Permit market - National University of Singapore

Oligopolistic Electricity Markets Equilibrium with Imperfect Competition in CO2

Emission Permits Trading

Tanachai Limpaitoon and Shmuel Oren, UC Berkeley and Yihsu Chen, UC Merced

Presented at the

IMS Workshop on Complementarity and Extensions (ICCP2012)

National University of Singapore, Singapore

December 17-21, 2012

Scope of this talk

• Describe an equilibrium model of an oligopoly electricity market in a congested grid in conjunction with a cap-and-trade policy.

• Account for complex interactions between network effects, ownership structure and exercise of market power in both energy markets and CO2 permit market

• Explore unintended consequences due to multiple market imperfections (theorem of the second best) and impact of initial permit allocation

Modeling Market Power in Permit

Markets

• Hahn (1984)

– one dominant firm and other price-taking firms in a static model in the context of markets for transferable property rights.

• Sartzetakis (1997)

– Two-stage model that assumes upstream-downstream interaction, where permits market (upstream) is cleared first . There are two Cournot firms competing in an output market, one of which is the leader in the permits market.

• Resende and Sanin (2009)

– Three-stage model that assumes the follower in the permit market can anticipate output response from its rival in the third stage, when deciding optimal permit quantity in the second stage.

• Montero (2009)

– extended Hahn's model to incorporate market settings such as permit auctions

• Tanaka and Chen (2011)

– Considered a model for electricity market in which permit prices can be manipulated through fringe producers

Our Modeling Approach

• Considers transmission-constrained electricity market at a more realistic scale

• Takes into account essential market

characteristics such as electrical loopflow, resource ownership, and transmission constraints based on thermal ratings.

• Examines simultaneous interactions, instead of a multi-stage model, of oligopoly competition between multiple players of electricity market which also participate in a carbon permit market.

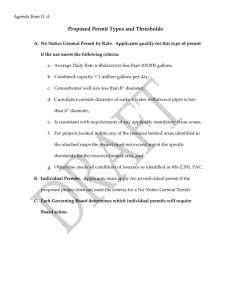

Equilibrium Model with C&T

LOAD SERVING ENTITIES

Purchase Decisions

LMP LOAD

ISO

Market clearing, Congestion control

LMP OUTPUT LMP OUTPUT LMP OUTPUT

Permit

Price

GEN FIRM

Production

Decision

Permits needed

Permit

Price

GEN FIRM

Production

Decision

Permits needed

Permit

Price

GEN FIRM

Production

Decision

PERMIT MARKET

Permit prices adjusted to clear supply and demand subject to CAP

Permits needed

5

Equilibrium Model

• LMP-based market: Transmission flows obey direct-current (DC) load flow model (Kirchhoff law) and are constrained by thermal limits and security limits (transmission constraints)

• Producers: Cournot producers with quadratic cost functions compete to sell energy at different locations in the LMP-based market and make production decisions so as to maximize profits.

• Consumers: Demand for energy is price-responsive and represented by nodal inverse demand functions

• Market clearing mechanisms:

– Electricity market: ISO clears the market and controls import/exports through locational congestion markups so as to maximize social welfare while satisfying transmission constraints

– Permit market: Endogenous permit market sets the permit price based on derived demand by producers, induced by output , and available permits.

• Bounded rationality: ISO and producers move simultaneously.

Producers do not account for their impact on congestion.

Direct-Current Electric Power Network

𝑁 = the set of buses

𝐿 = the set of transmission lines

(MW = Megawatt) 𝑞 𝑖

+ 𝑟 𝑖

= 𝑙𝑜𝑎𝑑 𝑖∈𝑁 𝑟 𝑖 𝑖

, ∀𝑖 ∈ 𝑁

+ 𝐿𝑜𝑠𝑠𝑒𝑠 = 0

−𝐾 𝑞 𝑖 𝑟 𝑖

MW output of the plant at bus

MW import/export at bus 𝑖 𝑖

(import = +) 𝑙

≤ 𝑞 𝑖 𝑖∈𝑁

≤ 𝑞

𝐷 𝑖 𝑙,𝑖 𝑟 𝑖

≤ 𝑞 𝑖

≤ 𝐾 𝑙

, ∀𝑙 ∈ 𝐿

, ∀𝑖 ∈ 𝑁

≤ K

1 𝑙𝑜𝑎𝑑 𝑖

𝐾 𝑙

MW fixed load at bus 𝑖

Rating of transmission line 𝑙 (MVA)

𝐷 𝑙,𝑖

PTDF l,i

of line 𝑙 with respect to a unit injection at bus 𝑖 and a unit withdrawal at the slack bus 𝑞 𝑖

Plant 𝑖 ’s must-run limit (MW)

≤ K

2 r i i q i 𝑞 𝑖

Plant 𝑖 ’s maximum capacity (MW) load i

7

Price-responsive demand

Consumers in each location i are represented by a linear inverse demand function:

• The inverse demand function at each bus is obtained from the result of a cost-minimizing power flow model.

• The price elasticity of demand is assumed to be -0.1 (Espey and

Espey, 2004) 𝑝 ∗

8

ISO Maximizes Social Welfare subject to

Transmission Constraints

Price ($/MWh)

Inverse Demand Function (WTP) - P(q)

Benefit Marginal cost curve

Production cost C(q)

Local

Production = q

Local

Consumption = q + import r

Quantity (MWh)

ISO Real Time Dispatch Problem

(solved every 5 minutes)

All Rights Reserved to Shmuel Oren

12

Scenario

PC

OG

OG-MP

PC-MP

Market Scenarios

Description

Both electricity and permit markets are perfectly competitive

Electricity market is oligopoly but permit market is perfectly competitive

Electricity market is oligopoly in the presence of market power in permit market

Electricity market is perfectly competitive in the presence of market power in permit market

These scenarios are also considered in Montero (2009),

“Market power in pollution permit markets.” The Energy Journal

PC

(LCP)

ISO solves (redispatch problem) 𝑟 max 𝑖

:𝑖∈𝑁 s. t.

−𝐾 𝑙 𝑖∈𝑁

0 𝑟 𝑖

+𝑞 𝑖 𝑃 𝑖 𝑞 𝑑𝑞 − 𝐶 𝑖

(𝑞 𝑖

) 𝑖∈𝑁 𝑟 𝑖

= 0 𝑝

≤ 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖

≤ 𝐾

− 𝑙∈𝐿 ℎ 𝑠,𝑙 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖 𝑟 𝑖

+ 𝑞 𝑖

≥ 0 𝑙

≤ 𝑇 𝑠 𝜅 𝑙

−

, 𝜅 𝑙

+ 𝜏 𝑖 𝜉 𝑖

∀𝑙 ∈ 𝐿

∀𝑠 ∈ 𝑆

∀𝑖 ∈ 𝑁

Permit Market Equilibrium

𝑀 − 𝑔∈𝐺 𝑥 𝑔

= 0

KKT of ISO (Only FOCs are shown here.) 𝜑 𝑖

= 𝑙∈𝐿 𝜅

+

− 𝜅

−

𝐷 𝑙,𝑖

∀𝑖 ∈ 𝑁

− 𝜏 𝑠 ℎ 𝑠,𝑙

𝐷

,𝑙,𝑖

− 𝜉 𝑖 𝑠∈𝑆 𝑙∈𝐿

𝑃 𝑖 𝑟 𝑖

+ 𝑞 𝑖

− 𝑝 − 𝜑 𝑖

= 0 ∀𝑖 ∈ 𝑁

Each firm g solves (profit maximization) 𝑞 𝑖 max

:𝑖∈𝑁 𝑔 𝑥 𝑔 𝑖∈𝑁 𝑔 𝑝 + 𝜑 𝑖 𝑞 𝑖

− 𝐶 𝑖 𝑞 𝑖

− 𝜇 𝑥 𝑔

− 𝑥 0 𝑔 𝑖∈𝑁 𝑔 𝑞 𝑖 𝑞 𝑖

≤ 𝑞 𝑖

= 𝑖∈𝑁

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

− 𝑖∈𝑁\𝑁 𝑔 𝑞 𝑖

, 𝜌 𝑙

−

, 𝜌 𝑙

+ 𝑞 𝑖

, 𝛽

∀𝑖 ∈ 𝑁 𝑔 𝑔 𝑥 𝑔

− 𝑖∈𝑁 𝑔

𝐹 𝑖 𝑥 𝑔

= 𝑀 − 𝑥

−𝑔 𝑞 𝑖

≥ 0 , 𝜇 − y(𝜇) , 𝜂 𝛼 𝑔 𝑔

KKT of Firm g (Only FOCs are shown here) 𝑝 + 𝜑 𝑖

= 𝛽 𝑔

− 𝜌 𝑖

−

+ 𝜌 𝑖

+

+ 𝑑𝐶 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

+ 𝜂 𝑔 𝑑𝐹 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

∀𝑖 ∈ 𝑁 𝑔

, 𝛽 𝑔 𝑖∈𝑁 𝑑 𝑑𝑝

−𝛼 𝑔

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

+ 𝑖∈𝑁 𝑔

−𝛼 𝑔

− 𝜇 + 𝜂 𝑔

= 0 𝑑𝑥

−𝑔 𝑑𝜇 𝑑y

+ 𝑑𝜇

− 𝑥 𝑔

− 𝑥 0 𝑔 𝑞 𝑖

= 0

= 0

OG

(LCP)

ISO solves (redispatch problem) 𝑟 max 𝑖

:𝑖∈𝑁 s. t.

−𝐾 𝑙 𝑖∈𝑁

0 𝑟 𝑖

+𝑞 𝑖 𝑃 𝑖 𝑞 𝑑𝑞 − 𝐶 𝑖

(𝑞 𝑖

) 𝑖∈𝑁 𝑟 𝑖

= 0 𝑝

≤ 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖

≤ 𝐾

− 𝑙∈𝐿 ℎ 𝑠,𝑙 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖 𝑟 𝑖

+ 𝑞 𝑖

≥ 0 𝑙

≤ 𝑇 𝑠 𝜅 𝑙

−

, 𝜅 𝑙

+ 𝜏 𝑖 𝜉 𝑖

∀𝑙 ∈ 𝐿

∀𝑠 ∈ 𝑆

∀𝑖 ∈ 𝑁

Permit Market Equilibrium

𝑀 − 𝑔∈𝐺 𝑥 𝑔

= 0

KKT of ISO (Only FOCs are shown here.) 𝜑 𝑖

= 𝑙∈𝐿 𝜅

+

− 𝜅

−

𝐷 𝑙,𝑖

∀𝑖 ∈ 𝑁

− 𝜏 𝑠 ℎ 𝑠,𝑙

𝐷

,𝑙,𝑖

− 𝜉 𝑖 𝑠∈𝑆 𝑙∈𝐿

𝑃 𝑖 𝑟 𝑖

+ 𝑞 𝑖

− 𝑝 − 𝜑 𝑖

= 0 ∀𝑖 ∈ 𝑁

Each firm g solves (profit maximization) 𝑞 𝑖 max

:𝑖∈𝑁 𝑔 𝑥 𝑔

,𝑝 𝑖∈𝑁 𝑔 𝑝 + 𝜑 𝑖 𝑞 𝑖

− 𝐶 𝑖 𝑞 𝑖

− 𝜇 𝑥 𝑔

− 𝑥 0 𝑔 𝑖∈𝑁 𝑔 𝑞 𝑖 𝑞 𝑖

≤ 𝑞 𝑖

= 𝑖∈𝑁

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

− 𝑖∈𝑁\𝑁 𝑔 𝑞 𝑖

, 𝜌 𝑙

−

, 𝜌 𝑙

+ 𝑞 𝑖

, 𝛽

∀𝑖 ∈ 𝑁 𝑔 𝑔 𝑥 𝑔

− 𝑖∈𝑁 𝑔

𝐹 𝑖 𝑥 𝑔

= 𝑀 − 𝑥

−𝑔 𝑞 𝑖

≥ 0 , 𝜇 − y(𝜇) , 𝜂 𝛼 𝑔 𝑔

KKT of Firm g (Only FOCs are shown here) 𝑝 + 𝜑 𝑖

= 𝛽 𝑔

− 𝜌 𝑖

−

+ 𝜌 𝑖

+

+ 𝑑𝐶 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

+ 𝜂 𝑔 𝑑𝐹 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

∀𝑖 ∈ 𝑁 𝑔

, 𝛽 𝑔 𝑖∈𝑁 𝑑 𝑑𝑝

−𝛼 𝑔

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

+ 𝑖∈𝑁 𝑔

−𝛼 𝑔

− 𝜇 + 𝜂 𝑔

= 0 𝑑𝑥

−𝑔 𝑑𝜇 𝑑y

+ 𝑑𝜇

− 𝑥 𝑔

− 𝑥 0 𝑔 𝑞 𝑖

= 0

= 0

Imports

WECC 225 Bus System

Fuel Type Avg. MC†

($/MWh)

Hydro

Nuclear

Gas

Biomass

Geothermal

Renewable

7

9

70

25

0

0

Avg. CO

2 rate

(lb/MWh)

0

0

1,281

0

0

0

Total MW Percent

10,842 23%

4,499 10%

26,979

558

57%

1%

1,193 3%

946 2%

Wind 0 0 2,256 5%

47,273 100%

†Source: Energy Information Administration, Annual Energy

Outlook 2010, DOE/EIA-0383(2009)

Source: California Energy Commission

Import

Arizona

Avg.CO

2 rate

(lbs/MWh)

1,219

Nevada

Oregon

1,573

456

Source: eGRID2006 V2.1, April

2007

16

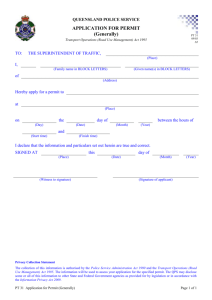

WECC 225-Bus Model

Source: Papavasiliou (2011) Ph.D. Dissertation “Coupling Renewable Energy Supply with Deferrable Demand”

Resource Mix by Firm

HHI Index by capacity = 2,100

(Moderate Concentration)

1600

20 000

18 000

16 000

14 000

12 000

10 000

8 000

6 000

4 000

2 000

-

1400

1200

1000

800

600

400

200

0

1 2 3 4 5 6 7 8

Firm (Highest to Lowest CO2 rate)

9 10 geothermal renewable wind hydro nuclear biomass gas CO2 rate

18

Test Case Scenarios and Assumptions

• Scenarios:

– Perfect Competition vs Oligopoly Competition

• 10 firms with 1 competitive fringe

– No CO

2 cap and CO

2 cap (20% reduction below Perfect

Competition with No Cap and Transmission Constraints)

– With/without transmission constraints

• Assumptions:

– Price-responsive linear demand function

• with demand elasticity of -0.1 ( Azevedo et al., Electricity Journal [2011] )

– Price-responsive linear supply function for imports

• with supply elasticity of 0.005 ( Tsao et. al., Energy Policy [2011] )

– Simulated hour: the median load (Summer 2004)

19

Economic Results for Test Case

(With / Without Trans. Constr.)

20

Total CO

2

Emission [tons]

Energy Consumption [MWh]

Avg. LMP [$/MWh]

CO

2

Price [$/ton]

CO

2 rate [ton/MWh]

Import CO

2 rate [ton/MWh]

In-State Fuel Costs (K$)

Social Surplus (K$)

Consumer Surplus (K$)

Producer Surplus (K$)

Congestion Revenues (K$)

Perfect Competition

No Cap Cap

Oligopoly

No Cap Cap

6,111 4,977 4,889 4,889 9,766 9,611 4,889 4,889

30,362 30,471 28,576 30,286 28,060 28,184 25,040 25,170

59 53 94 56 97 95 154 151

0 0 74 8 0 0 155 151

0.201

0.163

0.171

0.161

0.348

0.341

0.195

0.194

0.465

0.464

0.465

0.464

0.464

0.464

0.464

0.464

347 235 245 225 663 651 215 216

10,386 10,511 10,348 10,510 9,899 9,923 9,968 9,988

8,945 9,135 7,905 9,033 7,839 7,906 6,320 6,400

1,243 1,376 1,701 1,437 2,038 2,017 2,804 2,849

198 0 379 0 22 0 84 0

Comparison of Equilibrium Outputs between Transmission-

Constrained and Unconstrained Electricity Markets

T

NT

T

NT

T

NT

T

NT

0

5 000 10 000 15 000

MW Outputs

20 000 25 000 30 000 geothermal renewable wind hydro nuclear biomass gas import

21

Implications of Simulation Studies

• The interaction of congestion and ownership structure (market power)

• Complex interaction may lead to unintended

consequences that would not be revealed by simplified models.

– A tight emission cap and ownership concentration of clean resources amplify market power effects.

– In a transmission-constrained market, geographical concentration of clean resources can indirectly amplify market power via the permit market.

Tanachai Limpaitoon, Yishu Chen and Shmuel Oren,” The Impact of Carbon

Cap and Trade Regulation on Congested Electricity Market Equilibrium ”,

Journal of Regulatory Economics, Vol 40, No. 3, (2011), pp.237-260.

22

Modeling market power in the permit market

• Our approach follows the notion of conjectural variations where each strategic firm g conjectures aggregate permits demanded by other firms and other economy sectors as function of permit price.

• The approach is needed because the aggregate permit quantity M is fixed (i.e., inelastic) and the supply elasticity for permits faced by firm g is endogenously determined by the price response of other firms participating in the permit market.

𝜇

All other firms and other sectors Residual

• 𝑥 𝑔

= # of permits demanded by strategic firm g

• 𝑥

−𝑔

= # of permits demanded by all firms other than firm g

• 𝑦 = # of permits demanded by other economy sectors 𝑥

−𝑔

+ 𝑦 𝑥 𝑔

𝑀 𝑥

PC-MP

ISO solves (redispatch problem) 𝑟 max 𝑖

:𝑖∈𝑁 s. t.

−𝐾 𝑙 𝑖∈𝑁

0 𝑟 𝑖

+𝑞 𝑖 𝑃 𝑖 𝑞 𝑑𝑞 − 𝐶 𝑖

(𝑞 𝑖

) 𝑖∈𝑁 𝑟 𝑖

= 0 𝑝

≤ 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖

≤ 𝐾

− 𝑙∈𝐿 ℎ 𝑠,𝑙 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖 𝑟 𝑖

+ 𝑞 𝑖

≥ 0 𝑙

≤ 𝑇 𝑠 𝜅 𝑙

−

, 𝜅 𝑙

+ 𝜏 𝑖 𝜉 𝑖

∀𝑙 ∈ 𝐿

∀𝑠 ∈ 𝑆

∀𝑖 ∈ 𝑁

Permit Market Equilibrium

𝑀 − 𝑔∈𝐺 𝑥 𝑔

− 𝑦 = 0

KKT of ISO (Only FOCs are shown here.) 𝜑 𝑖

= 𝑙∈𝐿 𝜅

+

− 𝜅

−

𝐷 𝑙,𝑖

∀𝑖 ∈ 𝑁

− 𝜏 𝑠 ℎ 𝑠,𝑙

𝐷

,𝑙,𝑖

− 𝜉 𝑖 𝑠∈𝑆 𝑙∈𝐿

𝑃 𝑖 𝑟 𝑖

+ 𝑞 𝑖

− 𝑝 − 𝜑 𝑖

= 0 ∀𝑖 ∈ 𝑁

Each firm g solves (profit maximization) 𝑞 𝑖 max

:𝑖∈𝑁 𝑔

,𝑝 𝑥 𝑔

,𝜇 𝑖∈𝑁 𝑔 𝑝 + 𝜑 𝑖 𝑞 𝑖

− 𝐶 𝑖 𝑞 𝑖

− 𝜇 𝑥 𝑔

− 𝑥 0 𝑔 𝑖∈𝑁 𝑔 𝑞 𝑖 𝑞 𝑖

≤ 𝑞 𝑖

= 𝑖∈𝑁

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

− 𝑖∈𝑁\𝑁 𝑔 𝑞 𝑖

, 𝜌 𝑙

−

, 𝜌 𝑙

+ 𝑞 𝑖

, 𝛽

∀𝑖 ∈ 𝑁 𝑔 𝑔 𝑥 𝑔

− 𝑖∈𝑁 𝑔

𝐹 𝑖 𝑥 𝑔

= 𝑀 − 𝑥

−𝑔 𝑞 𝑖

≥ 0 , 𝜇 − y(𝜇) , 𝜂 𝛼 𝑔 𝑔

KKT of Firm g (Only FOCs are shown here) 𝑝 + 𝜑 𝑖

= 𝛽 𝑔

− 𝜌 𝑖

−

+ 𝜌 𝑖

+

+ 𝑑𝐶 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

+ 𝜂 𝑔 𝑑𝐹 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

∀𝑖 ∈ 𝑁 𝑔

, 𝛽 𝑔 𝑖∈𝑁 𝑑 𝑑𝑝

−𝛼 𝑔

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

+ 𝑖∈𝑁 𝑔

−𝛼 𝑔

− 𝜇 + 𝜂 𝑔

= 0 𝑑𝑥

−𝑔 𝑑𝜇 𝑑y

+ 𝑑𝜇

− 𝑥 𝑔

− 𝑥 0 𝑔 𝑞 𝑖

= 0

= 0

OG-MP

ISO solves (redispatch problem) 𝑟 max 𝑖

:𝑖∈𝑁 s. t.

−𝐾 𝑙 𝑖∈𝑁

0 𝑟 𝑖

+𝑞 𝑖 𝑃 𝑖 𝑞 𝑑𝑞 − 𝐶 𝑖

(𝑞 𝑖

) 𝑖∈𝑁 𝑟 𝑖

= 0 𝑝

≤ 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖

≤ 𝐾

− 𝑙∈𝐿 ℎ 𝑠,𝑙 𝑖∈𝑁

𝐷 𝑙,𝑖 𝑟 𝑖 𝑟 𝑖

+ 𝑞 𝑖

≥ 0 𝑙

≤ 𝑇 𝑠 𝜅 𝑙

−

, 𝜅 𝑙

+ 𝜏 𝑖 𝜉 𝑖

∀𝑙 ∈ 𝐿

∀𝑠 ∈ 𝑆

∀𝑖 ∈ 𝑁

Permit Market Equilibrium

𝑀 − 𝑔∈𝐺 𝑥 𝑔

− 𝑦 = 0

KKT of ISO (Only FOCs are shown here.) 𝜑 𝑖

= 𝑙∈𝐿 𝜅

+

− 𝜅

−

𝐷 𝑙,𝑖

∀𝑖 ∈ 𝑁

− 𝜏 𝑠 ℎ 𝑠,𝑙

𝐷

,𝑙,𝑖

− 𝜉 𝑖 𝑠∈𝑆 𝑙∈𝐿

𝑃 𝑖 𝑟 𝑖

+ 𝑞 𝑖

− 𝑝 − 𝜑 𝑖

= 0 ∀𝑖 ∈ 𝑁

Each firm g solves (profit maximization) 𝑞 𝑖 max

:𝑖∈𝑁 𝑔

,𝑝 𝑥 𝑔

,𝜇 𝑖∈𝑁 𝑔 𝑝 + 𝜑 𝑖 𝑞 𝑖

− 𝐶 𝑖 𝑞 𝑖

− 𝜇 𝑥 𝑔

− 𝑥 0 𝑔 𝑖∈𝑁 𝑔 𝑞 𝑖 𝑞 𝑖

≤ 𝑞 𝑖

= 𝑖∈𝑁

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

− 𝑖∈𝑁\𝑁 𝑔 𝑞 𝑖

, 𝜌 𝑙

−

, 𝜌 𝑙

+ 𝑞 𝑖

, 𝛽

∀𝑖 ∈ 𝑁 𝑔 𝑔 𝑥 𝑔

− 𝑖∈𝑁 𝑔

𝐹 𝑖 𝑥 𝑔

= 𝑀 − 𝑥

−𝑔 𝑞 𝑖

≥ 0 , 𝜇 − y(𝜇) , 𝜂 𝛼 𝑔 𝑔

KKT of Firm g (Only FOCs are shown here) 𝑝 + 𝜑 𝑖

= 𝛽 𝑔

− 𝜌 𝑖

−

+ 𝜌 𝑖

+

+ 𝑑𝐶 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

+ 𝜂 𝑔 𝑑𝐹 𝑖 𝑞 𝑖 𝑑𝑞 𝑖

∀𝑖 ∈ 𝑁 𝑔

, 𝛽 𝑔 𝑖∈𝑁 𝑑 𝑑𝑝

−𝛼 𝑔

𝑃 𝑖

−1 𝑝 + 𝜑 𝑖

+ 𝑖∈𝑁 𝑔

−𝛼 𝑔

− 𝜇 + 𝜂 𝑔

= 0 𝑑𝑥

−𝑔 𝑑𝜇 𝑑y

+ 𝑑𝜇

− 𝑥 𝑔

− 𝑥 0 𝑔 𝑞 𝑖

= 0

= 0

Estimation procedure of

𝒅𝒙

−𝒈

conjectural variations

sa;l

Perry (1982) defined “a conjectural variation is consistent if it is equivalent to the optimal response of the other firms at equilibrium defined by that conjecture.”

1.

Initially, simulate the OG scenario cap M (linearized relationship)

2.

∆𝜇 estimate of 𝑑𝑥

−𝑔 𝑑𝜇

3.

∆𝜇 repeated simulations of the OG-

MP scenario at the cap M until it converges.

Perry (1982), “Oligopoly and consistent conjectural variations.” The Bell Journal of Economics

Convergence of CV parameter at tight cap (= 6,836 tons)

64

63

62

61

OGMP

-0.02431

60

59

58

57

56

55

OG

OGMP

-0.02410

Slope = -0.02142

54

53

5940 5960 5980 6000 6020 6040 6060 6080 6100

Number of permits held by all firms other than firm 3

3

2

1

8

5

4

Economic Analysis of WECC 225-Bus system

• Sensitivity analysis of permit endowments allows us to examine strategies in which firms of different technologies exercise market power

• Comparative analysis of market scenarios provides insights into the extent of market power as well as its impact on social welfare under different assumptions on market competition in the joint markets (PC, OG, OG-MP, PC-MP)

Scenario Assumptions

• Emission cap

– Loose cap is set at 15% below emission resulted from OG without C&T

– Tight cap is set at 30% below

• Simulated hour: the median load (Summer 2004)

• Baseline permit allocation scheme

– Permits are freely allocated to firms in proportion to their emissions resulted from scenario OG in the absence of C&T.

Firm 1 2 3 4 5 6 7 8 9 10 import fringe

Emission (tons) 874 951 1157

Percent share 9% 10% 12%

48

0%

995

10%

245

3%

862

9%

821

8%

0

0%

0

0%

3814

39%

Sensitivity Analysis Results: Loose cap

𝑷 𝝁 𝒙 𝒈 𝜼 𝒈

Firm 10 (Clean firm) 𝜽

𝟏𝟎

Firm 3 (Polluting firm) 𝜽

𝟑

Sensitivity Analysis Results: Tight cap

𝑷 𝝁 𝜼 𝒈 𝒙 𝒈

Firm 10 (Clean firm) 𝜽

𝟏𝟎

Firm 3 (Polluting firm) 𝜽

𝟑

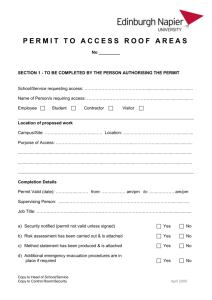

Impact on network congestion

Congestion on import corridors

The Miguel transmission corridor connecting Miguel, which is located in the

San Diego area, to Imperial Valley experiences higher level of congestion because gas-fired generation units in San Diego area, owned by firms 5 and

7, become less competitive and lower their outputs when permit price rises.

This situation increases energy imports from Imperial Valley which further draws more energy imports from Palo Verde, causing congestion on the

Arizona-to-Imperial Valley corridor. As a result, the zonal LMP of the San

Diego area rises in both cases, but higher in the case of firm 3.

Miguel Corridor 1100

IMPRLVLY 230 ~

MEXICO 230 # 1

IMPRLVLY 500 ~

MIGUEL 500 # 1

IMPRLVLY

230 {182}

IMPRLVLY

500 {181}

MEXICO

230 {188}

MIGUEL

500 {183}

Arizona to

Imperial Valley

Corridor

1100 PALOVRDE 500 ~

IMPRLVLY 500 # 1

PALOVRDE IMPRLVLY

500 { 16} 500 {181}

Comparative Analysis Results (Loose cap)

OG OG-MP

Baseline θ

10

=40% θ

3

=40%

PC-MP

Total CO2 emission [tons]

8301 8301 7293 8155 6075

Energy consumption [MWh]

Avg. LMP [$/MWh]

27343 27324 26819 27292 30275

111 111 120 112 61

Permit price [$/ton]

29 31 46 35 3

Emission rate [ton/MWh]

0.304

0.304

0.272

0.299

0.201

Social surplus [K$]

9957 9957 9985 9963 10385

Consumer surplus [K$]

7467 7457 7201 7440 8896

Producer surplus [K$]

2462 2471 2745 2489 1274

Congestion revenues [K$]

28 28

Sartzetakis, E. S. (1997). “Raising rivals' costs strategies via emission permits markets.” Review of Industrial Organization

39 34 214

Conclusion

• We developed an oligopoly equilibrium model for simultaneous interactions between permit and electricity markets, using conjectural variations to model market power in the permit market

• A firm with more efficient technologies can employ strategic withholding of permits, which allows for its increase in output share in the electricity market at the expense of other less efficient firms.

• Strategic permit trading can influence patterns of transmission congestion leading to potential gaming opportunity and interactions with (FTR/CRR) market.

• Needed extension:

– Inter temporal effect

• Banking and borrowing

• Demand seasonality

– Multi sector permits

• Price elasticity for permits due to demand in other industrial (e.g. chemichal , cement) and transportation sectors