TASBO Breakout Session

advertisement

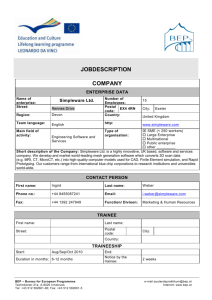

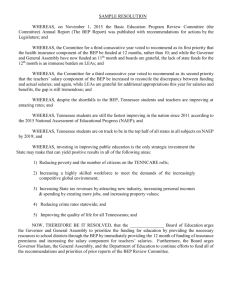

Understanding the BEP TASBO Breakout Session Murfreesboro, Tennessee November 16, 2011 History of the BEP 1977—enactment of Tennessee Foundation Program— funding formula that increased state’s contribution and used local property value to determine a county’s ability to pay. Late 1980’s—Tennessee Foundation Program (TFP) State Board of Education began working with various groups to reform education funding TFP appropriations were around $900 million Weaknesses in the TFP: Inadequate No adjustment for inflation Targeted “formula”—inflexible funding Insignificant amount of funding for consideration of local ability to pay 2 History of the BEP 1988—77 Small school systems sued the state, claiming TN’s funding formula was inequitable. TN Supreme Court agreed and ordered the state to develop a plan to correct the school funding program. 1992—passage of the Education Improvement Act, which implemented a new funding formula, called the Basic Education Program (BEP). Funding mechanism with components necessary for funding a “basic” education No “targeted” funding. Funding is flexible: BEP is a funding formula not a spending plan. Formula considers local ability to pay at a more significant level. 3 History of the BEP 2007—BEP 2.0 passed Largest increase in state funding for education--$280 million Not fully implemented. Cost to fully implement-$205 million BEP (Old Model) BEP 2.0 current BEP 2.0 full implementation $36,515 Salary Unit Cost $38,000 Salary Unit Cost $40,000 Salary Unit Cost 100% TACIR 50% TACIR, 50% CBER 100% CBER 100% CDF 50% CDF Eliminate CDF 38.5% At Risk Funding 100% At Risk Funding 100% At Risk Funding 1:45 ELL, 1:450 Translators 1:30 ELL, 1:300 Translators 1:20 ELL, 1:200 Translators 65% State Share Instructional 4 75% State Share Instructional 70% State Share Instructional FY12 BEP--By the Numbers 950,244 $3,754,398,000 62,370 $76.75 $38,700 560,000 5 FY12 BEP--By the Numbers 950,244—Total funded ADMs $3,754,398,000—State Cost of BEP 62,370—Professional positions generated $76.75—Unit cost for Textbooks $38,700—Teacher Salary Unit Cost 560,000—At Risk Students 6 BEP—many inputs ADMs Fiscal Capacity CDF Unit Costs 7 BEP Salaries, Retirement, Insurance How Does the BEP Work? Two Separate Parts: Funding—Department of Education determines need. Local Ability to Pay or Fiscal Capacity— Tennessee Advisory Commission on Intergovernmental Relations (TACIR) and UT Center for Business and Economic Research (CBER) provide fiscal capacity indices. 8 Determining Need--ADMs ADMs (average daily membership) drive the Formula— funded on prior year’s ADMs Regular ADMs, Special Ed Identified and Served, Vocational WFTEADM Funding months and weighting month 2 - 12.5% month 6 - 35.0% month 3 - 17.5% month 7 - 35.0% ADMs generate: Positions—teachers, supervisors, assistants Funding dollars—ADMs are multiplied times a Unit Cost Supplies, equipment, textbooks, travel, capital outlay, etc. 9 Unit Costs—source and calculation Equipment, supplies, travel, substitute teachers—actual costs from E-reporting. 3 year average average is inflated up two fiscal years Textbooks—projected current year cost obtained from Office of Textbook Services 3 year average average is inflated up one year Alternative Schools, Duty Free Lunch, Maintenance and Operations Prior year value inflated up one year Capital Outlay Square footage cost obtained from RS Means publication Formula –each ADM generates square footage, multiply times cost, include architect fees and equipment. Then amortize to arrive at yearly cost. 10 BEP Components by Category (45) Instructional Classroom Non-classroom Regular Education Vocational Education Special Education Elementary Guidance Secondary Guidance Elementary Art Elementary Music Elementary Physical Education Elementary Librarians (K-8) Secondary Librarians (9-12) ELL Instructors ELL Translators Principals Assistant Principals Elementary Assistant Principals Secondary System-wide Instructional Supervisors Special Education Supervisors Vocational Education Supervisors Special Education Assessment Personnel Social Workers Psychologists Staff Benefits and Insurance K-12 At-risk Class Size Reduction Duty-free Lunch Textbooks Classroom Materials and Supplies Instructional Equipment Classroom Related Travel Vocational Center Transportation Technology Nurses Instructional Assistants Special Education Assistants Library Assistants Staff Benefits and Insurance Substitute Teachers Alternative schools Exit Exams Superintendent System Secretarial Support Technology Coordinators School Secretaries Maintenance and Operations Custodians Non-instructional Equipment Pupil Transportation Staff Benefits and Insurance Capital Outlay Instructional Category—State Funds 70% 12 Classroom Category—State Funds 75% 13 Non-Classroom Category—State Funds 50% 14 Non-Classroom (continued) 15 Fiscal Capacity TACIR Model Per Pupil Own-Source Revenue Amount of local money that the school systems in the county report that they spend on education, divided by enrollment (average daily membership (ADM) Per Pupil Equalized Property Assessment Total property assessment for the county area, equalized by the appropriate county appraisal-to-sales ratio, and then divided by ADM. This is a measure of the local ability to raise revenue. Per Pupil Taxable Sales Local sales tax base divided by ADM-measure of the local ability to raise revenue. Per Capita Income Per capita income is included in the fiscal capacity model as a proxy measurement for ability to pay for education; and for all other local revenue not accounted for by property or sales taxes. Tax Burden Ratio of total equalized residential and farm assessment in each county divided by the total equalized property assessment. This variable is intended as a proxy for a county’s potential ability to export taxes. A high residential/farm ratio indicates a low ability to pass taxes on to non-residents. Service Burden Included as a reflection of spending needs. It equals average daily membership divided by county population. The greater the number of pupils per 100 residents, the greater the fiscal burden for each taxpayer. 16 CBER Model (New Model) The new formula determines a county’s capacity to raise local revenues for education from its property and sales tax base. Each county’s fiscal capacity is the sum of: The county’s equalized assessed property plus IDBs multiplied by a statewide average property tax rate for education (1.1583%) The county’s sales tax base multiplied by a statewide sales tax rate for education (1.5570%) Each county’s fiscal capacity index is the ratio of its fiscal capacity to total statewide fiscal capacity. CBER Calculation Example Davidson County Equalized Assessed Property plus IDBs (3-year average): $ 19,130,924,199 Sales Tax Base (3-year average): $ 10,702,878,267 Fiscal Capacity =($19,130,924,199 x 1.1583%)+ ($10,702,878,267 x 1.5570%) = $221,593,495+ $166,643,815 = $388,237,310 = $ 388,237,310 /$2,754,000,000 (state total) Fiscal Capacity Index = 14.10% Fiscal Capacity Used in FY12 BEP 50% of TACIR Model & 50% of CBER Model Davidson County Index (TACIR Capacity Index x .50) + (CBER Capacity Index x .50) 14.50% x.50 + 14.10% x.50 =14.30% 20 Davidson County BEP Funding Example Classroom Funding Instructional Funding $ 3,200,000,000 30% Statewide BEP Instructional Salaries State and Local (before fiscal capacity) $ 960,000,000 $ 280,000,000 BEP-Generated Davidson County Funding Before Fiscal Capacity 14.30% $ $ 137,280,000 142,720,000 $ 25% 217,500,000 $ 76,000,000 Davidson County Local Share Requirement (rounded) Amount After Subtracting Local Match 49.0% State Percentage 51.0% Local Share Percentage Statewide BEP Classroom Funding - State and Local (before fiscal capacity) Statewide Local Required Match Local Required Dollars for Classroom Funding BEP-Generated Davidson County Funding Before Fiscal Capacity Davidson County Fiscal Capacity $ 31,103,000 Davidson County Local Share Requirement (rounded) $ 44,897,000 59.1% 40.9% Amount After Subtracting Local Match State Percentage Local Share Percentage Non-Classroom Funding Davidson County Fiscal Capacity Total State BEP Funding $223,217,000 21 870,000,000 14.30% Statewide Local Required Match Local Required Dollars for Instructional Funding $ $ 1,600,000,000 Statewide BEP Non-Classroom Funding - State and Local (before fiscal capacity) 50% Statewide Local Required Match $ 800,000,000 Local Required Dollars for Non-Classroom Funding $ 150,000,000 BEP-Generated Davidson County Funding Before Fiscal Capacity 14.30% Davidson County Fiscal Capacity $ 114,400,000 Davidson County Local Share Requirement (rounded) $ 35,600,000 Amount After Subtracting Local Match 24.0% State Percentage 76.0% Local Share Percentage 22 Coffee County BEP Funding Example Classroom Funding $ 870,000,000 25% $ Instructional Funding 3,200,000,000 30% $ Statewide BEP Instructional Salaries - State and Local (before fiscal capacity) Statewide Local Required Match $ 960,000,000 Local Required Dollars for Instructional Funding 0.80% $ 7,680,000 50% $ 3,840,000 Coffee County School System Share of Local Share Requirement $ 10,260,000 Amount After Subtracting Local Match State Percentage Local Share Percentage 3,130,000 22% 78% Coffee County Schools Percent of ADM BEP-Generated Coffee County Schools Funding Before Fiscal Capacity Coffee County Area Fiscal Capacity Coffee County Area All Schools Local Share Requirement 1,740,000 (rounded) 50% Coffee County Schools Percent of ADM BEP-Generated Coffee County Schools Classroom 4,000,000 Funding Before Fiscal Capacity Coffee County School System Share of Local Share 870,000 Requirement $ Coffee County Area All Schools Local Share Requirement (rounded) 14,100,000 73% 27% $ Coffee County Area Fiscal Capacity $ State Percentage Local Share Percentage $ 1,600,000,000 Statewide BEP Non-Classroom Funding - State and Local (before fiscal capacity) Statewide Local Required Match Non-Classroom Funding 50% $ 800,000,000 0.80% 6,400,000 50% $ 23 Amount After Subtracting Local Match Non-Classroom Funding $ Total State BEP Funding $17,890,000 Local Required Dollars for Classroom Funding 0.80% $ $ 217,500,000 Statewide BEP Classroom Funding - State and Local (before fiscal capacity) Statewide Local Required Match 7,700,000 $ 3,200,000 $ 4,500,000 58% 42% Local Required Dollars for Non-Classroom Funding Coffee County Area Fiscal Capacity Coffee County Area All Schools Local Share Requirement (rounded) Coffee County Schools Percent of ADM BEP-Generated Coffee County Schools Non-Classroom Funding Before Fiscal Capacity Coffee County School System Share of Local Share Requirement Amount After Subtracting Local Match State Percentage Local Share Percentage For further information…. Tennessee Basic Education Program: An Analysis http://www.comptroller1.state.tn.us/orea/ See the Legislative Brief State Board of Education http://www.tn.gov/sbe/bep.html BEP Blue Book—up to date data on BEP components Recommendations of BEP Review Committee 24 Local Funding Requirements and the Basic Education Program 25 Maintenance of Effort • Supplanting test used to insure maintenance of local effort. • Governed by: • TCA §49-2-203; and TCA §49-3-314 • Budgeted local revenue must be equal or greater than the previous year’s amount, unless ADMs have decreased. 26 27 3% Fund Balance Test • If budgeted expenditures exceed revenues, LEA must have 3% of operating expenditures in fund balance, before budget will be approved. 28 TCA §49-3-352(c) Uses of Fund Balance • Provisions applicable after operating budget is adopted. – …shall be available to offset shortfalls of budgeted revenues… – …shall be available to meet unforeseen increases in operating expenses. 29 TCA §49-3-352(c) Uses of Fund Balance • The accumulated fund balance in excess of three percent (3%) of the budgeted annual operating expenses for the current fiscal year may be budgeted and expended for any education purposes but must be recommended by the board of education prior to appropriation by the local legislative body. 30 TCA §49-3-352(c) Uses of Fund Balance • 31 In other words, there is no requirement to have 3% of operating expenses in fund balance – but LEAs cannot use fund balance unless the fund balance exceeds 3% of operating expenses. If the fund balance is in excess of 3% of operating expenses, then the excess can be used for any education purposes, as long as the use is first approved by the board of education.