Opportunities for ethnic minority Entrepreneurs

advertisement

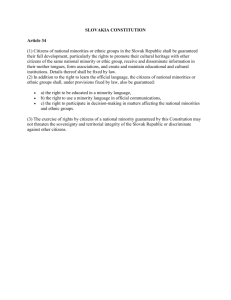

Directorate General for Enterprise and Industry Opportunities for ethnic minority Entrepreneurs • European week of Regions and Cities, Brussels 11 October 2005 • Mr.Albrecht Mulfinger, • Head of Unit „Crafts, Small Enterprises, Cooperatives and Mutuals, European Commission, DG Enterprise and Industry 1 Directorate General for Enterprise and Industry Introduction • in 15-20 years ethnic minorities will have a dominant place in the population of large European cities • more entrepreneurship for ethnic minorities will facilitate their integration in the society • also a considerable number of ethnic minority entrepreneurs need bank finance, But all need a bank account • • finance opportunities of ethnic minority entrepreneurs depend to a large extend from the person, his education, business plan, track record • banks are not allowed by law to lend to a person that is unable to reimburse 2 Directorate General for Enterprise and Industry Definition of ethnic minority entrepreneurs • an individual which is citizen of an EU 25 member state/ EEA country but has an immigrant background ( up to the 3rd generation) • an individual that recently came to an EU 25 member State/ EEA Country from a 3rd non EU country and holds a valid residency permit or had the necessary authorisation to become self-employed or start-up business 3 Directorate General for Enterprise and Industry Statistics for ethnic minorities • definition used for migrants and minorities varies considerably in the EU-member states • in DE, AT after naturalisation immigrant are removed from statistics. • in UK, FR, NL, DK ethnicity appears in statistics; in other member states not recorded or forbidden • different statistical concepts, • statistics on ethnic minorities very different, incoherent and quite weak • statistics on ethnic minority entrepreneurs and self-employed in formal or informal sector could be misleading • citizens with Chinese, Pakistani or Turkish origin are more entrepreneurial than those from black Africa or former Sovjet block 4 Directorate General for Enterprise and Industry Education of ethnical minority entrepreneurs • majority of first generation migrants has low level of education or qualification • exception: migrants selected for their skills ( nurses, doctors computer specialists) • educational level improves for 2nd and 3rd generation including university 5 Directorate General for Enterprise and Industry Reasons for self- employment • entrepreneur by necessity versus entrepreneur by vocation • escape unemployment or risk of unemployment (simple jobs suffer under delocalisation to low cost countries) • escape 3d jobs- dirty, dangerous and demanding occupation, often badly paid and almost no hope for promotion • become self-employed : facilitate integration into the society • reduces the risk of young people to become criminal • entrepreneurs by necessity mostly start a small business with low entry barriers such as • restaurant, food shop, house cleaning and repair, health care, nurses, gardening, textiles and clothing etc. • main target group of clients: same ethnic community or residents from the same urban area 6 Directorate General for Enterprise and Industry Entrepreneurship of Ethnic minorities • depending on countries and the mix of ethnic minorities the entrepreneurial dynamism vary considerably. • entrepreneurial activities of ethnic minorities have increased • • in SE immigrants are more likely to be self- employed than native Swedes • DE number of self employ persons among foreigners was 8.6% against 10% of the total employed population 7 Directorate General for Enterprise and Industry Access to Finance • Warwick Business School – no significant differences in likelihood of using external finance between white and ethnic minority owned business- some 80% of SME have used external sources of finance in last 3 years – 25% of ethnic minority entrepreneur report lack of self –confidence with finance (Average 16%) – ethnic minority owned businesses have significantly lower overdraft limits than white owned business (L 18 .000 versus L 35.000 ) – no significant differences in the size of term loans by gender or ethnicity – no significant differences in rejections or discouragement rates by gender, ethnicity or growth rate 8 Directorate General for Enterprise and Industry Access to Finance • ethnic minorities entrepreneurs raise funds from family, then from the same ethnic minority community, and then from banks • all banks say to treat finance requests from ethnic minorities in the same way than from white citizens • often banks are reluctant to finance start-up businesses irrespective of gender, ethnicity or growth prospects • bank clerks have to reach given profit targets, failure to meet them will reduce their promotion prospects • Basel II will increase the transparency requests by banks, • high risk will lead to higher interest rates, lower risk to lower interest rates 9 Directorate General for Enterprise and Industry Access to finance • a large number of ethnic minority entrepreneurs request microloans with less than € 25 000 • they are often unable to offer sufficient guarantees • poorly presented business plans and moderate business situations have an impact on the size and the cost of loans, even if they can assure credit institutions of good market opportunities • do ethnic minority entrepreneurs communicate efficiently with banks clerks (language, behaviour, clothing)?. 10 Directorate General for Enterprise and Industry Best practices for finance of ethnic minority entrepreneurs • all public promotional banks ( KfW, BDPME, ICO) offer their loans to all SME irrespective of gender and ethnicity • also Commission financial instruments managed by EIF are offered to all SMEs • some banks are promoting finance of ethnic minority entrepreneurs such as • Cooperative Banks in Italy for reason of corporate social responsibility (in form of reduced guarantee requirements) • Dutch cooperative banks with specific loans for ethnic minorities • Specific measures issued by Member States in disadvantaged urban areas 11 Directorate General for Enterprise and Industry Business opportunities for ethnic minorities • by filling market gaps – taking over small shops from native traders (retirement, decline of turnover in depressed urban areas with high immigrant density – creation of new shops in urban areas for citizens without car • by creation of new markets for specific products or services – ethnic fast food franchising with high quality service (food is safe, fresh and low fat) – tour operator for holidays in the country of origin (e.g. Turkish tour operator in Germany) – personal and health services for the ageing society in particular for women – arrival of highly skilled academics (financial analysts, software experts) as employee could lead in several years to new start ups, as Asian immigrants in California have successfully shown 12 Directorate General for Enterprise and Industry Specific actions of the DG ENTR • Ethnic minority entrepreneurs are a specific target group in the entrepreneurship action plan ( 2004) • Launch of a study on best practices for ethnic minority entrepreneurs • Network of member states experts on ethnic minority entrepreneurs • Final report and conference in 2007 • THANK YOU FOR YOUR ATTENTION 13 Directorate General for Enterprise and Industry Thank you for your attention 14