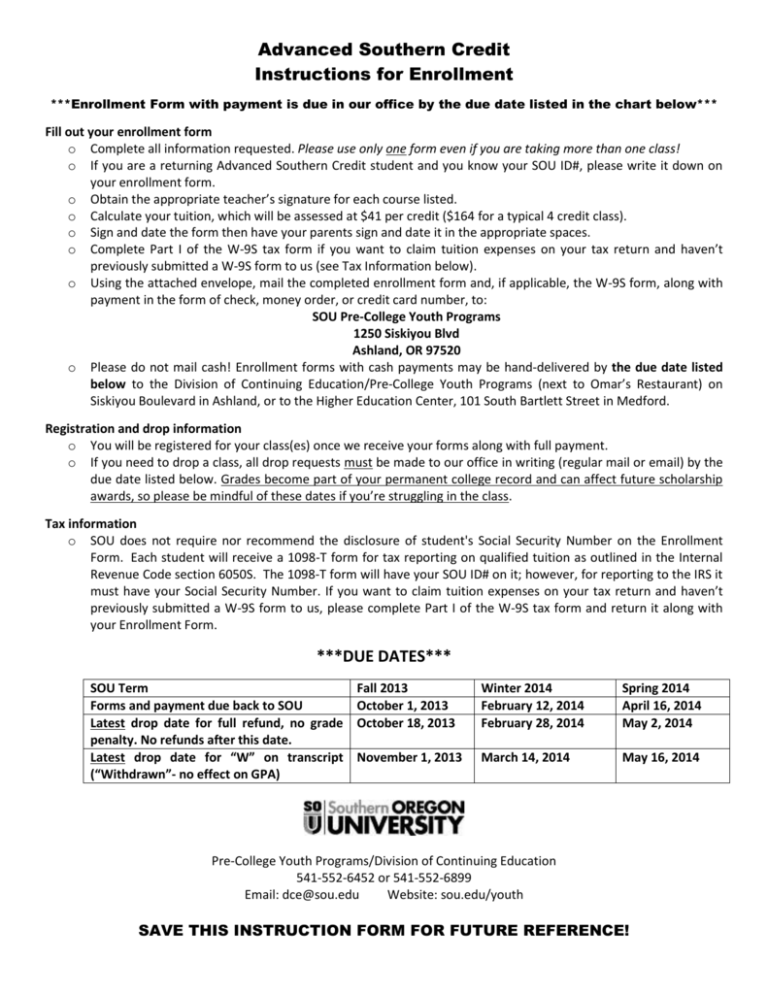

due dates

advertisement

Advanced Southern Credit Instructions for Enrollment ***Enrollment Form with payment is due in our office by the due date listed in the chart below*** Fill out your enrollment form o Complete all information requested. Please use only one form even if you are taking more than one class! o If you are a returning Advanced Southern Credit student and you know your SOU ID#, please write it down on your enrollment form. o Obtain the appropriate teacher’s signature for each course listed. o Calculate your tuition, which will be assessed at $41 per credit ($164 for a typical 4 credit class). o Sign and date the form then have your parents sign and date it in the appropriate spaces. o Complete Part I of the W-9S tax form if you want to claim tuition expenses on your tax return and haven’t previously submitted a W-9S form to us (see Tax Information below). o Using the attached envelope, mail the completed enrollment form and, if applicable, the W-9S form, along with payment in the form of check, money order, or credit card number, to: SOU Pre-College Youth Programs 1250 Siskiyou Blvd Ashland, OR 97520 o Please do not mail cash! Enrollment forms with cash payments may be hand-delivered by the due date listed below to the Division of Continuing Education/Pre-College Youth Programs (next to Omar’s Restaurant) on Siskiyou Boulevard in Ashland, or to the Higher Education Center, 101 South Bartlett Street in Medford. Registration and drop information o You will be registered for your class(es) once we receive your forms along with full payment. o If you need to drop a class, all drop requests must be made to our office in writing (regular mail or email) by the due date listed below. Grades become part of your permanent college record and can affect future scholarship awards, so please be mindful of these dates if you’re struggling in the class. Tax information o SOU does not require nor recommend the disclosure of student's Social Security Number on the Enrollment Form. Each student will receive a 1098-T form for tax reporting on qualified tuition as outlined in the Internal Revenue Code section 6050S. The 1098-T form will have your SOU ID# on it; however, for reporting to the IRS it must have your Social Security Number. If you want to claim tuition expenses on your tax return and haven’t previously submitted a W-9S form to us, please complete Part I of the W-9S tax form and return it along with your Enrollment Form. ***DUE DATES*** SOU Term Forms and payment due back to SOU Latest drop date for full refund, no grade penalty. No refunds after this date. Latest drop date for “W” on transcript (“Withdrawn”- no effect on GPA) Fall 2013 October 1, 2013 October 18, 2013 Winter 2014 February 12, 2014 February 28, 2014 Spring 2014 April 16, 2014 May 2, 2014 November 1, 2013 March 14, 2014 May 16, 2014 Pre-College Youth Programs/Division of Continuing Education 541-552-6452 or 541-552-6899 Email: dce@sou.edu Website: sou.edu/youth SAVE THIS INSTRUCTION FORM FOR FUTURE REFERENCE!