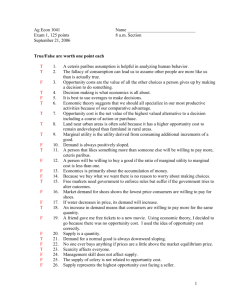

Principles of Economics

advertisement

Principles of Economics Session 3 Topics To Be Discussed Consumer Preferences Budget Constraints Consumer Choice Marginal Utility Substitution and Income Effect Topics to be Discussed Market Demand Consumer Surplus Recognizing Lock-In Steps of Studying Consumer Behavior Study consumer preferences How and why do people prefer one good to another? Study budget constraint How are consumers constrained by their limited incomes? Combine consumer preferences and budget constraints to determine consumer choices What combination of goods will consumers buy to maximize their satisfaction? Market Basket A market basket is a collection of one or more commodities. One market basket may be preferred over another market basket containing a different combination of goods. Three Basic Assumptions Preferences are complete. Preferences are transitive. Consumers always prefer more of any good to less. Consumer Preferences Market Basket A Units of Food 20 Units of Clothing 30 B 10 50 D 40 20 E 30 40 G 10 20 H 10 40 Indifference Curves Indifference curves represent all combinations of market baskets that provide the same level of satisfaction to a person. Consumer Preferences Combination B,A, & D yields the same satisfaction E is preferred to U1 U1 is preferred to H & G Clothing (units per week) B 50 H E 40 A 30 D 20 Indifference Curve G 10 10 20 30 40 Food (units per week) Consumer Preferences Clothing (units per week) 50 B 40 H The consumer prefers A to all combinations in the blue box, while all those in the pink box are preferred to A. E A 30 D G 20 10 10 20 30 40 Food (units per week) Indifference Map An indifference map is a set of indifference curves that describes a person’s preferences for all combinations of two commodities. Indifference Map Clothing (units per week) Market basket A is preferred to B. Market basket B is preferred to D. D B A U3 U2 U1 Food (units per week) Indifference Curves Can’t Cross Clothing (units per week) U2 U1 A The consumer should be indifferent between A, B and D. However, B contains more of both goods than D. B D Food (units per week) Substitution A Clothing 16 (units per week) 14 12 The amount of clothing given up for a unit of food decreases from 6 to 1 -6 10 B 1 8 -4 D 6 1 E -2 4 G 1 -1 1 2 1 2 3 4 5 Food (units per week) Marginal Rate of Substitution The marginal rate of substitution (MRS) quantifies the amount of one good a consumer will give up to obtain more of another good. It is measured by the slope of the indifference curve. Diminishing MRS A Clothing 16 (units per week) 14 12 MRS = 6 MRS C -6 10 B 1 8 F -4 D 6 MRS = 2 1 -2 4 E 1 -1 2 1 2 3 4 G 1 5 Food (units per week) Perfect Substitutes and Perfect Complements Two goods are perfect substitutes when the marginal rate of substitution of one good for the other is constant. Two goods are perfect complements when the indifference curves for the goods are shaped as right angles. Perfect Substitutes Apple Juice (glasses) 4 3 2 1 0 1 2 3 4 Orange Juice (glasses) Perfect Complements Left Shoes 4 3 2 1 0 1 2 3 4 Right Shoes Application of Consumer Preferences Automobile executives must regularly decide when to introduce new models and how much money to invest in restyling. An analysis of consumer preferences would help to determine when and if car companies should change the styling of their cars. Consumer Preferences Styling Consumers are willing to give up considerable styling for additional performance MRS>1 Performance Consumer Preferences Styling Consumers are willing to give up considerable performance for additional styling MRS<1 Performance Utility Utility refers to numerical score representing the satisfaction that a consumer gets from a given market basket. Utility Function U=f(X1 , X2 , X3 , … Xn) Assume the utility function for food (F) and clothing (C) U=f(F, C) = F + 2C Market Baskets F Units C Units Utils A 8 3 8 + 2(3) = 14 B 6 4 6 + 2(4) = 14 C 4 4 4 + 2(4) = 12 The consumer is indifferent to A & B The consumer prefers A & B to C Utility Functions & Indifference Curves Clothing (units per week) Assume: U = FC C 25 = 2.5×10 A 25 = 5 ×5 B 25 = 10 ×2.5 15 C 10 U3 = 100 (Preferred to U2) A 5 B 0 5 10 U2 = 50 (Preferred to U1) U1 = 25 15 Food (units per week) Ordinal vs. Cardinal Utility Ordinal Utility Function: places market baskets in the order of most preferred to least preferred, but it does not indicate how much one market basket is preferred to another. Cardinal Utility Function: utility function describing the extent to which one market basket is preferred to another. Budget Constraints Budget constraints limit an individual’s ability to consume in light of the prices they must pay for various goods and services. Budget Line The budget line indicates all combinations of two commodities for which total money spent equals total income. Budget Line Let F = amount of food purchased C = amount of clothing purchased Pf = Price of food Pc = price of clothing M = money income Then M Pf F PcC Budget Line Market Food (F) Clothing (C) Total Spending Basket Pf=$1 Pc=$2 PfF+PcC=M A 0 40 $80 B 20 30 $80 D 40 20 $80 E 60 10 $80 G 80 0 $80 Budget Line Clothing (units per week) (M/PC) = 40 Pc = $2 Pf = $1 M = $80 A Budget Line F + 2C = $80 B 30 M / Pc Slope C / F M / Pf D 20 1 Pf / Pc 2 E 10 G 0 20 40 60 Food 80 = (M/PF) (units per week) Budget Line As consumption moves along a budget line from the intercept, the consumer spends less on one item and more on the other. The slope of the line measures the relative cost of food and clothing. Budget Line The slope is the negative of the ratio of the prices of the two goods. The slope indicates the rate at which the two goods can be substituted without changing the amount of money spent. Budget Line The vertical intercept (M/PC), illustrates the maximum amount of C that can be purchased with income M. The horizontal intercept (M/PF), illustrates the maximum amount of F that can be purchased with income M. Effect of Income Change Clothing (units per week) A increase in income shifts the budget line outward 80 60 A decrease in income shifts the budget line inward 40 20 L3 (M= $40) 0 40 L2 L1 (M = $80) 80 120 (M = $160) 160 Food (units per week) Effect of Price Change Clothing (units per week) An increase in the price of food to $2.00 changes the slope of the budget line and rotates it inward. A decrease in the price of food to $.50 changes the slope of the budget line and rotates it outward. 40 L3 L1 L2 (PF = 1) (PF = 2) 40 80 (PF = 1/2) 120 160 Food (units per week) Consumer Choice Consumers choose a combination of goods that will maximize the satisfaction they can achieve, given the limited budget available to them. Conditions to Maximize Utility The choice must be located on the budget line. The choice must give the consumer the most preferred combination of goods and services. Consumer Choice The MRS of an indifference curve is: C MRS F The slope of the budget line is: Slope Pf Pc Therefore, satisfaction is maximized where: MRS Pf Pc Satisfaction Maximization Satisfaction is maximized when marginal rate of substitution (of F and C) is equal to the ratio of the prices (of F and C). Consumer Choice Clothing (units per week) Pc = $2 M = $80 Point B does not maximize satisfaction because the MRS (-10/10) = 1 is greater than the price ratio (1/2). 40 30 Pf = $1 B -10C Budget Line 20 U1 +10F 0 20 40 80 Food (units per week) Consumer Choice Clothing (units per week) Pc = $2 Pf = $1 40 M = $80 Market basket D cannot be attained given the current budget constraint. D 30 20 U3 Budget Line 0 20 40 80 Food (units per week) Consumer Choice Clothing (units per week) Pc = $2 Pf = $1 M = $80 At market basket A the budget line and the indifference curve are tangent and no higher level of satisfaction can be attained. 40 30 A 20 At A: MRS =Pf /Pc = .5 U2 Budget Line 0 20 40 80 Food (units per week) Consumer Choice Clothing (units per week) Pc = $2 Pf = $1 M = $80 40 30 D A D is not available. A offers less satisfaction than B. B is the optimum choice. B 20 U3 U2 U1 0 20 40 80 Budget Line Food (units per week) Marginal Utility and Consumer Choice Marginal utility measures the additional satisfaction obtained from consuming one additional unit of a good. Diminishing Marginal Utility The marginal utility derived from increasing from 0 to 1 units of food might be 9 Increasing from 1 to 2 might be 7 Increasing from 2 to 3 might be 5 Principle of Diminishing MU The principle of diminishing marginal utility states that as more and more of a good is consumed, consuming additional amounts will yield smaller and smaller additions to utility. Marginal Utility and Indifference Curve If consumption moves along an indifference curve, the additional utility derived from an increase in the consumption one good, food (F), must balance the loss of utility from the decrease in the consumption in the other good, clothing (C). Marginal Utility and Consumer Choice MU F (F ) MU c (C ) F MU c C MU F F PC MRS F C P MU c PC F F MU P Equation for Utility Maximization P P MU F MU c F C Equal Marginal Principle The equal marginal principle states that total utility is maximized when the budget is allocated so that the marginal utility per dollar of expenditure is the same for each good. Equal Marginal Principle Constraint=$20 Hot dog price=$2.5 MU of Units per hot dogs game (MUH ) 1 20 2 15 MUH /PH 8 6 Coke price=$2 MU of Cokes (MUc ) 60 40 MUc /Pc 30 20 3 12.5 5 20 10 4 5 10 7.5 4 3 16 8 8 4 6 5 2 4 2 Equal Marginal Principle P1 P2 P3 PN ... MU1 MU 2 MU 3 MU N Equal Marginal Principle Budget=$2,000 TV ad price=$400 Radio ad price=$300 Number of ads 1 2 3 4 5 6 Increase in units sold MBTV MBRadio 400 360 300 270 280 240 260 225 240 150 200 120 Equal Marginal Principle Budget=$2,000 TV ad price=$400 Radio ad price=$300 Number of ads 1 2 3 4 5 6 Increase in units sold MBTV MBRadio 400/400=1.00 360/300=1.20 300/400=0.75 270/300=0.90 280/400=0.70 240/300=0.80 260/400=0.65 225/300=0.75 240/400=0.60 150/300=0.50 200/400=0.50 120/300=0.40 Effect of a Price Change Clothing (units per month) M = $20 PC= $2 PF =$2, $1, $0.5 10 A 7 6 5 B U1 D U3 U2 3 8 10 20 Three separate indifference curves are tangent to each budget line. 40 Food (units per month) Effect of a Price Change Clothing (units per month) The price-consumption curve traces out the utility maximizing market basket for the various prices for food. 10 A 7 6 5 B U1 D U3 Price-consumption curve U2 3 8 10 20 40 Food (units per month) Demand Curve Clothing10 (units per month) 7 6 5 A B U2 3 8 10 Price of Food D U1 U3 20 40 Food (units per month) $2.00 $1.00 Demand curve $0.50 3 8 20 Food (units per month) Effects of Income Changes Pf = $1 Pc = $2 M = $10, $20, $30 15 Clothing (units per month) 10 Income-consumption curve 7 D 5 U3 U2 B 3 U1 A 4 10 16 20 Food (units 30 per month) Effects of Income Changes Price of food An increase in income, from $10 to $20 to $30, with the prices fixed, shifts the consumer’s demand curve to the right. E $1.00 G H D3 D2 D1 4 10 16 Food (units per month) Effects of Income Changes An increase in income shifts the budget line to the right, increasing consumption along the incomeconsumption curve. Simultaneously, the increase in income shifts the demand curve to the right. Normal Good vs. Inferior Good Normal Good The income-consumption curve has a positive slope. The quantity demanded increases with income. The income elasticity of demand is positive. Normal Good vs. Inferior Good Inferior Good The income-consumption curve has a negative slope. The quantity demanded decreases with income. The income elasticity of demand is negative. An Inferior Good Steak 15 (units per month) Income-Consumption Curve Both hamburger and steak behave as a normal good, between A and B... C 10 …but hamburger becomes an inferior good when the income consumption curve bends backward between B and C. U3 B 5 U2 A U1 5 10 20 Hamburger 30 (units per month) Income and Substitution Effects Substitution Effect Consumers will tend to buy more of the good that has become relatively cheaper, and less of the good that is now relatively more expensive. Income Effect Consumers experience an increase in real purchasing power when the price of one good falls. Income and Substitution Effects Clothing (units per month) 20 Normal Good M=$60, Pf = $3, Pc = $3 Decreased Pf = $2 Total Effect = 18.5 17 16 A Income Effect = 4.5 Substitution Effect = 14 D 5 B U2 Substitution Effect U1 Food (units O 4 Total Effect 18 20 22.5 25.5 30 per month) Income Effect Income and Substitution Effects Clothing (units per month) 20 M=$60, Pf = $3, Pc = $3 Inferior Good Decreased Pf = $2 Total Effect = 6.5 17 16 A Substitution Effect = 14 B Income Effect = - 7.5 13 U2 D 5 Substitution Effect O 10.5 4 Total Effect Substitution Effect > Income Effect. U1 25.5 30 18 20 Income Effect Food (units per month) Income and Substitution Effects Clothing (units per month) R Giffen Good The income effect may theoretically be large enough to cause the demand curve for a good to slope upward. This is of little practical interest B A U2 D Total Effect O U1 F2 F1 E Income Effect S Substitution Effect T Food (units per month) Market Demand Price Individual A Individual B Individual C Market ($) (units) (units) (units) (units) 1 6 10 16 32 2 4 8 13 25 3 2 6 10 18 4 0 4 7 11 5 0 2 4 6 Market Demand Curve Price 5 The market demand curve is obtained by summing the consumer’s demand curves 4 3 Market Demand 2 1 0 DA 5 DB 10 DC 15 20 25 30 Quantity Consumer Surplus Willingness to pay is the maximum price that a buyer is willing and able to pay for a good. It measures how much the buyer values the good or service. Consumer Surplus Consumer surplus is the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it. Four Possible Buyers’ Willingness to Pay Buyer Willingness to Pay John $100 Paul 80 George 70 Ringo 50 Consumer Surplus The market demand curve depicts the various quantities that buyers would be willing and able to purchase at different prices. Four Possible Buyers’ Willingness to Pay Price Buyer Quantity Demanded More than $100 None 0 $80 to $100 John 1 $70 to $80 John, Paul 2 $50 to $70 John, Paul, George 3 $50 or less John, Paul, George, Ringo 4 Measuring Consumer Surplus with the Demand Curve Price of Album John’s willingness to pay $100 Paul’s willingness to pay 80 70 George’s willingness to pay Ringo’s willingness to pay 50 Demand 0 1 2 3 4 Quantity of Albums Measuring Consumer Surplus with the Demand Curve Price of Album Price = $80 $100 John’s consumer surplus ($20) 80 70 50 Demand 0 1 2 3 4 Quantity of Albums Measuring Consumer Surplus with the Demand Curve... Price of Album Price = $70 $100 John’s consumer surplus ($30) 80 70 50 Paul’s consumer surplus ($10) Total consumer surplus ($40) Demand 0 1 2 3 4 Quantity of Albums Measuring Consumer Surplus with the Demand Curve The area below the demand curve and above the price measures the consumer surplus in the market. How the Price Affects Consumer Surplus Price A P1 P2 Initial consumer surplus B D Additional consumer surplus to initial consumers 0 Consumer surplus to new consumers C E F Demand Q1 Q2 Quantity Paradox of Value Nothing is more useful than water; but it will scare purchase anything. A diamond, on the contrary, has scarce any value in use; but a very great quantity of other goods may frequently be had in exchange for it -The Wealth of Nations, Adam Smith Price and Usefulness of Diamond Price P Consumer Surplus Demand 0 Q Quantity Price and Usefulness of Water Price Demand Consumer Surplus P 0 Q Quantity Consumer Surplus and Economic Well-Being Consumer surplus, the amount that buyers are willing to pay for a good minus the amount they actually pay for it, measures the benefit that buyers receive from a good as the buyers themselves perceive it. Consumer Surplus and Importation Price Domestic supply Price before trade World Price Price after trade Imports 0 Domestic quantity supplied Domestic quantity demanded Domestic demand Quantity Consumer Surplus and Importation Price Consumer surplus before trade Domestic supply A Price before trade Price after trade World Price Domestic demand 0 Quantity Consumer Surplus and Importation Price A Price before trade Price after trade 0 B Consumer surplus after trade D Imports Domestic supply World Price Domestic demand Quantity Recognizing Lock-In Recognizing Lock-In Cost of switching Compare Ford v. GM Mac v. PC What’s the Difference? Durable investments in complementary assets Hardware Software Wetware Supplier wants to lock-in customer Customer wants to avoid lock-in Basic principle: Look ahead and reason back Small Switching Costs Matter Phone number portability Email addresses Hotmail (advertising, portability) ACM, CalTech Look at lockin costs on a per customer basis Classification of Lock-In Contractual commitments: damages Durable purchases and replacement: declines with time Brand-specific training: rises with time Information and data: rises with time Specialized suppliers: may rise Search costs: learn about alternatives Loyalty programs: rebuild cumulative usage Contractual Commitments “Requirements contract”: Purchase supplies from one supplier Beware of “evergreen contracts” Follow the Lock-in cycle Brand Selection Sampling Lock-In Entrenchment Assignment Review Chapter 5 Answer questions on P94 Preview Chapter 6 Thanks