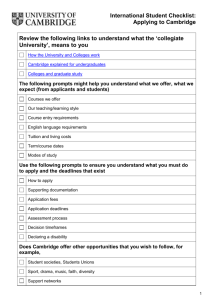

Description

advertisement

Global Consumer Credit Development Learnings Evangelos Stefatos Senior Director Business Line Development Payment Card 2007 Kiev, Ukraine 7th June 2007 Discussion Topics Global Consumer Lending Country Segmentation Learnings from Credit Leaders Product and Industry Developments Around the World Information Classification as Needed 2 Presentation Identifier.2 Global Consumer Lending Environment At the aggregate level, consumer lending and credit card industry expected to grow at similar rate as economic growth (personal disposable income). Key Observations 2006 Global Consumer Lending • Global consumer credit (including mortgage and nonmortgage credit) estimated at $22T, or around 90% of personal disposable income (PDI) and personal consumption expenditure (PCE) $24 T 2006 Figures (US $ in Trillion) $22 T • Non-mortgage credit estimated at $6T, around 25% of PDI / PCE $6 T $1.5 T PCE Consumer Non-Mortgage Credit Card Credit Consumer Credit Segmentation Sizing Estimate • Credit cards represent 25% of non-mortgage credit; the rest includes auto loans, retail financing, personal loans, etc. Source: Global Insight; Morgan Stanley Information Classification as Needed 3 Presentation Identifier.3 Regional Consumer Lending Environment At the regional level, opportunity for growth of non-mortgage lending varies according to level of country maturity. Key Observations 2006 Non-Mortgage Regional Sizing • In mature countries like US, Canada, and UK, mortgage lending taking share away from non-mortgage due to ease of home refinancing (some consumers view their home equity as “ATM machines”). % of Disposable Income 110% = Total Consumer Credit 95% 75% 40% 25% 25% = Non-Mortgage 20% US / Canada Asia Pacific Europe 20% Latin America Non-Mortgage Regional Sizing • In newly developed regions like Asia Pacific, penetration of nonmortgage credit is high as the growing upper-middle class consumers are very responsive to all forms of credit vehicles. Source: Morgan Stanley Information Classification as Needed 4 Presentation Identifier.4 Credit Card Growth Opportunities Opportunity exists to shift share from alternative consumer lending vehicles – especially in emerging countries. Credit Card Debt as % of Consumer Non-Mortgage Debt 40% 35% 30% Global Average 25% 20% 15% 10% 5% Fr an ce ia In d Ita ly an y er m G Ja pa n ra zi l B Sp ai n S U K U da or ea K an a C A us tr al ia 0% Source: Morgan Stanley (2002 Data); general purpose credit card receivables as % of all non-mortgage loans. Information Classification as Needed 5 Presentation Identifier.5 Discussion Topics Global Consumer Lending Country Segmentation Learnings from Credit Leaders Product and Industry Developments Around the World Information Classification as Needed 6 Presentation Identifier.6 Regional View of Visa Credit Business Large Variation Around the World Visa Credit RSV as % of PCE <2% 2-6% >6% Need an alternative way to compare development of credit environments Information Classification as Needed 7 Presentation Identifier.7 Economic Development Segmentation of Visa Business by Market Economic Development > $10K $2K to $10K < $2K Personal Consumption Expenditure (PCE) per Capita Information Classification as Needed 8 Presentation Identifier.8 6% 2% Economic Development Visa Debit Development Visa Debit RSV as % PCE Long Term High Potential Economies China Egypt India Indonesia 2% 6% Visa Credit Development Visa Credit RSV as % PCE < $2K PCE per Capita Information Classification as Needed 9 Presentation Identifier.9 6% 2% Visa Debit Development Visa Debit RSV as % PCE Economic Development Emerging Economies S. Arabia Brazil S. Africa Mexico Russia Poland Argentina 2% $2K to $10K Thailand Turkey 6% Visa Credit Development Visa Credit RSV as % PCE < $2K PCE per Capita Information Classification as Needed 10 Presentation Identifier.10 > $10K Portugal UK Italy Spain U.S. Australia Germany Japan UAE Greece Ireland 6% Sweden France 2% Visa Debit Development Visa Debit RSV as % PCE Economic Development Developed Economies 2% $2K to $10K 6% Visa Credit Development Visa Credit RSV as % PCE < $2K PCE per Capita Information Classification as Needed 11 Presentation Identifier.11 Credit Card Clustering Segmentation Criteria PCE per Capita NonCredit Card Marketing Credit card Credit Risk Mortgage % of NM Acceptance Mgmt Portfolio Mgt Lending Lending Developed Credit • Sample Countries: US, UK, Canada, Australia, Taiwan Emerging Credit • Sample Countries: Thailand, Turkey, Brazil, S. Africa, Mexico Established Charge • Sample Countries: Japan, Spain Established Debit • Sample Countries: France, Italy, Germany Long Term • Sample Countries: China, India, Indonesia, Egypt, Russia* Criteria • PCE per capita bands: <$2K, $2$10K, >$10K • Nonmortgage credit of PDI bands: >20%, 520%, <5% • Credit card share of nonmortgage bands: >20%, 1020%, <10% • Merchant acceptance of credit cards • Credit bureau and scoring • UW, line assign, collections Information Classification as Needed • Prospect / customer data mining • Pricing, products, distribution • Active PM 12 Presentation Identifier.12 Developed Credit Environment “Current State” Developed Credit • • Regulatory pressure on pricing Slower growth in prime segment Merchant Value Proposition Lending Infrastructure Opportunity Areas • • Mass affluent products Selective subprime / niche segments • Merchant value proposition Responsible Lending Product Innovations Common Themes and Opportunities Refine all aspects of consumer lending proposition to optimize value to merchants, consumers, and issuers. Information Classification as Needed 13 Presentation Identifier.13 Opportunities in Credit Card Environment “Current State” Developed Credit Emerging Credit • • • • • Regulatory pressure on pricing Slower growth in prime segment Prime segment already penetrated Large un-banked & subprime consumers Some acceptance challenges Merchant Acceptance Lending Infrastructure Opportunity Areas • • Mass affluent products Selective subprime / niche segments • Merchant value proposition • Credit risk management, especially subprime • • Product differentiation Portfolio management Portfolio Management Product Development Common Themes and Opportunities Strengthen fundamentals of consumer lending to improve product economics and deepen market reach Information Classification as Needed 14 Presentation Identifier.14 Income and consumer spending in Ukraine have been rising over the last few years Income and consumer spending increases are favorable for growth in demand for credit Yearly Average Nominal Wages of Persons Employed in the Ukrainian Economy (UAH) Yearly Nominal Consumer Spend per Capita (UAH) 7,074 12,497 6,135 9,674 4,337 7,075 3,479 5,547 2,711 2,939 4,517 3,733 2001 2002 2003 2004 2005 Source: National Bank of Ukraine, as of May 2007 2006 2001 2002 2003 2004 2005 2006 Source: Planet Retail, as of May 2007 Information Classification as Needed 15 Presentation Identifier.15 Discussion Topics Global Consumer Lending Country Segmentation Learnings from Credit Leaders Product and Industry Developments Around the World Information Classification as Needed 16 Presentation Identifier.16 Developed credit markets have very high RSV/CSV ratios in common Increasing credit card usage at POS is correlated with sustainable credit card growth Credit 93.1% 90.8% 89.1% RSV/CSV Ratio 87.2% 83.0% 82.5% 80.8% 68.4% 7.1% Credit Penetration of PCE A 14.7% lia a tr us N ew 13.6% nd a al e Z C 16.6% da a an 4.7% U A 6.5% E U SA 1.1% nd a l Po 7.9% U K K S. 20.8% ea r o 0.0% R a si s u 4.7% 0.1% U ne i a kr Source: RSV/ CSV from Visa Operating Certificates, 4QE Q42006 and subject to change; PCE from Global Insight, 2005 Information Classification as Needed 17 Presentation Identifier.17 Proposition must remain valuable through Account Life Cycle Retention Usage Activation Acquisition Start Using Get 0 1-3 Use more Keep Market Management 6-12 Portfolio Management Risk Management Reliable Information Systems Prospect Risk and Demographic Account Level Performance Tracking Market Strategy Risk Management Value Optimization Tools and Strategy Market Partners Acquisition Value Proposition Account Mgt Value Proposition Information Classification as Needed Time in months Product Potential Optimized with Discrete Streams (e.g. credit, debit, prepaid) 18 Presentation Identifier.18 Discrete Products Serve Discrete Customer Needs and Market Conditions SUFFICIENT MARKET INFORMATION CREDIT DEBIT OWN FUNDS BANK FUNDS Prepaid NO MARKET INFORMATION Information Classification as Needed 19 Presentation Identifier.19 Robust and complete information structures outside and inside the bank are fundamental to healthy credit growth Market Bank Efficient risk management Ability to reach deeper segments Cost efficient and reliable account management Better segmentation and product assignment Better segmentation and targeting Optimization of Marketing Better estimation of overall prospect risk through positive campaigns and negative information sharing Optimization of credit extension Prevention of market-wide risk issues More accurate new and existing customer risk management Product strategy support by correct economics Information Classification as Needed 20 Presentation Identifier.20 The importance of sharing and using positive and negative information – the case of the UK in 2005 Number of IVAs 35000 5.00% Charge-offs as % of outstandings 30000 4.50% 25000 20000 4.00% 15000 3.50% 10000 5000 3.00% Dec-02 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 “A PwC study of 1257 IVAs registered in July 2005 reported that: • Insolvent individuals had, on average, taken out 11 credit cards and other types of unsecured loan • The total average debt was around GBP 60,000, or 3-4 times gross annual income • 75% of insolvencies were caused by living above means” Source: Precious Plastic 2006, Consumer Credit in the UK, PriceWaterhouseCoopers 2006 Information Classification as Needed 21 Presentation Identifier.21 Discussion Topics Global Consumer Lending Country Segmentation Learnings from Credit Leaders Product and Industry Developments Around the World Information Classification as Needed 22 Presentation Identifier.22 Lending Infrastructure – UK Example Credit Bureaux in UK Description • UK market experiencing increased credit losses as a result of high consumer debt service burden • UK already has three advanced credit bureaux providing positive & negative credit history • Four major UK issuers agreed to share additional cardholder data to improve credit risk assessment and portfolio management UK Credit Bureaux will have the most comprehensive data fields in the world • New field include: amount of purchases, cash advances, and payments; changes to credit lines; bounced cheques; number of authorized users Responsible Lending, Optimum Credit Allocation and Risk Management Information Classification as Needed 23 Presentation Identifier.23 Lending Infrastructure – Korea Example Credit Bureau Development in Korea Description • Korea market experienced severe credit loss crisis in 2002-2003, following a period of exceptional growth in credit card lending • Visa Korea demonstrated industry leadership by developing a roadmap to migrate Korea’s credit bureau system from sharing “negative only” to sharing both “negative and positive” information. • Extensive research to compare credit bureau systems in other Asian countries (Singapore, Thailand, Australia, Hong Kong) and the United States Responsible Lending, Optimum Credit Allocation and Risk Management Information Classification as Needed 24 Presentation Identifier.24 Responsible Lending – US Example Money Choices in US Description Consumer Financial Lifecycle FINANCIAL HEALTH Income > Expenses FINANCIAL PRESSURES Expenses > Income LIFE AFTER BANKRUPTCY RECOGNITION OF DILEMMA BANKRUPTCY SITUATIONAL BEHAVIOR CHANGE DEALING WITH DILEMMA • Visa USA developed “MoneyChoices” – an internet based consumer education program • Integrated by Member banks through collections and delinquency prevention strategies • Enhance consumers’ understanding of credit and general financial information • Improve financial health to avoid delinquency, bankruptcy and charge-offs. Responsible Lending, Consumer Education Information Classification as Needed 25 Presentation Identifier.25 Product Innovations – UK Example Payment Rate Incentives in UK Description • Launched in October 2005, Barclaycard Flexi-Rate encourages cardholders to repay credit card balances more quickly • APR varies based on payment rate: • 9.9% APR (payment > 10% balance); • 12.9% (5% < payment < 10%) • 16.9% (2% min < payment < 5%) • Strong PR and consumer value in current UK environment, without giving up too much profitability Barclaycard “Flexi-Card” • Another way of implementing riskbased pricing those who can afford to pay more are generally lower risk anyway Responsible Lending, Budgeting, Customer Empowerment Information Classification as Needed 26 Presentation Identifier.26 Merchant Value Proposition – US Example The Visa Incentive Network (VIN) is a robust platform that enables Merchant partners to deliver value to Visa consumer credit cardholders Visa Incentive Network (VIN) in US Issuers VIN Database Send CMF files to VIN at least monthly and participate in Merchant offers Merchants Provide merchants access to highly desirable rewardsmotivated cardholders VIN Targeting Segmentation on cardholder spend behavior across entire universe to optimize merchant targeting and justify best in market merchant offers Increase utilization and loyalty Merchant Offers Drive revenue and new customers Offers are branded with Issuer’s Rewards program assets All-party value, Loyalty, New Customers Information Classification as Needed 27 Presentation Identifier.27 Portfolio Management – Brazil Example Private Label Conversion in Brazil Description • Private label cards in emerging credit environments tend to target growing middle class consumers who need financing for big ticket household items • Consumer finance specialists dominate this segment by mastering credit risk management and retailer distribution channel • Large global opportunity to convert private label credit card to Visa – successful conversion case studies seen in US, Europe, AP, and LAC Over 1 million Visa accounts from conversion of C&A private label portfolio! • Example – C&A Brazil had 12 million private label cards (targeting segments C/C- segment); average credit line of US$150; decision to convert to Visa to grow spending and revolving Reaching New Segments, Expand Credit Potential Information Classification as Needed 28 Presentation Identifier.28 Product Innovations – Taiwan Example Platinum Cards for Women in Taiwan Description • Targeting women – Business executives; entrepreneurs in 30’s to 40’s; high income earners • Wide Array of Benefits • Complimentary VIP club memberships (Howard Plaza) • Preferential discounts at selected merchants Headline : “Rose Platinum Ladies Love And Know How To Be Pampered.” Body copy : “Taishin Platinum Lady’s Card treats its women the way they deserve.” • Complimentary airport parking, 24-hour roadside assistance, annual vehicle servicing • Free Business Class upgrade on local carrier Affinity, Segmentation Information Classification as Needed 29 Presentation Identifier.29 Product Innovations – Spain Example Spain Leader in Mass Customization Description • La Caixa is leader in product customization and design • Focus on deep customer segmentation and multi-segment strategy oiptimization • Strength in customer lifecycle relationship management • Multiple and differentiated products • Unique card designs Affinity, Segmentation Information Classification as Needed 30 Presentation Identifier.30 Portfolio Management – Turkey Example Bonus Card in Turkey Description • Europe’s largest multi-branded credit card program • Launched in 2000, flexible and easy to use EMV-chip based rewards program • Multi-branded revolving credit card with over 1000 merchant partners in single rewards pool • Sophisticated CRM and rewards system – cash back pool, installment, discounts • Over 4 million credit cards (20% market share in Turkey) Efficient Account Management, Rewards, Security Information Classification as Needed 31 Presentation Identifier.31 Multi Segment Co-brand– Germany Example Description LandesBank X-box Visa Co-brand product set with Microsoft Xbox tapping a new youth segment for the bank • Xbox Visa Premium – Embossed, floor limit card – instalment • Xbox Young – Unembossed, managed credit line • Xbox Prepaid – Unembossed, reloadable no credit line Results • • • • 77% of cards issued as prepaid 60% of cardholders aged 18-25 New revenue stream/market Basis for future cross-sales Empowering repeat use, Segmentation, Serving unbanked segments Information Classification as Needed 32 Presentation Identifier.32 Product Development – México Example Installment Cards in Mexico Tarjeta Congelada (“Frozen Card”) Description • Leading Visa issuer in México launched new revolving credit card product • Targeting entry level (C / C-) segments • Credit lines of ~US$300 to $500 (about equal to monthly income) • Fixed monthly payment – minimum payment set at 10% of credit line • Translates to higher percentage of O/S balances (typically 5-8% in México) • Customer can choose to pay in full (no prepayment penalty) • Domestic use only; basic card benefits • Promise to review account for future upgrade (higher credit lines, international acceptance, more card benefits) Responsible Lending, Reaching “Deeper” Segments Information Classification as Needed 33 Presentation Identifier.33 Product Innovation and Cross-selling – Philippines Example Description Loan Disbursement - Philippines Chinatrust Loan Combi card Behavior Change, Retention, Convenience Value Proposition Bill Pmt, Fund Transfer, Net / Phone Banking Loan reload once loan is at least 50% paid Convenience, choice and control Bank Benefits Back-office and front-office cost savings Check handling cost savings Interest income from float or unused loan Revenue streams - POS, ATM fees, etc. Cross-selling Customer retention and extended account relationship Results 100,000 cards issued 92% of personal loans disbursed this way Information Classification as Needed 34 Presentation Identifier.34 Dual Line Private Label / Gen. Purpose US Example Dual Line Cobrand - US Wells Fargo / Pella Dual Card Description Targeted to retailers with private label portfolios Suitable for home furnishing and other big ticket financing Two distinct revolving lines of credit Private label (percentage of total line) Visa general purpose card One billing statement with detailed transactions for both lines. Potential for differential rates and features One monthly payment for both accounts Allows retailers to ensure there will be a portion of line available for purchases instore Affinity, Convenience, Enhancing POS Usage Information Classification as Needed 35 Presentation Identifier.35 Multi-product Co-brand– US Example Combi-product Innovation - US Starbucks Duetto Credit/Prepaid Card Description • Visa and Starbucks Card functionality • “Closed-loop” prepaid card, used to buy Starbucks products • Visa general purpose credit card used in Starbucks and everywhere else • Cash reloads from credit to prepaid card • 3% back on Visa auto-reload purchases • 1% Starbucks Duetto dollars back, on all Visa purchases • 40% higher average reloads on Duetto than on Starbucks prepaid-only • 58% percent of cardholders say will buy more Starbucks products with Duetto • 47% of Duetto cardholders have an improved image of Starbucks Affinity, Enhancing POS Usage Information Classification as Needed 36 Presentation Identifier.36 Instant Issuance Co-brand – Peru Example Mall instant issuance - Peru Megaplaza Interbank Visa Credit Card Description • Visa Co-brand program launched in shopping mall to compete directly with Ripley and Falabella (anchor stores with strong Private Label programs) • Bank developed process to approve and deliver Visa cards (Embossed Visa Flag) in 20 minutes. • “Fill out the application, go shopping and come back in 20 minutes” • Sales pitch: “6 months with no interest for 1st purchase today” • Sales module in food court and promoters along the mall • Instant prize through a game with credit card application • Results: 10,000 cards in first 3 months and delivering 100 instant cards daily Enhancing POS Usage, Instant Gratification of POS Demand Information Classification as Needed 37 Presentation Identifier.37 In Summary Long-term success in credit requires Overall The Ukraine economy is Positive and negative market growing and demand for information sharing and use credit is expected to continue Robust information systems to increase in and out of the bank Products will get more Discrete product offerings and sophisticated and credit product reporting that allow consumers will only get products to reach full potential savvier and more demanding Consumer propositions that Demands on banks for maintain value and appeal efficient and informed risk management will only increase as consumer credit exposure increases Strategies aimed at encouraging RSV spend Information Classification as Needed 38 Presentation Identifier.38 Thank you