Tax Rate Theory

advertisement

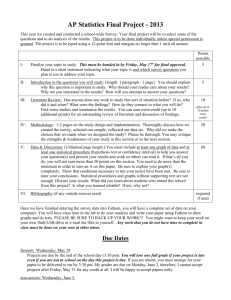

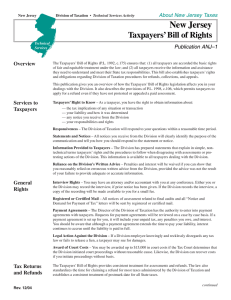

How can the U.S. significantly decrease the deficit 1) 2) 3) 4) Taxes Spending Tax Rate Introduction U.S. Federal Income Tax System 3 Types of Taxes • Progressive– Tax rate increase as income increases – Example: Income Taxes • Regressive– Consumes larger % of lower income worker’s salary – Example: Gasoline Tax, Bridge Tax • Flat – Same % for everyone – Example: Sales Tax, Some State income taxes Purpose/Goals of an INCOME TAX Tax Worksheet • History of Income Taxes • Taxes people pay Federal Income Tax • Progressive Income Tax As income Tax Rate Single % Tax Bracket Married Filing Jointly 10% $0 – $8,350 $0 – $16,700 15% $8,351– $33,950 $16,701 – $67,900 25% $33,951 – $82,250 $67,901 – $137,050 28% $82,251 – $171,550 $137,051 – $208,850 33% $171,551 – $372,950 $208,851 – $372,950 35% $372,951+ $372,951+ EVERY taxpayer pays 10% on first $8,350 of income Example: If you Earn $100,00 (single) ($ 8,350 - 0 ) x .10 : $ 835 (33,950 - 8,351) x .15 : 3,840 (82,250 - 33,951) x .25 : 12,075 (100,000 - 82,251 ) x .28 : 4,970 Total: $ 21,720 or 21.7% 2 Wage Earners Mary earns $60,000 John earns $360,000 $91,025 $4,485 $5,220 $32,123 Federal Taxes Social Security Medicare California Tax $5,855 $2,520 $870 $1,617 $226,965 $18,913 $133,035 Take Home Pay Pay Per Month Total Taxes Paid $49,137 $4,094 $10,863 37.0% Overall Tax % Rate 18.0% http://www.paycheckcity.com/calculator/netpay/us/california/calculator.html Numbers to Know for Exam • Top 1% of Taxpayers ($343,000 + Up) – Pay 38% of all taxes – Earn 20% of all income (1.4 million households) • Top 10% of Taxpayers ($115,000 + Up) – Pay 70% of all income taxes – Earn 46% of income • Bottom 50% of Taxpayers ($33,000 + Below) – Pay 3% of Income Taxes – Earn 13% of Income Top 1% pay more taxes but The income Gap has widened last 30-Years EQUAL % tax cuts What best stimulates economic growth? Equal % Tax Cuts • Example: 10% tax cut for ALL taxpayers • Who gets more nominal dollars (money) Earn $120,000 Taxes $36,000 Earn Taxes $3,000 $24,000 Refund $3,600 Refund $300 Fiscal Cliff December 2012 2013 Federal Tax Rate Brackets Tax Rate Bush Tax cuts are now permanent New top bracket Single Married filing Jointly or Qualifying Widow(er) 10% Up to $8,925 Up to $17,850 15% $8,926 – $36,250 $17,851 – $72,500 25% $36,251 – $87,850 $72,501 – $146,400 28% $87,851 – $183,250 $146,401 – $223,050 33% $183,251 – $398,350 $223,051 – $398,350 35% $398,351 – $400,000 $398,351 – $450,000 $400,001 + $450,001 + $6,100 $12,200 39.6% Standard Deduction