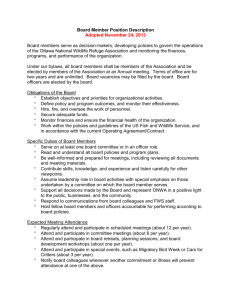

Fiduciary Duties of Corporate Officers

Fiduciary Duties of

Corporate Officers

K U R T M . H E Y M A N

P R O C T O R H E Y M A N L L P

W I L M I N G T O N , D E L A W A R E

K H E Y M A N @ P R O C T O R H E Y M A N . C O M

Gantler v. Stephens

965 A.2d 695, 708-09 & n.37 (Del. 2009)

The Court of Chancery has held, and the parties do not dispute, that corporate officers owe fiduciary duties that are identical to those owed by corporate directors. That issue-whether or not officers owe fiduciary duties identical to those of directors-has been characterized as a matter of first impression for this Court. In the past, we have implied that officers of Delaware corporations, like directors, owe fiduciary duties of care and loyalty, and that the fiduciary duties of officers are the same as those of directors. We now explicitly so hold.

* * *

That does not mean, however, that the consequences of a fiduciary breach by directors or officers, respectively, would necessarily be the same. Under

8 Del. C. § 102(b)(7), a corporation may adopt a provision in its certificate of incorporation exculpating its directors from monetary liability for an adjudicated breach of their duty of care. Although legislatively possible, there currently is no statutory provision authorizing comparable exculpation of corporate officers.

Gantler Raises Three

Fundamental Questions:

(1) What is an “officer”?

(2) What does it mean for officers to have “identical” fiduciary duties to directors?

(3) What are the consequences of officers having identical fiduciary duties to directors, and relatedly, are any legislative changes necessary or advisable?

What is an “Officer”?

Focusing on “non-director officers,” or perhaps “director-officers” acting solely in their capacities as officers, since directors have a well developed body of case law establishing their fiduciary duties.

No definition of “officer” in Delaware General Corporation Law. Section 142(a) merely provides that “Every corporation organized under this chapter shall have such officers with such titles and duties as shall be stated in the bylaws or in a resolution of the board of directors which is not inconsistent with the bylaws . . . .” That section further provides that “Officers shall be chosen in such manner and shall hold their offices for such terms as are prescribed by the bylaws or determined by the board of directors or other governing body.”

Delaware’s statute providing for personal jurisdiction over officers of Delaware corporations defines “officer” for purposes of that section as: “an officer of the corporation who (i) is or was the president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer of the corporation at any time during the course of conduct alleged in the action or proceeding to be wrongful, (ii) is or was identified in the corporation’s public filings with the United States Securities and Exchange Commission because such person is or was 1 of the most highly compensated executive officers of the corporation at any time during the course of conduct alleged in the action or proceeding to be wrongful, or (iii) has, by written agreement with the corporation, consented to be identified as an officer for purposes of this section.”

10 Del. C. § 3114(b).

What Does it Mean for Officers to Have

“Identical” Fiduciary Duties to Directors?

Directors’ Fiduciary Duties

Care: The duty of care requires that directors inform themselves of “all material information reasonably available to them,” prior to making a business decision. Smith v. Van Gorkom, 488 A.2d 858,

872 (Del. 1985) (citation omitted). Directors must “act in an informed and deliberate manner” prior to making a business decision. Id. at

873. Gross negligence is the standard in determining if there has been a breach of the duty of care. In re Walt Disney Co. Derivative

Litigation, 906 A.2d 27, 53 (Del. Ch. 2006).

Loyalty: Directors have an “affirmative duty to protect the interests of the corporation, but also an obligation to refrain from conduct which would injure the corporation and its stockholders or deprive them of profit or advantage. In short, directors must eschew any conflict between duty and self-interest.” Ivanhoe Partners v.

Newmont Mining Corp., 535 A.2d 1334, 1345 (Del. 1987).

“Other” Duties of Directors -- Do

Officers Share These As Well?

Good Faith: “To act in good faith, a director must act at all times with an honesty of purpose and in the best interests and welfare of the corporation.” In re Walt Disney Co. Derivative Litigation, 907 A.2d 693, 755 (Del. Ch.

2005), aff’d, 906 A.2d 27 (Del. 2006).

Directors cannot “consciously and intentionally disregard[ ] their responsibilities, [or] adopt[ ] a ‘we don’t care about the risks’ attitude concerning a material corporate decision.” Id. at 754-55 (citing In re Walt Disney Co. Derivative Litigation, 825 A.2d 275, 289 (Del. Ch. 2003)). The duty of good faith is a subset of the duty of loyalty. Stone ex rel. AmSouth Bancorporation v. Ritter, 911 A.2d 362, 370 (Del.

2006).

Disclosure: Directors are obligated to disclose all material information when soliciting stockholder action. Stroud v. Grace, 606 A.2d 75, 84 (Del. 1992). “When . . . directors disseminate information to stockholders when no stockholder action is sought, the fiduciary duties of care, loyalty and good faith apply.” Malone v. Brincat,

722 A.2d 5, 12 (Del. 1998). The duty of disclosure is an application of both the duties of care and loyalty. Pfeffer v.

Redstone, 965 A.2d 676, 684 (Del. 2009).

Candor:Directors have a duty to disclose to the board material information in their possession bearing upon a board decision, particularly where the directors have a personal interest in the outcome of the board decision. Mills

Acquisition Co. v. Macmillan, Inc., 559 A.2d 1261, 1283 (Del. 1989). This is an application of the duty of loyalty.

Duties in Particular Transactional Contexts (e.g., Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc., 506

A.2d 173 (Del. 1986) (duty to maximize price in sale of control); Unocal v. Mesa Petroleum Co., 493 A.2d 946 (Del.

1985) (duty to act reasonably in response to threat in adoption of takeover defenses)). Revlon and Unocal duties have been held to be applications of both the duties of care and loyalty. Malpiede v. Townson, 780 A.2d 1075, 1086

(Del. 2001) (Revlon); Gilbert v. El Paso Co., 575 A.2d 1131, 1146 (Del. 1990) (Unocal).

Duties of Oversight: Directors have a duty “to assure [that] a reasonable information and reporting system exists.” In re Caremark International Derivative Litigation, 698 A.2d 959, 971 (Del. Ch. 1996). The duty of oversight is an application of the duties of care and loyalty. Guttman v. Huang, 823 A.2d 492, 506 (Del. Ch. 2003).

Duties of Officers

Gantler specifically refers to duties of “care and loyalty.”

Makes no sense to extend duties to officers where officers are not involved in the decision (e.g., disclosures in proxy statements, Revlon duties), although this does not rule out the possibility of “aiding and abetting” liability.

There still may be room for officers to have duty of good faith (in carrying out duty of loyalty), duty of candor (duty to disclose matters to board or other officers), and duty of oversight.

What Are the Consequences of Officers Having Identical

Fiduciary Duties to Directors: Are Any Legislative Changes

Necessary or Appropriate?

As noted by Gantler, Section 102(b)(7) of the Delaware General Corporation Law only permits exculpation of liability of directors for certain breaches of duty:

In addition to the matters required to be set forth in the certificate of incorporation by subsection (a) of this section, the certificate of incorporation may also contain any or all of the following matters: . . .

A provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director: (i) For any breach of the director’s duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under § 174 of this title; or (iv) for any transaction from which the director derived an improper personal benefit. No such provision shall eliminate or limit the liability of a director for any act or omission occurring prior to the date when such provision becomes effective. All references in this paragraph to a director shall also be deemed to refer (x) to a member of the governing body of a corporation which is not authorized to issue capital stock, and (y) to such other person or persons, if any, who, pursuant to a provision of the certificate of incorporation in accordance with § 141(a) of this title, exercise or perform any of the powers or duties otherwise conferred or imposed upon the board of directors by this title.

Only permits exculpation for monetary breaches of the duty of care (e.g., acts of gross negligence).

Does not permit exculpation for monetary liability for breaches of the duty of loyalty. Also, does not bar suits for injunctive relief to enjoin acts that would breach any duties (including care and loyalty).

Additionally, Section 141(e) of the Delaware General Corporation

Law only provides directors with protection of liability for good faith reliance upon corporate records or reports of officers or advisors:

A member of the board of directors, or a member of any committee designated by the board of directors, shall, in the performance of such member’s duties, be fully protected in relying in good faith upon the records of the corporation and upon such information, opinions, reports or statements presented to the corporation by any of the corporation’s officers or employees, or committees of the board of directors, or by any other person as to matters the member reasonably believes are within such other person’s professional or expert competence and who has been selected with reasonable care by or on behalf of the corporation.

10 Del. C. § 3114(b) provides for personal jurisdiction in

Delaware over both directors and (since 2004) officers of

Delaware corporations, through implied consent:

Every nonresident of this State who after January 1, 2004, accepts election or appointment as an officer of a corporation organized under the laws of this State, or who after such date serves in such capacity, and every resident of this State who so accepts election or appointment or serves in such capacity and thereafter removes residence from this State shall, by such acceptance or by such service, be deemed thereby to have consented to the appointment of the registered agent of such corporation (or, if there is none, the Secretary of State) as an agent upon whom service of process may be made in all civil actions or proceedings brought in this State, by or on behalf of, or against such corporation, in which such officer is a necessary or proper party, or in any action or proceeding against such officer for violation of a duty in such capacity, whether or not the person continues to serve as such officer at the time suit is commenced. Such acceptance or service as such officer shall be a signification of the consent of such officer that any process when so served shall be of the same legal force and validity as if served upon such officer within this State and such appointment of the registered agent (or, if there is none, the Secretary of State) shall be irrevocable. As used in this section, the word “officer” means an officer of the corporation who (i) is or was the president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer of the corporation at any time during the course of conduct alleged in the action or proceeding to be wrongful, (ii) is or was identified in the corporation’s public filings with the United States Securities and Exchange Commission because such person is or was 1 of the most highly compensated executive officers of the corporation at any time during the course of conduct alleged in the action or proceeding to be wrongful, or (iii) has, by written agreement with the corporation, consented to be identified as an officer for purposes of this section.

Possible Legislative Changes

Adopt a Section 102(b)(7) for officers. Currently, an exculpatory provision in charter covering officers would be invalid.

Arguably unnecessary and/or inadvisable. Section 102(b)(7) was adopted in response to the

Delaware Supreme Court’s decision in Smith v. Van Gorkom, 488 A.2d 858, 872 (Del. 1985), which sparked a crisis in the D&O insurance market by holding that directors could be held personally liable for a breach of the duty of care. There were serious concerns that insurers would no longer issue policies covering directors, and that people would refuse to serve as directors, particularly as independent directors who were not directly involved in day-to-day operations.

By contrast, officers are the ones who are directly involved in day-to-day operations, and perhaps they should be held liable if they have acted with gross negligence, particularly since claims against them in all likelihood will only be asserted by the company itself or in a derivative suit (as opposed to a direct suit by stockholders), whereas directors may be sued both directly and derivatively. Moreover, the Gantler case is unlikely to spark the same kind of crisis sparked by Van Gorkom, since people serving as officers are unlikely to refuse to do so based upon the possibility of liability, as the positions usually serve as their means of employment, whereas independent directors affected by the Van Gorkom decision would likely be in a better position to refuse to continue to serve in such roles.

Additionally, corporations are already permitted to indemnify officers under Section 145 of the

Delaware General Corporation Law unless the officer is found liable for having breached a duty to the corporation. Given that the standard for liability is at least gross negligence (i.e., breach of the duty of care), in all likelihood there will be no liability except in cases of breach of the duty of loyalty, in which case exculpation would be unavailable in any event.

Possible Legislative Changes

Adopt a Section 141(e) for officers.

Arguably unnecessary. If an officer reasonably relies on reports of more junior employees or corporate advisors, it is highly unlikely that a court would find the officer to have breached a duty of care or loyalty.