20150113 IESBA-Transparency International

advertisement

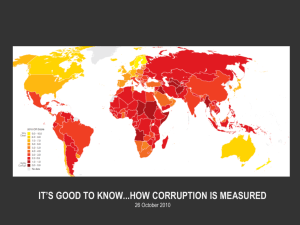

TRAC: TRANSPRENCY IN REPORTING OF Presentation to the IESBA 13 January 2015 Jeff Kaye & Peter van Veen Transparency International UK • Jeff Kaye, FCMA, CGMA – Trustee, Transparency International - UK • Peter van Veen – Director, Business Integrity Programme, Transparency International - UK Transparency International Founded in 1993 Chapters in over 100 countries Specialist anti-corruption NGO Transparency International’s Approach: • Zero tolerance • Corruption has victims • Any bribery embeds corruption in the system • Fighting corruption often requires collective action to achieve systemic change Corruption and Bribery What is corruption? “The abuse of entrusted power for private gain” What is bribery? “The offering, promising, giving, accepting or soliciting of an advantage as an inducement for an action which is illegal, unethical or a breach of trust.” 4 How Does Bribe Paying Happen? Grand Corruption (Large bribes) Offsets Facilitation payments Benefits & Perks to Relatives Gifts Employing of Relatives Hospitality Bribery Education & Training Projects Political donations In-kind help & Charitable donations support Enhanced Agents commissions Copyright Transparency International UK 2011 5 Corruption is a Global Problem Corruption Perception Index (CPI) 2013 What do those in business think of each other? Bribe Payers Index 2011 Corruption links to many other ethical issues… THE TIGHTENING NET 12 Legislation and Regulation increasing 13 UNCAC Anti-corruption Laws • Signatories encouraged to criminalise: – – – – – – Passive bribery of all public officials Illicit enrichment Abuse of function Trading in influence Private sector bribery and embezzlement Money laundering and concealment of assets • Whistleblower reporting and protection measures 14 Common features of anti-bribery laws • • • • • • They seek to punish bribe givers and takers Extra-territoriality Criminal offence Foreign public officials Penalties for individuals and organisations Corporate liability 15 MANAGING RISKS Adequate Procedures – – – – – – High-level commitment Risk assessment Policies and Procedures Implementation (e.g. training, communication) Due diligence assessment of partners, agents and contractors Monitoring and evaluation 17 Risks • Legal – Prosecution – Fines and imprisonment – Large legal and compliance costs. • Organisational – Loss of focus – takes up management time – Huge internal disruption • Reputational – Brand reputation damage – Loss of Key Customers – Loss of staff + decrease in morale 18 THE CHALLENGE OF FOR ACCOUNTANTS Inducements: when does a gift become a liability? • Gifts and hospitality are common in many parts of the world in business • Reciprocity is often (but not always) expected • In some cultures, the size of the gift is directly correlated to the perceived importance of the business relationship • Refusing gifts in many cultural contexts can be fatal for the business relationship • Different cultures/ industries have different expectations and traditions in terms of size of gifts and hospitality • Some companies ban the receipt and giving of gifts The Role of Accountants relating to Corruption • Uncover & Report Corruption/ Whistleblower • Unwitting participant in corruption – Hoodwinked – Negligence • Witting participant in corruption – Willful Blindness – Connivance • Willing participant in corruption – Collusion – Instigator • Illegal vs unethical….. What can Accountants do? • Be familiar with the law • Do not participate in Bribery • Understand where the risk of bribery/ corruption is in their organisation/ industry/ country • Understand the impact of a bribery incident to their organisation • Know what to look for in relation to Bribery • Ensure proper policies and procedures • Create an environment where they are comfortable to ask questions and push back • Be comfortable raising/ reporting concerns to senior management / compliance function or externally if need be Ethics codes – codes within codes Governance Industry A Industry B Industry C Industry D Location PAIBs Other “drivers”* * Education, training, business size, externalities, implementation, sanctions Transparency International Resources www.transparency.org www.transparency.org.uk 25 EXTRA SLIDES SOME ILLUSTRATIVE CASE STUDIES Case Study 1 You are in the process of issuing a tender for a new IT System. This is a significant project running into several hundred thousand Euros. • Bill works for Datax who have done IT work for you over the last few years and you have got to know him very well often meeting for lunch and occasionally playing golf or tennis on the weekend. You consider him a good friend – certainly more a friend than than a supplier –as his last project finished over 9 months ago. • You are due to meet Bill for lunch for a regular catch up and a chance to chat about your mutual interest: mountaineering. • Bill has just called you that he understands that there may be a tender coming up and that this is excellent news. In fact his boss has told him it is OK to put the lunch on expenses and go somewhere a lot nicer than the café you were planning. • Bill jokingly finishes off: “of course we can get the business end done quickly and focus on talking about the real business of our plan to climb K2 !” What do you do? Case Study 2 After a well deserved Christmas break you come back to the office to find 5 boxes on you desk. When you open them up you find the following: • A bottle of vintage champagne from a consultant to celebrate the completion of a major assignment • A Swarovski crystal plaque from one of your clients with an inscription celebrating 10 years of working together • A couple of good bottles of Bordeaux wine from a supplier • A small gold looking statue of an Eagle as a thank you from a delegation from the Gulf that visited you the previous year on behalf of Brunel Energy • A couple of tickets to a musical from a stagiaire thanking you for the opportunity to gain experience What do you do with these gifts? Do you accept them? Case Study 3 Some months ago you asked a distributor for a neighbouring country that you oversee to show a key customer, travelling in that country, around over a weekend. After a long delay, he's finally submitted an invoice for the expense. It is for 6,000 dollars and the transaction is described as "recharge of Distributor's sales promotion expenses". No further details are given. He's calling to chase it up. How would you respond to him? • Olaf: "Hi, did you get my invoice? Could you get it paid soon? We've been out of pocket for many months.” 1. 2. 3. Could you give me a breakdown of your costs? Yes, I've got the invoice. I'll get accounts payable to process it asap. Certainly, I'll get it paid today. You did well. We've done some more business with that customer. I'll keep you in mind if something like this comes up again. 30 • Olaf: "Sure. I can resubmit the invoice with a detailed breakdown and payment receipts. I know the cost is high, but I thought you wanted me to take good care of him. I took him out to the most expensive restaurant and bought some pearls for his partner." The distributor is recounting items that include rather lavish entertainment and gifts. What would you do now? 1. 2. 3. Inform your senior management or legal department about the incident and get advice as to how to proceed. Tell the distributor to leave the invoice as is to mask the problem. Tell the distributor that he overstepped his mandate and must bear some of these costs himself. 31