Lecture11 - UCSB Economics

advertisement

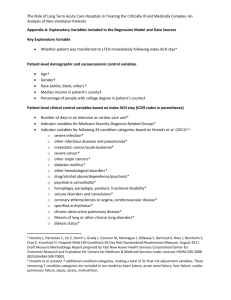

The role of government in health care Today: Reasons for having government-provided health care; Medicare; Medicaid; Reform efforts Last week… We saw that health care costs (as a percentage of GDP) have rapidly increased over the last 50 years Health care insurance Advantages and disadvantages Figure 9.1: US expenditures of selected goods and services as share of Gross Domestic Product (19602004) 18 16 14 Percentage of GDP 12 10 8 6 4 2 0 1960 1964 1968 1972 1976 1980 1984 1988 1992 Year Health Food Clothing and Shoes Housing 1996 2000 2004 Today Government-provided health care Programs Why should government provide health care? Medicare Medicaid The government’s role in health care reform Why should gov’t provide health care? Adverse selection Moral hazard Paternalism Income too low for some people Adverse selection Recall adverse selection problem (see example to the right) The government could force everyone into the same health care plan Pro: Adverse selection problems go away Con: Low-risk people subsidize high-risk people Example: 6 people at a firm Spending if sick: $10,000 3 people have a high risk of getting sick 3 people have a low risk of getting sick 10% each 5% each With no employer contribution, some at low risk do not buy insurance Moral hazard Some activities are more likely to occur to an insured person Bungee jumping Mountain climbing Skydiving Smoking? Bad eating habits? These activities lead to inefficient outcomes The government can intervene to try to discourage these things from occurring Anti-smoking campaigns Commercials promoting good eating habits Prohibiting certain very dangerous activities Withholding care due to dangerous activities Paternalism A paternalist would argue that some people “don’t get it right” when it comes to health insurance These people would say that everyone should be forced to have a minimum level of health care Much of the 2008 presidential debate involved paternalistic arguments Income too low for some people Some people do not make enough money to afford health care Downward spiral Problem made worse by increasing health care cost (see “Downward spiral” at right) Young adults and noncitizens make up a substantial fraction of the uninsured in the US Health care costs go up More people are unable to afford health insurance These people must use the Emergency room, driving up premiums for those insured When premiums go up due to increased numbers in the Emergency room, the cycle repeats What does the government do? The government provides over 45% of health care funds in the United States Two main programs of government-provided health care Medicare People 65 and older Disabled people Medicaid Poor people Refer again to Figure 10.2, p. 207: Source of health care funds in the US Medicare Enacted in 1965 Second largest domestic spending program Funded by a 2.9 percent tax on earnings of current workers Tax split evenly between employers and employees Provides health insurance to seniors and the disabled, primarily through the private sector Seniors must have worked and paid payroll taxes for at least 10 years About 35 million seniors enrolled Medicare: Overview Figure 10.3: Medicare expenditures (1966-2004) 350 3 2.5 250 2 200 Expenditures on Real Medicare as a expenditures Share of GDP 150 1.5 1 on Medicare 100 0.5 50 0 0 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 Year Expenditures (Billions $) SOURCE: Centers for Medicare and Medicaid Services [2005a]. Expenditures as % of GDP 1996 1998 2000 2002 2004 Expenditures as % GDP Real Expenditures (2004 $ Billions) 300 Different aspects of Medicare Parts A and B of Medicare are the largest components Part A: Hospital insurance Part B: Supplementary medical insurance New Medicare component: Part D Prescription drug benefit Part A Hospital insurance Structure for 2008 Monthly premium $423 per month Covered for people that have 10 years of contributions into FICA taxes Must also enroll in Part B if enrolled in Part A (typically) States may be able to help low-income enrollees Various benefits covering Blood Home health services Hospice care Hospital stays Skilled nursing facility care (Source: http://www.medicare.gov/Publications/Pubs/pdf/10050.pdf) Part B Supplementary medical insurance Sometimes optional, depending on whether or not you receive Social Security benefits Enrollment is automatic if you receive Social Security benefits Structure for 2008 All but high income people pay $96.40 per month Benefits Medically-necessary services Preventive services Coinsurance and deductibles may apply, depending on the benefit Part D Prescription drug benefit Benefits began in 2006 Different plans offered Some numbers for the plan in 2006 Expected premium: $386 per year Low-income earners can qualify for lower premiums Benefit structure $250 deductible Beneficiary pays 25% of cost for next $2,000 Beneficiary pays 100% of cost for next $2,850 (“donut hole”) Beneficiary pays at most $5 or 5% thereafter per prescription Cost control measures for Medicare Before 1983, Medicare reimbursement was retrospective for Part A Compensation is made after services are completed Little incentive to economize on costs Since 1983, this changed to a prospective payment system (PPS) Compensation level is set before services start 500 diagnosis related groups exist for the prospective payment system This gives incentives to economize on costs Cost control measures for Medicare Recall DWL that occurs when MB is low PPS appears to have decreased DWL Average stay for Medicare patients in short-stay hospitals decreased from 10.5 days in 1981 to 8.5 days in 1985 The decrease in stay appears to have no effect on health outcomes Cost control measures for Medicare To keep costs down for Part B, a resourcebased relative value scale system is used Fees are set per service provided Does not necessarily keep down number of services If fees are set too low, many medical practices will not accept Medicare patients Medicare patients would then get low-quality care Cost control measures for Medicare Managed-care options Since 1985, Medicare beneficiaries could enroll in HMOs Originally, the HMO received 95% of the average amount that the average patient would require Problem: Adverse selection… Healthier patients enrolled in HMOs The government was overpaying the HMO Cost control measures for Medicare Solution to adverse selection problem: Riskadjusted payments to HMOs Reduced HMO enrollment New methods are being tested to try to increase HMO enrollment and decrease costs simultaneously Medicaid: Overview Figure 10.4: Medicaid expenditures (1966-2004) 3 300 2.5 250 2 200 1.5 150 1 100 0.5 50 0 0 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 Year Expenditures (Billions $) Expenditures as % GDP 1996 1998 2000 2002 2004 Expenditures as % GDP Real Expenditures (2004 $ Billions) 350 Medicaid eligibility 1965: Health insurance for recipients of cash welfare payments 1980s: Children of low-income two-parent families became eligible “Children” can include care to pregnant women 1997: State Children’s Health Insurance Program Allows states to get additional money from federal government to reduce number of uninsured kids Financing and benefits Federal and state governments share the cost Poor states get higher matching rates than rich states Federal government contribution comes from general revenues States must offer major services with Medicaid Hospital stays, physician visits, prenatal care, vaccines for children Financing and benefits States have some flexibility in program administration Example: Capitation-based reimbursement is allowed Recall that health care provider receives annual payment per patient in their care, independent of services rendered Some empirical evidence (Duggan 2004) shows that forcing people into managed care increased Medicaid costs Questionable if this is actually true Medicaid stigma Many people do not enroll in Medicaid Guilty feelings Stigmas Uninformed about benefits Public service announcements help to get more eligible children on Medicaid Person who values private insurance relatively highly F A Person who values private insurance relatively lowly F A Amount of publicly provided insurance F B C M Person who is uninsured before public insurance A B B 0 Quantity of all other goods Quantity of all other goods Quantity of all other goods Does Public Insurance Crowd Out Private Insurance? C 0 M Health insurance Amount of publicly provided insurance C 0 M Health insurance Amount of publicly provided insurance Health insurance Are Medicaid expansions effective? Unclear for two reasons How much is due to crowding out? Many eligible people do not enroll in Medicaid Cutler and Gruber (1996) estimate that about half of new Medicaid enrollment previously had private insurance Card and Shore-Sheppard (2004) estimate that crowding out occurs less than Cutler and Gruber estimate They also find that take-up rates due to expansion are low Health care reform Two factors are leading to more talk about health care reform Increased costs Significant portion of population without insurance Increases cost to others Health care reform Some proposals to try to solve the health care problem Mandating everyone to have insurance Catastrophic insurance Hot topic in the 2008 Presidential race Only provides payment when expenses become large Health Savings Accounts can be used to pay for this type of insurance Nationalized health care… Nationalized health care Pros Everybody is covered Cons Commodity egalitarianism No adverse selection problems Government can use cost-cutting measures to prevent care with low MB Predetermined budget may lead to a suboptimal amount of health care provided Long lines in some cases Government determines what is “medically necessary” New technology may not be adopted quickly Moral hazard problems Is there a solution? Is there a solution to the health care problems presented over the last week? There will probably never be a complete solution Security and efficiency will be “at odds” with each other Some people will always choose NOT to have insurance unless forced to Current trend: More middle-class Americans are deciding to have little or no insurance This increases health care insurance premiums for those that remain insured Downward spiral Is there a solution? What if we are willing to accept new ways for health care and insurance to be administered? We will likely be able to increase security without giving up efficiency Catastrophic insurance may be most important at reducing risk Higher deductibles, co-payments, and coinsurance rates can decrease loss of efficiency Is there a solution? Is prevention the key? Should people be encouraged to eat healthy? Should healthy food be subsidized? Should unhealthy food be taxed? Are taxes on smoking and alcohol set at the optimal level? Should some drugs be legalized, taxed, and regulated? Tax money can be used for health care costs Summary The government provides health care insurance for millions of Americans through Medicare and Medicaid Some believe that every person should be able to access needed health care Adverse selection and moral hazard are significant problems Future health care reforms can try to balance paternalistic views and efficiency Next lecture Social Security Chapter 11 Read pages 228, 232-236, and 240-251 History Current structure Long-run problems due to the graying of America How people’s decisions differ with and without Social Security Problem Timothy has the following utility function U(x, y) = x + (10,000y)½ x denotes Timothy’s consumption on everything except health care y denotes Timothy’s consumption on health care Note: We assume no disutility from work Problem Timothy is currently working 1,500 hours per year Hourly wage is $10 He also receives government health care, valued at $3,000 per year Timothy could work a second job for 700 hours per year Hourly wage is $8 With the second job, Timothy would make too much money for government health care Problem What should Timothy do? We need to find Timothy’s highest possible utility working one job …working both jobs Problem: Working one job Total wages: $15,000 Total government health care: $3,000 Total benefits: $18,000 How does Timothy maximize utility if he has $18,000 in total benefits? Note that at least $3,000 must go to health care Maximize x + (10,000y)½ subject to x + y = 18,000 and y ≥ 3,000 Problem: Working one job Maximize x + (10,000y)½ subject to x + y = 18,000 and y ≥ 3,000 For now, ignore y ≥ 3,000 Maximize x + (10,000y)½ subject to x + y = 18,000 Equivalent to Maximize 18,000 – y + (10,000y)½ First order condition –1 + 10,000½ / 2y½ = 0 y = 2,500 Since Timothy would only want $2,500 in care, he is constrained to take at least $3,000 Utility from working one job Utility when x = 15,000 and y = 3,000 15,000 + (10,000 * 3,000)½ = 20,477 Working two jobs Wages $15,000 from first job $5,600 from second job $20,600 total Working two jobs Timothy’s maximization problem Maximize x + (10,000y)½ subject to x + y = 20,600 Notice that x and y only need to be nonnegative here Maximize 20,600 – y + (10,000y)½ First order condition is the same as with one job y = 2,500 Working two jobs What is Timothy’s utility if he works both jobs? He spends $2,500 on health care He has $18,100 left for everything else Utility is 18,100 + (10,000 * 2,500)½ = 23,100 What should Timothy do? Utility from one job: 20,477 Utility from both jobs: 23,100 Timothy should work the second job and give up his government health care