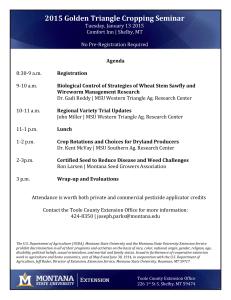

PowerPoint, “Financial Management and Estate Planning

advertisement

MSU Extension Personal & Family Financial Management Publications 1 1 Main Author: Marsha A. Goetting ® Ph.D., CFP , CFCS Professor & Extension Family Economics Specialist Department of Agricultural Economics & Economics 2 2 Family Economics Web site www.montana.edu/ extensionecon/family economics.html 3 Web site www.montana.edu/ extensionecon/ financialpublications. html Print out FREE 4 Order from: store.msuextension. org… but there is a charge for postage 5 5 Available FREE: From local county Extension offices 6 6 Credit Management 7 7 Credit Card Trackers EB-168 Small credit card tracker that fits around credit/debit cards Includes a Record of Credit Card Debt 8 8 MSU Extension Estate Planning Publications 9 9 Main Author: Marsha A. Goetting ® Ph.D., CFP , CFCS Professor & Extension Family Economics Specialist Department of Agricultural Economics & Economics 10 10 Web site www.montana.edu/ estateplanning Print out FREE 11 Available FREE: From local county Extension offices 12 12 Accessing a Deceased Person’s Financial Accounts MT200301HR Describes how heirs can access deceased person’s financial accounts 13 Annuities MT199213HR Provides information about annuities Outlines how to shop for an annuity 14 14 Beneficiary Deeds in Montana MT200707HR Explains how Beneficiary Deeds allow owners of real property to: • Transfer their Montana property to one or more beneficiaries without probate 15 15 Using a Bypass Trust to Provide for Children from Remarried, Step, and Blended Families MT201407HR Explores: • Important issues for Montana families (remarried, step, and blended) about the varying challenges to the estate planning 16 16 process. Montana Common Law Marriage & Estate Planning MT201408HR Explores: • Montana common law marriage from an estate planning perceptive 17 17 Cremation MT200201HR Explores: • Personal & family concerns • State & Federal regulations • Costs 18 18 Designating Beneficiaries Through Contractual Arrangements MT199901HR Learn about transferring your assets through contractual arrangements: • • • • • Insurance policies IRAs Employee benefit plans Payable on death accounts (POD) Transfer on death accounts (TOD) 19 19 Dying Without a Will in Montana: Who Receives Your Property MT198908HR Provides legal terms & detailed examples of possible scenarios for distribution of property if a person dies without writing a will 20 20 Dying Without a Will in Montana: Interactive Web site www.montana.edu/dyingwithoutawill Web site illustrates how your property will be distributed under Montana law if you are a Montana resident and if you pass away without a written will (as do 7 out of 10 Americans) 21 21 Estate Planning for Families with Minor &/or Special Needs Children MT199117HR Explains how to provide for children's physical & financial care in case of parents' death 22 22 Estate Planning: Getting Started MT199508HR Explains how & why to arrange for the future use & distribution of your property 23 23 Estate Planning Tools for Owners of Pets & Companion Animals or Service Animals MT201405HR Outlines legal options for owners who plan to name a caregiver for their pets. 24 24 Federal Estate Tax MT199104HR Analyzes how federal tax laws affect individual estates 25 25 Gifting: A Property Transfer Tool Estate Planning MT199105HR Explains how to use: • Gifts of real & personal property to reduce income taxes & eventually estate taxes 26 26 Glossary of Estate Planning Terms MT200202HR Provides definitions of some of the estate planning terms used in MSU Extension Estate Planning MontGuides 27 27 Letter of Last Instructions MT198904HR Explains what should be included in a letter of last instructions to assist survivors after the death of the writer 28 28 Life Estate: A Useful Estate Planning Tool MT200510HR Explains how to leave a life estate to someone for use during his/her lifetime with estate passing on to the remainderman after the death of the life tenant 29 29 Life Insurance: An Estate Planning Tool MT199211HR Explains uses of life insurance as a part of a family's estate plan 30 30 Long-Term Care Partnership Insurance in Montana MT201202HR Provides basic information about the Montana long-term care partnership insurance program, tax benefits, and shopping tips 31 31 Medicaid & Long-Term Care Costs MT199511HR Outlines the legal & tax ramifications Explores impacts on emotional & physical health of financing long-term care 32 32 Montana’s End-of-Life Registry MT200602HR Answers commonly asked questions about the Montana End-of-Life Registry 33 33 Montana Rights of Terminally Ill Act MT199202HR Describes how a person can choose to terminate his/her medical treatment, if they have an incurable or irreversible condition 34 34 Montana Uniform Transfers to Minors Act (UTMA) Custodial Accounts for Children Under Age 21 MT199910HR Describes how a parent or other adults can make gifts of assets to children: Bequests with a will Distributions from a trust Gifts while living 35 35 Nonprobate Transfers MT199509HR Describes the various forms of ownership that allow the deceased's property to bypass probate & transfer directly to beneficiaries 36 36 Personal Representatives MT199008HR Explains responsibilities of a personal representative when settling an estate 37 37 Power of Attorney MT199001HR Explains how to give another person authority to make financial decisions for you 38 38 Probate in Montana MT199006HR Provides guidelines & costs for the process of settling an estate in Montana 39 39 Property Ownership MT198907HR Describes the three main forms of property ownership: • Solely-owned • Joint tenancy with right of survivorship • Tenancy in common 40 40 Provider Orders for LifeSustaining Treatment MT199008HR Form that gives you control over your medical treatments near the end-of-life. • Recognized as an actual medical order 41 41 Revocable Living Trusts MT199612HR Explains: • Benefits & shortfalls • Costs & tax consequences of living trusts 42 42 Selecting an Organizational Structure for Your Business MT199708HR Describes the various types of business structure: • • • • Sole proprietorship Partnership Corporation (S&C) Limited liability company (LLC) 43 43 Settling an Estate: What Do I Need to Know MT201004HR Assists survivors start the process of settling an estate & ease the burden following the death of a loved one 44 44 Transferring Your Farm or Ranch to Next Generation EB 149 Provides ideas about starting a conversation with family members who are reluctant to discuss estate planning 45 45 What Are Your Rights Over Your Remains? MT200918HR Describes the Montana Right of Disposition Act that allows a person to provide instructions for disposing of his or her remains 46 46 Who Gets Grandma’s Yellow Pie Plate? MT199701HR Explains how to deal with some of the issues that may arise with the transfer of non-titled property 47 47 Wills MT198906HR Outlines why & how to construct a will including: • Costs • Restrictions • Changes after its completion 48 48 Estate Planning: The Basics Packets EB 144 COST $10.00 19 Estate Planning guides Free Additional guides can be ordered Name will be added to a mailing list to receive update when there are state & federal law changes 49 49 Financial Management 50 50 Check Register EB 50 COST $1.00 Detailed instructions explain how to transform an own ordinary checkbook into a handy budgeting tool 51 51 Using a Check Register to Track Your Expenses MT198903HR Accompanies Check Register Tracking System (EB 50) • Explains how to utilize the Check Register 52 52 Developing a Spending Plan MT199703HR Contains worksheets for balancing income & expenses so that money is available for the things families need most 53 53 Helping with Friends Cope with Financial Crisis MT200206HR Explains the resources that are available to help friends that may be in financial crisis 54 54 Schedule of Non-monthly Living Expenses MT198910HR Includes instructions & a worksheet for determining a set-aside amount for a family's non-monthly living expenses 55 55 Using a Homestead Declaration to Protect Your Home from Creditors MT199815HR Explains how to file a homestead declaration to protect equity in home against most creditor’s claims 56 56 Household Record-Keeping 57 57 Record of Important Papers Interactive Form provided by eXtension 58 58 Your Important Papers— What to Keep & Where MT199611HR Offers personalized & efficient system for preserving & safeguarding important family papers Provides a handy reference for deciding what items to keep 59 59 Marriage & Families 60 60 Lending Money to Family Members MT199323HR Analyzes potential hazards of loaning money to relatives Reviews the tax implications & other legal aspects of the various options 61 61 Talking With Aging Parents About Finances MT199324HR Provides strategies for dealing diplomatically with family finance issues with aging parents 62 62 Remarried Families: Making Financial Decisions MT201211HR Tips for developing successful communication about financial goals within a remarried family 63 63 Premarital Agreement Contracts in Montana: Financial & Legal Aspects MT201212HR Helps couples resolve concerns over: • Money • Work • Children • Home • Inheritance and mutual issues 64 64 Saving & Investing 65 65 First-Time Homebuyer Savings Accounts MT199918HR Explains how Montana residents can save money in a special savings account for the purchase of a first home & save on Montana income taxes 66 66 Health Care Savings Accounts MT200704HR Explains the Federal Health Savings Account (HSA) eligibility requirements 67 67 Investing in Certificates MT199801HR Provides information on comparing a range of savings certificates that are available from a variety of financial institutions 68 68 Montana Medical Care Savings Account MT199817HR Explains: • • • • 69 Who is eligible What expenses are allowed How to set up an MSA How much can be saved on Montana Income Taxes 69 Track’n Your Savings Goals MT200303HR Illustrates a technique to help track progress towards achieving family & personal savings goals 70 70 Track’n Your Savings Goals Register EB 164 A 36-page 3x6" savings register fits inside a checkbook cover to keep savings goals handy 71 71