Course Description - Brandeis University

THE HELLER SCHOOL FOR SOCIAL POLICY AND MANAGEMENT

BRANDEIS UNIVERSITY

HS248b: Financial Management

Mondays and Wednesdays 2:00pm to 4:50pm

Spring 2016

Instructor: Robert Angell

Phone: 866-700-0894

Office: Sachar 1d

Office Hours: T/Th 6:30pm to 7:30pm and by appointment

Email: rangell@brandeis.edu

Teaching Assistant: Jamie C. Hennick (Jamie.hennick@gmail.com)

Course Description:

The objective of this course is to prepare students to operate in financial contexts by integrating previous financial theories and concepts in a practical, accessible course of study. Specific objectives will include the following:

1.

To learn some basic and advanced financial, analytical and managerial concepts.

2.

To be able to apply those concepts to financial matters in the context of actual practice as represented by case studies, and in-class discussion.

3.

To be able to evaluate and create budgets and basic financial formats.

4.

To get academic experience with internal controls and management of risk

5.

To learn how to think and take action as a mission-based financial manager.

6.

To be able to communicate effectively with financial personnel.

7.

To create a business plan for a new not-for-profit entity.

Management Discipline Skills and Competencies: This course develops students as educated consumers of financial information, not producers. It covers common financial management problems encountered by today's nonprofit professionals in a real world perspective based on sound financial and accounting theory. The course covers skills and competencies such as financial statement analysis, budget development and control, cash flow management, and asset management.

1

Course Requirements:

You will be graded on your ability to:

Analyze financial situations

Use financial concepts to interpret material

Build a financial case, including correct use of principles and techniques

Demonstrate technical accuracy

Grading will be according to the following formula:

Classroom Participation 15%

Attendance

Quiz 1

10%

15%

Quiz 2

Quiz 3

15%

15%

Business Plan 30%

Classroom Participation: The single most important purpose of this course is to give students the chance to learn some financial management concepts and to use them to develop coherent, integrated approaches to actual problems in financial management. Although some of this material is best presented in didactic format, a great deal of the learning in this class is expected to occur during classroom discussions of cases and exercises prepared prior to class. Most of the classes will cover technical matters plus managerial or policy applications of the material. In many cases, you will be asked to prepare a case analysis or recommendation as part of preparing for class. As is true in practice, there will often be no single 'correct' answer to a given case.

However, you will always be expected to be technically correct and accurate in your analyses.

Comments that move the group discussion forward or that offer fresh insights or thoughtfully unique approaches to the material are the most valuable. Comments that re-cast some aspect of the case or exercise under analysis or that call attention to overlooked but relevant details are also valued. Participation that merely re-states the facts of the case, while sometimes helpful at the beginning of discussion, is the least valuable.

Be prepared to present and/or discuss any assignment during class.

Attendance: Students will receive credit equivalent to an ‘A’ for each class attended. The final attendance grade will be derived by multiplying the percentage of each student’s attendance by the possible total of 10 points. For example, if a student attended 90% of the classes s/he would receive an ‘A’ for 9% of their grade, or 9 points. THERE ARE NO EXCUSED ABSENCES: an absence

2

simply means that no credit will be earned for attending that class. Advance notification of a planned absence is appreciated but not mandatory.

Course Reading:

1.

McLaughlin, Thomas A. Streetsmart Financial Basics for Nonprofit Managers, 3 nd

edition,

John Wiley & Sons (New York, 2009) ‘ Streetsmart’

2.

Various articles, notes and cases (ex., HBS =Harvard Business School case). Cases and articles may be purchased directly from Harvard.

Link: https://cb.hbsp.harvard.edu/cbmp/access/43538996

3.

Additional articles may be accessed on Latte or directly from other sources during the course.

Students will also need an ordinary hand calculator for all classes.

Previous Coursework

Certain academic coursework is a prerequisite for this course. Refer to school policies for specific requirements.

Academic Integrity: Academic integrity is central to the mission of educational excellence at

Brandeis University. Each student is expected to turn in work completed independently, except when assignments specifically authorize collaborative effort. It is not acceptable to use the words or ideas of another person- be it a world-class philosopher or your classmate – without proper acknowledgement of that source. This means that you must use footnotes and quotation marks to indicate the sources of any phrases, sentences, paragraphs or ideas found in published volumes, on the internet, or created by another student. Violations of university policies on academic integrity, described in Section 3 of Rights and Responsibilities , may result in failure in the course or on the assignment, and could end in suspension from the University. If you are in doubt about the instructions for any assignment in this course, you must ask for clarification.

Note that the wording in IRS 990s, Forms 10K and 10Q and any other public filing must not be plagiarized.

The use of computers and cell phones during class is not permitted unless authorized by professor.

Notice: If you have a documented disability on record at Brandeis University and require accommodations, please bring it to my attention prior to the second meeting of the class. If you have any questions about this process, contact Mary Brooks, disabilities coordinator for the

Heller School at x 62816, or at maryeliz@brandeis.edu

.

3

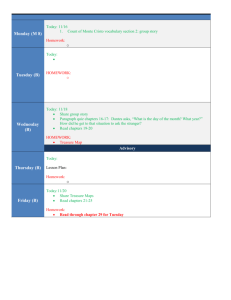

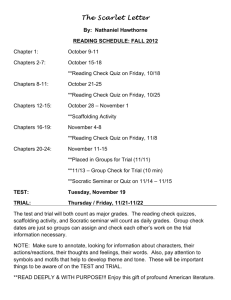

Course Outline, Readings and Assignments (assignments are due for the following Class) – Subject to Change at Professor’s Discretion.

1 st Class Overview of Financial Management and Corporate Structure in the

Nonprofit Sector

Read: Streetsmart Financial Basics for Nonprofit Managers, Preface,

Appendix A (Chapters 1, 2, 3), Chapters 1, 2, 3

Read: Creating Business Plans (HBS: 16998-PDF-ENG) Pages 1 - 33

Develop a list of new business concepts that you might want to pursue for your business plan. Be prepared to share in class.

Browse these sites as general background http://nccs.urban.org/ www.guidestar.org

www.nptimes.com www.independentsector.org http://www.boardsource.org/ www.wallacefoundation.org

http:foundationcenter.org www.bridgespan.org

https://nonprofitsassistancefung.org

www.charitynavigator.org

2 nd Class Accounting as Second Language, Balance Sheets, Financial Analysis

Read: Streetsmart, Appendix A (Chapters 4, 5, 6) Chapters 4, 5 and 6

Read: Creating Business Plans (HBS: 16998-PDF-ENG) Pages 34 - 56

Find, read and analyze : Brandeis 990: Look at 3 years of information and formulate your observations about the university’s financial health. Be prepared to discuss in class.

Decide what business concept you want to pursue for your business plan.

Write a one page summary of your business concept for a not-for-profit entity.

Hand in at the beginning of class. The summary should address the following:

What problem are you trying to solve?

How big is the problem?

Who is addressing the problem now?

What services/products will you provide?

What populations will be served?

Possible funding sources?

Growth strategy?

4

3 rd Class Nonprofit Accounting, Cost Accounting, The Auditor

Read: Streetsmart; Appendix A (Chapters 7, 8, 9), Chapter 7, 8, 9

Read: Creating Business Plans (HBS: 16998-PDF-ENG) Pages 57 - 70

Prepare a spreadsheet analyzing Brandeis’ financial performance during the most recent 3 year period. Compare Brandeis to other colleges/university. How would you characterize Brandeis financial strength?

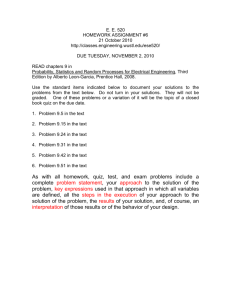

4th Class: Quiz and Business Planning

Quiz 1: Covers all material to date

Read: Developing Business Plans and Pitching Opportunities

(HBS: 8062-HTM-ENG) Pages 1- 33

Read and prepare case: Covers 4 Change (HBS: W13159-PDF-ENG)

5 th Class Cash Flow Management, Capital

Read:

Read:

Streetsmart, Appendix A (Chapters 10, 11), Chapters 10, 11

Creating Business Plans (HBS: 16998-PDF-ENG) Pages 71 - 92

Read and prepare case: Asian Americans for Community Involvement

(HBS: B5813-PDF-ENG)

6 th Class Business Planning

Finalize the organization that you are in the process of starting or would like to start someday. Assume that the entity will be a standalone nonprofit.

Read: Creating Business Plans (HBS: 16998-PDF-ENG) Pages 93 - 108

Describe your model in 3 to 5 pages including the following elements:

Business model

Capital structure – amount and sources

Competitors

Consumers – organizational, personal, or both?

Geographic range, if applicable

Legal and regulatory considerations

5

Length of startup phase (almost certain to be years)

Regulatory constraints, if any

Staffing considerations

7 th Class Budgeting, Indirect Costs, Pricing

Read : Streetsmart, Appendix A (Chapters 12, 13, 14,),Appendix B Chapters 12,

13, 14

Read: Creating Business Plans (HBS: 16998-PDF-ENG) Pages 109 - 118

Read and prepare case: Atlantic Park Medical Center v. Hamlin Asset

Management (HBS: BAB002-PDF-ENG)

8 th Class Quiz 2 and Profit, Money

Quiz 2:

Read:

Covers all material to date

Streetsmart, Appendix A (Chapters 15, 16), Chapters 15, 16

Submit first draft of your business plan’s Financial Forecast (include Income

Statement, Cashflow Statement and Balance Sheet. It should include

the first twelve months of operations, including startup expenses and administrative costs.

Years 2 and 3

9 th Class Insurance, Internal Controls

Read: Streetsmart, Appendix A (Chapters 17, 18), Chapters 17, 18

Read and prepare case: National Kidney Foundation

(HBS: HKU584-PDF-ENG )

10 th Class Management Controls

Read: Streetsmart, Appendix A (Chapters 19, 20), Chapters 19, 20

Read and prepare case: The American Reperatory Theater

(HBS: 512026-PDF-ENG)

6

11 th Class Quiz 3 and Business Plan Clinic

Quiz 3: Covers all material to date

Complete: Final Business Plan and Powerpoint presentation (10 slides)

12 th Class . Business Plan Presentations

13 th Class Business Plan Presentations

7