BIRCH PAPER COMPANY

advertisement

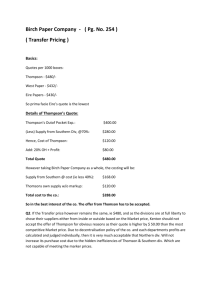

Dharma Putranto Dendy Fikosasono Jemy Yapola Robby S Irawan Yuli Rosiana BIRCH PAPER COMPANY NORTHERN DIVISION THOMPSON DIVISION SOUTHERN DIVISION X DIVISION Was a medium-sized company which partly an integrated paper company Producing white and craft papers and paperboard and converted into corrugated boxes The corrugated boxes produce by the Thompson Division which also printed and colored the outside surface of the boxes Had 4 (four) producing divisions - Northern Division: designed a special display box - Thompson Division: package design, perfecting the design, production methods - Southern Division: produce linerboard and corrugating medium and sometimes sell to Thompson division For several years, each division had been judged independently on the basis of its profit and return on investment The company’s top management believed that the company’s profits and competitive position definitely had improved Most of Thompson’s sales were made to outside customers The Northern division received bids on the boxes of $480 from Thompson division, $430 from West Paper Company and $432 from Eire Papers, Ltd. Which bid should Northern division accept to minimize the cost and maximize the profit in the best interest of Birch Paper Company ? West Paper Company $ 430 Eire Paper Company $ 432 Contribution of profit from Southern $ 90 x 40% = $ 36 Contribution of profit from Thompson $ 30 - $25 = $ 5 Total Cost $ 391 Thompson Division $ 480 Contribution of profit from Southern $ 400 x 70% x 40% = $112 Contribution of profit from Thompson $ 480 - $ 400 = $ 80 Total Cost $ 288 So Northern Division should accept bids on the boxes of Thompson Division, because it minimizes cost of the Birch Paper Company Should Mr. Kenton accept this bid ? Why or Why not ? Mr. William Kenton as a manager of Northern Division should not to accept the bid, because: 1. Birch Paper Company gave a decentralizing responsibility and authority for each division based on profit and return on investment. Mr. Kenton should not accept the bid from Thompson Division and chose either Eire’s or West Paper bids which offered lower price cost on the interest of Northern Division 2. Since Eire bought the materials from Southern Division which means that Eire gives a contribution to Birch Paper Company as a whole. Southern Division could be more optimalizing its capacity and reduced its excess inventory by taking the order from Eire Paper company. Should the vice president of Birch Paper Company take any action ? The vice president of Birch Paper should take some action in order to decide the best decision for the company’s benefit overall. If the vice president did not take any action, Northern division would most likely to choose Eire Paper to provide the order and it would cause a more inefficiency in Thompson division In the controversy described, how, if at all, is the transfer price system dysfunctional ? Does this problem call for some change, or changes, in the transfer pricing policy of the overall firm ? If so, what specific changes do you suggest ? The transfer pricing become dysfunctional because did not accommodate the issue with the market price. The profit-center transfer pricing should be adjusted based on the cost-based transfer pricing. Detail of the calculation: THOMPSON DIVISION: Thompson’s selling price to Northern Division = $ 480 20% profit margin (profit margin: ($ 480 - $ 400)/ $ 400 = 20%) Thompson’s out-of-pocket costs Southern’s selling price to Thompson (transfer pricing: 70% x $ 400) Other overhead costs (outsider suppliers) SOUTHERN DIVISION : Southern’s out-of-pocket costs (60% x $ 280) Southern’s profit ($ 280 - $ 168 = $ 112) = $ 400 = $ 280 ----------- = $ 120 = $ 168 = $ 112 67% ($ 112/$ 168) - Southern division should reduce percentage of its profit lower than 67 % the - Thompson division’s profit can’t be lower because the overhead costs and 67 % of margin should be adjusted to follow the market price in the end Market Price approximately = $ 430 THOMPSON DIVISION: Thompson’s selling price to Northern Division = $ 430 20% profit margin Thompson’s out-of-pocket costs (new out-of-pocket costs: $ 430 / 1.2 = $ 358.33) Other overhead costs (outsider suppliers) = $ 358.33 = $ 120 ----------- New Southern’s selling price to Thompson Division= $ 238.33 SOUTHERN DIVISION : Southern’s out-of-pocket costs (60% x $ 280) New Southern’s profit / $ 168) ($ 238.33 - $ 168 = $ 70.33) = $ 168 = $ 70.33 42% ($ 70.33 - From the calculation, there is a reduction profit margin in Southern division from 67 % to 42 % so the price could meet with the market price - Top-level management should develop an arbitration committee to provide the best solution based on profit sharing and profit mechanism for the company as a whole without affecting the decentralization that has been well established - Profit sharing itself is dealing with the share of profit in each division so that each division could well operate. - Profit mechanism more dealing with efficiency and effectiveness on each division such as excess inventory, production and operation capacity. THANK YOU