Investment Analysis & Portfolio Management Lecture 1 MARKET

advertisement

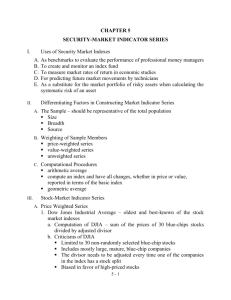

Investment Analysis & Portfolio Management Lecture 1 MARKET INDEXES Introduction: Indexes are useful in assessing investment results. They provide a benchmark against which performance can be compared. They also useful in financial research, through which an investigator seeks to discover the relationship between certain economic variables and market results. In fact, most of us keep abreast of developments in “the market” by watching the indexes. Because television or radio announcers cannot possibly cover price changes for every security, they quote the value of some wellknown market measure, such as the Dow Jones Industrial Average. On-the-hour radio news frequently concludes with a statement such as “On Wall Street, the Dow Jones Industrial Average is up 123 points on volume of 630 million shares.” To investors everywhere, this news is an indicator of the day’s market activity and a good clue as to what is happening with their own favorite securities. This chapter provides an overview of some of the most popular indexes. Index Construction: Indexes can be useful in following investment performance, but only if an investor knows what the index is measuring and how similar the index is to a particular investment portfolio. Knowing that the general level of bond prices in Singapore declined today may not tell investors much about how U.S computer stock fared. Price Weighting: A price-weighted index is composed of a single share of each of the index component, regardless of the price of the share or the size of the underlying company: the Dow Jones Industrial Average (DJIA) is an example of such an index. The first step the 30 industrial companies comprising the index. A problem with a price-weighted index lies in the distortions that occur when a company in the index chooses to split its stock. On day one the value of a portfolio composed of one share in each of the three stocks is $60. On day two, company a splits its shares three for one, which causes company A’s share price to fall to $10. One share in each of the three companies now costs a total of $40. Someone unaware of company A’s stock split would observe the decline in the index from $60 to $40 and conclude that the market lost a third of its value overnight. This conclusion however would obviously be inaccurate because the decline in value stemmed purely from an accounting change. To deal with this problem, analyses use a divisor to adjust the value of the portfolio before reporting the final value of the index. The divisor ensures the index does not change artificially because of the split. Some interpretation problems arise with a price-weighted index. For one thing, highvalue stocks carry more weight than lower-valued issues, which may distort the bigger picture the index purports to provide. Also price weighting carries a bias against a growth stock. As its price raises a growth stock share carries more weigh in the index. After the shares reach too high a price, the company splits the shares thereby knocking the price down and reducing the company’s influence in the index. St. Paul’s University 157 Investment Analysis & Portfolio Management Also the index provides no consideration of any dividends paid by the company. A price-weighted index might begin and end the year at a value of 100.00. It would be incorrect to assume that an investor in the index earned no return; any dividends received are being ignored. The index divisor accounts for artificial price changes due to stock splits. Equal Weighting: An equal weighting index reflects the performance associated with selection of a particular security by chance. For instance, an equal-weighting index of the ten securities would be based on one-tenth of the performance of each of the ten companies. Performance is measured by price change rather than by price alone. Equal weighting of the resulting returns represents the statistical average of random security selection. Equal weighting is theoretically preferable to price weighting. An equal-weighting index can be calculated with or without dividends. Including dividend can only make returns larger, so their omission results in a downward biased measure of market activity. In capitalization weighting, share price is multiplied by the number of outstanding shares. Capitalization Weighting: Capitalization weighting is also called value weighting. This method weights components by the size of the company rather than by the value of a share. Share price is multiplied by the number of shares outstanding. This value is summed for each component of the index, with the total compared to some arbitrary starting value. POPULAR INDEXES: Stock Indexes: Probably no one knows precisely how many different stock indexes exist at any given time even considering just those indexes in the United States. Globally, the chore of maintaining an accurate accounting of each index is probably impossible. Now measures are continually being added and some are deleted as more effective ones come about. The continued success of the options market frequently spawns a new index. A person can trade put and call option on dozens of different U.S stock indexes. These range from the classic Dow Jones Industrial Average to the more contemporary Street.com index. 1. Dow Jones Averages: To the general public, the Dow Jones averages are probably the most familiar stock market indictors. The four primary averages are the industrial average the transportation average, the utilities average, and the Dow Jones composite. Dow Jones & Company introduced the Dow Jones Industrial Average in 1896. Initially the index was based on the value of 12 companies. The first value of the average was 40.94 on May 26, 1896. St. Paul’s University 158 Investment Analysis & Portfolio Management Since 1928, 30 large blue chip companies have comprised the index. General Electric is the lone survivor of the original group. The other 29 companies have either merged, changed names folded, or been replaced with another firm. With 30 stocks in the index, the initial value of the divisor was 30. Stock splits reduced it to 16.67 later that year. Changing the index components can result in a substantial change in what the index measures. Replacing a troubled firm with a strong one clearly makes before and after components difficult. The capricious nature of this index, along with the other shortcoming mentioned earlier, are reason why the Dow Jones averages are the seldom used in financial research or for performance appraisal purposes. Investors might wonder why the Dow is price-weighted rather than value-weighted. According to the editors of the Wall Street Journal, the answer lies party in the technology of Charles Dow’s day; he needed something that was easy to figure with paper and pencil: in fact, he probably never imagined a market-weighted index because there was no ready means available to make the calculations required. And the Journal’s editors today feel there’s no reason to thinker with the formula because, oddly enough, the seemingly simple method actually works. Despite its shortcomings, the Dow has always had fierce supporters. An especially vocal cheerleader was the writer Richard Russell, who helped publicize the Dow Theory technical analysis system. He recorded these comments in Barron’s magazine in 1959; “The closing prices of the Dow Jones rail and industrial averages give us a complete index of everything known by anybody that can possibly affect the economy and corporate profits (excluding acts of God).” While you won’t find many investment advisors willing to go this far out on a limb today, most still follow the index and take note of it when the news reports it. The Dow Jones Transportation Average is like the DJIA expect that it includes 20 transportation companies. The Dow Jones Utility Average contains 15 public utility stocks. The Dow Jones Composite contains all65 stocks in the DJIA, DJTA and DJUA. The composite index is sometimes referred to as “65 stocks”. In addition to these well-known averages, Dow Jones publishes 105 different industry groups indexes ion the basic materials, conglomerate, consumer (cyclical), consumer (non-cyclical), energy, financial, industrial, technology, and utilities areas. To give an idea of the precision with which some people select their index of choice, one of the Dow Jones indexes is “computers with IBM”, while another is “computers, without IBM” take your pick. The industry groups are all on a June 30, 1982, value of 100. There are a variety of other narrowly focused or specialized Dow Jones indexes useful to certain market followers. 2. Standard & Poor’s Indexes: Not surprisingly, the Standard & Poor’s Corporation also prepares and publishes a large number of indexes. The calculation method for all S&P indexes is identical. The S&P 500 Composite is probably the most widely used. This value-weighted index contains 500 NYSE-traded securities. Standard & Poor’s describes it as “an index of leading companies in leading industries.” It is not, however, the 500 largest U.S stocks, although many people erroneously believe so. St. Paul’s University 159 Investment Analysis & Portfolio Management It is important to recognize that just because there are 500 stocks in the S&P 500 index this does not mean that the index cannot be swayed by individual stock performance. Because it is value-weighted, it does not have a problem with the stock splits. Still a divisor is necessary for three reasons. One reason stems from the impact of the replacement of a firm in the index. Second reason is the issuance of additional shares by a firm in the index. A primary offering essentially brings capital into the index without stock market movement. If no adjustment were made for the sale of new shares; returns calculated from the index would be biased upward. A third reason is a corporate decision to purchase the firm’s own shares, taking capital out of the index. The S&P 500 index is based on an initial value of 10.00 associated with the 1941-1943 time period. In April 2000, the index stood at about 1,455, meaning that shares values were, on average, about 146 times what they were during World War II. In late 1999, the median market value of a stock in the S&P 500 was about $7.3 billion. Investors in mid-cap or small-cap stock will find a suitable benchmark on the S&P menu. The S&P Mid Cap 400 as the name suggest, contains 400 mid capitalization. The S&P Small Cap 600 is 600 small cap stocks. Other Standard & Poor’s indexes include the S&P 100, S&P Financial Stocks, S&P 20 Transportation Stocks, and the S&P $0 Utility Stocks. The S&P 100 ticker symbol OEX, is especially popular in option users. OEX option provides a convenient way to hedge market risk or to speculate on market movements. In May 1992 Standard and Poor’s, in conjunction with the well known market research firm BARRA, announced two new indexes designed to provide a benchmark for the growth and value investment styles. These are the S&P 500/BARRA Growth index and the S&P 500 Value index. These two indexes are constructed by essentially partitioning the stocks in the S&P 500 by their price to book ratio. The two groups do not necessarily’ contain the same number of securities. On September 30, 1995, there were 317 stocks in the Value Index and 183 in the Growth Index. Because there are always 500 stocks in the S&P 500, there will always be a total of 500 stocks in the two indexes. Others: The New York Stock Exchange publishes its own indexes based on the industrial firms, transportation firms, and utilities, among others, traded at the exchange. The most widely quoted is the NYSE Composite an average of all NYSE listed stocks. The American Stock Exchange prepares a similar index on its securities as does the NASDAQ market. Value Line publishes an index based on the securities covered in the Value Line Investment Survey. Some portfolio managers find the Russell 3000 index particularly useful. For years S&P 500 index was considered the "best" proxy for the over all stock market, but increasing evidence indicates this generalization may no longer be true. The S&P500 index is 95 percent comprised of large capitalization stocks, while large caps stocks make up only 73 percent of the market as a whole. Extensive financial report supports the hypothesis that small capitalization stocks often do better than their larger counterparts. Consequently many portfolio managers consciously include small cap stocks in their funds. The Russell 3000 index is a mixture of both large and small capitalization stocks. St. Paul’s University 160 Investment Analysis & Portfolio Management According to a study done by Value Line, in 1991 the S&P500 posted a total return of 36.6%, while the total US. Equity market returned 33.4%. The Russell 3000 index returned 33.7%, much closer to the over all market average than the S&P 500 performance. The Frank Russell Company, from Tacoma, Washington, prepares the Russell 3000. It also provides Russell 2000, which deals only with small cap stocks. In early 1995 the firm established four new indexes based on firm size and investment management style: the Russell Madcap Growth Index, the Russell Midcap Value Index, Russell Top 200 Growth Index, and Russell 200 Value Index. The Russell 3000 index is a mix of both large- and small- capitalization stocks and, to many portfolio managers a better presentation of the broad market. Fixed Income Indexes: More than 400 indexes measure fixed income securities. Despite what the typical investor might think, bonds vary widely in their riskiness and investment characteristics. When comparing performance, investors need to distinguish between corporate bonds, tax- exempt bond, foreign bonds, short and long term bonds, investment grade and junk bonds, and so on. The wide range of available indexes increases the likelihood that investors can identify a benchmark with characteristics they want. The Dow Jones 20 Bond Index is part of the Dow Jones &Company stable of market indexes. Standard &Poor's has more than a dozen indexes of bond, market. Two especially important ones are the S&P Municipal Bond Index and the S&P U.S. government Bond Index. The investment banking firm Salomon Smith Barney prepares about 45 indexes. Most noteworthy is the Salomon Smith Barney Corporate Bond Index. Lehman Brothers and Merrill Lynch compute and maintain another 130 indexes. Moody's Investors Service publishes about 20 of its own. Some indexes are especially specific. J.P. Morgan prepares an emerging markets bond index designed to provide an overview of commercial lending in the developing markets of the world. The company also maintains an index of foreign government bonds. Value Line has an index on 585 convertible bonds. Other indexes deal with mortgaged backed securities. International Indexes: The popularity of international investing has triggered an increasing number of useful global indexes. Some of these owe their creation to the popularity of trading in derivative instruments such as futures and options contracts. 1. European Indexes: In the United Kingdom, the most important index is probably the FT-SE, 100, known as the "Footsie 100". This Financial Times stock exchange is based on the 100 U.K. stocks with the largest capitalization. In Germany, the principal index is the DAX30, specifically introduced for the trading of futures contracts. This total return index includes the reinvestment of dividends on the individual components. In France, the CAC40 and Italy the MIB30 were both created for the trading of equity index futures. 2. Asia and the Pacific Rim: Japan is the principal market in Asia, although Hong Kong and Singapore are rapidly rising in importance. Japan has the Nikkei 225, a price weighted index that has been around since 1949. This is index contains 225 large, activity traded Japanese stocks on the Tokyo Stock St. Paul’s University 161 Investment Analysis & Portfolio Management Exchange. Another Japanese index, TOPIX, includes about 1,200 large companies. A recent addition for futures market purposes is the Nikkei 300, a capitalization weighted index like the S&P500. Australia has the all Ordinaries index, which covers 240 stocks and is capitalization weighted. In Hong Kong, the Hang Seng predominate covering 33 stocks, it is also capitalization weighted. Summary: Indexes are useful in assessing the performances of an investment. It is important, however, to ensure that the chosen index is an accurate proxy for what investors want to measure. A stock index should not be used with a bond portfolio, nor should an index of large-capitalization stocks (like the S & P 500) be used to judge a small-cap stock portfolio. An investor can choose from any of the hundreds of indexes. For equity securities, the Dow Jones Industrial Average and the S & P 500 stock market index are the best known. For the purposes of financial research, the Standard & Poor’s 500 are much more useful than the Dow Jones Industrial Average. A price-weighted index assigns heavy weight to high priced stocks and makes use of a divisor to adjust for stock splits. A capitalization weighted index considers the size of the company and needs no adjustment for stock splits, but must be adjusted for changes in index components, primary stock offerings, and share repurchases. St. Paul’s University 162