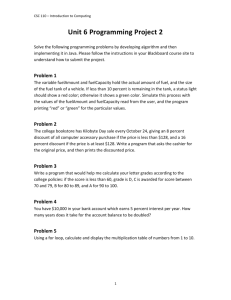

Marketing Indicator 2

advertisement

Marketing Indicator 2.09 Sales Calculations Practice Making Change Practice How would you make or arrange for change in the following situations using the smallest number of bills and coins possible? 1. A customer gives you a $50 bill to pay for $22.61 purchase. What change would you give her? 2. A customer is buying two CD’s that total $15.09, including tax. The smallest bill he has is $20 and he doesn’t want too much change back. What is your response? 3. A customer gives you $40.15 for a $27.15 purchase. How would you count back the change? 4. You are a cashier at Long’s Drugstore, and a customer gives you $20.75 to pay for a purchase of $13.63. Count the customer’s change back to him. Why did he give you the change along with the $20 bill? Sales Calculations Practice Do the sales calculations indicated below. 1. Calculate the amount for each item by multiplying the unit price times the quantity purchased. Dept. Quantity Item Unit Price 12 10 Vests $85.00 16 5 Footballs $15.95 18 11 Clocks $26.50 21 20 Irons $39.95 Total 2. If all of the above items were part of a single purchase, what would be the merchandise total? 3. Determine the price for one can of soda when a six-pack sells for $2.17. 4. Determine the price for two rolls of film when three rolls sell for $12.25. Credit Card Fee Practice Calculate the impact credit card fees would have on the business described below. 1. At Rachel’s Gifts, VISA sales are usually between $13,000 and $15,000 per month. The VISA handling charge for $10,000 - $14,999 is 3% of sales; for $15,000 - $19,999, 2.5%; and for $20,000 $29,999, 2%. a. Rachel had $15,500 in VISA sales one month. How much more would she net than if sales were $14,300? b. How much would Rachel net in that month if her shop did $21,000 in sales Adapted from Marketing Essentials. 2. Rachel has decided to accept the Diner’s Club card in her shop. The handling charges are 1% higher than for VISA at each sales level. If Rachel had $21,000 in Diner’s Club sales, how much more would she pay in handling fees than she does for VISA sales? 3. Rachel had $13,600 in cash sales, $14,800 in Dinner’s Club sales, and $15,200 in VISA sales one month. What were her net sales after handling charges? Sales Tax Practice 1. Assuming a sales tax rate of 8.25%, find the tax and total amount due for each purchase listed below. Round the tax to the nearest cent. Item Price Tires $315 Ski Boots $185 Clock $105 Books $110 Washer $429 Tax Total Return Fee Practice How much will be returned to or paid by the customer in each of the following cases? Assume a sales tax rate of 7%. 1. Mrs. Smith returned a $150 dress that was too large and selected a smaller size in another style priced at $115. How much will you return to her? 2. Mr. Jordan returned a $45 radio because it was apparently defective. He selected another model priced at $75. How much more will you charge him? Sales Tax Practice III Which is the better deal? Sometimes the purchaser of a product has the option to use either a coupon or a discount. In the table below, first compute the market price using a 20% discount. Second, compute the market price using a $10.00 coupon. Finally, circle the better option. List Price ($) Discount (%) 24.99 20 63.98 20 37.00 20 43.00 20 99.98 20 Discount Amount ($) Adapted from Marketing Essentials. Market Price with Percent Discount ($) Market Price with $10 Coupon ($) Making Change Practice Answers 1. Four pennies, a dime, a quarter, two $1 bills (or a $2 bill), a $5 bill, and a $20 bill. Note: If the customer has a penny (for the $.61), then a nickel could substitute for the four pennies. $27.39 2. Ask if the customer has $.09 in change or a dime. 3. By disregarding the exact change provided, the cashier is less like to get confused. Disregard the $.15 and simply say “That’s $27 out of $40; $28, $29, $30 (giving back three $1 bills, one at a time); and $40 (giving back $10) 4. That’s $13.63 out of $20.75; $.64, $.65 (handing back two pennies), $.75 (handing a dime). Then say, “That leaves $13 out of $20; $14, $15 (handing back two $1 bills) and a$20 (handing back a $5 bill). By tendering the $0.75, the customer reduces the amount of small change to be returned to him. Sales Calculations Practice Answers Sales Tax Practice 1. Vests: $850; Footballs: $79.75; Clocks $291.50; Irons $799 2. $2020.25 3. $.36 4. $8.17 Credit Card Fee Practice Answers 1. Tires $333.90 2. Ski Boots $196.10 3. Clock $111.30 4. Books $116.60 5. Washer $454.74 Return Fee Practice 1. 1. $37.45 a. $1,241.50 2. $32.10 b. $20,580 3. $112.35 2. $210 4. $74.90 3. $42,628 Sales Tax Practice II 10 Discount Amount ($) 2.00 Market Price ($) 18.00 29.95 15 4.49 25.46 63.99 20 12.80 51.19 89.88 60 53.93 35.95 List Price ($) Discount (%) 20.00 Adapted from Marketing Essentials. 72.99 5 3.65 69.34 84.00 25 21.00 63.00 102.00 10 10.20 91.80 159.99 20 32.00 127.99 79.98 25 20.00 59.98 24.99 10 2.50 22.49 129.98 15 19.50 110.48 162.00 50 81.00 81.00 74.99 5 3.75 71.24 48.00 20 9.60 38.40 63.98 60 38.39 25.59 249.00 40 99.60 149.40 599.99 25 150.00 449.99 600.00 10 60.00 540.00 649.98 75 487.49 162.49 829.99 5 41.50 788.49 763.88 20 152.78 611.10 Sales Tax Practice III List Price ($) Discount (%) 24.99 20 5.00 Market Price with Percent Discount ($) 19.99 63.98 20 12.80 51.18 53.98 37.00 20 7.40 29.60 27.00 43.00 20 8.60 34.40 33.00 99.98 20 20.00 79.98 89.98 Discount Amount ($) Adapted from Marketing Essentials. Market Price with $10 Coupon ($) 14.99