Town of Windham, NH

advertisement

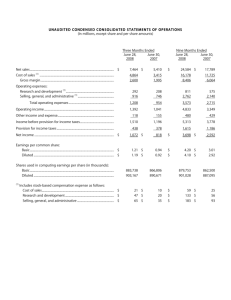

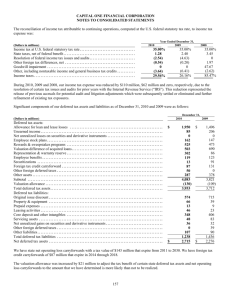

Review of Audited Financial Statements as of and for the Year Ended June 30, 2013 As one should expect, the City received an Unmodified Opinion on its financial statements as of and for the year ended June 30, 2013. The City also received an Unmodified Opinion on its Federal Compliance Audit. There were 2 new pronouncements implemented during the year ending June 30, 2013: ◦ GASB 63 – Financial Reporting of Deferred Outflows of Resources, Deferred Inflows of Resources, and Net Position ◦ GASB 65 – Items Previously Reported as Assets and Liabilities These 2 new pronouncements resulted in the following changes to the City’s financial statements: o Previously classified “assets” have been split into “assets” and “deferred outflows of resources” o Previously classified “liabilities” have been split into “liabilities” and “deferred inflows of resources” o The previous terminology of “net assets” has been changed to “net position” Financial Highlights ~ ◦ Total assets and deferred outflows of resources of the City amount to $82.7 million. The majority consists of capital assets of $59.1 million and another $15.7 million in cash and investments. ◦ Total liabilities and deferred inflows of resources of the City amount to $57.6 million. The majority pertains to outstanding bond obligations of $34.7 million and unearned property tax revenue of $9.2 million. Financial Highlights (continued) ~ ◦ Net Position at June 30, 2013 for the City totaled $25.1 million as follows: net investment in capital assets of $26.1 million restricted net position of $274 thousand the balance of ($1.2 million) represents a deficit as the compensated absences and OPEB are unfunded liabilities Total revenues and other financing sources exceeded budgeted estimates by $21 thousand. This favorable variance amounts to .06% of the total estimated revenues of $35,652,923. Great job in estimating the fiscal year revenue! Total expenditures and other financing uses of $35.8 million were $438 thousand less than final budgeted amounts. This favorable variance amounts to 1.21% of the total appropriations of $36,248,923. Again, very good job in managing the City’s finances within the approved budget. The Budgetary Fund Balance is what is available to manage the City’s tax rates. The change in budgetary fund balance is as follows: Budgetary Fund Balance – July 1, 2012 Net change in fund balance Budgetary fund balance - June 30, 2013 $4,476,762 ( 136,657) $4,476,762* The decrease in fund balance was anticipated since $350,000 of the City’s fund balance from June 30, 2012 was used to reduce the tax rate * detailed on the next page The components of the budgetary fund balance are as follows: Nonspendable: Prepaid expenses Assigned: Designated to offset subsequent fiscal year tax rate Unassigned: General operations $ 32,412 325,000 4,119,350** ** The City’s fund balance policy is to strive to maintain an unassigned fund balance equal to 5-17% of the total appropriations of the community. ACTUAL PERCENTAGE 9.61% 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0 2010 2011 2012 Nonspendable Assigned Unassigned DRA recommended (at 17%) 2013 The City of Somersworth has two significant enterprise funds – the Water Fund and the Sewer Fund Several resolutions were previously passed authorizing the increase in user fees for both water and sewer users. The following charts show the positive impact that these increased user fees have had on each fund. Water Fund 2,500,000 2,000,000 1,500,000 1,000,000 500,000 (500,000) FY10 FY11 FY12 FY13 (1,000,000) Cash & equivalents Unrestricted Net position Revenues Expenses Sewer Fund 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 (500,000) FY10 FY11 FY12 FY13 (1,000,000) (1,500,000) (2,000,000) Cash & equivalents Unrestricted Net position Revenues Expenses The last rate increase was effective July 1, 2011. The rate increases and the change to monthly billings has effectively achieved the following: Advances from the General Fund have been repaid Cash and equivalents are now positive figures Cash flows have improved due to the monthly billings The unrestricted net position has increased The water fund and sewer fund have achieved the status of “self-supporting” enterprise funds! The City expended approximately $1.8 million in federal awards, and a federal compliance audit was also performed. Of the federal awards, $1.59 million (or 89.3%) pertains to the school department. As part of the federal compliance audit, we tested the City’s internal control over both financial reporting and on compliance with the federal awards. We are pleased to report that there were no deficiencies or weaknesses identified and no findings or questioned costs to report. Congratulations on your outstanding efforts! On behalf of myself and the members of our firm, we thank you for allowing us to serve as your independent auditors. We also want to express our appreciation to the management team, especially the finance office within the City and the school department, for their assistance during the audit.