Introduction to the Money Supply Process

advertisement

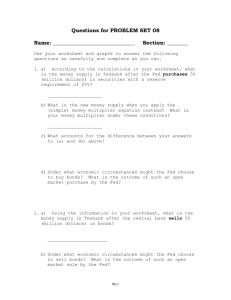

Introduction to the Money Supply Process Fundamental Property -- Money supply expands when banks make loans (or more generally, expand loans or buy bonds) Deposit Expansion: The Individual Bank Consider the following example. (rD = 0.10, rT = 0.05) Chase R $20000 D $70000 L $90000 T $80000 Bonds $50000 E $10000 Computing Required and Excess Reserves Chase R $20000 D $70000 L $90000 T $80000 Bonds $50000 E $10000 rD = 0.10 rT = 0.05 RR = rDD + rTT = (0.10)($70000) + (0.05)($80000) = $11000 ER = R - RR = $20000 - $11000 = $9000 Loan of $9000 Step #1 -- Loan is Approved Chase R $20000 D $79000 L $99000 T $80000 Bonds $50000 E $10000 Borrower signs loan contract, receives check from bank. Step #2 -- Loan is Spent Chase R $11000 D $70000 L $99000 T $80000 Bonds $50000 E $10000 Seller deposits check in her bank. R HSBC + $9000 D + $9000 Bank Loaning and Money Supply Expansion Consider: M2 = C + D + T + MMMF M2 = C + D + T + MMMF Our example: M2 = $0 + $9000 + $0 + $0 = $9000 (Chase’s loan leads to new deposits for HSBC.) Key Concepts: Money Supply Expansion Key is step #1, Chase expands its deposit commitments without changing its reserves. Note -- Process is symmetric. Repayment or liquidation of loan leads to decrease in M2 (by the amount of the loan). Deposit Expansion: The Banking System Multiple Expansion -- An initial change in bank reserves prompted by the Federal Reserve leads to an eventual increase in the money supply which is a multiple of that initial change. Developing a Formula for Multiple Expansion Define -- The Monetary Base, or High Powered Money (H) H=C+R Key Properties: The Monetary Base The monetary base (H) is unaffected by changes in public asset holdings. The monetary base (H) is also unaffected by bank loaning. Important factors that change H: Open Market Operations and Discount Loans (DL). Discount Loans and the Monetary Base Example 1 -- Chase borrows $100 from the Federal Reserve. R Chase + $100 DL + $100 H = C + R = $0 + $100 = $100 Open Market Operations and the Monetary Base Example 2 -- The Federal Reserve buys a $100 bond from Chase. Bonds R Chase - $100 + $100 H = C + R = $0 + $100 = $100 The Nonborrowed Base The Nonborrowed Base (HNON) HNON = H - DL Key property -- The nonborrowed base is only affected by open market operations. A Formula for Money Supply Determination Define the following variables. k = C/D t = T/D e = ER/D Money Supply Determination: The Formula M2 = (1 + k + t) (HNON + DL) + MMMF (k + rD + rTt + e) The money multiplier (m2) Computing the Money Multiplier: An Example Suppose that: C = 550 rD = 0.10 D = 600 rT = 0.03 T = 3000 ER = 10. Compute the money multiplier (m2). Computing the Ratios k = C/D = 550/600 = 0.917 t = T/D = 3000/600 = 5.000 e = ER/D = 10/600 = 0.0167 Plugging Into The Multiplier Formula m2 = 1+k+t k + rD + rTt + e m2 = 1 + 0.917 + 5.0 0.917 + 0.10 + (0.03)(5.0) + 0.0167 m2 = 5.84 Effects of HNON and DL on M2 Determination Since M2 = (m2)(HNON + DL), M2 = (m2)( HNON), M2 = (m2)(DL). In other words, HNON M2 DL M2 Changes in HNON or DL give banks reserves, greater ability to loan. Effects of Reserve Ratios on M2 Determination Increases in reserve ratios hinder bank loaning, thereby decreasing the multiplier and M2. m2 = 1+k+t k + rD + rTt + e rD m2 M2 rT m2 M2 Effects of k (C/D) and t (T/D) on M2 Determination Changes in k and t (public’s desire to reallocate assets) have different effects on bank loaning, the multiplier, and M2. m2 = 1+k+t k + rD + rTt + e k m2 M2 t m2 M2 Effects of e (ER/D) on M2 Changes in e (banks desire to hold more excess reserves) affect the multiplier, which affects M2. m2 = 1+k+t k + rD + rTt + e e m2 M2 M2 Determination: Summary First, the formula again. M2 = (1 + k + t) (HNON + DL) + MMMF (k + rD + rTt + e) A Summary Table HNON DL rD rT k t e M2 M2 M2 M2 M2 M2 M2 The Multiplier -- Trying to Control the Money Supply M2 = (1 + k + t) (HNON + DL) + MMMF (k + rD + rTt + e) Federal Reserve controls HNON, rD, and rT and uses them as policy tools. But M2 is also determined by public asset holding (k, t, MMMF) and bank behavior (e, DL). Can the Federal Reserve Control the Money Supply? Practical Solution -- The Federal Reserve tries to control money supply growth within a given target range. If actual M2 growth falls within the range, M2 is considered controlled. The Multiplier Effect and Controlling M2 Consider formula for M2 determination (apart from MMMF), written as follows (recall that H = HNON + DL). M2 = (m2)(H) M2 Determination in Growth Rates Since the levels are multiplicative, the growth rates are additive Growth in M2 (Growth in m2) + (Growth in H) Implications for M2 Control Growth in M2 (Growth in m2) + (Growth in H) If the multiplier is roughly constant over time (growth in m2 0), then the growth rate of M2 will approximate closely the growth rate of the monetary base. Difficulties in M2 Control Growth in M2 (Growth in m2) + (Growth in H) But if the multiplier changes over time (growth rate either positive or negative), then the growth rate of M2 will deviate from the growth rate of the monetary base. Non-Federal Reserve Changes in M2 Best solution: constant multiplier, zero DL. Unfortunately, not true. Second best solution: predictable multiplier and DL. How to predict non-Fed controlled changes in M2? What determines movements in the components (k, t, e, DL, MMMF)?