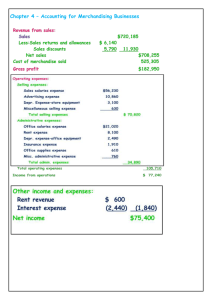

Selling expenses

advertisement

Chapter 4 – Accounting for Merchandising Businesses Analyze Merchandising transactions Cash On Account 1 Discount Return Chapter 4 – Accounting for Merchandising Businesses 2 Chapter 4 – Accounting for Merchandising Businesses Exercises 1 : Sales Transaction Cash Sales On January 3, Alsaud sold 1000 RS of merchandise for cash. The cost of merchandise sold was 200 RS Date Jan. 3 Description Debit Credit Jan. 3 Sales on Account On January 12, Alsaud sold merchandise on account for 5000 RS . The cost of merchandise sold was 2000 RS . Date Jan. 12 Description Debit Credit Jan. 12 Receipts on Account On January 17, Alsaud deducted (………… ) Date Jan. 22 receives the amount due within ten days, so the buyer (15000 x 3 %) from the invoice amount. Description Debit Credit Credit Memo A credit memorandum, often called a creditmemo, authorizes a credit to (decreases) the buyer’s account receivable. 3 Chapter 4 – Accounting for Merchandising Businesses On January 13, issued Credit Memo No. 32 to Krier Company for merchandise returned to Alsaud . Selling price, 5000 RS ; cost to Alsaud , 1500 RS . Date Jan. 13 Description Debit Jan. 13 Exercises 2 : Complete the following table : Gross profit 50000 - Total operating expenses 15000 = Income from operations - Other expenses and losses 5000 = Net income 4 Credit Chapter 4 – Accounting for Merchandising Businesses Exercises 3 : 1. On March 18, Diamond Store sold $25,000 of merchandise on account. The merchandise was carried in inventory at a cost of $18,000. 2. On June 8, Diamond. sold merchandise costing $3,500 for $6,000 on account. Credit terms were 2/10, n/30. Let’s prepare the journal entries. 3. On June 17, Diamond Store . received a check for $5,880 in full payment of the June 8 sale 4. On June 14, merchandise with a sales price of $800 and a cost of $470 was returned to Diamond Store . The return is related to the June 12 sale Date Description 5 Debit Credit Chapter 4 – Accounting for Merchandising Businesses 6