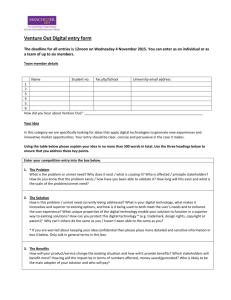

a review on venture capital

advertisement