MBA Module 2 PPT

Module 2:

Overview of Business

Activities and

Financial Statements

Four Main Financial Statements

Balance Sheet

Income Statement

Statement of Stockholders’ Equity

Statement of Cash Flows

Balance Sheet

Mirrors the Accounting Equation

Assets = Liabilities + Equity

Uses of funds = Sources of funds

Assets are listed in order of liquidity

Liabilities are listed in order of maturity

Equity consists of Contributed Capital and

Retained Earnings

Assets

To be reported on a balance sheet, an asset must

1.

Be owned (or controlled) by the company

2.

Must possess expected future economic benefits

Assets are listed in order of liquidity

Current assets comprise assets that can be converted to cash within a year

Long-term assets cannot be easily converted to cash within a year.

Examples of Current Assets

Cash—currency, bank deposits, and investments with an original maturity of 90 days or less (called cash equivalents);

Marketable securities—short-term investments that can be quickly sold to raise cash;

Accounts receivable, net—amounts due to the company from customers arising from the sale of products and services on credit (“net” refers to uncollectible accounts explained in

Module 6);

Inventory—goods purchased or produced for sale to customers;

Prepaid expenses—costs paid in advance for rent, insurance, advertising or other services.

Examples of Long-term Assets

Property, plant and equipment (PPE), net—land, factory buildings, warehouses, office buildings, machinery, motor vehicles, office equipment and other items used in operating activities (“net” refers to subtraction of accumulated depreciation, the portion of the assets’ cost that has been transferred from the balance sheet to the income statement, which is explained in Module 6);

Long-term investments—investments that the company does not intend to sell in the near future;

Intangible and other assets—assets without physical substance, including patents, trademarks, franchise rights, goodwill and other costs the company incurred that provide future benefits.

Apple’s Assets

Cisco Systems, Inc. Assets

Assets are Reported at

Historical Cost

Historical Cost is

Objective

Verifiable

“Relevance vs. Reliability”

Only include items that can be reliably measured.

Considerable amount of “assets” may not be reflected on a balance sheet

Strong management team, a well-designed supply chain, or superior technology.

Knowledge Based Assets are not

Reflected on the Balance Sheet

NOTE: While resources expended for research and development reflect and economic asset, they generally are expensed as incurred.

INSIGHT: Pharmaceutical firms do not have assets reflecting the full amount of money that they have spent developing drugs. These amounts, for the most part, have been expensed in the past and serve to reduce retained earnings. Internally developed trade marks are also economic assets, but may not show up on the balance sheet. [The purchase of externally developed trademarks are treated as assets.]

Disney’s Assets

Where’s Mickey? The market value of the

Mickey Mouse trademark does not explicitly show up here.

Apple’s Liabilities and Equity

Examples of Current Liabilities

Accounts payable —amounts owed to suppliers for goods and services purchased on credit.

Accrued liabilities —obligations for expenses that have been incurred but not yet paid; examples are accrued wages payable (wages earned by employees but not yet paid), accrued interest payable

(interest that is owing but has not been paid), and accrued income taxes (taxes due).

Unearned revenues —obligations created when the company accepts payment in advance for goods or services it will deliver in the future; also called advances from customers, customer deposits, or deferred revenues.

Short-term notes payable —short-term debt payable to banks or other creditors.

Current maturities of long-term debt —principal portion of long-term debt that is due to be paid within one year.

Cisco systems, Inc. Current Liabilities

Net Working Capital

Operating Cycle

Examples of Noncurrent Liabilities

Long-term debt —amounts borrowed from creditors that are scheduled to be repaid more than one year in the future; any portion of long-term debt that is due within one year is reclassified as a current liability called current maturities of long-term

debt. Long-term debt includes bonds, mortgages, and other long-term loans.

Other long-term liabilities —various obligations, such as pension liabilities and long-term tax liabilities, that will be settled a year or more into the future. We discuss these items in later modules.

Cisco Systems, Inc.

Long-term Liabilities

Equity

Equity consists of:

Contributed Capital (cash raised from the issuance of shares)

Earned Capital (retained earnings). Retained

Earnings is updated each period as follows:

Examples of Equity Accounts

Common stock —par value received from the original sale of common stock to investors.

Preferred stock —value received from the original sale of preferred stock to investors; preferred stock has fewer ownership rights compared to common stock.

Additional paid-in capital —amounts received from the original sale of stock to investors in addition to the par value of common stock.

Treasury stock —amount the company paid to reacquire its common stock from shareholders.

Retained earnings —accumulated net income (profit) that has not been distributed to stockholders as dividends.

Accumulated other comprehensive income or loss —accumulated changes in equity that are not reported in the income statement (explained in Module 8).

Cisco Systems, Inc.

Stockholders’ Equity

Income Statement

Apple’s Income Statement

Cisco Systems, Inc.

Income Statement

When are Revenues and Expenses Recognized?

Revenue Recognition Principle—recognize revenues when earned

Matching Principle—recognize expenses when incurred.

Profit vs. Cash

Net Income does not necessarily correspond to a net cash flow.

A firm could have “good income” but “poor cash flow” or vice versa (i.e., there are two dimensions to consider).

We have previously summarized the mechanics of the balance sheet with the expanded accounting equation:

Operating vs. Nonoperating

Operating expenses are the usual and customary costs that a company incurs to support its main business activities

Nonoperating expenses relate to the company’s financing and investing activities

Transitory Items in the

Income Statement

Transitory items

Discontinued operations Gains or losses (and net income or loss) from business segments that are being sold or have been sold in the current period.

Extraordinary items Gains or losses from events that are both unusual and infrequent.

Accrual Accounting

Accrual accounting refers to the recognition of revenue when earned

(even if not received in cash) and the matching of expenses when incurred (even if not paid in cash).

Statement of Stockholders’ Equity

Statement of Equity is a reconciliation of the beginning and ending balances of stockholders’ equity accounts.

Main equity categories are:

Contributed capital

Retained earnings (including Other

Comprehensive Income or OCI)

Treasury stock

Apple’s Statement of

Stockholders’ Equity

Statement of Cash Flows

Statement of cash flows (SCF) reports cash inflows and outflows

Cash flows are reported based on the three business activities of a company:

Cash flows from operating activities - Cash flows from the company’s transactions and events that relate to its operations.

Cash flows from investing activities - Cash flows from acquisitions and divestitures of investments and long-term assets.

Cash flows from financing activities- Cash flows from issuances of and payments toward borrowings and equity.

Apple’s

Statement of Cash

Flows

Cisco

Systems,

Inc.

Statement of

Cash Flows

Relation of SCF to Income

Statement and Balance Sheet

General Coding of

Balance sheet Changes

Working Capital Accounts

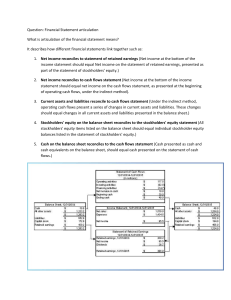

Articulation of Financial Statements

Financial statements are linked within and across time – they articulate .

Balance sheet and income statement are linked via retained earnings.

Apple’s Retained Earnings

Reconciliation

Recording transactions –

Pay $100 Wages in Cash

• Cash assets are reduced by $100, and wage expense of $100 is reflected in the income statement, which reduces income and retained earnings by that amount.

• All transactions incurred by the company during the accounting period are recorded similarly.

Adjusting Accounts

Prepaid Rent

Unearned Revenue

Accrual of Wages

Accrual of Revenue

Exercise: The Ice Cream Store, Inc.

The Ice Cream Store, Inc. incurred the following start-up costs:

1.

2.

3.

4.

5.

The Ice Cream Store, Inc. was formed on October 1, 20XX, with the investment of $90,000 in cash by the owners.

Obtained a bank loan and received the proceeds of $35,000 on

October 2. The cash will be used for operations.

Purchased equipment for $25,000 cash on October 2.

Acquired a building at a cost of $80,000. It was financed by making a $20,000 down-payment and obtaining a mortgage for the balance. The transaction occurred on October 2.

On October 2, the President of the United States publicly declared that she will eat (and plug) our ice cream while entertaining guests in the White House.

Prepare a transaction analysis of 1. – 5. using the financial statement effects template:

Transaction

1. The Ice Cream Store, Inc. was formed on October 1,

20XX, with the investment of

$90,000 by the owners.

Cash Asset +

Noncash

Assets

Balance Sheet

=

Liabi

-lities

+

Contrib

. capital

+

Retained

Earnings

Income Statement

Revenues – Expenses

+90 +90

2. Obtained a bank loan and received the proceeds of

$35,000 on October 2. The cash will be used for operations.

+35

3. Purchased equipment for

$25,000 cash on October 2.

4. Acquired a building at a cost of $80,000. It was financed by making a $20,000 downpayment and obtaining a mortgage for the balance. The transaction occurred on

October 2.

-25

-20

+25

Equip

+80

Bldg.

+35

N/P

+60

M/P

5. The President of the United

States agreed to eat (and plug) our ice cream while entertaining guests in the White

House on Oct. 2.

Ice Cream Shop

Balance Sheet:

ASSETS

Cash

Equipment

Building

Total Assets

$80,000

25,000

80,000

$185,000

LIABILITY AND STOCKHOLDERS' EQUITY

Liabilities:

Note Payable

Mortgage Payable

Total Liabilities

$35,000

60,000

95,000

Stockholders Equity:

Capital Stock

Total Liabilities and

Stockholders Equity

90,000

$185,000

Ice Cream Shop – additional transactions

6.

7.

8.

9.

10.

11.

On October 4, purchased merchandise inventory (i.e., ice cream) at a cost of

$15,000 by paying $5,000 cash and receiving short-term credit for the remainder from the supplier.

Immediately returned some of the ice cream because some of the flavors delivered were not ordered. The cost of the inventory returned was $3,000.

Sales of ice cream for the month of October, 20XX, totaled $8,000. All sales were for cash. The ice cream cost $3,500.

For all of October, total employee wages and salaries earned/paid were

$3,000.

As of the end of October, one month's depreciation on the equipment and building was recognized -- $383 for the building and $167 for the equipment.

$450 interest expense on the note and mortgage was due and paid on

October 31. Assume that the principal amounts ($35,000 + $60,000) of the note and mortgage remain unchanged.

Prepare a transaction analysis of 6. -11. using the balance sheet/income statement template presented above:

Transaction

6.

7.

8.

9.

10.

11.

Cash

Asset

+ Noncash Assets

-5

+8

+15

Inv.

-3

Inv.

-3.5

Inv.

Balance Sheet

=

Liabilities

+10

A/P

-3

A/P

+

Contrib. capital

+

Income Statement

Retained

Earnings

Revenues – Expenses

+4.5

+8

Sales

-3 .

- .383

Bldg., net

-.167

Equip., net

-3

-.550

-3.5

COGS

-3

Wage exp.

-.550

Dep. exp.

-.450

-.450

-.450

Int. Exp.

Prepare the following financial statements (ignore income taxes): (i) an updated Balance Sheet as of October 31, 20XX; and (ii) an Income Statement for the month of October 20XX.

Cash ($80,000 -5,000 +8,000 -3,000 -450)

Merchandise Inventory ($0 + 15,000 -3,000 -3,500)

Equipment ($25,000 )

Less: Accumulated Depreciation

Building ($80,000)

Less: Accumulated Depreciation

Total Assets

Accounts Payable ($0 + 10,000 – 3,000)

Note Payable ($35,000 principal is unchanged)

Mortgage Payable (60,000 principal is unchanged)

Stockholders' Equity:

Capital Stock

Retained Earnings

Total Liabilities and Stockholders' Equity

$79,550

8,500

25,000

(383)

80,000

(167)

$192,500

$7,000

35,000

60,000

102,000

90,000

500

90,500

$192,500

REVENUES:

Sales of Ice Cream

Cost of Sales

GROSS PROFIT:

Payroll Expense

Depreciation Expense

INCOME FROM OPERATIONS

Interest Expense

NET INCOME

Note: Assume no income taxes.

$8,000

3,500

4,500

3,000

550

950

450

$500

Preparing the Financial

Statements

Balance Sheet and Income Statement

Statement of Stockholders’ Equity

Additional Sources of Information

Form 10-K

Item 1, Business; Item 1A. Risk Factors;

Item 2, Properties;

Item 3, Legal Proceedings;

Item 4, Submission of Matters to a Vote of Security Holders;

Item 5, Market for Registrant’s Common Equity and Related Stockholder Matters;

Item 6, Selected Financial Data;

Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations;

Item 7A, Quantitative and Qualitative Disclosures About Market Risk;

Item 8, Financial Statements and Supplementary Data;

Item 9, Changes in and Disagreements With Accountants on Accounting and

Financial Disclosure;

Item 9A, Controls and Procedures.

Additional Sources of Information

Form 8-K

Entry into or termination of a material definitive agreement (including petition for bankruptcy)

Exit from a line of business or impairment of assets

Change in the company’s certified public accounting firm

Change in control of the company

Departure of the company’s executive officers

Changes in the company’s articles of incorporation or bylaws

Analyst Reports

Credit and Data Services

Credit Analysis

Standard & Poor’s (StandardAndPoors.com)

Moody’s Investors Service (Moodys.com)

Fitch Ratings (FitchRatings.com)

Data Services

Thomson Corporation (Thomson.com)

First Call - summary of analysts’ earnings forecasts

Compustat database - individual data items for all publicly traded companies or for any specified subset of companies.