ECON 1100 * Global Economics (Fall 2007)

advertisement

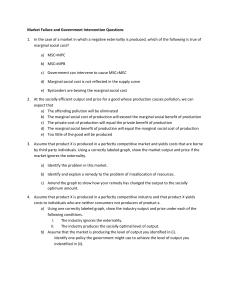

ECON 1100 – Global Economics (Section 03) Exam #3 – Spring 2012 (Version A) Multiple Choice Questions ( 2 12 points each): 1. The ________________ refers to government policies aimed at changing the final division of goods/services across consumers, usually with the intention of realizing a “fairer” apportionment of consumption/income/wealth. A. Taxation Function of Government B. Allocation Function of Government C. Distribution Function of Government D. Stabilization Function of Government 2. A free market would be expected to realize an inefficiency (i.e., Deadweight Loss) due to too much trade A. when a firm with market power maximizes profit. B. in the presence of a positive externality. C. in the presence of a negative externality. D. More than one (perhaps all) of the above answers is correct. 3. As noted by Dr. Folsom in his guest lecture, the 1920s were a time of tremendous invention and innovation in the U.S. Which of the following items was either invented or gained widespread use during this time? A. The Zipper. B. Air Conditioning. C. Sliced Bread. D. More than one (perhaps all) of the above answers is correct. 4. One of the “6 Determinants of Productivity, Income, and Wealth” is “acquired skills,” which refers to the recognition that differences in income or wealth across individuals could result from differences in A. how hard individuals choose to work. B. the amount of money that individuals receive as inheritances. C. the natural talents that people are endowed with at birth. D. the skills and experience that individuals obtain through education, training, and employment. 5. Government Failure may arise because: “Once created, government agencies often take on a ‘life of their own.’ Employees of such agencies often have incentives to ‘expand the scope of their agency’ in order to increase their own job security.” This phenomenon is known as A. Agency Inertia. B. Collective Action. C. Capture of Regulators. D. Rent Seeking Behavior. 6. Between 1991 and 2006, “Government Expenditures as a percentage of GDP” took on a mean value above 50% in which of the following countries? A. Sweden. B. South Korea. C. The United States. D. More than one (perhaps all) of the above answers is correct. 7. _________________________ wrote “The General Theory of Employment, Interest, and Money.” A. Ronald Coase B. Gordon Tullock C. John Maynard Keynes D. Milton Friedman and Anna Schwartz 8. A firm operating in a “Perfectly Competitive Market” has “No Market Power,” which implies that the firm A. would lose some but not all of their customers if they increased price above the prevailing market price. B. can increase the quantity of output that they sell without having to decrease price. C. faces a demand curve for its output that is a horizontal line at the prevailing market price. D. More than one (perhaps all) of the above answers is correct. 9. If the government of Miltonvania (a small, landlocked city-state in central Europe, with an economy highly dependent upon the production of woodwind instruments) had revenues of $170,000,000 and expenditures of $130,000,000 in 2011, then in 2011 this government A. realized a budget surplus of $40,000,000. B. realized a budget deficit of $40,000,000. C. realized a budget surplus of $300,000,000. D. realized a budget deficit of $300,000,000. 10. ______________________ refers to the periodic but irregular fluctuation in overall macroeconomic activity which occurs over time. A. Government Failure B. The Business Cycle C. Crowding Out D. A Recession 11. The notion of ______________ equity says that in order for a tax to be “fair,” two individuals of equal economic capacity should have equal tax burdens. A. regressive B. horizontal C. vertical D. diagonal 12. The new Taco Bell Doritos Locos Taco is A. rival in consumption and excludable. B. non-rival in consumption and excludable. C. rival in consumption and non-excludable. D. non-rival in consumption and non-excludable. For Questions 13 through 15, consider a monopolist facing Demand and with Marginal Costs and Marginal Revenue as illustrated below. $ 14.80 a 10.90 b c 7.20 Marginal Costs of Production d e f 4.50 Demand 0 quantity 0 7,000 Marginal Revenue of Monopolist 11,000 14,000 13. To maximize profit, this firm should charge a price of _______. A. $14.80 B. $10.90 C. $7.20 D. $4.50 14. The efficient level of output for this good is _____ units. A. 7,000 B. somewhere between 7,000 and 11,000 C. 11,000 D. 14,000 15. When this monopolist sets the price and sells the quantity which maximizes her profit, A. Deadweight-Loss is equal to “area (f).” B. Consumers’ Surplus is equal to “areas (a)+(b)+(c)+(d)+(e).” C. less than the efficient level of trade takes place. D. More than one (perhaps all) of the above answers is correct. 16. The “Bailey Wildlife Foundation Wolf Compensation Trust” A. believes that reintroducing the gray wolf into the wilderness of the western United States would be tremendously inefficient. B. believes that ranchers need not be compensated for any attacks on their flocks/herds as a result of the reintroduction of the gray wolf into the wilderness of the western United States. C. desires to “shift the economic responsibility for wolf recovery away from the individual rancher and toward the millions of people who want to see wolf populations restored.” D. More than one (perhaps all) of the above answers is correct. 17. Bob lives in a country in which military output is not provided by the government, but rather is supplied by profit maximizing firms and purchased by individual consumers in a free market. Bob chooses to enjoy the benefits of national security which result from military output purchased by others, while purchasing “zero units of military output” of his own. This example illustrates A. Progressive Taxation. B. Government Failure due to Lack of Information. C. the Free Rider Problem. D. Crowding Out. 18. In the “widget industry”: the Average Costs of producing 15,000 units of output are $7.12 per unit, the Average Costs of producing 20,000 units of output are $6.56 per unit, and the Average Costs of producing 25,000 units of output are $5.98 per unit. Based upon these figures it would appear as if A. the widget industry is a Natural Monopoly. B. production of widgets generates a substantial negative externality. C. widgets are “non-rival in consumption.” D. None of the above answers are correct. For Questions 19 and 20, consider a state with an income tax as follows: for each of the first $250,000 earned a worker must pay 3% to the government; for every dollar earned beyond $250,000 a worker must pay 5% to the government. 19. Amy earns $300,000 per year. At her current level of income, Amy’s “Marginal Tax Rate” is A. 3% B. 4% C. 5% D. 8% 20. Based upon the description given above, this tax A. clearly violates the notion of horizontal equity. B. is a Progressive Tax. C. is a Proportional Tax. D. is a Regressive Tax. 21. Government Spending as a Percentage of GDP in the United States is projected to A. steadily decrease to less than 30% by 2015. B. remain above 41% for the foreseeable future. C. steadily increase to roughly 75% by 2015. D. increase to 55% by 2013 but then decrease to 25% by 2015. For Questions 22 through 24, consider a good for which Marginal Private Benefits, Private Costs, Social Benefits, and Social Costs are as illustrated below. $ Marginal Social Costs Marginal Private Costs 50.00 f e c 42.00 b d a 24.00 (Marginal Private Benefits) = (Marginal Social Benefits) quantity 0 0 4,000 6,200 9,300 22. Based upon the graph above, A. production/consumption of this good results in a “negative externality.” B. production/consumption of this good results in a “positive externality.” C. this good is being produced by an inefficient government bureaucracy. D. None of the above answers are correct. 23. The efficient level of trade in this market is ______ units, while the free market level of trade is ______ units. A. (0); (9,300) B. (4,000); (6,200) C. (6,200); (4,000) D. (9,300); (6,200) 24. At the “free market outcome” (that is, the outcome without any government intervention in this market), Deadweight-Loss is equal to A. “areas (a)+(b)+(c).” B. “area (b).” C. “area (c).” D. “areas (c)+(d)+(e)+(f).” 25. The “Top 5% of wage earners” in the U.S. earn roughly 35.75% of all income earned in the U.S. Under the current U.S. Federal Income Tax, these workers pay roughly A. 29.73% of all income taxes paid. B. 36.12% of all income taxes paid. C. 59.67% of all income taxes paid. D. 100% of all income taxes paid (since nobody with income below $150,000 has to pay any income taxes in our country). 26. Consider the following two statements: (1) “Fiscal Policy has a significant stimulative impact on a less than fully employed economy” and (2) “The Inflation Rate is completely unrelated to the money supply.” Most economist would A. agree with both statements. B. disagree with both statements. C. agree with Statement (1) but disagree with Statement (2). D. agree with Statement (2) but disagree with Statement (1). 27. ____________________ refers to the time it takes policymakers to decide upon the specific stabilization policies to enact. A. An Implementation Lag B. An Information and Recognition Lag C. A Fiscal Delay D. A Decision Lag 28. Which of the following is NOT one of the primary policy tools used by a central bank? A. Setting the discount rate. B. Conducting open-market operations. C. Setting marginal income tax rates. D. None of the above answers are correct (since each of the choices listed is one of the primary policy tools used by a central bank). 29. Related to the issue of “Pork Barreling,” ________________ argued that government failure can often arise in a democracy since many politicians often act with an aim of maximizing their probability of re-election. A. Sam Peltzman B. Milton Friedman C. John Maynard Keynes D. James Buchanan 30. Which of the following countries has a progressive income tax (for which Average Tax Rate is higher for people with higher incomes)? A. Iraq. B. The United States. C. Russia. D. More than one (perhaps all) of the above answers is correct. 31. ________________________ refers to increases in the money supply intended to stimulate overall macroeconomic activity. A. Antitrust Policy B. Expansionary Fiscal Policy C. Expansionary Monetary Policy D. Expansionary Tax Policy For questions 32 through 34, consider a market with Supply and Demand as illustrated below. $ Supply 16.50 a 15.00 b c d e 14.00 Demand 0 quantity 0 8,000 13,500 17,250 32. If a per unit tax of $1.00 were imposed on sellers in this market, then A. 0 units would be traded. B. exactly 8,000 units would be traded. C. more than 8,000 but fewer than 13,500 units would be traded. D. more than 13,500 but fewer than 17,250 units would be traded. 33. Imposing a tax of $2.50 per unit on sellers in this market would A. result in a Deadweight Loss equal to “areas (d)+(e).” B. increase Total Producers’ Surplus by “areas (b)+(d).” C. generate tax revenue of exactly (13,500)($2.50) = $33,750. D. More than one (perhaps all) of the above answers is correct. 34. Comparing the outcome which would result from imposing a per unit tax of $3.00 on buyers in this market to the outcome which would result from imposing a per unit tax of $3.00 on sellers in this market, A. Total Consumers’ Surplus would be equal to “area (a)” under either tax. B. more trade would take place if the tax is imposed on buyers than if it is imposed on sellers. C. Deadweight-Loss would be smaller if the tax is imposed on sellers. D. None of the above answers are correct. 35. During his guest lecture, Dr. Folsom noted that the unemployment rate in the U.S. A. decreased from 12% in 1921 to 2.4% in 1923 and then remained relatively low throughout most of the 1920s. B. increased from 1.2% in 1921 to 11.3% in 1923 and then remained relatively high throughout most of the 1920s. C. was above 15% in every single year from 1919 through 1945. D. was below 3% in every single year from 1919 through 1945. 36. Ronald Coase argued that in order to realize an efficient outcome in the presence of an externality, society should A. do nothing, since there are no policies that can ever reduce the Deadweight-Loss caused by an externality. B. completely ban the activity which is generating the externality. C. “sit back and let market forces work” (since market outcomes are always efficient). D. “internalize the externality” by clearly and completely defining property rights and allowing affected parties to negotiate with each other. 37. Comparing Average Tax Rates in the United States resulting from the Federal Income tax in 2000 and in 2006 A. the “Top 1% of wage earners” was the only segment of individuals who realized any decrease in their Average Tax Rate between 2000 and 2006. B. the Average Tax Rate decreased across all income levels between 2000 and 2006. C. the Average Tax Rate increased for “the wealthy” (i.e., the “top 25% of wage earners”) but decreased for the poor (i.e., the “bottom 25% of wage earners), while remaining relatively constant for “the middle class” (i.e., the “top 25%-75% of wage earners) between 2000 and 2006. D. the Average Tax Rate increased across all income levels between 2000 and 2006. 38. ______________ refers to unselfish concern for the welfare of others. A. Vertical Equity B. Altruism C. Utilitarianism D. Antitrust Policy 39. The arguments made by John Maynard Keynes suggest that during an economic downturn, the government should A. have the government seize ownership of and directly control the “Commanding Heights” of our economy. B. run a budgetary deficit, in order to stimulate the economy by replacing missing private spending with government spending. C. run a budgetary surplus, so that we do not accumulate a tremendous amount of debt that will ultimately burden our children and grandchildren. D. drastically decrease the money supply in order to avoid inflation. 40. Monetary Policy in the United States is determined by A. the President of the United States. B. the Governors of the 50 different states. C. the Federal Reserve. D. the U.S. Supreme Court. (Blank Page)