Part 'd'

advertisement

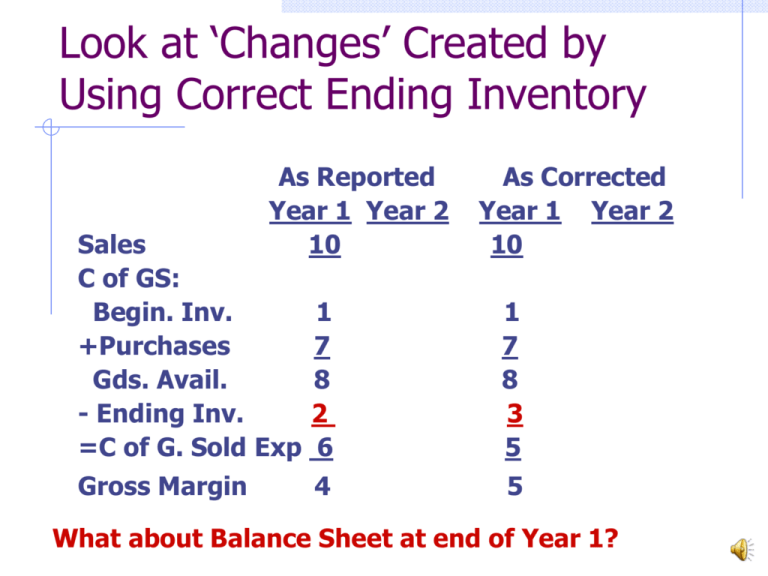

Look at ‘Changes’ Created by Using Correct Ending Inventory As Reported Year 1 Year 2 10 As Corrected Year 1 Year 2 10 Sales C of GS: Begin. Inv. +Purchases Gds. Avail. - Ending Inv. =C of G. Sold Exp 1 7 8 2 6 1 7 8 3 5 Gross Margin 4 5 What about Balance Sheet at end of Year 1? Sales C of GS: Begin. Inv. +Purchases Gds. Avail. - Ending Inv. =C of G. Sold Gross Margin As Reported Year 1 Year 2 10 11 As Corrected Year 1 Year 2 10 1 7 8 2 6 2 8 10 4 6 1 7 8 3 5 4 5 5 Sales C of GS: Begin. Inv. +Purchases Gds. Avail. - Ending Inv. =C of G. Sold Gross Margin As Reported Year 1 Year 2 10 11 As Corrected Year 1 Year 2 10 11 1 7 8 2 6 2 8 10 4 6 1 7 8 3 5 3 8 11 4 7 4 5 5 4 What about Balance Sheet at end of Year 2? What was the effect of understating the Year 1 ending inventory by $1? (ignore taxes) Year 1 Sales Begin. Inventory +Purchases =Goods Avail. for Sale -Ending Inventory =Cost of Goods Sold Gross Profit Margin Net Income Ret. Earn, end. Bal. Year 2 What was the effect of understating the Year 1 ending inventory by $1? (ignore taxes) Year 1 Year 2 Sales Begin. Inventory +Purchases =Goods Avail. for Sale -Ending Inventory =Cost of Goods Sold Gross Profit Margin Net Income Ret. Earn, end. Bal. Compare the Reported amounts for each year with the Corrected amounts. What was the effect of understating the Year 1 ending inventory by $1? (ignore taxes) Year 1 Sales No effect Begin. Inventory No effect +Purchases No effect =Goods Avail. for SaleNo effect Understated $1 -Ending Inventory =Cost of Goods Sold Overstated $1 Gross Profit Margin Understated $1 Net Income Understated $1 Ret. Earn, end. Bal. Understated $1 Year 2 What was the effect of understating the Year 1 ending inventory by $1? (ignore taxes) Year 1 Year 2 Sales No effect No effect Begin. Inventory No effect Understated $1 Purchases No effect No effect Understated $1 Goods Avail. for Sale No effect Understated $1 No effect Ending Inventory Cost of Goods Sold Overstated $1 Understated $1 Gross Profit Margin Understated $1 Overstated $1 Net Income Understated $1 Overstated $1 Ret. Earn, end. Bal. Understated $1 No effect (why?) Does Bal. Sheet Balance? Does Bal. Sheet Balance? Ex: In Yr. 3 we find that Yr. 1 ending inv. was understated by $1. As Reported Year 1 Year 2 Sales 10 C of GS: Begin. Inv. 1 +Purchases 7 Gds. Avail. 8 - Ending Inv. 2 =C of G. Sold 6 Gross Margin As Corrected Year 1 Year 2 4 What was the effect of the error on the Yr. 1 and Yr. 2 Statements? Inventory Ratio--Avg. Number of Days Supply of Inventory on Hand (Do NOT follow method used on page 281 in Textbook) How long will your inventory supply last before you run out? (How many days go by between the time inventory arrives and when it is sold to a customer?) Average Number of Days = Inventory_____________ Supply of Inventory on Hand Average Daily Cost of Goods Sold (Cost of Goods Sold Expense for Year /365 Days) Inventory Ratio--Avg. Number of Days Supply of Inventory on Hand An Example Inventory Average Daily Cost of Goods Sold (Cost of Goods Sold Expense for Year / 365 Days) $5,000 Inventory $82.19 Average Daily Cost of Goods Sold ($30,000 CofGS/365 days) Answer = 60.8 Days Supply of Inventory on Hand Cost of carrying too much inventory vs. cost of not carrying enough inventory! Inventory “Turnover” Ratio Inventory “Turnover” = _______365 Days__________ 60.8 Days Inv. on Hand Inventory “Turnover” = 6 times Which is more “understandable”: 1.) You have 61 days supply of inventory on hand ? 2.) Your inventory “turned over” 6 times ? Class Assignment Questions Questions 1, 5, 6, 12, 15 (Page 289 in textbook) Chapter 6 The End