Perkins Compliance

advertisement

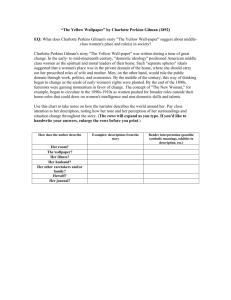

PERKINS COMPLIANCE PREPARING FOR SUPPLEMENTAL MONITORING Monieca West ADHE Federal Program Manager October 19, 2012 COMPLIANCE REVIEWS Annual Compliance • Annual • Routine • Focus • Program • Fiscal • Accountability Supplemental Monitoring • As needed • Need based on risk • Risk determined by points • • • • • • • • Grant size Coordinator tenure Unused funds Reimbursement patterns Programmatic deadlines Amendment patterns Improvement plan status Other compliance areas ADHE AUTHORITY PERKINS SEC. 122. STATE PLAN. • (c) Plan Contents- The State plan shall include information that-• (11) provides assurances that the eligible agency will comply with the requirements of this Act and the provisions of the State plan, including the provision of a financial audit of funds received under this Act which may be included as part of an audit of other Federal or State programs STATE PLAN • Annual on-site compliance/technical assistance • Risk management plan FINANCIAL GOVERNANCE AUTHORITIES • The Carl D. Perkins CTE Act of 2006 • EDGAR (Education Department General Administrative Regulations) • OMB Circulars (Office of Management and Budget) • A-87—Cost Principles for State and Local Governments • A-21—Cost Principles for Postsecondary Educational Institutions • Arkansas Perkins State Plan for Career and Technical Education • Arkansas Department of Higher Education Policy Defaults to the most restrictive SUPPLEMENTAL MONITORING CHECKLIST WW W . A D H E P E R K I N S . C O M / F O R M S . H T M L WWW.ADHEPERKINS.COM GENERAL ACCOUNTING • Personnel interviewed: • Describe how transactions are recorded in the accounting system. • Who posts A/R, A/P, general ledger? Who signs checks? Who reconciles bank statements? How are ETF transactions handled? • How are purchase discounts, rebates, returns and refunds accounted for? • Supporting documents accompany checks to be signed. • Promptness of recording of transactions. • Approvals for correcting/adjusting entries. • Frequency of financial reports. • Access to accounting records. • Source documents available for examination (approval/obligation/payment/reimbursement). • Previous year audit findings. PERKINS ACCOUNTING • • • • • • • • • • • • • Personnel interviewed: Responsibility for Perkins fiscal management. Process for classification as Perkins expenditure. Documentation of cost sharing with other programs/grants. Perkins coordinator approves all Perkins related expenses. Frequency of financial reporting to Perkins coordinator. Authority for expensing to Perkins. Alignment of Annual Plan budget with institution Business Office account coding. Control for supplanting. Reversing entry process and approvals. Quarterly comparison of budget to actual and reconciling amendments if needed. Control for allocability (CTE limitation/proportionality). Retention of records (3 years from date of final expenditure report for given year). INVENTORY • Personnel interviewed: • Adherence to procurement standards, including competition. • Process for tracking Perkins funded equipment. • Complete listing of Perkins funded inventory (item/serial number/inventory number/acquisition date/location/cost and % Federal /disposal). • Items disposed of appropriately. • Items physically found at location records indicated. SALARIES AND WAGES • Personnel interviewed: • Time and effort documented for Perkins funded salaries (monthly for multiple cost objectives or semi-annually for single cost objective). • PARs reflect after-the fact distribution of actual activity, account for total employee activity, and signed by employee and supervisor.) • Prorated salaries are reconciled quarterly and activity budgets amended as needed. • Name of all Perkins funded employees and % Perkins funding. CONSORTIA • Personnel interviewed: • Memorandum of Agreement in place and signed by member institutions. • Distribution of funds is by method other than what institutions would have received using Pell/BIA formula. • All member institutions receive benefit. • Fiscal agent maintains administrative responsibility for annual plan, reimbursements, accountability and improvement plans. • Member agencies provide fiscal agent with information and documentation necessary to meet program, financial and accountability requirements. COMPLIANCE REVIEW CHECKLIST WW W . A D H E P E R K I N S . C O M / F O R M S . H T M L REVIEW ELEMENTS • • • • • • I. II. III. IV. V. VI. Program Review Fiscal Review Accountability/Program Improvement Review Other Information/Technical Assistance Activities Review Summary/Exit Interview I. PROGRAM REVIEW • Personnel interviewed: • Review how Perkins supports or is integrated into institution’s CTE improvement activities, including institutions requirement for addressing Required Use of Funds. • Review how activities are selected for Perkins funding. • Review how data is used to determining activity selection and clearly defining CTE goals. • Review how special populations and nontraditional students are supported. • Review how institution links with secondary programs for seamless transition from high school to college. • Review how professional development is funded and targeted. • Review how institution assesses effectiveness of Perkins funded activities. • Review consortia issues or concerns, if appropriate. • Verify current AA page. • Verify current PoS documentation. • Review organization and management of Perkins programs and records. II. FISCAL REVIEW • Personnel interviewed: • Review financial management system as related to Perkins, including quarterly reconciliation. • Review PARs on file for Perkins funded positions. • Review documentation of admin funds, including Indirect Cost Rate Letter, if appropriate. • Review Perkins inventory management system and physical check of selected items. • Review selected expenditures (Annual Plan approval through Request for Reimbursement). • Review Supplemental Review areas of concern. ___ Unused Funds ___Late reports ___Results ___Amendments ___Tenure III. ACCOUNTABILITY REVIEW • • • • • • Personnel interviewed: Review collection and reporting of Special Populations information. Review collection and reporting of Technical Skills Assessment results. Review how Perkins performance results are used on campus. Review historical results and future year targets. Review progress on Improvement Plans, if appropriate. IV. OTHER/TECH ASSISTANCE • • • • • • Personnel interviewed: Review collection and reporting of Special Populations information. Review collection and reporting of Technical Skills Assessment results. Review how Perkins performance results are used on campus. Review historical results and future year targets. Review progress on Improvement Plans, if appropriate. V. ACTIVITIES REVIEW • Review progress to date (interview person responsible for implementing activity) • Review assessment method tracking • Review End of Year Program Report from previous year, including professional development impact VI. SUMMARY/EXIT INTERVIEW • Review progress to date (interview person responsible for implementing activity) • Review assessment method tracking • Review End of Year Program Report from previous year, including professional development impact • Perkins reauthorization update. POST REVIEW • Compliance review summary drafted. • If there are findings, coordinator is given a chance to review. • Report uploaded to Portal and coordinator notified. • Written Compliance Review Report provided to president/chancellor. PREPARING FOR VISIT • Review the checklist and anticipate the discussions. • Have appropriate staff available. • Perkins Team representation • Business office • Lead person for each funded activity • Have Perkins documents available. • • • • • • Financial documents Inventory records and access arranged PARs Program of Study documentation Indirect cost rate letter Improvement plan progress QUESTIONS MONIECA.WEST@ADHE.EDU BRINDA.BERRY@ADHE.EDU