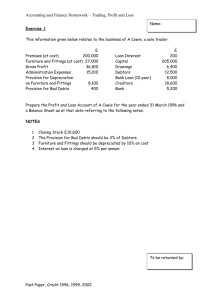

final a/cs practice questions

DESPO PAPAETI-GEORGIOU

1 | P a g e

DESPO PAPAETI-GEORGIOU

PRACTICE QUESTIONS- PARNERSHIPS

–

FINAL AC/S

UESTION 1

M To and D Wong are in partnership sharing profits and losses in the ratio 3:1 respectively. The following incomplete list of balances was extracted from the books on 30 September 2015 after preparing the Trading Account:

€

129,927 Gross Profit

Capital Accounts:

M To

D Wong

Current Accounts:

60,000

20,000

M To

D Wong

Drawings Accounts:

M To

D Wong

Trade debtors

4,500 Dr

1,500 Cr

15,000

7,500

14,800

Rent

Insurance

Lighting & heating

Vehicle running expenses

Depreciation

General expenses

Wages and salaries

The partnership agreement states that:

10,700

4,600

7,300

9,300

12,000

2,600

52,500

(1) D Wong is to receive an annual salary of e20,000

(2) The partners are entitled to interest on their fixed capitals at 6% per annum

(3) Interest is to be charged at 5% of the balance on each partne r’s drawings account at the financial year-end

The following information is also available relating to the year ended 30 September 2005:

(4) The partners decided to create a provision for doubtful debts of 2% of trade debtors

(5) Vehicle running expenses include

€1,800 to be shared equally between the partners for private use of the business vehicles

(6) Prepaid insurance amounted to

€800

(7) Accrued lighting and heating expenses amounted to €350

REQUIRED

(a) Prepare for the year ended 30 September 2015 the:

(i) Profit & Loss and Appropriation Account (12 marks)

(ii) Pa rtners’ current accounts in columnar form

(11 marks)

(b) State 2 other items a partnership agreement might cover, apart from the ones given in (1), (2) and (3) above.

(2 marks)

(Total 25 marks)

2 | P a g e

DESPO PAPAETI-GEORGIOU

QUESTION 2

An, Shan and Zi are in partnership sharing profits in the ratio 2:1:1.

They have fixed capitals of £120,000; £60,000 and £50,000 respectively and interest on capital is allowed at the rate of 10% per annum.

During the year to 31 December 2008, the three partners took drawings of £76,000; £22,400 and

£24,000 respectively.

On 1 January 2008 all three partners had credit balances on their current accounts of £800; £640 and

£1,260 respectively.

In addition, An is paid a salary of £34,000 per annum.

The following information is also available relating to the year ended 31 December 2008:

Purchases

Sales

Stock at 1 January 2008

Stock at 31 December 2008

Depreciation

Discount received

Discount allowed

Rent payable

Light and heat

Wages

Repairs to equipment

£

402,300

645,320

23,360

25,020

17,820

2,260

1,640

24,000

28,880

45,980

7,620

REQUIRED

(a) Prepare for the year ended 31 December 2008:

(i) the Trading and Profit & Loss and Appropriation Account

(ii) the Current Accounts for the three partners in columnar format.

DESPO PAPAETI-GEORGIOU

QUESTION 3

Adder and Viper are in partnership sharing profits and losses in the ratio 3:2. The partnership agreement further states that:

(1) Viper will be credited with an annual salary of £10,000.

(2) Each partner is to be charged interest at 5% per annum on the total amount of his drawings in any year.

(3) Each partner is to be allowed interest of 4% per annum on the opening balance of his capital account in any year.

Additional information:

(1) The net profit for the year ended 31 December 2002 was £37,900.

(2) The following credit balances applied at 1 January 2002:

Capital account

Current account

Adder

£

20,000

1,800

Viper

£

15,000

4,500

(3) Drawings during the year ended 31 December 2002 amounted to:

Adder

£

16,000

Viper

£

9,500

(4) On 31 December 2002, the following transfers were made from the partners ’ current accounts to their respective capital accounts:

Adder

£

1,100

Viper

£

13,000

REQUIRED

(a) Prepare for Adder and Viper, in respect of the year ended 31 December 2002:

(i) The Profit & Loss Appropriation Account.

(8 marks)

(ii) The partners ’ Capital Accounts, in columnar format. Dates may be ignored.

(4 marks)

(iii) The partners ’ Current Accounts, in columnar format. Dates may be ignored.

(9 marks)

DESPO PAPAETI-GEORGIOU

(b) In the absence of a partnership agreement what, if anything, does the Partnership Act of

1890 specify in relation to:

(i) Interest on drawings

(ii) Interest on capital

(iii) Partners ’ salaries

(iv) Profit sharing ratio.

DESPO PAPAETI-GEORGIOU

QUESTION 4

Thames and Severn are in partnership sharing profits and losses in the ratio 2 : 3 respectively. The following Trial Balance was extracted from the partnership books at 31 December 2002:

Freehold premises

Motor vehicles, at cost

Fixtures and fittings, at cost

Plant and machinery, at cost

Capital – Thames

Capital – Severn

Drawings – Thames

Drawings – Severn

1 January 2002

1 January 2002

Rent

Salaries

Carriage In

Carriage Out

Returns In

Purchases

Sales

Insurance

Light and heat

Trade debtors

Trade creditors

General office expenses

Motor vehicle expenses

Bad debts

Provision for doubtful debts 1 January 2002

Discounts received

Discounts allowed

Interest on bank loan

Bank loan

Cash at bank

Telephone expenses

Stock 1 January 2002

Provision for Depreciation 1 January 2002

Motor vehicles

Plant and machinery

Fixtures and fittings

9,300

7,800

126,000

15,350

9,900

1,800

8,300

3,750

66,950

8,000

67,900

Dr

£

300,000

50,000

18,000

80,000

19,700

38,500

28,000

101,000

4,700

8,950

9,500

609,000

1,592,400

Cr

£

209,000

163,000

1,005,000

91,000

3,700

1,800

75,000

10,000

30,300

3,600

1,592,400

DESPO PAPAETI-GEORGIOU

QUESTION 4 CONTINUED

The following additional information has been made available in respect of the year ended

31 December 2002:

(1) Depreciation is to be provided at the following rates using the straight line method:

Fixtures and fittings

Plant and machinery

Motor vehicles

10% pa

15% pa

20% pa

(2) The Provision for Doubtful Debts is to be adjusted to 2% of debtors.

(3) Thames is to receive a salary of £25,000.

(4) The partners are to receive interest at the rate of 5% per annum based on the balance on their

Capital Accounts at 1 January 2002.

(5) Closing stock was valued at £58,900.

(6) There were no balances on the partners ’ current accounts at 1 January 2002.

(7) Accrued charges at 31 December 2002 were:

Salaries

Interest on loan

Motor vehicle expenses

Telephone

Light and heat

1,000

3,750

600

550

450

(8) The prepayments at 31 December 2002:

Rent

Insurance

4,000

50

REQUIRED

Prepare, in the books of the partnership:

(a) the Trading, Profit & Loss Account and Appropriation Account for the year ended 31 December

2002

(b) The partners' current accounts, in columnar format, in respect of the year ended 31

December 2002.

DESPO PAPAETI-GEORGIOU

QUESTION 5

Smith and Jones are partners with fixed capitals - Smith £20,000 and Jones £30,000.

The following information was extracted from the trial balance of Smith and Jones at 30 June 2014:

Freehold Land and Buildings

Motor Vehicles at cost 1 July 2013

Provision for Depreciation, Motor Vehicles 1 July 2013

Stocks 1 July 2013

Credit sales

Cash sales

Bank overdraft

Bank loan, repayable 30 June 2018

Trade creditors

Trade debtors

Provision for doubtful debts 1 July 2013

Purchases, net of drawings

Wages

Miscellaneous expenses

Loan from Jones, due 30 June 2016

Insurance

The following additional information is available:

£

30,000

72,000

14,400

42,000

181,000

67,000

19,500

30,000

38,000

27,000

627

121,000

38,000

8,500

10,000

1,000

Profits and losses are shared in the ratio of their fixed capitals

Jones receives a salary of £25,000 per annum

Smith receives 15% commission on all cash sales

Interest on partners' fixed capital is 5% per annum

Interest on partners' loan is 10% per annum

Interest on drawings is 6% per annum - on the total drawings in any year

•Motor vehicle depreciation is charged at 20% per annum on a straight-line basis

•Bad Debts of £500 should be written off in the year to 30 June 2014 and a provision for doubtful

debts is to be made of 3% of remaining debtors

•Interest accrued on bank loan at 30 June 2014 was £252

•Stocks at 30 June 2014 were £37,000

•Wages of £1,500 for month ending June 2014 was not paid until July 2014

•Insurance premiums of £400 were paid in advance

Drawings for the year to 30 June 2014 were:

Smith

Jones

Cash

£

6,000

2,500

Goods

£

1,000

5,000

REQUIRED

The Trading, Profit & Loss and Appropriation Account for the year ended 30 June 2014.

DESPO PAPAETI-GEORGIOU