Mature Clusters - University of Toronto

advertisement

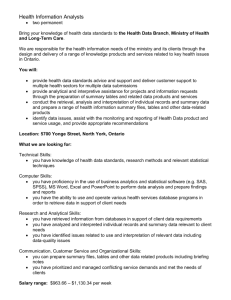

Mature Cluster: Industry & Supply Chain Dynamics ONRIS Seminar Nov 4, 2005 Peter Warrian University of Toronto ONRIS: Mature Clusters • Role of Lead/Anchor Firm • Shift from Analytic to Synthetic Knowledge • Supply Chain Dynamics • External Linkages and Internal Dynamics of Clusters • Conclusions Cluster Typology: Mature Industries Knowledge Dimensions Industrial Structure and Cluster Linkages Lead/Anchor Firm Global Supply Chain Local Value Chain Synthetic Ontario Steel Montreal Aerospace Southern Ontario Autoparts Sudbury Mining S&S Windsor Automotive TDM Toronto Multimedia Analytic New Brunswick IT Ottawa Photonics and Telecom Waterloo ICT Mtl, Tor, Van, Hal Biotech Cape Breton IT Vancouver New Media Montreal New Media Quebec Photonics Ottawa Biotech Saskatoon Biotech Ontario/BC Wine BC Wood Ontario Food Hybrid Cluster Typology: Mature Industries Knowledge Dimensions Industrial Structure and Cluster Linkages Lead/Anchor Firm Global Supply Chain Local Value Chain Synthetic Ontario Steel Montreal Aerospace Southern Ontario Autoparts Sudbury Mining S&S Windsor Automotive TDM Toronto Multimedia Analytic New Brunswick IT Ottawa Photonics and Telecom Waterloo ICT Mtl, Tor, Van, Hal Biotech Cape Breton IT Vancouver New Media Montreal New Media Quebec Photonics Ottawa Biotech Saskatoon Biotech Ontario/BC Wine BC Wood Ontario Food Hybrid Cluster Typology: Mature Industries ON Steel Knowledge Dimensions Industrial Structure and Cluster Linkages Lead/Anchor Firm Global Supply Chain Local Value Chain Synthetic Ontario Steel Montreal Aerospace Southern Ontario Autoparts Sudbury Mining S&S Windsor Automotive TDM Toronto Multimedia Analytic New Brunswick IT Ottawa Photonics and Telecom Waterloo ICT Mtl, Tor, Van, Hal Biotech Cape Breton IT Vancouver New Media Montreal New Media Quebec Photonics Ottawa Biotech Saskatoon Biotech Ontario/BC Wine BC Wood Ontario Food Hybrid Role of Lead Firm • Exit: Windsor TDM (International Tool) • Labour Shedding: Mining (Inco) • Implosion: Steel (Stelco) International Tool: Exit of Leader Inco/Falconbridge: Shedding Labour Stelco: Implosion of a Leader • Withdrawal from Analytic Knowledge – Decline and elimination of Stelco Engineering • Applied Product Development – Dofasco as franchiser/value added reseller of Arcelor & NKK technology – Solutions in Steel: Application Development Know How Shift from Analytic to Synthetic Knowledge • Patent Data – Dates of Application – Dates of Publication • Steel Industry Patents 1970-2005 – Decline of Stelco Engineering/Steltech 90s Steel Patent Data by Application Date 60 8 7 50 6 40 5 30 4 3 20 2 10 1 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 0 2010 USA Canada ON Steel Knowledge Networks • Withdrawal from Analytic Knowledge – Decline and elimination of Stelco Engineering • Applied Product Development – Dofasco as franchiser/value added reseller of Arcelor & NKK technology – Solutions in Steel: Application Development Know How Supply Chains • Asymmetric Knowledge Flows in Supply Chains: Aerospace • Dynamics and Dysfunction in Auto-Steel Supply Chain Advanced Technology Cluster: Aerospace • Niosi: Dynamics within Supply Chain – OEM aerospace assemblers – Tier 1 & Tier 2 suppliers • Knowledge flows: International circuits of design, procurement • Asymmetry between knowledge flows between firms and local labour pool Aerospace: Asymmetry of Knowledge Flows Changing Supply Chain Models Drive Innovation • Toyota Model – Lean Production & JIT – Reduced inventory, cycle times, SPC • Dell Model – Mass Customization – Build-to-Order Typical Order-to-Delivery Process Purchasing Plan Programming Marketing National Sales Co. Order Bank Plan Scheduling Schedule Schedule Sequencing Tier 2 Supplier Tier 1 Supplier Inbound Logistics Body, paint, assemble Outbound Logistics Dealer Inv. Customer Auto Industry Build to Order • On average, it takes 40 days to get a car • 30 days for an customer order to actually be inserted in the assembly plant schedule. • 60 days total inventory in the supply chain • Same number as Henry Ford in 1926. • Closer integration of supply chain has increase volatility Auto Supply Chain Volatility 2500 2000 OEM Assembly 1500 Supplier Assemby 1000 500 0 Component (internal) Component (external) Dofasco • Benchmarking against Dell: Vanilla Boxes • Mass customization strategy: Platforms – Information content of the steel • Diversity creates key bottleneck in Mills: Slab Specifications & Production – Slabs ‘Designs’: Dimensionality, Physical & Chemical Properties – From 10,000 Designs -> 300 Vanilla Boxes External Linkages and Internal Dynamics of Clusters • Dynamics of Disaggregation in Cluster – Mining Services – ON Steel Disaggregation in Mining Services Algoma • OEM, Tier 1and • • Specialized Tier 2 Suppliers Interface with Design Capacities: Safety Metallurgy: AHSS microstructures Disaggregation of Auto Steel Cluster • Circuit 1: Global Supply Chain – Auto OEM, Tiers 0.5-1.0, highly specialized Tier 2 firms – Integrated Mill Metallurgy: DFS, STE, AGA • Circuit 2: Local Value Chain – Generalized Tier 2, Tier 3, Stampers – Processing Technology: Service Centres, Processors, Minimills Conclusions • Cluster Life Cycles • Multiple Policy Objects – Disaggregation • Policy targets are moving and changing Knowledge Dimensions and Flows in Mature Clusters • Synthetic Knowledge & Innovation – Application of existing sources & combination of knowledge – Interaction between clients & suppliers – Reliance on applied product development • Infrastructure – Problem solving – Sources of talent & recruitment