cover yourself: insurance hints

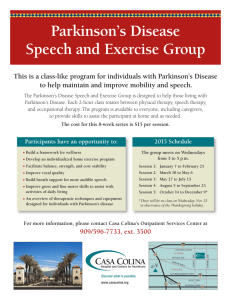

advertisement

COVER YOURSELF: INSURANCE HINTS Prepared by Walton & Parkinson Limited Insurance Brokers 20 St Dunstans Hill London EC3R 8PP Tel: 0845 218 4140 Fax: 0845 218 4141 Email: enquiry@waltonandparkinson.co.uk INTRODUCTION Theatrical productions need to have some insurance by law and quite a bit more through prudence. Benjamin Franklin said that “in this world nothing can be said to be certain, except death and taxes” and it is true that only rarely can future events be predicted with absolute confidence. It is therefore vital to try to avoid, or at least to minimise, the unpleasant results of the unexpected. TYPES OF INSURANCE POLICIES FOR THEATRICAL PRODUCTIONS Insurance policies fall into four basic categories:• Covering physical effects for loss or damage Covering third party liabilities: injury to persons or damage to property Covering business interruption or cancellation of one or more performances Covering personnel: either as key people to a production in which their non-appearance would force its cancellation, or for those involved in hazardous work, or because they are travelling abroad. Each of the four types of insurance can be broken down into sub-divisions specifically referring to the type of work you will be undertaking. LOSS OR DAMAGE Insuring against loss or damage to physical assets in the case of a drama or musical would cover sets, props, costumes, lighting and sound equipment, musical instruments, skips, wig blocks and all other production material including front of house photographs etc. All such items need insurance protection against loss or damage all the time whilst they are your responsibility; including when in transit, when in use or when in temporary storage. Money should also be insured against loss. EMPLOYERS LIABILITY AND PUBLIC LIABILITY Every employer is required by UK law to have Employer’s Liability Insurance, which provides up to £10 million indemnity for any employee who suffers a work-related accident or illness. © Walton & Parkinson Ltd Sponsored by Walton & Parkinson Ltd, insurance brokers to the theatre industry. Tel: 0845 218 4140. Email: enquiry@waltonandparkinson.co.uk. A minimum of £2 million indemnity is recommended by insurers for Public Liability claims involving injury to other persons or damage to third party property caused by the negligence of the Insured. BUSINESS INTERRUPTION OR CANCELLATION OF AN EVENT There could be loss or damage to the theatre, sets or equipment, or one or more of the cast might fall ill or have an accident. If a tour is cancelled then you might well suffer loss of fare monies and transportation costs as well. PERSONNEL For those involved in hazardous or potentially hazardous work during performance or fit-up, Equity requires that producers take out appropriate insurance for death, loss of limbs, eyes etc. and permanent total disablement for a sum of not less than £30,000 and weekly benefits for temporary total disablement relating to between 75% and 100% of the individual’s normal earnings. If travelling abroad, you have to take out Travel Insurance involving temporary Life Insurance, Medical Insurance, Personal Effects and subsistence costs if the cast’s return is delayed. COSTS The cost of the relevant insurance for your particular production depends upon numerous factors such as reinstatement values of physical assets, the payroll, the likely costs and commitments in the event of a cancellation, the age and health record of artists and sometimes the nature of the work involved. Invariably, the cost of the insurance amortized over the period of the production is often one of the smallest elements of the budget. It would appear that few insurance companies have much experience of theatre, so it is advisable to use a specialist broker who will be able to assess your needs and provide quotations for cover with a proper understanding of what your production involves. It is the insurance broker’s role to evaluate the risk factors and match the risks involved with the appropriate insurance - bought at the best price commensurate with breadth of cover and the security of the insurer, coupled with their concern to settle claims fairly and promptly. © Walton & Parkinson Ltd Sponsored by Walton & Parkinson Ltd, insurance brokers to the theatre industry. Tel: 0845 218 4140. Email: enquiry@waltonandparkinson.co.uk.