowed from state security blue sky laws and common law fraud - Odometer Example o 500 miles on the odometer would not be material - TSC Industries (US 1976) o A fact is material if “there is a substantial likelihood a reasonable investor would consider it important” in deciding how to vote [whether to buy or sell stock] o Substantial Likelihood – significant o Reasonable Investor – Contextual – depends on who is being conveyed the information o Would consider it important Would – still indefinite; not certain but more definite than could It – the information or omission Important – not necessarily decisive but also more than just relevant or of interest o Put Another Way, there must be a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the “total mix” of information made available Again, context is everything Materiality Contexts - Forward-looking information (“speculative” information) - Objective tests - Total Mix - Management Integrity Background of Basic - The companies are in discussions - Optimism about these possible negotiations - Statement #1 – No negotiations are under way - Statement #2 – another lie - Statement #3 – another lie - Merger is then announced Company’s Arguments - Did not want to overwhelm investors - Company needs secrecy – need negotiations that have reached near fruition - Knowability - need to have a clear standard for when management would know that information is material Sixth Circuit - Information became material by virtue of its existence - USSC – this is too far from the common law Response to Defendant Arguments - Defense Argument 1 – Did not want to overwhelm investors Spring 2013 Securities Regulation - - o Response - These are reasonable investors – stock analysts; cannot have information overload with them, particularly with regard to a merger Defense Argument 2 - Secrecy of merger negotiations o Response - this argument is more properly considered under a duty to disclose o An issuer is not duty bound to disclose information just because it is material o Application here – the company voluntarily disclosed partial information – it commented The company should have just said “no comment” o When do you have a duty to disclose – 3 Instances When you talk When the SEC requires you to in special report – 8k To correct or update information Defense Argument 3 - Knowability o Interpreting the securities laws here – not giving management an easy test Probability / Magnitude Test - Def. - With respect to contingent or speculative information or events … materiality “will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity” - What does this statement mean? o E(v) – “Expected Value” o Stock analysts think in terms of expected value o Example: 20% chance of merger that would cause company stock to double from $22 to $44 This information would be worth $4.40 (20% x 22) The expected value of the company would be $26.40 - If this stock information would have been valuable to a stock analyst, then this is material information Hypothetical #1 - Facts o CEOs of Six Feet and Dearly Departed (two mortuary companies – Six Feet is publicly-traded; Dearly Departed is privately-held) have discussed a merger o Reporter asks about the discussions Answer – No Comment - Even if the information is extremely material, there is no duty to disclose unless there is some duty disclose by the SEC in some other rule or regulation - No continuous disclosure securities regime in this country Relevant Statutes to Today’s Discussions - MDNE Disclosure Item 303(a)(1) - Must describe in your annual report any significant likely events on the horizon - Rule 12b-20 – o This is the Basic Rule – if you speak you have to speak honestly and fully about any information Spring 2013 Securities Regulation January 22 Basic v. Levinson Test - It would be convenient to have a price-structure test - While qualitative tests provide some guidance, but we need lawyerly quantitative guidance - Issue / Holding o Issue - When there is speculative information, is information about or omissions to talk about that speculative information is material? o Holding – depends the information’s magnitude / probability Magnitude – potential premiums over market value Probability – how far away are we to that event E.g. price-structure agreement v. breakfast meeting - Reasonable Investor Here – Probability Relevance o The current shareholders who are selling Basic’s shares o Stock Analysts – these are the individuals that are setting the price for the stock by reading every detail about the stock o Looking to the stock analysts to determine how important the information is to stock analyst Extra Notes on Stock Analysts – Valuation Slide - The cases we read today all had to do with stock analysts - They are essentially running the present-valuation program based on all of the information they receive - Looking at what are future cash flows – what is the risk of that cash happening / not happening – significance of the information affecting valuation spread sheet Materiality Contexts - Forward-looking information (“speculative” information) - Objective tests - Total Mix - Management Integrity Litwin v. Blackstone Group LP (2nd Cir. 2011) - Background o FGIC is company that Blackstone acquired from GE Capital o FGIC insures financial instruments o Blackstone company groups Corporate private equity Real estate Marketable Alternative Asset Mgt Financial Advisory o What kind of Lawsuit Brought under the claim that when the management disclosed future trends, that it did not disclose fully the effects of the possible losses o Who are the parties Spring 2013 Securities Regulation - - - - - Plaintiffs - Class action – shareholders Defendants – Blackstone and some of its executives SEC – not in this lawsuit – passed rule 303 mandating certain disclosures, so setting up the framework for this lawsuit Plaintiff Arguments o What should have been stated in the press release – Blackstone stands to lose all of FGIC o Should have more fully disclosed the risks Blackstone Lawyers o Should have put in some cautionary statements o Response to plaintiffs – can’t be too hopeful but can’t be too gloomy o Problem – seems like Blackstone will be sued no matter what SEC 5% Test o Blackstone Argument – Quantitatively there is no problem $331 million = .4% of assets under management $122 million decline = 4% annual revenue o Plaintiff Argument – must look at the quality of the disclosure – how important is this to the investors This is still very important to the business; private equity is significant to the business overall Lower Court o Who are the reasonable investors – stock analysts – no surprise o No significant market reaction nd 2 Circuit o Important Point – enough of a case to overcome 12(b)(6) motion o Corporate Private Equity is a significant segment of the business o This masks changes in earnings Need to discuss the possible domino effect of the losses o Affect management pay Pay to management changes the way they act – whether they start taking more risks, straining accounting standards, etc. o Materiality question is a matter for fact finders – the jury SEC on Qualitative Factors - This is a broader set of factors - May cause misstatement of quantitatively small amounts to be material o Hides unlawful transactions o Relates to a significant segment E.g., Blackstone PE group o Significant market reaction to disclosure Market reaction shows something different than quantitative test o Hide failure to meet analysts expectations o Changes in Income / Cash Flow Change in assets not as important o Affect compliance with loan covenants - There are other factors that any court would consider – can come up with additional qualitative deals o E.g. health of Steve Jobs In re Merck & Co.Sec. Litigation (3rd Cir. 2005) - Spinoff of subsidiary MedCo Spring 2013 Securities Regulation - - - Revenue recognition Policy o Recognize the co-pay revenue and then subtract it later o This would never affect income or cash flow o This is false / misleading but analysts can figure this out – savvy stock analysts would see through this How Merck stock price is effected o Market reacted favorably to the spinoff announcement Sequence of Events o As part of IPO – Merck discloses this revenue recognition policy, but it did not disclose the total amount of co-payments recognized o IPO gets canned – b/c of this misleading information about revenue-recognition policy Merck Argument – stock price didn’t drop when it came clean about its revenue recognition policy – in fact, price even went up modestly Plaintiff Response – must do all kinds of math from Merck’s initial disclosure o April 17 was not full disclosure – only when WSJ did the math did things become clear Court Conclusion o Opaque disclosure is not a material omission Delayed, piecemeal disclosure not material omission o Efficient market theory – court response is very dependent on the efficient market theory o Plaintiff can’t have it both ways Do you want to overcome reliance element with the efficient market theory? Or, do you want to overcome the materiality element by claiming that the April 17 event was too opaque and misleading? Matrixx Initiatives v. Siracusano (US 2011) - Rule - something statistically irrelevant can become investor relevant - Background o Reports that plaintiffs are losing their sense of smell o How is this a securities case – Rule 10b-5 antifraud - Arguments in the Case o Company – There is no cause and effect b/w drug and smell loss – statistically there is nothing happening here from a pharmaceutical standpoint These reports are just outliers Don’t want to bury investors with “trivial information” o Plaintiff – Company continues to paint a rosy picture about the drug and the earnings associated with the drug Company should have disclosed reports - Power of the FDA – FDA can take drug off the market even if there is not conclusive scientific proof that there are negative side effects - Looking Back as a Lawyer for Matrixx o Initially - Silence Don’t have to disclose anything, no matter how material Silence is not actionary o Once company decides to issue a press release Disclose everything - Court Decision o Medical researchers use not only statistically significant events but also rare events; ethics issue Spring 2013 Securities Regulation o FDA acts on suspicion of causation, as do consumers – thus, this is very relevant to investors and company should be disclosing this Materiality Contexts - Forward-looking information (“speculative” information) - Objective tests - Total Mix - Management Integrity Basic – we’re also told by Basic that we look at the total mix of information Food Lion Case (4th Cir. 1999) - Background o Labor union claims that there are labor violations o Labor union then brings DOL complaint and issues press release – company says it has clear policy against “off the clock” o PrimeTimeLive trashes Food Lion’s labor practices and sanitation Employees forced to work off the clock – owe big $$$ backpay liability; unsanitary practices Stock falls 11% when program shown - Fourth Circuit o Company said that it was investigating these problems – o Risk to earning were well known to the market before the PrimeTime Live broadcast o Investors knew that these things were going on o The stock fell on the bad press – not b/c these bad things were happening o This is mere puffery – public statements that it did make were no more than soft, puffing statements about clean and conveniently located stores that no reasonable investor could rely upon Company can essentially lie here Taj Mahal Hypo – “Bespeaks Caution” Doctrine - These are junk bonds – the market knows these are junk bonds - Investor knowledge can make a material omission suddenly immaterial – - Why is this dismissed o Is the case dismissed b/c the statements are not false and misleading, or o Is the case dismissed b/c the cautionary statements render the false and misleading information immaterial Materiality Contexts - Forward-looking information (“speculative” information) - Objective tests - Total Mix - Management Integrity Intent of Securities Laws - Create Transparency Spring 2013 Securities Regulation - Create Trust - once individuals state good side of things, individuals have internal commitment to match up to those expectations Brandeis Quote – manager must be held accountable and answerable to the investors that place their capital and assets in the manager’s control In re Franchard (SEC 1964) - SEC enforcement action - Issue – whether company adequately disclosed certain features of management; what disclosure of selfdealing is required - Not Fully Disclosed o Withdrawal of money from company o Pledging of Glickman’s shares - SEC – using this enforcement action to basically create common law - Duty of Disclosure o In a prospectus, must disclose completely o This includes the quality of management – amount of withdrawals not relevant – every single loan or withdrawal by management should be disclosed o Quality of management is at the heart of the reasons investors invest o RULE – all self-dealing is “material” - Rule 12b-20 (See also Rule 408) o This is the catch-all o This requires more disclosure than under common law – includes misleading information / technically lying - Federalism o Issue – should company disclose things about directors o Rule – don’t have to disclose that certain actions of the directors are possible breaches of state fiduciary duties o Tensions b/w Federal and State Law Disclosures on Statements / Reports v. Fiduciary Duties Trade secrets SEC v. Fehn (9th Cir.) - Rule - Criminal Behavior – o Must disclose criminal behavior in last 5 yeas that relate to securities fraud o Must disclose incriminating facts – Exceptions – if under investigation and some others - Lawyer Responsibility o SEC has both civil and criminal authority to come after lawyers for aiding and abetting nondisclosure o Malpractice premiums are highest in this field Spring 2013 Securities Regulation Linda Boss 2. MATERIALITY Rules and Statutes 1. Regulation S-K [things that must be disclosed] a. 103: legal proceedings b. 303: management’s discussion and analysis of financial condition and results of operations c. 401: directors, executive officers, promoters, and control persons d. 403: security ownership of certain beneficial owners and management e. 404: transactions with related persons, promoters and certain control persons f. 406: code of ethics 2. Rule 10b-5 of the Exchange Act a. Prohibition of any act or omission resulting in fraud or deceit in connection with the purchase or sale of securities 3. Rule 12b-20 of the Exchange Act a. In addition tot eh information expressly required to be included in a statement or report, there shall be added such further material information, if any, as may be necessary to make the required statements, in the light of the circumstances under which they are made not misleading. I. What Matters to Investors? a. Choices must be made to determine what information must be disclosed in periodic filings and which false statements give rise to liability b. According to authors of supplemental reading, the purpose of securities laws is to get information to sophisticated investors that they can rely on i. Stock analysts should be able to figure it out ii. To them, that is enough to assume every human being knows that information and that translates into the stock price c. A plaintiff or SEC must show not only that a misleading statement or omission occurred, but also that it was material d. Regulation S-K i. Where SEC filing requirements are contained ii. If an item is listed in it, it must be disclosed, whether or not it would independently be deemed material iii. Some items mandated by the regulation are required only if they are material e. Exchange Act Rule 12b-20— i. In addition to the information expressly required to be included in a statement or report, there shall be added such further material information, if any, as may be necessary to make the required statements, in the light of the circumstances under which they are made not misleading. f. Rule 408 also prohibits misleading ‘half-truths’ g. Malone case i. Said shareholders in Delaware can’t sue in a class action without proving individualized reliance without allegations of fraud h. How is fraud in the market regulated? Spring 2013 Securities Regulation II. i. To get people to buy your stocks, you can either work really hard and make the company successful, or you can lie. ii. Securities fraud actions 1. Parties are plaintiffs (purchasers or sellers—those who transacted) and defendant (the primary violator, including the company) 2. Elements of the case—burden is all on plaintiffs, unless there’s a presumption of reliance a. Materiality b. Misrepresentation or omission c. Scienter [evil heart] i. The heart of classic common law fraud—the person speaking knows the true statement, and in speaking falsely, expects you will believe his statement ii. Above recklessness?—lower courts say it can be the basis for a 10b-5 action; but the supreme court hasn’t addressed the issue. Congress has said you can plead knowledge or recklessness. d. Reliance i. All you have to show is that the market relied—the group of stock analysts relied, and that’s all you need to prove ii. Stock analysts relied if the price changed on the market e. Causation f. Damages i. What is the market loss? g. Supreme court has said section 10b of securities fraud act basically just means fraud. SEC can regulate fraud. SEC passed a rule in 10b-5 that goes beyond fraud; court says we’re talking about intentional misrepresentations here; not negligent misrepresentations 3. Required nexus a. Jurisdictional nexus—in federal court i. Must be in federal court--exclusivity b. Transactional nexus--(‘in connection with securities trading’) i. TSC Industries Inc. v. Northway i. Seminal formulation of materiality ii. Information is material if there is a ‘substantial likelihood a reasonable investor would consider it important’ in deciding whether to buy or sell the stock 1. A reasonable investor is contextual, but usually someone w/ the knowledge of a stock analyst, a sophisticated investor 2. Would—not just whether it’s possible; it’s more than that. iii. There must be a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available 1. Keep in mind this is contextual j. Materiality contexts—forward looking information [speculative information], objective tests [past information could be an indication of future planning], total mix, and management integrity. Valuation a. This is what stock analysts are doing every day b. What are likely future cash flows and what is the risk of that cash flow happening or not happening? Spring 2013 Securities Regulation III. c. Take current cash flows divided by the discount rate to get the present value of future cash flows d. So when reading, see how each of these cases affects stock analysts spreadsheets when they’re doing this analysis Forward-Looking Information a. Basic Inc. v. Levinson i. Facts 1. Basic and Levinson discussed a merger beginning in 1976 2. In 1977 and 1978, Basic made 3 public statements denying any merger plans, denying knowledge of why stock prices were fluctuating 3. Basic shareholders sold stock after the first public statement 4. In Dec. of 1978, Basic publicly announced merger ii. Procedure 1. Shareholders sued Basic in a class action lawsuit for violations of Rule 10b-5 for make material misrepresentations a. Atypical class action because here the corporation gave no news which turned out to be good news; usually good news that turns out to be bad news b. Company argued that the information wasn’t material because disclosing the information would be excite investors too much, they needed the secrecy, and the courts needed a clear standard for when information should be disclosed 2. Trial Court granted SJ for defendants because any statements made were not material 3. Sixth Circuit reversed, holding any statement voluntarily released can’t mislead, and once a statement is made denying existence of discussions, that statement immediately becomes material because it was untrue iii. Issue 1. Once a statement is made regarding a possible merger, how do courts determine whether the statement is material? iv. Reasoning 1. Denied Third and Sixth Circuit’s reasoning because they are too narrow or broad a. 6th—just because a statement is untrue doesn’t make it material—focusing on company instead of reasonable reliance by stockholders—circular definition b. 3rd—preliminary statements can’t be misleading until the merger ‘agreement-in-principle’ occurs and price and structure of transaction is decided 2. court says— a. you can’t just say information would overwhelm investors—they aren’t simple minded people who need the protection of corporation management b. the need for secrecy has to do with the duty to disclose, not the duty to not misrepresent information. The management could’ve said nothing; they just can’t say something that isn’t entirely true. i. Not duty bound to disclose information just because it’s material 1. court says ‘no comment’ = silence ii. You cannot disclose partially omitting material facts iii. When do you have a duty to disclose? 1. When you talk in connection w/ securities transactions Spring 2013 Securities Regulation 2. When the SEC has forms that say we want to know about specific information in special reports a. There’s no duty to disclose pending merger transactions 3. Sometimes there’s a duty to correct and update information c. Court isn’t here to make things convenient for business management— federal securities laws don’t care about the business judgment rule. You don’t get an easy test 3. court adopted second circuit’s reasoning a. materiality ‘will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity’ i. What is the expected value of the information being disclosed and the things that are happening ii. Court-made definition that tracks how the market works—if a stock analyst would consider it important and worth trading on, that’s what the court adopts as the definition b. inside information can become material at an earlier stage than would be the case as regards lesser transactions—even though mortality rate of mergers is high 4. Whether merger discussions in any particular case are material depends upon the facts a. A fact-finder must consider size of two corporate entities and potential premiums on market value b. No particular event or r factor short of closing the transaction is necessary or sufficient by itself to render merger discussion material v. Rule 1. Materiality depends on the significance the reasonable investor would place on the withheld or misrepresented information 2. Probability * magnitude test is how you get materiality, but you’re looking from the reasonable investor’s mind (current shareholders who are selling—stock analysts) a. Magnitude is the effect it would have on the corporation on investor returns i. Will depend on the company b. Probability i. Likelihood of that event happening in the future ii. Figure this out by looking at how far you are toward the occurrence of that event b. Basic Notes i. The reasonable shareholder 1. The standard for materiality is objective—information relevant only to the idiosyncratic investor about a company does not define the company’s disclosure obligations 2. Materiality is a mixed question of law and fact that should ordinarily be determined by the fact finder at trial—but this is usually ignored by trial courts ii. Forward-looking information 1. Aka ‘soft information’ receives mixed treatment under securities laws Spring 2013 Securities Regulation IV. 2. Companies during ‘quiet period’ leading up to public offering disclose soft information at their peril 3. Congress also enacted a safe harbor for forward-looking statements Objective Tests of Materiality a. Some use a rule of thumb to determine materiality i. 5% threshold to apply to probability * magnitude formula from Basic v. Levinson b. SEC Staff Accounting Bulleting No. 99 i. Staff has no objection to a 5% rule of thumb as an initial step in determining materiality ii. Cannot be the end of the analysis, though-must conduct full analysis iii. ‘total mix’ includes quantitative and qualitative factors that are equally important c. Liftwin v. Blackstone Group (2d Cir. 2011) i. Facts 1. Blackstone had several sectors, their Corporate Private Equity sector being the largest 2. Blackstone invested in FGIC, who participated in subprime mortgage lending and credit default swaps 3. Blackstone didn’t disclose any known issues w/ FGIC, then market crashed and the investment lost millions ii. Procedure 1. District court said that Blackstone didn’t have to disclose any investment issues w/ FGIC because it wasn’t material 2. Not material because the investment only made up .04% of Blackstone investments 3. Also, when evaluating the qualitative factors, said only one was present, so not material iii. Issue 1. Was the knowledge of the subprime investing of FGIC material, so that Blackstone should’ve disclosed the investment issues to investors iv. Reasoning 1. Item 303 says— a. Registrant must describe any known trends or uncertainties that the registrant reasonably expects will have a material unfavorable impact on revenues or income from continuing operations b. There’s a duty to disclose where a trend, demand, commitment, event, or uncertainty is both presently known to management and reasonably likely to have material effects on the registrant’s financial condition or results of operations 2. District Court didn’t consider lots of qualitative factors a. Whether misstatement or omission relates to a segment that plays a significant role in registrant’s business i. Corporate private equity segment was the most important segment to Blackstone b. Omissions mask a change in earnings or other trends i. The omission did mask a severe change in earnings of Blackstone ii. Because if FGIC is going under, that means a lot of Blackstone is going to go under c. Affects management pay i. Which changes how management acts and discloses—whether they take more risks and invest in different things Spring 2013 Securities Regulation v. CLASS NOTES 1. Class action Lawsuit brought under SEC for failing to disclose fully a. The omission was that FGIC carried a lot of risk because it was dealing w/ subprime lending and all of that stock lost value b. You don’t have to go that far, that would be a mistake, but you could put cautionary language in the draft of the SEC filing 2. SEC isn’t involved in this lawsuit—private enforcement action 3. Plaintiff’s argument is you can’t just look at numbers; you have to look at the quality of the investment, looking at qualitative factors 4. Note that this is at the motion to dismiss stage— a. Usually companies settle after this stage b. Maybe you get to summary judgment 5. Question of materiality is a jury decision 6. Qualitative factors can equally be used to show something is not material, even if quantitatively the loss to the company is above 5% 7. SEC says some qualitative factors in Staff Accounting Bulletin— a. Qualitative factors may cause misstatements of quantitatively small amounts to be material i. hides unlawful transactions ii. Relates to a significant segment iii. Significant market reaction to disclosure iv. Hiding something creates a failure to meet analyst expectations v. Changes in income vi. Affects compliance with loan covenants d. In re Merck & Co. Inc. Securities Regulation (3d Cir. 2005) i. Facts 1. Merck announced plans for Medco IPO, and eventually disclosed that they recognize as revenues copayments made by consumers, which really go right to the pharmacists 2. Did not disclose total amount of copayments recognized 3. stock price went up for a month 4. two months later, Wall Street Journal announces MedCo recognized over 5 billion of those copayments as revenues, and stock price declined for a month ii. Reasoning 1. standard for measuring materiality of statements in an efficient market is that ‘materiality of disclosed information may be measured post hoc by looking to the movement, in the period immediately following disclosure, of the price of the firm’s stock 2. Merck’s stock did not drop after their disclosure, it went up 3. Merck’s stock dropped after Wall Street Journal, which did calculations any reasonable investor could have done 4. This shows that a reasonable investor still would’ve invested in Merck stock following the disclosure, so it is not material iii. CLASS NOTES 1. On paper, MedCo looks like a good asset, so do an IPO while the market is responding positively to this asset 2. Remember we’re talking about Merck’s stock price, which is affected by the failure of the MedCo IPO Spring 2013 Securities Regulation 3. The market reacted favorably to the IPO announcement, then the market didn’t change when Merck announced how they calculate ‘revenue recognition’ 4. The MedCo IPO gets withdrawn, because of a Wall Street Journal article talking about these revenue recognitions, and so the market doesn’t trust Merck anymore because they didn’t disclose this amount 5. Seems like the revenue recognition was highly material and should’ve been material for this motion to dismiss a. Plaintiff argument 6. A reasonable stock analyst should have been able to calculate how much revenue recognition Merck was recognizing w/ Medco, since a wall street journalist did this a. When merck disclosed revenue recognition, market reacted favorably toward this, so how can it be material? i. Plaintiff’s argument was that the statement should’ve included the amount and done the math for the stock analysts b. Not until wall street journal article that did the math is when market reacted unfavorably i. Plaintiff’s argument is that this should be the full disclosure moment, and since stock price crashed at that time, material 7. Plaintiffs can’t have it both ways— a. Can’t say market’s efficient so wall street journal disclosure was material b. But at the same time you want to say the market’s inefficient and therefore the first ‘opaque’ disclosure shouldn’t be the disclosure that we use 8. We’re not bringing plaintiffs claims into court on the assumption of an irrational market reaction after this wall street journal article e. Matrixx Initiatives, Inc. v. Siracusano et al. i. Facts 1. Matrixx released Zicam intranasal medicines which were causing anosmia, and Matrixx knew they were reported as causing these issues 2. After receiving reports about the issues, MAtrixx announced that it was in good standing and expected increased revenues, etc. 3. Good Morning America then released the reports and the stock price dropped significantly. Shareholders sued ii. Procedure 1. District court granted motion to dismiss for Matrixx because shareholders hadn’t shown a ‘statistically significant correlation between the use of Zicam and anosmia, therefore disclosure wasn’t required 2. Court of Appeals reversed 3. Supreme Court affirmed court of appeals, holding materiality can’t be reduced to a bright-line rule iii. Reasoning 1. Lack of statistically significant data does not mean something isn’t material and shouldn’t be disclosed 2. The FDA doesn’t require this before pulling a product, so why should the Supreme Court when determining materiality 3. Must be something more than just reports of a problem, but that doesn’t necessarily have to be statistical data iv. CLASS NOTES 1. Holding--Something scientifically irrelevant can be investor relevant Spring 2013 Securities Regulation 2. Stock price fell after FDA investigation by 11% in one day (which is huge), and also fell even more after good morning America story a. FDA can take your product off the market even if there is no scientific statistical relationship b. That’s the risk involved and that’s why the stock price fell after FDA investigation 3. Only when you speak is there an omission—silence is not actionable a. So Matrixx comes in and speaks about this rosy great picture for Matrixx—this is misleading b. Matrixx says they didn’t have to disclose because there’s no relation between these reports and their drug—not material c. Company says since there’s no statistical relation, we don’t have to disclose this and bury our investors in ‘trivial information’ i. It would even be misleading, because investors might drop stock and be pissed if it then goes up 4. Court’s decision a. FDA acts on suspicion of causation, so do consumers, and so do investors b. Medical researchers don’t only use statistical correlation 5. Compare with other cases a. MedCo might be an outlier in 2005 b. We’re now doubtful about management knowing best for investors after the financial crisis c. We don’t treat investors as having to hold the system up—companies have to give them information they can use to do their job 6. What should they have done at the drafting table? a. Say nothing—don’t say anything rosy; don’t say anything negative b. It’s a fine line to tread—what is too positive; what is too negative? c. Question is—when does the crazy irrational statement about your product become material? 7. Are reasonable investors in this market, the medical field, supposed to keep up with medical literature? a. Those stock analysts likely have to know about those studies and the effect on sales f. Longman v. Food Lion, Inc. (‘Total Mix’) i. Facts 1. ABC aired an expose showing bad sanitation practices by Food Lion and off-theclock working 2. Before it aired, Food Lion announced that they were looking into the allegations made by a union that Food Lion had bad sanitation practices and off the clock working. 3. Stock price did not fall by 11% after Food Lion made its announcement, but did fall after ABC aired its expose 4. Shareholders sued ii. Reasoning 1. The nature of the allegations against Food Lion were well known before ABC aired the expose, and the stock price did not change after Food Lion announced they were looking into the allegations, therefore the information was not material and did not have to be disclosed Spring 2013 Securities Regulation V. VI. 2. Reasonable investors do not rely upon puffery and generalizations of companies when deciding to buy stock 3. Court also said you can’t consider something material if it affects a couple stores out of 1,000 stores a. Food Lion isn’t required to make public statements about the existence of various sanitation problems that were revealed from time to time—not material iii. CLASS NOTES 1. 4th circuit gets securities cases wrong all the time, unlike the 2d circuit who gets it right because that’s the Wall Street circuit 2. so can you lie about your stores if the market should know you were fibbing— puffery words. 3. Can investor knowledge make material information immaterial? a. Doesn’t what knowledge investors should have about the risk affect the ‘total’ mix’? 4. Be sure to distinguish between— a. The statement is not false or misleading b. The statement is false or misleading, but it is not material (‘bespeak caution’) iv. This is known as the ‘truth on the market’ defense g. “bespeaks caution” defense i. forward-looking statements are rendered immaterial as a matter of law if they are accompanied by disclosure of risks that may preclude the forward-looking projection from coming to fruition (Donald Trump case in 3d circuit) Quick Sum-Up a. historical facts judged w/ TSC b. speculative facts judged by Basic c. contextual facts look at ‘truth on market’ and ‘bespeaks caution’ defenses Management Integrity a. Isn’t this a matter of state law? Does federal law require you come forward and say that you’re breaching state law b. In the Matter of Franchard Corporation i. Facts 1. Glickman was a real estate investor who had many corporations with which he held real estate 2. The plaintiff company’s money was secretly transferred by Glickman into one of his other companies 3. Glickman also started selling his stock for loans with high interest rates 4. In his SEC filings, he made no mention of these secret transfers, or the sale of his stock, or any financial issues ii. Reasoning 1. Disclosures relevant to an evaluation of management are particularly pertinent where securities are sold largely on the personal reputation of a company’s controlling person 2. Just because the SEC doesn’t explicitly require disclosure does not mean management doesn’t have to disclose things that are material 3. All of these things were material to investors, because it would’ve shown investors that Glickman was irresponsibly running the company and was in need of cash Spring 2013 Securities Regulation c. d. e. f. 4. SEC rejects the notion that disclosure requires that directors have performed their duties responsibly, because that’s beyond what the statute suggests iii. CLASS NOTES 1. Issue is whether a company adequately disclosed its CEO’s relationship to the company 2. Investors are given Class A shares, Glickman has Class B shares that he’s pledging as collateral for loans. 3. Glickman is withdrawing money which doesn’t have to be disclosed. He’s also taking out loans and pledging stock and not disclosing that either. 4. SEC is using this enforcement decision in order to create common law 5. Question is what disclosure of self-dealing is required? a. SEC doesn’t say they’re interpreting a rule here, they’re just saying once you’ve talked, these things are material b. The quality of management is important. i. Withdrawals, diverting assets to another company owned by management, pledges of stock for personal loans, default terms on loans ii. These are all material and of interest to investors c. Even if not material from an accounting standpoint, these are material for investors 6. Rule 12b-20 is a catch-all rule a. In addition tot eh information expressly required to be included in a statement or report, there shall be added such further material information, if any, as may be necessary to make the required statements, in the light of the circumstances under which they are made not misleading b. This rule is a little beyond the common law, because it includes omitting important information iv. Shows tension between state law required duties of management and federal securities laws v. Also there’s a tension between trade secrets and securities laws—depends if public offering and private placement company 1. You can file things w/ SEC with special rules for filing trade secrets— confidentiality agreement Item 404 of Regulation S-K i. Requires disclosure of transactions in excess of $120,000 between issuer and directors, 5% stockholders and the family members of any of those classes § 402 of Sarbanes-Oxley i. prohibits loans by public companies to their executive officers and directors § 406 of Sarbanes i. requires disclosure of whether company has code of ethics for CEO, CFO and controller. If not, must explain why. SEC v. Fehn i. 5th amendment does not bar disclosure of previous, undiscovered securities law violations ii. three factors to determine whether compelled disclosure is self-incrimination— 1. whether disclosure requirement targets a highly selective group inherently suspect of criminal activities, rather than the public generally 2. whether requirement involves an area permeated with criminal statutes, rather than an essentially noncriminal and regulatory area of inquiry; Spring 2013 Securities Regulation 3. whether compliance would compel disclosure of information that would surely prove a significant link in a chain of evidence tending to establish guilt, rather than disclosing no inherently illegal activity iii. court said securities laws are not permeated with criminal activities or targeted inherently illegal activities iv. CLASS NOTES 1. Criminal behavior of management has to be disclosed 2. Is a lawyer responsible for aiding and abetting management? a. Yes—sec has authority to come after lawyers 3. The court says you have to incriminate yourself if there are facts that are incriminating, that’s one of the deals w/ trading securities 4. SEC forms say you have to actually be indicted; not just under investigation; but you do have to disclose criminal violations in the past 5 years that relate to securities frauds