Applications of bootstrap method on finance

advertisement

Applications of bootstrap

method to finance

Chin-Ping King

Population distribution function F

empirical distribution function(EDF) Fn

F

(x1, x2,…, xn)

where x= (x1, x2,…, xn)

Fn

(x1*, x2*,…, xn*)

where x*= (x1*, x2*,…, xn*)

Probability of elements of population which occur in x : P

Probability of elements of EDF which occur in x*: Pn

Pn ~ Bi(P, (p*(1-p)/n))

By Weak Law of Large Number and Central Limit Theorem

(n)1/2(Fn - F)

d

N(0, p*(1-p))

Estimation of standard deviation and bias

Estimator of θ : θ’

θ’ =s(x)

Standard deviation:

se={∑nj=1 [θ’j- θ’(.)]2/(n-1)}

se(.)= ∑nj=1 θ’ j/n

Bias:

bias=E[θ’]- θ

Root mean square error of an estimator θ’ for θ:

E[(θ’- θ)2]= se2*{1+(1/2)*(bias/se)} 2

Nonparametric bootstrap

The bootstrap algorithm for estimating standard errors(or bias)

1. Select B independent bootstrap samples x*1, x*2 , …, x*B, each consisting of n data drawn

with replacement from x . Total possible number of distinct bootstrap samples is

C(2n-1,n) .

2. Evaluate the bootstrap replication corresponding to each bootstrap sample

θ’*(b)=s(x*b )

b=1,2,…,B

3. Estimate the standard error (or bias) by the sample standard deviation (or bias) of the B

replications:

se’B = se={∑Bb=1 [θ ’*(b)- θ’*(.)]2/(B-1)}

θ’* (.)= ∑Bb=1 θ ’*(b) /B

Bias’B=θ’*(.)- θ’

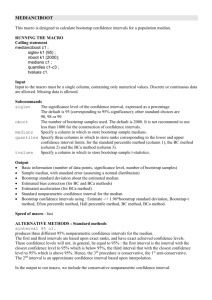

A Schematic diagram of the nonparametric

bootstrap

Unknown

Population

Distribution

F

Observed Random

Sample

x= (x1, x2,…, xn)

θ’ =s(x)

Statistic of interest

Empirical

Distribution

Fn

Bootstrap

Sample

x*= (x1*, x2*,…, xn*)

θ’*(b)=s(x*b )

Bootstrap Replication

Parametric bootstrap

Function form of population probability distribution F has been known, but

parameters in population probability distribution F are not known

Parametric estimate of population probability distribution : Fpar

We draw B samples of size n from the parametric estimate of estimate of the

population probability distribution Fpar:

Fpar

x*= (x1*, x2*,…, xn*)

Error in bootstrap estimates

mi= the ith moment of the bootstrap distribution of θ’

Var(se’B) = Var(m21/2 ) + E[(m2(△+2))/4B]

△= m4/m22-3, the kurtosis of the bootstrap distribution of θ’

Var(m21/2 ):sample variation , it approaches zero as the sample size n

approaches infinity

E[(m2(△+2))/4B]:resampling variation, it approaches zero as B approaches

infinity

Confidence intervals based on bootstrap percentiles

(1-α) Percentile interval:

[θ’%low , θ’%up ]= [θ’*(α/2)B , θ’*(1-(α/2))B ]

θ’*(α/2)B : 100*(α/2)th empirical percentile, or B *(α/2)th value in the ordered

list of the B replications of θ’*

θ’*(1-(α/2))B : 100*(1-(α/2))th empirical percentile, or B *(1-(α/2))th value in the

ordered list of the B replications of θ’*

Percentile interval lemma

Suppose the transformation ψ’=t(θ’) perfectly normalize the distribution of θ’:

ψ’ ~ N(ψ, c2)

For some standard deviation c. Then the percentile interval based on θ’

equals [t-1(ψ’-z(1-(α/2))*c), t-1(ψ’-z(α/2)*c)]

Example:

θ’ =exp(x)

ψ’=t(θ’)=logθ’

x ~ N(0,1)

Coverage performance

Results of 300 confidence interval realizations for θ’ =exp(x)

Method

Standard normal

Interval

Bootstrap percentile

Interval

miss left: left endpoint >1

Miss right: right endpoint <1

% miss left

% miss right

1.2

8.8

4.8

5.2

Transformation-respecting property

The percentile interval for any (monotone) parameter transformation ψ’=t(θ’)

is simply the percentile interval for θ’ mapped by t(θ’) :

[ψ’%low , ψ’%up ]= [t(θ ’%low) , t(θ ’%up) ]

Better bootstrap confidence intervals

(1-α) BCa interval:

[θ ’low , θ ’up ]= [θ’*(α1) , θ’*(α2) ]

α1 and α2 are obtained by standard normal cumulative distribution function

of some correction formulas for bootstrap replications.

BCa interval is transformation respecting.

Accuracy of bootstrap confidence interval

For (1- α )coverage, approximate confidence interval points θ ’low and θ ’up are

called first order accurate if:

Pr(θ ≦ θ ’low )= (α/2 )+ O(n-1/2)

Pr(θ ≧ θ ’up)= (α /2)+ O(n-1/2 )

And second order accurate if

Pr(θ ≦ θ ’low )= (α/2 )+ O(n-1)

Pr(θ ≧ θ ’up)= (α/2 )+ O(n-1)

Percentile interval : first order accurate.

BCa interval : second order accurate.

Calibration of confidence interval points

1.

Generate B bootstrap samples x*1, x*2 , …, x*B. For each sample b=1,2,…,B:

1a) Compute a λ-level confidence interval point θ’*λ (b) for a grid of

values of λ. Where θ’*λ (b) can be θ’*(b)-z1-λ *se ’*(b) .

2. For each λ compute p’ (λ)=#{θ’ ≦ θ’*λ (b) }/B.

3. Find the value of λ satisfying p’ (λ)= α/2

Calibration of percentile interval and BCa interval

Once calibration of percentile interval: second order accurate

Pr(θ ≦ θ ’low )= (α/2 )+ O(n-1)

Pr(θ ≧ θ ’up)= (α/2 )+ O(n-1)

Once calibration of BCa interval: third order accurate

Pr(θ ≦ θ ’low )= (α/2 )+ O(n-3/2)

Pr(θ ≧ θ ’up)= (α /2)+ O(n-3/2 )

Computation of the bootstrap test statistics

1.

Draw B samples of size n with replacement from x.

2.

Evaluate ϕ(.) on each sample,

ϕ(x*b) where ϕ(.) is test statistics

b=1,2,…,B

3. Approximate P-value by

P-value=#{ϕ(x*b) ≧ ϕobs}/B or

P-value=#{ϕ(x*b) ≦ ϕobs}/B

Where ϕobs= ϕ(x) the observed value of test statistics

Asymptotic refinement

Asymptotically normal test statistics ϕ

ϕ

d

N(0,σ2)

ϕ ~ Gn(u,F)

Gn(u,F): exact cumulative distribution

Gn(u,F)=Pr(|ϕ| ≦u|F)

Gn(u,F)

φ(u) as n approaches infinity (assume σ=1)

φ(u): standard normal cumulative distribution

An asymptotic test is based on φ(u)

φ(u)- Gn(u,F)=O(n-1)

G*n(u): bootstrap cumulative distribution

A bootstrap test is based on G*n(u)

G*n(u)-Gn(u,F)= O(n-3/2)

Reality test for data snooping

Forecasting model: lk

Benchmark model: l0

dk= lk- l0

H0 :maxk=1,2,…,nE(dk) ≦0

Data: 1000 daily closing stock prices of UMC

Benchmark model: random walk with drift

lnPt = a + lnPt-1 + εt

Forecasting model :

lnPt = a + ΔlnPt-1 + εt

where ΔlnPt = lnPt – lnPt-1

V=(1/B) ∑Bb=1 d1(b)

Critical value

Quantile of bootstrap distribution

for V

0.000808

The difference is significant, so reject H0

Forecasting model beat random walk model

Statistics V

-1.9874504*

Inference when a nuisance parameter is not identified

the null hypothesis

Threshold Autoregressive (TAR)model:

α10 + α11 yt -1+ ε1t

yt -1 ≦η

α20 + α21 yt -1+ ε2t

yt -1 > η

yt =

η : threshold value

H0: time series is linear

H1: time series is TAR process

Data: monthly data of U.S. dollar/Sweden krona exchange rate from January

1974 to December 1998

U.S. dollar/Sweden krona

Bootstrap P-value

0.0200

Reject H0

U.S. dollar/Sweden krona exchange rates follow TAR process

Bootstrap percentile confidence interval

1.0

0.8

0.6

0.4

0.2

0.0

91:01 91:04 91:07 91:10 92:01 92:04 92:07 92:10

SDN

L05

L10

U90

U95

Thanks for listening