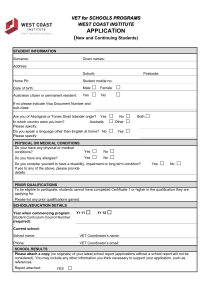

VET Administrative Information for Providers

advertisement