Investment Analysts Society Presentation

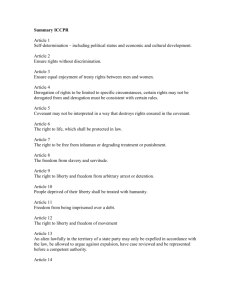

advertisement

Presentation to Investment Analysts Society of Southern Africa 6 March 2002 Roy Andersen Group Chief Executive Content Roy Andersen 2001 achievements The future STANLIB and bancassurance International operations Human capital Goals for 2002 Conclusion Mike Jackson Building value in Financial Services Operations Financial highlights 2001 Financial services environment in 2001 Good demand for Offshore products Guaranteed products Bancassurance products Volatile investment markets Implementation of policyholder protection rules Implementation of CGT Environment anticipated and addressed well by Liberty Highlights Embedded value per share + 23% Headline ROE continuing operations 25% Return on embedded value 26% Headline earnings per share – continuing operations + 14% Indexed new business premiums + 11% Recurring new business premiums + 17% Value of new business + 16% New business margin 18% Headline earnings on continuing operations 2001 Rm 2000 Rm % Change 1 320 1 153 14 Revenue earnings on shareholders’ funds 222 202 10 Preference dividend in subsidiary (43 ) (40) 7 Life fund operating surplus Headline earnings Headline earnings per share Headline ROE 1 499 1 315 14 551 485 14 25% 16% * * Total operations Investment return (Managed portfolio) Consistent first and second halves Return 30% 25,3% 25% 20% 14,4% 15% 10,6% 10% 7,2% 5% 0% First half Actuarial expectation Second half Actual Bonus stabilisation reserves boosted New business 2001 (excluding natural increases) Single premiums Corporate Benefits Individual business Recurring premiums Corporate Benefits Individual business Total on balance sheet New business index Value of new business 2001 Rm 2000 Rm % Change 1 225 6 415 2 167 5 589 (43 ) 15 225 1 475 9 340 2 465 455 190 1 251 9 197 2 217 391 18 18 2 11 16 Unit trust sales Rm 6000 +61% 5000 4000 +120% +91% 3000 2000 +142% +99% +25% 1000 0 1999 Money market 2000 Other 2001 Total Three Raging Bull awards Net insurance cash flow Rm 4000 3 378 3500 2 930 3000 2500 2000 1 622 1500 1000 500 102 0 -500 -633 -1000 1997 1998 1999 2000 Claims and benefits up 10% 2001 Embedded value 2001 Rm 2000 Rm % Change Shareholders’ funds 8 346 6 123 36 Net value of life business in force 5 112 4 822 6 Financial services subsidiaries fair value adjustment 1 310 996 32 Total embedded value 14 768 11 941 24 Embedded value per share R54,21 R43,95 23 Return on embedded value 26,4% 11,3% Capital adequacy cover 20 18,6 16 12,2 12 7,3 8 3,6 4 3,5 0 1997 1998 1999 2000 2001 Overweight deployment of capital in SAB significantly reduced Dividend Final Continuing operations In respect of capital reduction Interim 2001 cents per share 2000 cents per share 150 131 150 128 278 19 150 133 * 283 * Pre capital reduction Cover 2x earnings % Change + 15 Headline return on equity 30% 25% 25% 20% 16% 15% 13% 13% 1997 1998 11% 10% 5% 0% 1999 2000 2001 Scorecard Goals set for 2001 financial year 1. Redeploy shareholder investments into financial services 2. Individual business – leverage the strong position in the upper income market 3. Implement customer value management ½ Scorecard Goals set for 2001 financial year 4. Expand Liberty Corporate Benefits’ business 5. Drive continued growth in bancassurance 6. Provide private banking services to clients Scorecard Goals set for 2001 financial year 7. Achieve further synergies with Stanbic 8. Establish an empowerment partnership 9. Leverage Liberty Ermitage for international expansion The future a new Wealth Management Group and an enhanced Bancassurance Structure Standard Bank STANLIB Organisational structure Stanbic CEO-Jacko Maree 50% Liberty CEO - Roy Andersen 50% STANLIB Limited Executive Chairman Roy Andersen 100% 100% STANLIB Asset Management Alan Miller STANLIB Wealth Management John Liackman “The factory” “Product / marketing / distribution arm” Asset management components introduced STANLIB Asset Management Libam SCMBAM Best investment processes retained STANLIB wealth management components introduced STANLIB Wealth Management 100% 100% Unit Trusts Lisps Liberty Collective Investments Liberty Specialised Investments Standard Bank Unit Trusts Standard Bank Investment Services 100% Lodestone 52% Simeka Summary of the benefits Plays to each company’s undisputed strengths Powerful and far reaching distribution = client convenience Leverages the power of two blue chip brands Combines asset management, banking and actuarial skills for product development Pools and leverages intellectual capital Economies of scale achieved New Stanfin and bancassurance contract attractive Building value in Financial Services Operations Mike Jackson Executive Director: FSO Building distribution Intermediaries 1 935 2100 1 663 1800 1500 1200 900 1 135 1 310 994 1 197 970 187 420 668 783 715 642 669 738 1997 1998 1999 2000 End Feb 2002 600 300 0 Agency Franchise Consultancy new business up 18% Growing bancassurance production Rm 1800 1 556 1600 1 661 1400 1 155 1200 1000 800 600 680 757 400 200 0 1997 1998 Complex 1999 Simple 2000 2001 Liberty Healthcare Approaching critical mass Principal members Total lives February December 2002 2000 36 343 86 500 18 870 45 161 • R12,7 million loss in 2001 Focusing on quality growth and profitability Liberty Corporate Benefits Enhancing new business profitability 2001 Rm 2000 Rm % Change Single premiums 26 38 (32) Recurring premiums 21 4 425 Total 47 42 12 674 588 15 Embedded value of in-force Focusing on expense control and margins Liberty Personal Benefits New business – average policy size Recurring premiums RAs Risk and investment Single premiums Liberty Full year 2001 Industry (Values for first half 2001) R R 5 650 6 179 4 043 2 429 40 154 136 104 56 699 140 Focused on the profitable segment % Difference Liberty Personal Benefits Building market share – New recurring individual 20% 17,7% 16% 16,2% 15,5% 14,9% 18,2% 17,2% 15,7% 16,4% 14,1% 12% 8% June 2000 December 2000 All offices Brokers June 2001 Agents Liberty Personal Benefits Building market share – New single individual 20% 17,0% 16% 16,7% 14,8% 13,4% 12% 13,3% 11,5% 10,7% 9,1% 9,5% June 2000 December 2000 8% All offices Brokers June 2001 Agents Liberty Personal Benefits Policyholder returns Portfolio Fund returns (after tax) % Liberty Managed Variable 20,0 20,2 Equity Performance Global Managed 21,0 35,8 Liberty Personal Benefits Liberty Ermitage returns in Rand Dollar Money Alpha Class Asset Selection Global Equity North American Equity Pan European Equity Asia Pacific Equity Fund returns (after tax) % 51,5 50,8 53,0 47,4 52,2 46,4 31,7 Runner-up to Goldman Sachs – Global Investor Award for Excellence 2001 Liberty Personal Benefits Leveraging existing clients Cross-selling and retention are key objectives Intermediary productivity tools implemented successfully Client data mart, data analysis tools and campaign management capabilities established Enterprise data warehouse infrastructure implementation due April 2002 Liberty Personal Benefits Individual surrenders and maturities Rm 1800 16% 1600 15% 1400 14% 1200 1000 13% 800 600 12% 400 200 0 11% % of in-force book 1997 1998 1999 2000 2001 Higher retention of in-force book 10% Product innovation Investment products launched 2001 Global bond – UK Properties Guaranteed Hedge Fund 100 Liberty CPI Plus Investment Liberty Secured RA Guaranteed Global Equity Index Sandton Properties Liberty Ermitage portfolio range LSI Symphony wrap funds Product development Risk products launched 2001 Optimum/Optimum Plus LivAbility, FemAbility, CareAbility,EnAbility Procure An exciting future Reaping benefits of an expanding distribution force Bancassurance – growing SBFC (Stanfin) sales Ongoing market share growth Full pipeline of products for 2002 Managing and leveraging in-force business Goals for 2002 Roy Andersen Group Chief Executive Liberty Properties Developing value through property Portfolio continually upgraded Disciplined programme of improvements Revaluations Continued conservatism 5,3% uplift of R466 million to R9,2 billion Disposals of R141 million confirmed valuations The Earth Summit will boost Sandton International growth Liberty Ermitage AUM up 69% in Rands Hedge funds doubled – sales force doubled Capital uplift in 2001 + R146 million Effect on earnings of depreciated Rand to be felt in 2002 Offshore acquisition Discerning approach Human capital Creating value through people B3 Vision “The best people, doing the best things, best!” Human capital Creating value through people The best people Attitude towards the client – key Energy and enthusiasm – a requirement Correct cultural diversity – on track Measure progress through growth in Human Capital Index Liberty a top ten employer for the second year Human capital Creating value through people The best things Clear and open strategies A wide understanding of what drives value Incentivisation aligned with value creation Top 200 people on incentive scheme linked to growth in appraisal value Human capital Creating value through people Best Use of international benchmarks Integrity, trust and honesty core values Goals for 2002 1. Launch and grow STANLIB Limited 2. Develop SBFC (Stanfin) and increase bancassurance sales 3. Reposition Charter in mass and niche markets 4. Focus on profitability in Employee Benefits Goals for 2002 5. Leverage CVM initiative for new business and retention 6. Grow Liberty Ermitage sales 7. Focus on productivity of Agency and Franchise Conclusion