Birch paper Company

advertisement

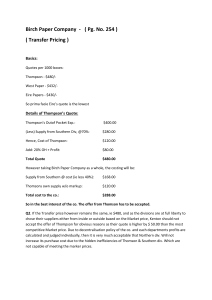

Birch Paper Company - ( Pg. No. 254 ) ( Transfer Pricing ) Basics: Quotes per 1000 boxes: Thompson - $480/West Paper - $432/Eire Papers - $430/So prima facie Eire’s quote is the lowest Details of Thompson’s Quote: Thompson’s Outof Pocket Exp.: $400.00 (Less) Supply from Southern Div, @70%: $280.00 Hence, Cost of Thompson: $120.00 Add: 20% OH + Profit: $80.00 Total Quote $480.00 However taking Birch Paper Company as a whole, the costing will be: Supply from Southern @ cost (ie less 40%): $168.00 Thomsons own supply w/o markup: $120.00 Total cost to the co.: $288.00 So in the best interest of the co. The offer from Thomson has to be accepted. Q2. If the Transfer price however remains the same, ie $480, and as the divisions are at full liberty to chose their suppliers either from inside or outside based on the Market price, Kenton should not accept the offer of Thompson for obvious reasons as their quote is higher by $ 50.00 than the most competitive Market price. Due to decentralisation policy of the co. and each departments profits are calculated and judged individually, then it is very much acceptable that Northern div. Will not increase its purchase cost due to the hidden inefficiencies of Thomson & Southern div. Which are not capable of meeting the marker prices. Q3. Should the vice president of Birch paper Co. Take any action. Ans. Though the case suggest that the qty. Involved in the subject transaction is less than 5% of any of the divisions production capacities, it is necessary for the VP to step in and take an overall view of the individual division profit based decision making as against the companies profitability. What is expected to happen in this case? If VP does not intervene, Northern div. Will go ahead and buy from Erie Papers. This will lead to nominal profits of USD 36 to Southern div. And USD 5 to Thomson as Erie will buy a few items from them to complete the order. But, this will not take care of the continuously incurring fixed costs, under utilisation of capacities and over stocking. Hence, to encourage cleaning up of internal inefficiencies he needs to redirect the transfer pricing policy to either 2 step pricing or make them focus on overall company profitability. As in this case, if Northern div. Buys from Erie only that div will save USD 50.00, however if VP forces Thomson and southern to transfer the products on Variable cost then the company will save USD 142 ($430 - $ 288). This savings can be then divided amongst the three div. Based on their overhead cost and sustainable profitability. The same principle can then be used for Transfer pricing decisions for any future transactions. Q4. Changes. 1. The focus should be changed from just individual department profitability to Group profitability. 2. The 2 step pricing method should be used wherever the co. has over capacity or over stocks. This will help take care of the fixed costs. 3. A Transfer pricing decision board or committee should be set up which can take care of the controversial issues and can have a broader understanding of group gains.