Document

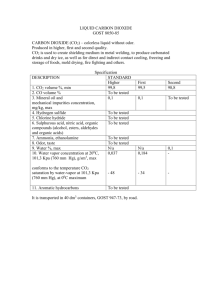

advertisement

Economic assessment of the whole CCS technology cycle Ksenia Sidorova, PhD student Department of Organization and Management, National Mineral Resources University (St. Petersburg, Russia) Email: ksenia.sidorova@inbox.ru Storage potential assessment Abstract Carbon Capture and Storage (CCS) is currently regarded as a promising option to reduce the emissions of CO2 into the atmosphere and mitigate climate change. This technology is especially beneficial for countries whose energy systems are based on fossil fuels. CO2 capture CO2 storage in a geological reservoir CO2 Transport Despite the significant potential of CCS, currently it is at the initial stage of development, not least because of its high capital costs. One of the ways to increase the investment attractiveness of CCS is the injection of CO2 into depleted oil-fields for enhanced oil recovery (EOR-CO2). According to initial estimates of certain regions, such application of CO2 can recover high capture costs of the project. In Russia the government expresses certain interest in the CCS technology, especially EOR-CO2. The oil industry being the main driver of Russian economy, it can also serve as a platform for environmentally significant innovations. The key objectives of this research are: - to evaluate the potential of Russian oil fields to serve as CO2-sinks; - to develop a techno-economic model of the CCS chain, to analyze emerging costs and to demonstrate the possibility of CCS projects to be commercially efficient. For Russian Federation such assessment has not yet been carried out, that is why the results obtained are of great importance for the evaluation of economic efficiency of CCS projects in general and conditions under which the projects start paying off in particular. http://radiogreenearth.org/blog/wp-content/uploads/2012/03/Global-warming.jpg It is widely believed that CO2 storage potential in oil-fields is limited and can be of interest only at the demonstration stage of CCS projects. This is true only if CO2 injection stops at the same time oil enhancement comes to an end - during EOR operations storage potential is quite scarce due to the fact that more than 70% of CO2 mixes with the oil and emerges to the surface with it. However, after the EOR is finished, the oil field being fully equipped for CO2 storage, it can be used as a CO2-sink just like saline aquifers or any other suitable geologic reservoir. In the latter case, the total storage potential is significantly higher: Return of investment NPV Breakeven CO2 price Oil prices Discount rate Taxes and charges Capture cost per 1 tonne CO2 Economics model Construction costs; Other capital costs; O&M costs; Electricity cost Economics model Capital pipeline costs Capital compression costs O&M pipeline costs O&M compression costs Table 1 summarizes data on the storage potential of Russian oil-fields, both during EOR operations and after their completion, and on the amount of annual CO2 emissions from power sector. Table 1. Assessment of prospectivity of Russian regions for CO2 storage Annual СО2 Total storage Number of EOR storage emission from Federal district potential, suitable oil-fields potential, Mt power plants, Mt Mt/year North85 13,01 266,36 9,66 Caucasian Southern 57 12,84 265,86 6,934 Northwestern 40 107,99 339,66 9,149 Volga 93 290,88 5152,9 62,66 Ural 30 172,7 534,39 Siberian 9 28,79 152,86 44 Far Eastern 8 17,91 37,86 7,87 TOTAL 322 644,12 6749,89 140,273 Transportation cost per 1 tonne CO2 Pipeline diameter Economics model Well construction costs Production equipment costs Injection equipment costs CO2 recycle costs O&M costs Type of the power plant (pulverized coal, gas turbine) Base plant Waste disposal Capture costs (by technological process) Coal combustion NOx control TSP control SO2 control CO2 control Water supply TOTAL Annual capital costs, million € 11,44 0,46 0,65 1,12 28,93 2,10 44,71 Table 2. Capture costs by technological process O & M costs, Total costs, Cost per unit, million € million € €/MWh 28,27 39,72 15,59 1,58 2,04 0,80 1,53 2,18 0,86 5,81 6,92 2,72 11,34 40,27 15,81 1,66 3,76 1,48 50,19 94,90 37,26 CO2 injection Volume of gas injected Volume of gas stored Volume of gas recycled Injected СО2 Stored СО2 Recovered oil Enhanced oil recovery Residual oil in place Hydrocarbon pore volume Koval factor Effective mobility Heterogeneity factor Gravity segregation factor Aerial and vertical sweep efficiency Overall recovery efficiency Cprodnew, Cprodold - cost of electricity production with and without CO2 capture respectively; Q – amount of CO2 captured. For the reference case the capture cost is 21,76 €/tonne CO2, annual amount of CO2 captured is 2,52 Mt. The figure demonstrates the structure of capture costs for 1 tonne of CO2. NOx Control 2% TSP Control 2% SO2 Control 7% CO2 transport & storage The cost of CO2 transport directly depends on the distance from the source to the sink. The assessment of the transportation costs is based on the federal unified rates and conversion factors for September 2014 and is reflected in Table 3. By dividing the overall value by the annual CO2 flow rate, one gets the cost of transport for 1 tonne of CO2 - in the reference case it is 2,74 €. Table 3. СО2 transport costs Costs Value, million € Main pipeline construction 22,56 Compression station 15,56 construction Total capital costs 38,12 Annual capital costs 3,81 Pipeline O&M 1,51 Compression station O&M 1,59 Total O&M 3,10 TOTAL COSTS 6,91 Table 4. СО2 injection costs Costs Value, million € Well drilling and completion 66,06 Producing equipment 14,80 installation Injection equipment installation 10,23 Installation of CO2 recycle 0,61 facilities Total capital costs 91,70 Annual capital costs 9,17 СО2 purchase 15,44 Other O&M 10,13 Total O&M 25,57 TOTAL COSTS 34,74 CO2 injection costs were estimated based on empirical data from US oil-fields and are presented in Table 4. The cost of injection into the reservoir for 1 tonne of CO2 is therefore 13,78 €. The figures demonstrate the NPV graph of the project and the relationship between oil price and CO2 breakeven price. According to the latter graph, the project will stay profitable provided that the oil price exceeds 55 $/bbl. 120 350 90 100 300 80 80 250 70 60 200 40 150 Income-costs 20 100 NPV 0 50 Emissions Technological model Technological model CO2 flow rate CO2 flow rate Coal combustion 42% CO2 Capture 43% The cost assessment of the CCS cycle was carried out on the basis of the following project: CO2 is captured at the coal power plant Izhevskaya-2 CHPP (390 MW) and transported via pipeline to Pavlovskoye oil-field located 250 km from the plant. -20 Water supply 4% Based on the developed maps and calculations, the regions have been classified according to their prospectivity: •Highly prospective (there are numerous CO2 sources and oil-fields large enough located no further than 300 km from each other); •Prospective (there is at least one CO2 source and at least one oil-field large enough located no further than 300 km from each other); •Prospective for pilot projects (there are weak CO2 sources and small oil-fields located no further than 300 km from each other); •Limited prospects (there are both CO2 sources and oil-fields large enough, but they are located at a significant distance from each other) •Not prospective at the current stage of development (there are medium and large oilfields but no significant sources of CO2); •Not prospective (there are no sources of CO2 and/or oil-fields large enough). One can see that the most promising regions for CCS are situated in the Volga federal district - those are Bashkortostan, Tatarstan, Udmurt Republic, Perm Krai and Samara Oblast - highly-industrialized regions, having a large number of depleted oil-fields. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 0 -40 -50 -60 -100 СО2 price, euro/t Fuel CO2 cut Water supply Technological model СО2 density СО2 viscosity Pressure loss Reynolds number Friction factor Compression unit output SDPP - State District Power Plant; CHPP - Combined Heat and Power Plant CO2 capture The economic assessment is based on the methodology of Integrated Environmental Control Model, adapted to Russian prices. Table 2 contains the calculated results for CO2 capture at Izhevskaya-2 CHPP. CCS prospectivity map The figures show an example of the maps created for one of the most promising regions, Volga federal district. The cost of CO2 capture itself can be derived from the equation: Equipment performance; Consumption of materials, water, energy; Fuel consumption Waste generation volumes Contamination control (NOx, suspended particles, SO2, S, Hg, CO2) To assess the CO2 storage potential in different regions of Russia, an analysis of Russian oil fields has been carried out as well as the estimation of industrial development of each region (particularly, the number, capacity and location of coal and gas power plants). Qeor - CO2-enhanced oil recovery, Mt; Qcum - cumulative oil production, Mt; ρoil, ρco2 - densities of oil and CO2 respectively, kg/m3 CCS techno-economic model Economic assessment of the CCS technology cycle consists of three separate stages - cost assessments of CO2 capture, transport and storage. All these stages are technologically diverse, but nevertheless they have to be integrated in a single system, where each element is related to the others by means of different parameters: e.g. the price of CO2 for the oil company depends on the capture and transportation expenses; likewise, the amounts of CO2 stored is closely linked to the amounts of CO2 captured. In order to integrate all these parameters a technoeconomic model of CCS was developed. CO2-source & sink maps 60 50 Conclusions According to the calculations carried out, the storage potential of Russian oil-fields amounts to 6,8 Gt – which is enough to store all the CO2 emitted by Russian power plants in the course of 40 years. The most promising regions for large-scale CO2-EOR deployment are situated in the Volga federal district: Bashkortostan, Tatarstan, Udmurt Republic, Samara Oblast, Perm Krai. As for pilot projects, those can be implemented in Dagestan, Kaliningrad and Sakhalin Oblast. The cost estimation was carried out on the basis of a coal power plant Izhevskaya-2 CHPP (Udmurt Republic) and Pavlovskoye oil-field 250 km away from it. The cost of CO2 capture depends on the type and capacity of the power plant, amount of CO2 emissions and the applied capture technology. For a 390-MW coal the cost of capture is 21,76 €/tonne CO2, annual amount of CO2 captured is 2,52 Mt. Transportation costs were calculated for pipeline transport and amount to 2,74 €/tonne CO2. The key technological factors of influence are pipeline length and diameter. All in all, transport costs represent only a minor part in the cost of the whole CCS chain. Finally, the cost of CO2 injection into the oil reservoir makes 13,78 €/tonne CO2, which is a high estimation. Even despite high investment costs, the project is commercially efficient. In the course of 14 years while the project is in operation, 8,82 Mt CO2 will be stores in Pavlovskoye oil-field, resulting in extraction of additional 14,97 million bbl of crude oil. 40 30 20 10 0 30 50 70 Oil price, $/bbl 90 110 http://esco-ecosys.narod.ru/2012_1/art102.htm To sum it up, an analysis of a breakeven CO2 price shows that the project will pay off as long as the oil prices keep higher than 55 $/bbl.