Appendix

advertisement

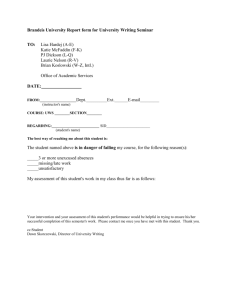

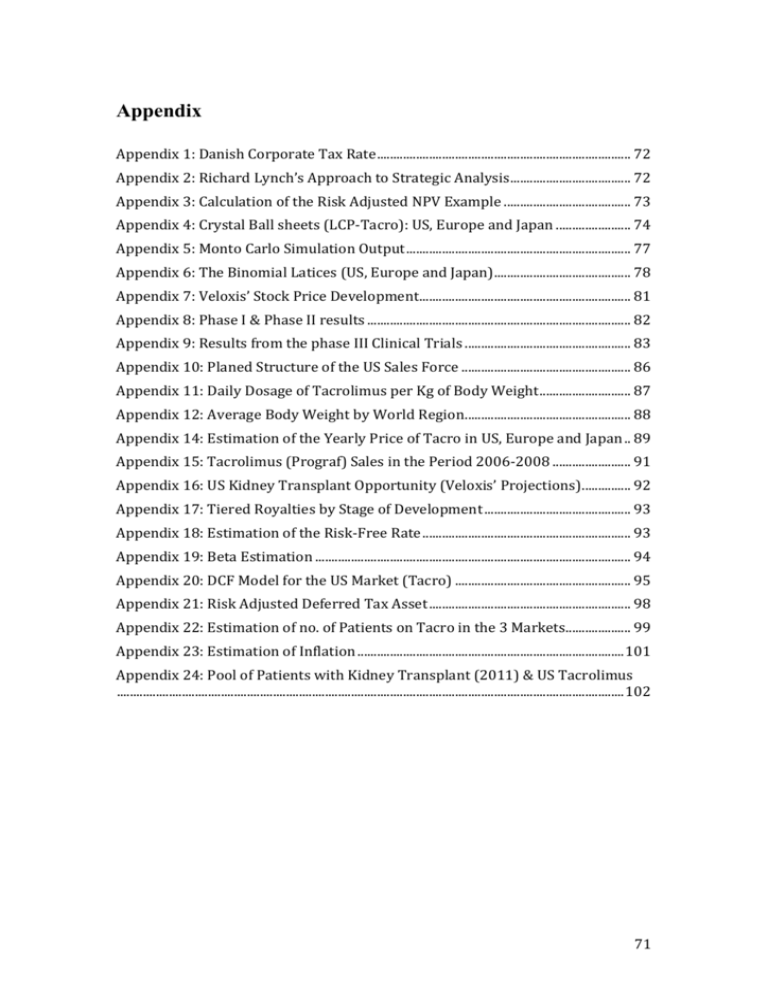

Appendix Appendix 1: Danish Corporate Tax Rate .............................................................................. 72 Appendix 2: Richard Lynch’s Approach to Strategic Analysis ..................................... 72 Appendix 3: Calculation of the Risk Adjusted NPV Example ....................................... 73 Appendix 4: Crystal Ball sheets (LCP-Tacro): US, Europe and Japan ....................... 74 Appendix 5: Monto Carlo Simulation Output ..................................................................... 77 Appendix 6: The Binomial Latices (US, Europe and Japan) .......................................... 78 Appendix 7: Veloxis’ Stock Price Development ................................................................. 81 Appendix 8: Phase I & Phase II results ................................................................................. 82 Appendix 9: Results from the phase III Clinical Trials ................................................... 83 Appendix 10: Planed Structure of the US Sales Force .................................................... 86 Appendix 11: Daily Dosage of Tacrolimus per Kg of Body Weight ............................ 87 Appendix 12: Average Body Weight by World Region ................................................... 88 Appendix 14: Estimation of the Yearly Price of Tacro in US, Europe and Japan .. 89 Appendix 15: Tacrolimus (Prograf) Sales in the Period 2006-2008 ........................ 91 Appendix 16: US Kidney Transplant Opportunity (Veloxis’ Projections) ............... 92 Appendix 17: Tiered Royalties by Stage of Development ............................................. 93 Appendix 18: Estimation of the Risk-Free Rate ................................................................ 93 Appendix 19: Beta Estimation ................................................................................................. 94 Appendix 20: DCF Model for the US Market (Tacro) ...................................................... 95 Appendix 21: Risk Adjusted Deferred Tax Asset .............................................................. 98 Appendix 22: Estimation of no. of Patients on Tacro in the 3 Markets.................... 99 Appendix 23: Estimation of Inflation .................................................................................. 101 Appendix 24: Pool of Patients with Kidney Transplant (2011) & US Tacrolimus ............................................................................................................................................................ 102 71 Appendix 1: Danish Corporate Tax Rate Corporate Tax Rate Denmark 2013 25% 2014 24,5% 2015 23,5% 2016+ 22% Source: http://www.ft.dk/samling/20121/lovforslag/L218/index.htm (Law no. 792 of June 28th 2013) Appendix 2: Richard Lynch’s Approach to Strategic Analysis Richard Lynch's Approach to the Strategic Analysis Society * National & international economy * Technology * Political factors * Sociological factors * Demographic structures Industry * Suppliers * Customers * Competitors Company Source: Schack 2009 72 Appendix 3: Calculation of the Risk Adjusted NPV Example Consider the development of a drug compound, which recently successfully completed phase I. Assume the empirical findings regarding the probabilities of clinical success (section 3.4.1), matches the risk of the compound. Further, it is assumed that the PV of the CF’s is 260, and that PV of the future development costs is 130. Based on these information, the calculation of the risk adjusted NPV is presented below: Example of how to calculate the risk-adjusted NPV Probabilities of clinical sucess Phase II Phase III Approval 56,3% 64,2% 71,0% PV of Cash Flows 260 PV of estimated development costs 130 Cummulative probability of clinical success 25,7% (=56.3%*64.2%*70.0%) Risk Adjusted NPV -63,3 (=(260*25.6%)-130) Source: Own contribution 73 Appendix 4: Crystal Ball sheets (LCP-Tacro): US, Europe and Japan Inputs Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation 2013 25% 7,46% 12,5% 50% 1,41% 5,632 2,13% 2014 24,5% 2015 23,5% 2016+ 22% Crystal Ball DCF (US) 2015 185.117 157.349 11% 2016 187.893 159.709 24% 2017 190.712 162.105 38% 2018 193.572 164.537 56% 2019 196.476 167.005 74% 2020 199.423 169.510 88% 2021 202.415 172.052 97% 2022 205.451 174.633 100% 2023 208.533 177.253 100% 2024 211.661 179.911 100% 2025 214.835 182.610 91% 2026 218.058 185.349 62% 2027 221.329 188.130 41% 2028 224.649 190.951 25% 2029 228.019 193.816 16% 2030 231.439 196.723 12% 2031 234.910 199.674 6% ∑r LN(Vt+1/Vt) -36,8% Patients on LCP-Tacro Lowest no. of patients 2.164 865 8,0 N/A 2.164 -36,8% 80% 0,80 4.791 1.917 8,0 -36,8% 47% 0,47 7.700 3.080 8,0 -36,8% 40% 0,40 11.518 4.607 8,0 -36,8% 29% 0,29 15.448 6.179 8,0 -36,8% 19% 0,19 18.646 7.458 8,0 -36,8% 11% 0,11 20.861 8.345 8,0 -36,8% 5% 0,05 21.829 8.732 8,0 -36,8% 1% 0,01 22.157 8.863 8,0 -36,8% 1% 0,01 22.489 8.996 8,0 -36,8% -8% -0,08 20.772 8.309 8,0 -36,8% -37% -0,37 14.365 5.746 8,0 -36,8% -40% -0,40 9.642 3.857 8,0 -36,8% -48% -0,48 5.967 2.387 8,0 -36,8% -43% -0,43 3.876 1.551 8,0 -36,8% -27% -0,27 2.951 1.180 8,0 -36,8% -68% -0,68 1.498 599 8,0 Patients on immunosuppression Patients on tacrolimus Penetration index 2*sqr(16) st dev Patients on LCP-Tacro in the simulation ∑r LN(Vt+1/Vt) 33,7% LCP-Tacro yearly price (DKK) Lowest yearly price for LCP-Tacro (DKK) 2*sqr(16) st dev LCP-Tacro yearly price in simulation (DKK) 51.463 38.597 8,0 N/A 51.463 Revenue (DKK m) ∑r LN(Vt+1/Vt) Costs Lowest possible costs (DKK m) 2*sqr(16) st dev Yearly costs in simulation (DKK m) 55,7 44,5 8,0 N/A 55,7 Profits (DKK m) Proftis after tax (DKK m) Time factor Discount factor PV of CF (DKK m) Sum of PV of CF's (DKK m) (2013) Sum of PV of CF's (DKK m) (2013) 56 43 2,5 0,84 35,6 2.400,1 2.400,1 PV of CF's (DKK m) (2014) 2579,2 LN(PV2014/PV2013) 0,0720 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 0,069 4.791 7.700 11.518 15.448 18.646 20.861 21.829 22.157 22.489 20.772 14.365 9.642 5.967 3.876 2.951 1.498 33,7% 2,1% 0,021 52.558 39.419 8,0 33,7% 2,1% 0,021 53.677 40.258 8,0 33,7% 2,1% 0,021 54.820 41.115 8,0 33,7% 2,1% 0,021 55.987 41.990 8,0 33,7% 2,1% 0,021 57.178 42.884 8,0 33,7% 2,1% 0,021 58.395 43.797 8,0 33,7% 2,1% 0,021 59.638 44.729 8,0 33,7% 2,1% 0,021 60.908 45.681 8,0 33,7% 2,1% 0,021 62.204 46.653 8,0 33,7% 2,1% 0,021 63.528 47.646 8,0 33,7% 2,1% 0,021 64.881 48.660 8,0 33,7% 2,1% 0,021 66.262 49.696 8,0 33,7% 2,1% 0,021 67.672 50.754 8,0 33,7% 2,1% 0,021 69.113 51.834 8,0 33,7% 2,1% 0,021 70.584 52.938 8,0 33,7% 2,1% 0,021 72.086 54.065 8,0 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 0,078 52.558 53.677 54.820 55.987 57.178 58.395 59.638 60.908 62.204 63.528 64.881 66.262 67.672 69.113 70.584 72.086 111,3 251,8 413,3 631,4 864,9 1.066,2 1.218,2 1.301,9 1.349,5 1.398,9 1.319,6 932,0 638,9 403,8 267,9 208,3 108,0 -3,1% -3,1% 0,82 0,82 125,9 100,7 8,0 -3,1% 0,50 0,50 206,7 165,3 8,0 -3,1% 0,42 0,42 315,7 252,6 8,0 -3,1% 0,31 0,31 432,4 346,0 8,0 -3,1% 0,21 0,21 533,1 426,5 8,0 -3,1% 0,13 0,13 609,1 487,3 8,0 -3,1% 0,07 0,07 650,9 520,7 8,0 -3,1% 0,04 0,04 674,8 539,8 8,0 -3,1% 0,04 0,04 699,5 559,6 8,0 -3,1% -0,06 -0,06 659,8 527,8 8,0 -3,1% -0,35 -0,35 466,0 372,8 8,0 -3,1% -0,38 -0,38 319,4 255,5 8,0 -3,1% -0,46 -0,46 201,9 161,5 8,0 -3,1% -0,41 -0,41 134,0 107,2 8,0 -3,1% -0,25 -0,25 104,1 83,3 8,0 -3,1% -0,66 -0,66 54,0 43,2 8,0 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 0,024 125,9 206,7 315,7 432,4 533,1 609,1 650,9 674,8 699,5 659,8 466,0 319,4 201,9 134,0 104,1 54,0 126 98 3,5 0,78 76,3 207 161 4,5 0,72 116,6 316 246 5,5 0,67 165,8 432 337 6,5 0,63 211,3 533 416 7,5 0,58 242,4 609 475 8,5 0,54 257,7 651 508 9,5 0,50 256,3 675 526 10,5 0,47 247,2 699 546 11,5 0,44 238,5 660 515 12,5 0,41 209,4 466 363 13,5 0,38 137,6 319 249 14,5 0,35 87,8 202 157 15,5 0,33 51,6 134 104 16,5 0,31 31,9 104 81 17,5 0,28 23,1 54 42 18,5 0,26 11,1 74 Inputs 2013 25% 7,46% 12,5% 50% 1,41% 5,632 2,13% 2014 25% 2015 24% 2016+ 22% 2014 105.724 8% 2015 108.367 26% 2016 111.076 57% 2017 113.853 73% 2018 116.130 88% 2019 117.872 97% 2020 119.640 100% 2021 121.435 100% 2022 123.256 100% 2023 125.105 100% 2024 126.982 98% 2025 128.886 74% 2026 130.820 52% 2027 132.782 34% 2028 134.774 18% 2029 136.795 13% 2030 138.847 6% ∑r LN(Vt+1/Vt) -1,5% Patients on LCP-Tacro Lowest no. of patients 2*sqr(16) st dev Patients on LCP-Tacro in the simulation 1.057 529 8 N/A 1.057 -1,5% 120,3% 120,3% 3.522 1.761 8 -1,5% 81,0% 81,0% 7.914 3.957 8 -1,5% 27,2% 27,2% 10.389 5.195 8 -1,5% 20,7% 20,2% 12.774 6.387 8 -1,5% 11,2% 11,2% 14.292 7.146 8 -1,5% 4,5% 4,5% 14.955 7.478 8 -1,5% 1,5% 1,5% 15.179 7.590 8 -1,5% 1,5% 1,5% 15.407 7.704 8 -1,5% 1,5% 1,5% 15.638 7.819 8 -1,5% -0,5% -0,5% 15.555 7.778 8 -1,5% -26,6% -26,6% 11.922 5.961 8 -1,5% -33,8% -33,8% 8.503 4.252 8 -1,5% -41,0% -41,0% 5.643 2.822 8 -1,5% -62,1% -62,1% 3.032 1.516 8 -1,5% -31,1% -31,1% 2.223 1.111 8 -1,5% -75,8% -75,8% 1.041 521 8 ∑r LN(Vt+1/Vt) 33,7% LCP-Tacro yearly price (DKK) Lowest yearly price for LCP-Tacro (DKK) 2*sqr(16) st dev LCP-Tacro yearly price in simulation (DKK) 40.270 26.176 8 N/A 40.270 Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation Crustal Ball DCF (EU) Patients on tacrolimus Penetration index Revenue (DKK m) 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 0,085 3.522 7.914 10.389 12.712 14.222 14.882 15.105 15.332 15.561 15.479 11.864 8.462 5.616 3.018 2.212 1.036 33,7% 2,1% 2,1% 41.127 26.733 8 33,7% 2,1% 2,1% 42.003 27.302 8 33,7% 2,1% 2,1% 42.897 27.883 8 33,7% 2,1% 2,1% 43.810 28.476 8 33,7% 2,1% 2,1% 44.742 29.083 8 33,7% 2,1% 2,1% 45.695 29.702 8 33,7% 2,1% 2,1% 46.667 30.334 8 33,7% 2,1% 2,1% 47.661 30.979 8 33,7% 2,1% 2,1% 48.675 31.639 8 33,7% 2,1% 2,1% 49.711 32.312 8 33,7% 2,1% 2,1% 50.769 33.000 8 33,7% 2,1% 2,1% 51.850 33.703 8 33,7% 2,1% 2,1% 52.954 34.420 8 33,7% 2,1% 2,1% 54.081 35.153 8 33,7% 2,1% 2,1% 55.232 35.901 8 33,7% 2,1% 2,1% 56.408 36.665 8 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 41.127 42.003 42.897 43.810 44.742 45.695 46.667 47.661 48.675 49.711 50.769 51.850 52.954 54.081 55.232 56.408 43 145 332 446 557 636 680 705 731 757 769 602 439 297 163 122 58 Royalties Highest possible Royalties Lowest possible Royalties 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% 15,0% 20% 10% Royalties (DKK m) Royalties after tax (DKK m) Time factor Discount factor PV of CF (DKK m) Sum of PV of CF's (DKK m) (2013) Sum of PV of CF's (DKK m) (2013) 6,4 4,8 1,5 0,90 4,3 464,8 466,7 21,7 16,6 2,5 0,84 13,9 49,9 38,9 3,5 0,78 30,2 66,8 52,1 4,5 0,72 37,7 83,5 65,2 5,5 0,67 43,9 95,4 74,4 6,5 0,63 46,6 102,0 79,6 7,5 0,58 46,4 105,7 82,5 8,5 0,54 44,7 109,6 85,5 9,5 0,50 43,2 113,6 88,6 10,5 0,47 41,6 115,4 90,0 11,5 0,44 39,4 90,3 70,5 12,5 0,41 28,7 65,8 51,3 13,5 0,38 19,4 44,6 34,8 14,5 0,35 12,3 24,5 19,1 15,5 0,33 6,3 18,3 14,3 16,5 0,31 4,4 8,8 6,8 17,5 0,28 1,9 PV of CF's (DKK m) (2014) 499,5 LN(PV2014/PV2013) 0,0680 75 Inputs Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation 2013 25% 7,46% 12,5% 50% 1,41% 5,632 2,13% 2014 25% 2015 24% 2016+ 22% 2015 42.650 10% 2016 43.716 31% 2017 44.809 62% 2018 45.481 73% 2019 46.163 90% 2020 46.856 100% 2021 47.559 100% 2022 48.272 100% 2023 48.996 100% 2024 49.731 97% 2025 50.477 74% 2026 51.234 52% 2027 52.003 34% 2028 52.783 18% 2029 53.575 11% 2030 54.378 6% 2031 55.194 5% -43,5% -43,5% 115,6% 115,6% 1.355 678 8 -43,5% 71,8% 71,8% 2.778 1.389 8 -43,5% 17,8% 17,8% 3.320 1.660 8 -43,5% 22,4% 22,4% 4.155 2.077 8 -43,5% 12,0% 12,0% 4.686 2.343 8 -43,5% 1,5% 1,5% 4.756 2.378 8 -43,5% 1,5% 1,5% 4.827 2.414 8 -43,5% 1,5% 1,5% 4.900 2.450 8 -43,5% -1,6% -1,6% 4.824 2.412 8 -43,5% -25,6% -25,6% 3.735 1.868 8 -43,5% -33,8% -33,8% 2.664 1.332 8 -43,5% -41,0% -41,0% 1.768 884 8 -43,5% -62,1% -62,1% 950 475 8 -43,5% -47,8% -47,8% 589 295 8 -43,5% -59,1% -77,4% 326 163 8 -43,5% -16,7% 1,5% 276 138 8 0,032 Crystal Ball DCF (JAP) Patients on tacrolimus Penetration index ∑r LN(Vt+1/Vt) Patients on LCP-Tacro Lowest no. of patients 2*sqr(16) st dev Patients on LCP-Tacro in the simulation 426 213 8 N/A 426 ∑r LN(Vt+1/Vt) 33,7% LCP-Tacro yearly price (DKK) Lowest yearly price for LCP-Tacro (DKK) 2*sqr(16) st dev LCP-Tacro yearly price in simulation (DKK) 34.643 22.518 8 N/A 34.643 Revenue (DKK m) 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 0,032 1.355 2.778 3.320 4.155 4.686 4.756 4.827 4.900 4.824 3.735 2.664 1.768 950 589 272 276 33,7% 2,1% 2,1% 35.380 22.997 8 33,7% 2,1% 2,1% 36.133 23.487 8 33,7% 2,1% 2,1% 36.903 23.987 8 33,7% 2,1% 2,1% 37.688 24.497 8 33,7% 2,1% 2,1% 38.490 25.019 8 33,7% 2,1% 2,1% 39.310 25.551 8 33,7% 2,1% 2,1% 40.146 26.095 8 33,7% 2,1% 2,1% 41.001 26.651 8 33,7% 2,1% 2,1% 41.874 27.218 8 33,7% 2,1% 2,1% 42.765 27.797 8 33,7% 2,1% 2,1% 43.675 28.389 8 33,7% 2,1% 2,1% 44.605 28.993 8 33,7% 2,1% 2,1% 45.554 29.610 8 33,7% 2,1% 2,1% 46.524 30.241 8 33,7% 2,1% 2,1% 47.514 30.884 8 33,7% 2,1% 2,1% 48.526 31.542 8 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 0,096 35.380 36.133 36.903 37.688 38.490 39.310 40.146 41.001 41.874 42.765 43.675 44.605 45.554 46.524 47.514 48.526 15 48 100 123 157 180 187 194 201 202 160 116 79 43 27 13 13 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% 12,5% 15% 10% Royalties (DKK m) Royalties after tax (DKK m) Time factor Discount factor PV of CF (DKK m) Sum of PV of CF's (DKK m) (2013) Sum of PV of CF's (DKK m) (2013) 1,8 1,4 2,5 0,84 1,2 93,2 93,3 6,0 4,7 3,5 0,78 3,6 12,5 9,8 4,5 0,72 7,1 15,3 11,9 5,5 0,67 8,0 19,6 15,3 6,5 0,63 9,6 22,5 17,6 7,5 0,58 10,3 23,4 18,2 8,5 0,54 9,9 24,2 18,9 9,5 0,50 9,5 25,1 19,6 10,5 0,47 9,2 25,2 19,7 11,5 0,44 8,6 20,0 15,6 12,5 0,41 6,3 14,5 11,3 13,5 0,38 4,3 9,9 7,7 14,5 0,35 2,7 5,4 4,2 15,5 0,33 1,4 3,4 2,7 16,5 0,31 0,8 1,6 1,3 17,5 0,28 0,4 1,7 1,3 18,5 0,26 0,3 PV of CF's (DKK m) (2014) 100,2 LN(PV2014/PV2013) 0,0712 Royalties Highest possible Royalties Lowest possible Royalties 76 Appendix 5: Monto Carlo Simulation Output Crystal Ball Output: (US) Volatility of the Project è : Source: Own contribution Crystal Ball Output: (Europe) Volatility of the Project è Source: Own contribution Crystal Ball Output: (Japan) Volatility of the Project è Source: Own contribution 77 Appendix 6: The Binomial Latices (US, Europe and Japan) Binomial Lattice (US) NDA 2013 Q3 Volatility Up Factor Down Factor Q4 2014 Q1 Q2 0,685 1,408 0,710 Q3 Q4 13300 9443 6705 4761 3380 2400 6705 4761 3380 2400 3380 2400 1704 1704 1210 1704 1210 859 859 610 433 Compound Option NDA 2013 Q3 Querterly Discount Rate Risk Neutral Probabilities, Q (1-Q) Q4 2014 Q1 Q2 1,004 0,420 0,580 Q3 Q4 8818 6215 4368 3056 2124 1463 4366 3055 2123 1462 2122 1461 993 992 659 991 658 421 420 253 133 Compound Option NDA 2013 Q3 PV of NDA filing costs PV of launch costs Probabilities Value of Option Risk adjusted static NPV Total value Q4 2014 Q1 Q2 Q3 Q4 236,4 68% 79,6 1383,7 1463,3 78 Binomial Lattice (Europe) NDA 2013 Q3 Volatility Up Factor Down Factor Q4 2014 Q1 Q2 0,670 1,398 0,715 Q3 Q4 2490 1782 1275 912 652 467 1275 912 652 467 652 467 334 334 239 334 239 171 171 122 87 Compound Option NDA 2013 Q3 Querterly Discount Rate Risk Neutral Probabilities, Q (1-Q) Q4 2014 Q1 Q2 1,0035 0,422 0,578 Q3 Q4 1681 1203 860 616 440 315 860 616 440 315 440 315 225 225 161 225 161 115 115 83 59 Costs and Probabilities NDA 2013 Q3 PV of NDA filing costs PV of launch costs Probabilities Value of Option Risk adjusted static NPV Total value Q4 2014 Q1 Q2 Q3 Q4 68% 0,0 315,0 315,0 79 Binomial Lattice (Japan) NDA 2013 Q3 Volatility Up Factor Down Factor Q4 2014 Q1 2015 Q2 Q3 0,722 1,435 0,697 Q4 Q1 Q2 1169 814 568 396 276 276 192 134 93 192 134 276 192 134 93 65 568 396 93 65 134 93 65 45 45 32 65 45 32 22 32 22 15 15 11 7 Compound Option NDA 2013 Q3 Querterly Discount Rate Risk Neutral Probabilities, Q (1-Q) Q4 2014 Q1 2015 Q2 Q3 1,0035 0,415 0,585 Q4 Q1 Q2 789 550 383 267 186 186 30 17 9 130 90 186 130 90 7 3 383 267 63 44 90 63 44 0 31 21 44 31 21 15 21 15 10 10 7 5 Compound Option NDA 2013 Q3 PV of NDA filing costs PV of launch costs Probabilities Value of Option Risk adjusted static NPV Total value Q4 2014 Q1 40,5 0 33% 2015 Q2 Q3 Q4 Q1 Q2 68% 28,2 -19,5 8,7 80 Appendix 7: Veloxis’ Stock Price Development Veloxis' Stock Price Development (DKK), (Aug 2nd 2013-Jul 31st 2013) & (Nov 13th 2006-Jul31st 2013) 1,4 1,2 1 0,8 0,6 0,4 2013-07-02 2013-06-02 2013-05-02 2013-04-02 2013-03-02 2013-02-02 2013-01-02 2012-12-02 2012-11-02 2012-10-02 2012-09-02 2012-08-02 2012-07-02 2012-06-02 2012-05-02 2012-04-02 2012-03-02 2012-02-02 2012-01-02 2011-12-02 2011-11-02 2011-10-02 2011-09-02 0 2011-08-02 0,2 Veloxis' Stock Price Development (DKK) (Aug 2nd 2013 - Jul 31st 2013) 70 60 50 40 30 20 10 0 2006-11-13 2007-11-13 2008-11-13 2009-11-13 2010-11-13 2011-11-13 2012-11-13 Veloxis' Stock Price Development (DKK) (Nov 13th 2006 - Jul 31st 2013) Source: Euroinvester.dk 81 Appendix 8: Phase I & Phase II results Phase I+II resutls: Clinical Profile of LCP-Tacro vs Prograf or Advagraf Source: Investor Presentation Q1 2008 Phase I+II resutls: Clinical Profile of LCP-Tacro vs Prograf or Advagraf Source: Interim Report, 1st quarter 2009 82 Appendix 9: Results from the phase III Clinical Trials Study 3001 – Stable “Switch” Study Phase III: Study 3001 - Stable "Switch" Study Source: Company Presentation Feb 14th 2012 83 Study 3002 – “de novo” Study Phase III: Study 3002 - "de novo" Study Source: Study Presentation Jun 27th 2013 84 Study 3003 – Strato Tremor Study Phase III: Study 3003 - Strato Tremor Study Source: Study Presentation May 20th 2013 Three studies show the same results Comparison of Three Clinical Trials Source: Study Presentation Jun 27th 2013 85 Appendix 10: Planed Structure of the US Sales Force Planed Structure of the US Sales Force Source: Inverstor Presentation Feb 14th 2012, p22 86 Appendix 11: Daily Dosage of Tacrolimus per Kg of Body Weight Daily Dose of Tacrolimus: Statement From Pharmacists Dr. Ogbru, pharmacist, CEO, and founder of RxEconsult, LLC: DOSING: Oral tacrolimus is taken twice daily. Starting doses range between 0.075 mg/kg/day to 0.2 mg/kg/day. Doses vary widely and are based on tests that measure the amount of tacrolimus in the blood. Taking tacrolimus with food can reduce some of the abdominal pain that can occur with this medicine; however, food can reduce the amount of tacrolimus that is absorbed. This is especially true with fatty foods. Capsules should be taken consistently with or without food in order to avoid major swings in blood levels. Grapefruit juice increases blood levels of tacrolimus and should be avoided. The injection is only used for patients who cannot tolerate tacrolimus capsules. Source: http://www.medicinenet.com/tacrolimus/article.htm Tacrolimus Dosing Study: In American Patients Source: http://www.rxlist.com/prograf-drug/indications-dosage.htm 87 Appendix 12: Average Body Weight by World Region Avg. Body Weights Female Male Total Adjusted for children US Europe R.O.W. 75.6 kg N/A N/A 88.9 kg N/A N/A 82.3 kg 70.8 kg 60.0 kg 80.0 kg 68.5 kg 57.7 kg Sources: www.cdc.gov/nchs/fastats/bodymeas.htm & Walpole, Sarah Catherine et al; The weight of nations: an estimate of adult human biomas, 2005, p3 Population, Body Mass and Biomass by World Region in 2005 Source: Walpole, Sarah Catherine et al; The weight of nations: an estimate of adult human biomass 2005, p3 Appendix 13: Estimated Daily Dosage of Tacrolimus for Kidney Transplant Patients Estimated Daily Dosage of Tacrolimus for Kidney Transplant Patients Estimated avg. Daily dose = 0.1*avg. Body weight LCP-Tacro US: Avg. daily dosage: Daily dosage (mg/kg) 0,1 Avg. body weight 80 8 mg (mg/kg) 0,1 Avg. body weight 68,5 6,85 mg (mg/kg) 0,1 Avg. body weight 57,7 5,77 mg LCP-Tacro - Europe: Avg. daily dosage: Daily dosage LCP-Tacro - Japan: Avg. daily dosage: Daily dosage Source: Appendix 15 & 16 88 Appendix 14: Estimation of the Yearly Price of Tacro in US, Europe and Japan Estimation of Yearly Price of LCP-Tacro in the US: Exchange rate (DKK/USD) The estimated prices are in 2013 prices 5,6324 Avg. daily dosage: Daily dosage Prograf Prograf price (per mg) Daily price Yearly price Generics Generics price (per mg) Daily price Yearly price Advagraf Prograf price (per mg) Daily price Yearly price (mg/kg) 0,1 Avg. body weight 80 3,1 USD/mg 17,5 DKK/mg 140 DKK 50984 DKK 1,8 USD/mg 10,1 DKK/mg 81 DKK 29604 DKK 4 USD/mg 22,5 DKK/mg 180 DKK 65786 DKK 8 mg As the cheaper generic version cover most of the US tacrolimus market, LCP-Tacro will be fighting with the cheaper compounds and, the soon to be launched, Astagraf, which is expected to take over for Prograf. LCP-Tacro is expected to be priced between the two competing products, but closest to Astagraf, as LCP-Tacro is a branded compound. Tacro is forecasted to be priced at 3.75USD per mg. LCP Tacro price Daily dosage (mg/kg: 80%*0.1mg/kg) Estimated LCP-Tacro price (per mg) Daily price Yearly price (mg/kg) 0,08 3,75 Avg. body weight 80 USD/mg 6,4 mg 21,1 DKK/mg 135 DKK 49340 DKK 89 Estimation of Yearly Price of LCP-Tacro in Europe: Exchange rate (DKK/USD) The estimated prices are in 2013 prices 5,6324 Avg. daily dosage: Daily dosage Prograf Prograf price (per mg) Daily price Yearly price Generics Generics price (per mg) Daily price Yearly price Advagraf Prograf price (per mg) Daily price Yearly price (mg/kg) 0,1 Avg. body weight 68,5 2,9 USD/mg 16,3 DKK/mg 112 DKK 40839 DKK 1,6 USD/mg 9,0 DKK/mg 62 DKK 22532 DKK 3,7 USD/mg 20,8 DKK/mg 143 DKK 52105 DKK 6,85 mg LCP-Tacro is expected to be priced between the prices of Prograf and Advagraf, but closest to Advtagraf, as LCP-Tacro is a branded new compound. Tacro is forecasted to be priced at 3.5USD per mg. LCP Tacro price Daily dosage (mg/kg: 80%*0.1mg/kg) Estimated LCP-Tacro price (per mg) Daily price (mg/kg) 0,08 3,5 Avg. body weight 68,5 USD/mg Yearly price 5,5 mg 19,7 DKK/mg 108 DKK 39431 DKK Estimation of Yearly Price of LCP-Tacro in Japan: Exchange rate (DKK/USD) The estimated prices are in 2013 prices 5,6324 Avg. daily dosage: Daily dosage Prograf Prograf price (per mg) Daily price Yearly price Advagraf Prograf price (per mg) Daily price Yearly price (mg/kg) 0,1 Avg. body weight 57,7 2,9 USD/mg 16,3 DKK/mg 94 DKK 34400 DKK 3,7 USD/mg 20,8 DKK/mg 120 DKK 43890 DKK 5,77 mg LCP-Tacro is expected to be priced between the prices of Prograf and Advagraf, but closest to Advtagraf, as LCP-Tacro is a branded new compound. Tacro is forecasted to be priced at 3.5USD per mg. LCP Tacro price Daily dosage (mg/kg: 80%*0.1mg/kg) Estimated LCP-Tacro price (per mg) Daily price Yearly price (mg/kg) 0,08 3,5 Avg. body weight 57,7 USD/mg 4,6 mg 19,7 DKK/mg 91 DKK 33214 DKK 90 Appendix 15: Tacrolimus (Prograf) Sales in the Period 2006-2008 Tacrolimus (Prograf) Sales from 2006-2008 Source: Invester Presentation March 3rd 2009, p12 91 Appendix 16: US Kidney Transplant Opportunity (Veloxis’ Projections) US Kidney Transplant Opportunity (Veloxis' Projections) Source: Inverstor Presentation Feb 14th 2012, p23 Calculations Based on Veloxis' Projections Market share 40,000/200,000 50,000/200,000 = = 20% 25% De novo patients 4,000/17,000 6,000/17,000 = = 24% 35% Source: Inverstor Presentation Feb 14th 2012, p23 92 Appendix 17: Tiered Royalties by Stage of Development Tiered Royalties by Stage of Development Source: http://www.lesi.org/docs/lesi-updates-and-news-documents/f 2008biopharmaceauticalroyaltyratedealterms-110108.pd Appendix 18: Estimation of the Risk-Free Rate Danish government bond - August 1st 2013 Expire Coupon Rate Effective rate 2021 112,38 3% 1,36% Danish government bond - August 1st 2013 Expire Coupon Rate Effective rate 10 year government bond 2024 154,011 7% 1,60% 1,41% Source: nasdaqomxnordic.com/obligationer 93 Appendix 19: Beta Estimation Beta (Raw) Estimation Using 5 Years of Monthly Data (Outliers Removed) Regression Statistics Multiple R 0,28188824 R Square 0,07946098 Adjusted R Square 0,06272391 Standard Error0,13194864 Observations 57 ANOVA df Regression Residual Total SS MS F Significance F 1 0,08265788 0,08265788 4,74760316 0,03364111 55 0,95757438 0,01741044 56 1,04023225 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95,0% Upper 95,0% Intercept -0,0297034 0,01756961 -1,6906107 0,09657162 -0,0649136 0,00550691 -0,0649136 0,00550691 X Variable 1 0,7020827 0,32221894 2,17889953 0,03364111 0,05634151 1,34782388 0,05634151 1,34782388 ! "#$%&'( $%. " $%0" ! "#"$%&$' ( ) "*"$%$' +&" , -"#"$%$&+. / " $%' " $%( " 2345) 67" $" *$%' " *$%( 1" *$%( " *$%$1" $" $%$1" $%( " $%( 1" 8693: ;"<2345) 67=" *$%( " *$%' " *$%0" *$%. " 94 Appendix 20: DCF Model for the US Market (Tacro) DCF Model for the US Market Probabilities Approval rate Likelyhood of refusion Cummulative 90% 75% 68% Inputs Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation 2013 25% 7,46% 12,5% 50% 1,41% 5,632 2,13% Development costs 2013 2014 24,5% 2015 23,5% 2014 0 0 2,13% 0 0,5 0,99 0,0 236,4 0 1 2,13% 0 1,5 0,98 0,0 2015 Launch 255,3 2 2,13% 244,8 2,5 0,97 236,4 Patients on immunosuppression Patients on tacrolimus Penetration index Patients on LCP-Tacro Yearly price per patient (DKK) Revenue (DKK m) Profits (DKK m) Proftis after tax (DKK m) Time factor Discount factor PV of CF (DKK m) Sum of PV of CF's (DKK m) 2015 185.117 157.349 11% 2.164 51.463 111,3 55,7 42,6 2,5 0,84 35,6 2.400,1 2016 187.893 159.709 24% 4.791 52.558 251,8 125,9 98,2 3,5 0,78 76,3 2017 190.712 162.105 38% 7.700 53.677 413,3 206,7 161,2 4,5 0,72 116,6 Risk adjusted NPV (DKK m) 1.383,7 NDA Filing and launch associated costs Inflation factor Inflation Inflation adjusted costs Time factor Discount factor PV of CF's PV of filing and launch associated costs 2016+ 22% DCF (US) 2018 193.572 164.537 56% 11.518 54.819 631,4 315,7 246,2 5,5 0,67 165,8 2019 196.476 167.005 74% 15.448 55.986 864,9 432,4 337,3 6,5 0,63 211,3 2020 199.423 169.510 88% 18.646 57.178 1.066,1 533,1 415,8 7,5 0,58 242,4 2021 202.415 172.052 97% 20.861 58.395 1.218,2 609,1 475,1 8,5 0,54 257,7 2022 205.451 174.633 100% 21.829 59.638 1.301,8 650,9 507,7 9,5 0,50 256,3 2023 208.533 177.253 100% 22.157 60.907 1.349,5 674,8 526,3 10,5 0,47 247,2 2024 211.661 179.911 100% 22.489 62.204 1.398,9 699,4 545,6 11,5 0,44 238,5 2025 214.835 182.610 91% 20.772 63.528 1.319,6 659,8 514,6 12,5 0,41 209,4 2026 218.058 185.349 62% 14.365 64.880 932,0 466,0 363,5 13,5 0,38 137,6 2027 221.329 188.130 41% 9.642 66.261 638,9 319,4 249,2 14,5 0,35 87,8 2028 224.649 190.951 25% 5.967 67.672 403,8 201,9 157,5 15,5 0,33 51,6 2029 228.019 193.816 16% 3.876 69.112 267,9 134,0 104,5 16,5 0,31 31,9 2030 231.439 196.723 12% 2.951 70.583 208,3 104,1 81,2 17,5 0,28 23,1 2031 234.910 199.674 6% 1.498 72.086 108,0 54,0 42,1 18,5 0,26 11,1 95 DCF Model for the European Market (Tacro) DCF Model for the European Market Probabilities Approval rate Likelyhood of refusion Cummulative 90% 75% 68% Inputs Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation 2013 25% 7,46% 12,5% 50% 1,41% 5,632 2,13% 2014 24,5% 2015 23,5% 2016+ 22% 2014 105.724 8% 1.057 40.270 42,6 773,3 137,3 2015 108.367 26% 3.522 41.127 144,8 2016 111.076 57% 7.914 42.003 332,4 2017 113.853 73% 10.389 42.897 445,7 DCF (EU) Patients on tacrolimus Penetration index (Based onon section XXPLC) Patients on LCP-Tacro Yearly price per patient (DKK) Revenue (DKK m) Max Revenue (DKK m) Max Revenue (USD m) Royalties 15% Royalties for Veloxis (DKK m) Royalties after tax (DKK m) Time factor Discount factor PV of CF's (DKK m) Static NPV of CF's (DKK m) 6,4 4,8 1,5 0,90 4,3 466,7 Risk-adjusted NPV (DKK m) 315,0 2018 116.130 88% 12.774 43.810 559,6 2019 117.872 97% 14.292 44.742 639,5 2020 119.640 100% 14.955 45.695 683,4 2021 121.435 100% 15.179 46.667 708,4 2022 123.256 100% 15.407 47.661 734,3 2023 125.105 100% 15.638 48.675 761,2 2024 126.982 98% 15.555 49.711 773,3 2025 128.886 74% 11.922 50.769 605,3 2026 130.820 52% 8.503 51.850 440,9 2027 132.782 34% 5.643 52.954 298,8 2028 134.774 18% 3.032 54.081 164,0 2029 136.795 13% 2.223 55.232 122,8 2030 138.847 6% 1.041 56.408 58,7 66,1 51,6 13,5 0,38 19,5 44,8 35,0 14,5 0,35 12,3 24,6 19,2 15,5 0,33 6,3 18,4 14,4 16,5 0,31 4,4 8,8 6,9 17,5 0,28 2,0 A royalty rate of 15% is estimated based on the max. revenue of USD 210 m, according to the figure in appendix XX 21,7 16,6 2,5 0,84 13,9 49,9 38,9 3,5 0,78 30,2 66,8 52,1 4,5 0,72 37,7 83,9 65,5 5,5 0,67 44,1 95,9 74,8 6,5 0,63 46,9 102,5 80,0 7,5 0,58 46,6 106,3 82,9 8,5 0,54 45,0 110,1 85,9 9,5 0,50 43,4 114,2 89,1 10,5 0,47 41,8 116,0 90,5 11,5 0,44 39,5 90,8 70,8 12,5 0,41 28,8 96 DCF Model for the Japanese Market (Tacro) DCF Model for the Japanese Market Probabilities Likelyhood of finding a partner Approval rate Likelyhood of refusion Cummulative 33% 90% 75% 22% Inputs Tax rate WACC Market share Margin Risk free rate Exchange rate Inflation 2013 25% 7,46% 10% 50% 1% 5,632 2% NDA costs 2013 2014 25% 2015 24% 2014 2016+ 22% 0 1 2,13% 0 0,5 0,993 0,0 40,5 42,2 1 2,13% 41,362568 1,5 0,979 40,5 2015 Launch 0 1 2,13% 0 2,5 0,966 0,0 Patients on tacrolimus Penetration index Patients on LCP-Tacro Yearly price per patient (DKK) Revenue (DKK m) Max Revenue (DKK m) Max Revenue (USD m) 2015 42.650 10% 426 34.643 14,8 202,0 35,9 2016 43.716 31% 1.355 35.380 47,9 2017 44.809 62% 2.778 36.133 100,4 2018 45.481 73% 3.320 36.903 122,5 2019 46.163 90% 4.155 37.688 156,6 2020 46.856 100% 4.686 38.490 180,3 2021 47.559 100% 4.756 39.310 187,0 2022 48.272 100% 4.827 40.146 193,8 2023 48.996 100% 4.900 41.001 200,9 2024 49.731 97% 4.824 41.874 202,0 2025 50.477 74% 3.735 42.765 159,7 2026 51.234 52% 2.664 43.675 116,4 2027 52.003 34% 1.768 44.605 78,9 2028 52.783 18% 950 45.554 43,3 2029 53.575 11% 589 46.524 27,4 2030 54.378 6% 326 47.514 15,5 2031 55.194 5% 276 48.526 13,4 Royalties 12,5% 6,0 4,7 3,5 0,78 3,6 12,5 9,8 4,5 0,72 7,1 15,3 11,9 5,5 0,67 8,0 19,6 15,3 6,5 0,63 9,6 22,5 17,6 7,5 0,58 10,3 23,4 18,2 8,5 0,54 9,9 24,2 18,9 9,5 0,50 9,5 25,1 19,6 10,5 0,47 9,2 25,2 19,7 11,5 0,44 8,6 20,0 15,6 12,5 0,41 6,3 14,5 11,3 13,5 0,38 4,3 9,9 7,7 14,5 0,35 2,7 5,4 4,2 15,5 0,33 1,4 3,4 2,7 16,5 0,31 0,8 1,9 1,5 17,5 0,28 0,4 1,7 1,3 18,5 0,26 0,3 NDA Filing and launch associated costs Inflation factor Inflation Inflation adjusted costs Time factor Discount factor PV of CF's PV of filing and launch associated costs DCF (JAP) Royalties for Veloxis (DKK m) Royalties after tax (DKK m) Time factor Discount factor PV of CF's (DKK m) Static NPV of CF's (DKK m) 1,8 1,4 2,5 0,84 1,2 93,3 Risk-adjusted NPV (DKK m) -19,5 97 Appendix 21: Risk Adjusted Deferred Tax Asset Risk Adjusted Deferred Tax Asset Cummulative Probability Deferred Tax Asset Risk Adjusted Defered Tax Asset 68% 401,4 272,9 98 Appendix 22: Estimation of no. of Patients on Tacro in the 3 Markets Patients on LCP-Tacro in US Patients living with transplanted kidney (2011) CAGR (Pool of patients) Tacrolimus share (estimation) LCP-Tacro market share SANITY CHECK Prograf market share Generics market share Inflation Patients on immunosuppression Patients on tacrolimus Patients on Prograf Patients on generics Yearly price Prograf Yearly price generics Coresponding market value (DKK b) Penetration index Patients on LCP-Tacro 174.414 1,50% skal justeres og armmenteres 85% skal argumenteres for 12,5% 2011 41% 59% 2,13% 2012 31% 69% 2011 174.414 148.252 60.783 87.469 48.881 28.383 5,454 2012 177.030 150.476 46.647 103.828 49.922 28.987 5,338 patent expiry 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 179.686 182.381 185.117 187.893 190.712 193.572 196.476 199.423 202.415 205.451 208.533 211.661 214.835 218.058 221.329 224.649 228.019 231.439 234.910 152.733 155.024 157.349 159.709 162.105 164.537 167.005 169.510 172.052 174.633 177.253 179.911 182.610 185.349 188.130 190.951 193.816 196.723 199.674 50.984 29.604 11% 2.164 24% 4.791 38% 7.700 56% 11.518 74% 15.448 88% 18.646 97% 20.861 100% 21.829 100% 22.157 100% 22.489 91% 20.772 62% 14.365 41% 9.642 25% 5.967 16% 3.876 12% 2.951 6% 1.498 99 Patients on LCP-Tacro in Europe Patients living with transplanted kidney (2011) CAGR (Pool of patients) (2011-2017) CAGR (Pool of patients) (2018-2031) Tacrolimus share (estimation) LCP-Tacro market share Exchange rate DKK/EUR as of July 1st 2011 187.402 2,5% 2,0% 52% 12,5% 7,4589 (Based on statement from direktøren) Own conservative estimate (Calculated as; patients on tacrolimus/total pool of patients) (Euroinvestor.dk) Data from Astellas A.R. 2012 p95 2011 Prograf+Advagraf sales Europe (DKK b) Generics share on average Generic sales Europe (b DKK) Estimated total tacrolimus sales (DKK b) 4,117 3% 0,068 4,185 (4,117*3%*generic price discount) Assumption The overall tacrolimus share of the European immunosuppression market remains constat at 52% 2011 Estimated number of patients on tacrolimus 98.175 (Prograf+Astellas sales*0,26/Astellas price est +Prograf+Astellas sales*0,74/Prograf price est + Generic sales/Generic price est) Patent expiry 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Patients on immunosuppression 187.402 192.087 196.889 201.811 206.857 212.028 217.329 221.675 226.109 230.631 235.244 239.949 244.748 249.643 254.635 259.728 264.923 270.221 275.626 281.138 Patients on tacrolimus 98.175 100.630 103.145 105.724 108.367 111.076 113.853 116.130 117.872 119.640 121.435 123.256 125.105 126.982 128.886 130.820 132.782 134.774 136.795 138.847 Penetration index 8% 26% 57% 73% 88% 97% 100% 100% 100% 100% 98% 74% 52% 34% 18% 13% 6% Patients on LCP-Tacro 1.057 3.522 7.914 10.389 12.774 14.292 14.955 15.179 15.407 15.638 15.555 11.922 8.503 5.643 3.032 2.223 1.041 Patients on LCP-Tacro in Japan Patients living with transplanted kidney R.O.W. (2011) 124.787 CAGR (Pool of patients) (2011-2017) 2,5% (Based on statement from direktøren) CAGR (Pool of patients) (2018-2031) 1,5% Own conservative estimate LCP-Tacro market share 10% Exchange rate DKK/JPY as of July 1st 2011 0,06366 (Euroinvestor.dk) Total prograf+astagraf sale (2011) (DKK b) Estimated number of patients on tacrolimus Patients on tacrolimus Penetration index Patients on LCP-Tacro 1,513 (=60% (Astellas A.R. 2012 p95)) 2011 38.639 2011 38.639 2012 39.605 2013 40.595 2014 41.610 2015 42.650 10% 426 2016 43.716 31% 1.355 2017 44.809 62% 2.778 2018 45.481 73% 3.320 2019 46.163 90% 4.155 2020 46.856 100% 4.686 2021 47.559 100% 4.756 2022 48.272 100% 4.827 Patent expiry 2023 2024 2025 48.996 49.731 50.477 100% 97% 74% 4.900 4.824 3.735 2026 51.234 52% 2.664 2027 52.003 34% 1.768 2028 52.783 18% 950 2029 53.575 11% 589 2030 54.378 6% 326 2031 55.194 5% 276 100 Appendix 23: Estimation of Inflation Comsumer Price Index, Avg. Annual Inflation (DK) from 1992-2012 4,00% 3,50% 3,00% 2,50% 2,00% 1,50% 1,00% 0,50% 12 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 Avg. annual price increase (DK) 20 99 20 98 19 97 19 96 19 95 19 94 19 93 19 19 19 92 0,00% Avg. annual price increase 1992-2012 (DK) Source: dst.dk (=Denmark's statistics) Data Year 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Avg. Avg. annual price increase (DK) 2,1% 1,3% 2,0% 2,1% 2,1% 2,2% 1,8% 2,5% 2,9% 2,4% 2,4% 2,1% 1,2% 1,8% 1,9% 1,7% 3,4% 1,3% 2,3% 2,8% 2,4% Avg. annual price increase 19922012 (DK) 2,1286% Source: dst.dk (Denmark's statistics 101 Appendix 24: Pool of Patients with Kidney Transplant (2011) & US Tacrolimus Overall Living Kidney Transplant Population and de novo Transplants (2011) US EU R.O.W. Population 174.414 187.402 124.787 de novo 16.879 18.209 17.979 Maintenance Therapy in the US (2008) Cyclosporine Tacrolimus Sirolimus 7,6% 87,8% 4,1% Immunosuppressive Medication Sales W.W. Total Sales 2005 USD 5.3b 2010 USD 5.8b Source: isotechnika.com/dnn/ProductsInDevelopment/Voclosporin/ImmunosuppressionMarket.aspx 102