Income from Debt Financed Property

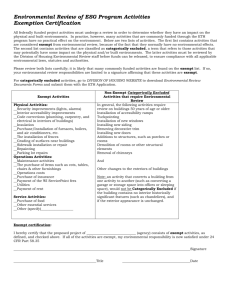

advertisement

Unrelated Business Income and Other Tax Issues Presented By: Xiaoyan Luo Learning Objectives At the end of this session, you will be able to: • Recognize unrelated business income • Understand the basic exclusions from unrelated business income • Understanding of worker classification • Understanding of tax laws regarding cell phone/auto reimbursement or allowances What is UBI? • UBI = Unrelated Business Income • Unrelated business taxable income = gross income derived by any organization from: – Unrelated – Trade or business – Regularly carried on by it (IRC § 512(a)(1)). Unrelated Business Income • What Sort of Activities Generate Unrelated Business Income? • Three Prong Test – Is the activity: ◊ A trade or business? ◊ Regularly carried on? ◊ Not substantially related? Test 1 - Trade or Business – Is the activity performed in a commercial manner similar to a trade or business (within meaning of §162)? ◊ Does it involve selling goods or performing services? ◊ Is it carried on for the production of income? ◊ Primary objective of UBI tax rules is to eliminate unfair competition by placing unrelated business activity on same basis with for profit counterparts. – If the organization is selling goods or services to generate income, even if it is conducting the activity within a larger group of activities related to its exempt purpose, the activity is a trade or business. Test 2 - Regularly Carried On • Frequency and continuity • Pursued in manner similar to commercial activity Examples: - Not regularly carried on – sandwich stand operated two weeks at the state fair – fundraising activity lasting a short period of time - Regularly carried on – commercial parking lot operation on Saturday all year Test 3 - Not Substantially Related – A business activity is not substantially related to an organization’s exempt purpose if it does not contribute importantly to accomplishing that purpose. ◊ Must be a causal relationship to achievement of exempt purpose, AND ◊ Relationship must be a substantial one ◊ Must “contribute importantly” to the accomplishment of the exempt purpose of the organization – Examples: ◊ Operation of sports and fitness center is substantially related to healthcare provider’s exempt purpose, but sales of items by its pro shop not used at fitness center are not. Unrelated Business Income • Exclusions: – Even where the activity is a regularly carried on trade or business and is not substantially related, it may be statutorily excluded. – Certain types of income are also statutorily excluded. Exclusions from UBI • What types of activities are excluded from UBI? • What types of income are excluded from UBI? What activities are excluded from UBI? Must have one of these characteristics: - Is not regularly carried on - Substantially all of the work is performed by volunteers or by the organization without compensation - The activity is carried on for the convenience of its members (for orgs described in 501(c)(3) or 511(a)(2)(B)) - Substantially all of the merchandise being sold was received as gifts or contributions What activities are excluded from UBI? Section 513(d) through 513(i) specifically excludes: - Trade Shows / Public Entertainment activities - Certain qualified sponsorship payments - Distributions of low-cost articles - Certain bingo games - Certain hospital services - Certain pole rentals What is Excluded from UBI? I.R.C. Section 512 specifically excludes: - Interest / dividends - Rental income - Mailing list rentals (between charitable orgs) - Royalties - Possibly other types of mailing list rentals - Gains and losses from asset dispositions - Research income Advertising Income The Sale of Advertising in an organization’s exempt periodical is a common form of UBI activity – – – – qualitative or comparative language price information or indication of savings or value endorsements inducements to buy Qualified Sponsorship Payment • Qualified Sponsorship Payment is not advertising and not subject to UBI tax • Payment by a business for which there is no arrangement or expectation that the business will receive any “substantial return benefit” Substantial Return Benefits Do Not Include • Recognizing sponsor by: – sponsor’s name/logo – slogans that are part of the sponsors identity or that do not contain qualitative or comparative descriptions – listing of sponsor’s locations, telephone #’s, or internet addresses – value-neutral descriptions – sponsor’s brand or trade names and product listings – Display or distribution of the sponsor’s product by the sponsor or exempt org. at the sponsored activity – Hyperlink on the exempt org. website to the sponsor’s site – cannot contain any endorsement or promotion Income from Debt Financed Property Another complex area – 5 full pages in Publication 598 Investment income generally excluded from UBTI must be included to the extent it is derived from debt-financed property. Income included is proportionate to the debt on the property. Income from Debt Financed Property In general, debt-financed property is property held to produce income (including gain from disposition) for which there is an acquisition indebtedness: o At any time during the tax year or o During the 12-month period before the date of the property’s disposal, if disposed of during the year. Includes real estate, tangible personal property, and corporate stock Income from Debt Financed Property Computation of Debt-Financed Income Complex – uses average acquisition indebtedness, average adjusted basis of property and gross income from debt financed property. Average acquisition indebtedness Average Adjusted Basis X Gross income from debt-financed property Income from Debt Financed Property Example: ABC Inc, an exempt organization, owns an office building which is debt-financed property. The building produces $40,000 of gross rental income. The average adjusted basis of the building is $200,000, and the average acquisition indebtedness with respect to the building is $60,000. Accordingly, the debt/basis percentage is 30% (the ratio of $60,000 to $200,000). Therefore, the unrelated debtfinanced income with respect to the building is $12,000 (30% of $40,000). Exceptions to Debt-Financed Property Property related to exempt purposes- If substantially all (85% or more) of the use of any property is substantially related to an organization’s exempt purposes, the property is not treated as debt-financed property. Property used in an unrelated trade or business Property used in research and certain excluded activities Related Exempt uses Medical clinics Neighborhood land rule If an organization acquires real property with the intention of using the land for exempt purposes within 10 years, it will not be treated as debtfinanced property if it is in the neighborhood of other property that the organization uses for exempt purposes. This rule applies only if the intent to demolish any existing structures and use the land for exempt purposes within 10 years is not abandoned. Deductions for Debt-financed property 1. 2. The allowable deductions are those directly connected with the debt-financed property or with the income from it (including the dividends received deduction), except that: The allowable deductions are subject to the modifications for computation of the unrelated business taxable income, and The depreciation deduction, if allowable, is computed only by use of the straight-line method. The deductions allowed for each debt-financed property are determined by applying the debt/ basis percentage to the sum of allowable deductions. Capital Loss / Net Operating Loss Any capital loss on the sale or exchange of debt financed property can be carried back or carried forward to another tax year Any NOL (where deductions exceed the income related to the debt financed property) can also be carried back or carried forward to another tax year. Unrelated Business Income Tax • Filing Info – Organizations that have total gross income from a regularly carried-on unrelated trade or business of at least $1,000 are required to file Form 990-T and pay income tax on the net unrelated business income. ◊ Tax is computed using corporate tax rates. ◊ Estimated quarterly tax payments may be required. ◊ Organization may be subject to alternative minimum tax. – Form 990T of any other exempt organization must be filed by the 15th day of the 5th month after the end of its tax year. – Filer may request an automatic 6-month extension of time to file a return by submitting Form 8868. Worker Classification – Federal government estimates that up to 30% of companies misclassify workers, and approximately 3.4 M employees are improperly excluded from payrolls. www.accountingweb.com) ( – Both states and the federal government have announced increased enforcement efforts for 2010. This is a revenue source for them in a down economy. – Potentially misclassified workers are a financial liability for employers. Employee vs. Independent Contractor • Courts have identified three categories of facts when determining worker classification: – Behavioral Control – Financial Control – Relationship of the Parties • IRS Publication 1779 (Updated 8/2008) Behavioral Control • Facts that show whether there is a right to direct or control how the worker does the work • Does not matter if the business actually controls the way the work is done, as long as they have the right to do so • Behavioral control factors include type of instructions given, degree of instruction, evaluation systems, & training Financial Control • Financial control refers to facts that show whether or not the business has the right to control the economic aspects of the worker’s job • Factors to evaluate include: • Significant investment • Unreimbursed expenses • Opportunity for profit & loss • Services available to the market • Method of payment Type of Relationship • How do the worker and business perceive their relationship to each other? • Facts include • • • • Written contracts Employee benefits Permanency of relationship Services provided as key activity of the business Expense Reimbursements – An advance, reimbursement or other expense allowance received under an “accountable plan” – not taxable – Accountable plan defined: • Business Connection • Substantiation • Returning amounts in excess of expenses Listed property • Section 274(d)(4) of the Code provides that no deduction shall be allowed with respect to any listed property (as defined in § 280F(d)(4)), unless the taxpayer substantiates by adequate records or by sufficient evidence corroborating the taxpayer’s own statement: (A) the amount of such expense or other item, (B) the use of the property, (C) the business purpose of the expense or other item, and (D) the business relationship to the taxpayer of persons using the property. Cell Phones – Small Business Jobs Act of 2010 signed into law on Sept. 27th includes a provision that removes cell phones and similar telecommunications equipment (Blackberry, but not computers) from the definition of “listed” property for taxable years beginning after December 31, 2009. – Notice 2011-72 – Tax treatment of employerprovided cell phones - issued on September 14, 2011 – The notice addresses the treatment of employerprovided cell phones primarily for noncompensatory business reasons Cell Phones – Excludable from an employee’s income as a working condition fringe benefit – If paid by employees, such payment would be allowable as a deduction under Section 162 for the employee – Personal use of an employer-provided cell phone primarily for noncompensatory business purposes as excludable from the employee’s income as a de minimis fringe benefit Cell Phones – Interim guidance on reimbursement of employee personal cell phone usage – reimbursements for work-related use of personallyowned cell phones are not taxable for substantial noncompensatory business reasons – the employee must maintain the type of cell phone coverage that is reasonably related to the needs of the employer’s business, and the reimbursement must be reasonably calculated so as not to exceed expenses the employee actually incurred in maintaining the cell phone Questions? Xiaoyan Luo, CPA LarsonAllen LLP (612)376-4810 xluo@larsonallen.com