Penny Cagan - Where Do We Go From Here?

Where Do We Go From Here?

Penny Cagan

Managing Director

Where We Have Come From

© 2008 Algorithmics Incorporated. All rights reserved.

2008: A year of great volatility

Pieter Bruegel the Elder, The Fall of the Rebel Angels

March 2008: Bear Stearns is acquired by JP

Morgan in a transaction orchestrated by the

US government

July 2008: US Federal government seizes

IndyMac (largest thrift to fail in US history)

Sept. 7, 2008: US government takes over

Freddie Mac and Fannie Mae

Sept. 14, 2008: Bank of America announces it will acquire Merrill Lynch

Sept 15, 2008: Lehman Brothers files for bankruptcy

© 2008 Algorithmics Incorporated. All rights reserved.

2008: A Year of Great Volatility

Sept. 16, 2008: US government announces $85 billion emergency aid package for AIG

Sept. 18, 2008: Federal Reserve and central banks in

Asia and Europe pump up to $180 billion into money markets. US Congress considers $700 billion facility to buy bad debt from banks.

Sept. 19, 2008: US government announces that it will insure all money market funds. The SEC bans short selling of shares in 799 financial stocks.

Pieter Bruegel the Elder, Landscape with the Fall of Icarus

© 2008 Algorithmics Incorporated. All rights reserved.

Sept. 22, 2008: Goldman Sachs and Morgan Stanley announce they have requested a change in their status to Bank Holding Companies, regulated by

Federal Reserve

Where Risk Lies

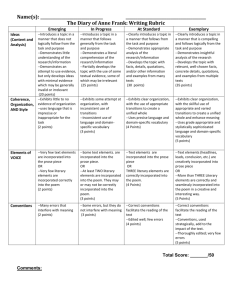

Underwriting of new loans: Credit Risk (loan quality) & OpRisk

(documentation, background check, integrity of loan process)

Securitization: Reputation & OpRisk (mis-selling, valuation, investor issues) & Liquidity Risk (cash shortages)

Investor: Credit, Market & OpRisk (mark-to-market issues, what are securitized loans worth when they are sold in volatile markets, will the investment pay off, what’s under the hood of structured products)

Market Reactions: Market Risk, OpRisk (increased volatility leads to behavior that can increase oprisk, such as unauthorized trades, questionable valuations, processing issues), Credit Risk (bankruptcies can occur if investors, issuers and packagers can not raise funds.)

© 2008 Algorithmics Incorporated. All rights reserved.

Events by Trigger

SubPrime Market Volatility - Event Trigger: Number of Events

RELATIONSHIP RISK CLASS

PROCESS RISK CLASS

PEOPLE RISK CLASS

EXTERNAL RISK CLASS

0 10 20 30 40 50 60 70 80 90 100

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

Events by Trigger

SubPrime Market Volatility - Event Trigger: Number of Events

BUSINESS & STRATEGIC RISK

SECURITIES LAW VIOLATIONS

SALES RELATED ISSUES

LEGAL LIABILITIES

DISCLOSURE RELATED ISSUES

LAW/REGULATION CHANGE

TRADING MISDEEDS

INTERNAL FRAUD

EMPLOYMENT, HEALTH & SAFETY

SPECIFIC LIABILITIES

ERRORS AND OMISSIONS

EXTERNAL FRAUD

NEGLIGENCE

TRANSACTIONAL AND BUSINESS PROCESS

RISK

0 10

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

20 30 40 50 60 70 80 90

The Bezzle

“At any given time there exists an inventory of undiscovered embezzlement in - or more precisely not in - the country's business and banks. This inventory - it should be called the bezzle.

It also varies in size with the business cycle." from “The Great Crash: 1929” by John Kenneth Galbraith.

© 2008 Algorithmics Incorporated. All rights reserved.

Procylicality of Fraud & Market Practice Issues

Supply of fraud is correlated with supply of credit

Access to credit allows for the continuance of both fraud and gray-matter market practice issues

Corporations push the boundaries when credit is available in terms of compensation, disclosure, client relationships, profit taking and financial reporting

Enron, Worldcom, and Madoff frauds initiated during bubble and uncovered during retraction

The absence of credit during a downturn results in uncovering of frauds

© 2008 Algorithmics Incorporated. All rights reserved.

CBOE Volatility Index,1990-2008, vs. events in the FIRST database

WGZ $230m UAT

Enron

$2.2 billion fraud

Codelco $170m UAT BankBoston

$73m fraud

Kidder Peabody/

J. Jett $350m UAT

Barings $1.3 billion

UAT

AIB Allfirst

$691m UAT

Hamilton Bank

$130m fraud

December 2008:

Bernard Madoff

$50 billion

Ponzi Scheme

SocGen $7.2b

UAT

Calyon $247m

UAT

Source: CBOE, Bloomberg and FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

A Gallery of Rogues: Bernard Madoff and Robert Stanford

Bernard Lawrence "Bernie" Madoff (born April 29, 1938 ) is an

American businessman and former chairman of the NASDAQ stock exchange. He founded the Wall Street firm Bernard L. Madoff

Investment Securities LLC in 1960 and was its chairman until

December 11, 2008, when he was charged with perpetrating what may be the largest investor fraud ever committed by a single person .

© 2008 Algorithmics Incorporated. All rights reserved.

• Robert Alan Stanford , charged with running $9.2 billion investment fraud

• Sold $8 billion of Certificates of Deposit through Stanford

International Bank, based in Antigua

• Promised double-digit returns over the past 15 years

• Bank claimed $51 billion in deposits and assets under management, with more than 70,000 clients in 140 countries

• Possible money laundering charges pending

Largest Losses from Credit Crisis

Organization Name

American International Group Inc.

Sum of Loss Amount

Citigroup Inc.

Bank of America Corporation

UBS AG

Wells Fargo & Co.

Morgan Stanley & Company

Goldman Sachs Group, Inc., The

JPMorgan Chase & Co

Top 8 Total

Others

Grand Total

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

96,278,000,000

63,400,000,000

55,038,000,000

48,400,000,000

8,617,925,000

3,700,000,000

3,060,000,000

1,600,000,000

280,093,925,000

65,634,029,280

345,727,954,280

Percentage

0.89%

0.46%

81.02%

18.98%

100.00%

27.85%

18.34%

15.92%

14.00%

2.49%

1.07%

Product Types Behind Subprime losses

SubPrime/Market Volatility - Products and Services

LENDING PRODUCTS & FINANCING SERVICES

INSURANCE PRODUCTS AND SERVICES

FINANCIAL PRODUCTS (UNSPECIFIED)

EQUITY PRODUCTS

DERIVATIVES, STRUCTURED PRODUCTS AND

COMMODITIES

DEBT PRODUCTS

CLEARING SERVICES

CASH MANAGEMENT SERVICES

ASSET MANAGEMENT PRODUCTS AND SERVICES

0 10 20 30

Number of Events

40 50

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

60

The Opportunity: OpRisk at the Core of the Solution

We will see a fundamental re-design of risk management:

Operational Risk provides the governing framework

IN: Integrated. Consistent. Actionable. Non-deterministic.

OUT: Silos, automatic models, compliance running on auto-pilot

Categorizations have become meaningless!

Operational risk is the driver for change

© 2008 Algorithmics Incorporated. All rights reserved.

Largest Bank Failures

Organization Name

Kaupthing hf

Glitnir Bank

Indymac Bancorp Inc

BankUnited FSB, Coral Gables, Florida

Wachovia

Guaranty Bank, Austin, TX

Colonial Bank, Montgomery, Alabama

Franklin Bank, S.S.B., Houston, Texas

Downey Financial Corp.

Top 10 Total

Others

Grand Total

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

Loss Amount

28,200,000,000

23,400,000,000

15,900,000,000

9,400,000,000

4,900,000,000

4,500,000,000

3,000,000,000

2,800,000,000

1,500,000,000

1,400,000,000

95,000,000,000

19,429,024,512

114,429,024,512

Percentage

2.45%

1.31%

1.22%

83.02%

16.98%

100.00%

24.64%

20.45%

13.90%

8.21%

4.28%

3.93%

2.62%

Control Failings Behind Bank Failures

Bank Failures - Contributory Factors

CORPORATE/MARKET CONDITIONS

LACK OF CONTROL

MANAGEMENT ACTION/INACTION

STRATEGY FLAW

CORPORATE GOVERNANCE

OMISSIONS

ORGANIZATIONAL STRUCTURE

EMPLOYEE ACTION/INACTION\EMPLOYEE

MISDEEDS

STAFF SELECTION/COMPENSATION

0 20 40 60 80

Incidence of Factors

(An event can have more the on contributory factor)

Source: Algo FIRST

© 2008 Algorithmics Incorporated. All rights reserved.

100 120

Product Types Behind Bank Failures

LENDING PRODUCTS & FINANCING

SERVICES

DERIVATIVES, STRUCTURED

PRODUCTS AND COMMODITIES

CLEARING SERVICES

CASH PRODUCTS

CASH MANAGEMENT

CARD PRODUCTS

0

Bank Failures - Products and Services

20 40 60

Number of Events

80 100

© 2008 Algorithmics Incorporated. All rights reserved.

120

Where We Came From: Five Deadly Sins

1.

Lack of care for stakeholders

2.

Automatic approach

3.

Unknowns ignored

4.

Silos accepted

5.

Risk and return managed separately

Domenico di Michelino, La commedia illumina Firenze

© 2008 Algorithmics Incorporated. All rights reserved.

1. Lack of Care for Stakeholders

Short-term earnings culture threatened shareholder value

Failure to put clients’ interests first

Fiduciary duties became secondary

Compensation

Community Role

Pieter Bruegel the Elder, The Fall of the Rebel Angels

© 2008 Algorithmics Incorporated. All rights reserved.

2. Automatic Approach

Perfecting standard models

Firms that experienced more significant problems tended to apply a mechanical risk management approach.

Senior Supervisors Group (2008)

The tendency to overly formalize arcane aspects of an analysis often detracts from the bigger picture.

Corrigan Report (2008)

© 2008 Algorithmics Incorporated. All rights reserved.

Pieter Bruegel the Elder, Parable of the Blind

3. Unknowns ignored

Methodology can convey a false sense of precision

All models use assumptions and assumptions can have a material impact on the model outcomes.

However, most models do not specifically acknowledge what assumptions they are making.

Federal Reserve Bank of New

York (2008)

Pieter Bruegel the Elder, The Adoration of Kings

© 2008 Algorithmics Incorporated. All rights reserved.

4. Silos Accepted

The existence of organizational silos appeared to be detrimental to performance during the turmoil.

Business areas [made] decisions in isolation and in ignorance of other area’s insights.

Senior Supervisors Group (2008)

Pieter Bruegel the Elder, The Tower of Babel

© 2008 Algorithmics Incorporated. All rights reserved.

5. Risk and Reward Separated

Pursuing returns without managing risk

Firms that recorded relatively larger unexpected losses tended to champion the expansion of risk without commensurate focus on controls .

Senior Supervisors Group (2008)

Pieter Bruegel the Elder, Gluttony

© 2008 Algorithmics Incorporated. All rights reserved.

Where We Can Go From Here: Five Virtues

1.

Focus on the Stakeholders

2.

Acknowledge uncertainty transparently

3.

Imagine and Challenge assumptions

4.

Manage risk at the enterprise level

5.

Manage risk and return proactively

Pieter Bruegel the Elder, Fortitude

© 2008 Algorithmics Incorporated. All rights reserved.

1. Focus on the Stakeholders

Develop a culture of risk governance

Risk management must rely heavily on judgment, communication and coordination . This culture of governance will help to break down the silo mentality.

It [requires] rigorous and continuous attention at the highest levels.

Pieter Bruegel the Elder, Justice

Corrigan Report (2008)

© 2008 Algorithmics Incorporated. All rights reserved.

2. Acknowledge Uncertainty

Risk is more than a single number

[We] must recognize the limitations of mathematical models.

Corrigan Report (2008)

Managers at better performing firms relied on a wide range of measures of risk.

Senior Supervisor Group (2008)

Pieter Bruegel the Elder, Prudence

© 2008 Algorithmics Incorporated. All rights reserved.

3. Imagine. Challenge Assumptions

Discover the Unknown, Don’t Perfect the Known

Firms [must] think creatively about how stress tests can be conducted.

Corrigan Report (2008)

Firms that tended to avoid significant challenges assessed risk positions drawing on different underlying assumptions .

Senior Supervisors Group (2008)

© 2008 Algorithmics Incorporated. All rights reserved.

4. Manage Risk at the Enterprise Level

Dismantle silos

Firms that understood quickly the risk they faced relied on information from many parts of their businesses.

Better performing firms were able to integrate their measures of market risk and counterparty risk across businesses.

Senior Supervisors Group (2008)

Institute of International Finance (2008)

Pieter Bruegel the Elder, The

Tower of Babel

© 2008 Algorithmics Incorporated. All rights reserved.

5. Manage Risk (and Return) Pro-actively

The need for speed

[Firms] must have the capacity to monitor risk concentrations as well as exposures to institutional counterparties in a matter of hours and provide effective and coherent reports to senior management.

Corrigan Report (2008)

© 2008 Algorithmics Incorporated. All rights reserved.

The Next Wave: A Prediction

Black Swans will happen

There will be more risk-related regulation:

Recent G20 and BIS actions are just a start

Comprehensive and active ERM is “back”

Assumptions, models and results will become context specific

Client-centric financial innovation is here to stay

Pieter Bruegel the Elder, The Battle about Money

© 2008 Algorithmics Incorporated. All rights reserved.

The Next Wave: A Hope

Think!

Imagine. Explore what you don’t know

Challenge your assumptions

Communicate, don’t “report”

Use sound judgment

Risk management =

Decision making under uncertainty Pieter Bruegel the Elder, Hope

© 2008 Algorithmics Incorporated. All rights reserved.

Where do we go from here

OpRisk Best Practices is part of the solution

Manage risk on a firm-wide basis and overcome silos

Integrate risk identification, risk and self assessments, monitoring and testing of controls within the enterprise-wide risk framework

Look at all material risks together, and not be limited to market, credit, liquidity and operational risk

Understand assumptions and what happens if assumptions fail

Integrate scenario approaches within overall framework

Lobby to change an organization’s culture

Supplement quantitative tools with qualitative judgment

© 2008 Algorithmics Incorporated. All rights reserved.

Thank you for your time

For further information contact:

Penny Cagan

Managing Director penny.cagan@algorithmics.com

212-612-7853

© 2008 Algorithmics Incorporated. All rights reserved.