IPCC MOCK TEST-1_ANSWER SHEET_LI-23

advertisement

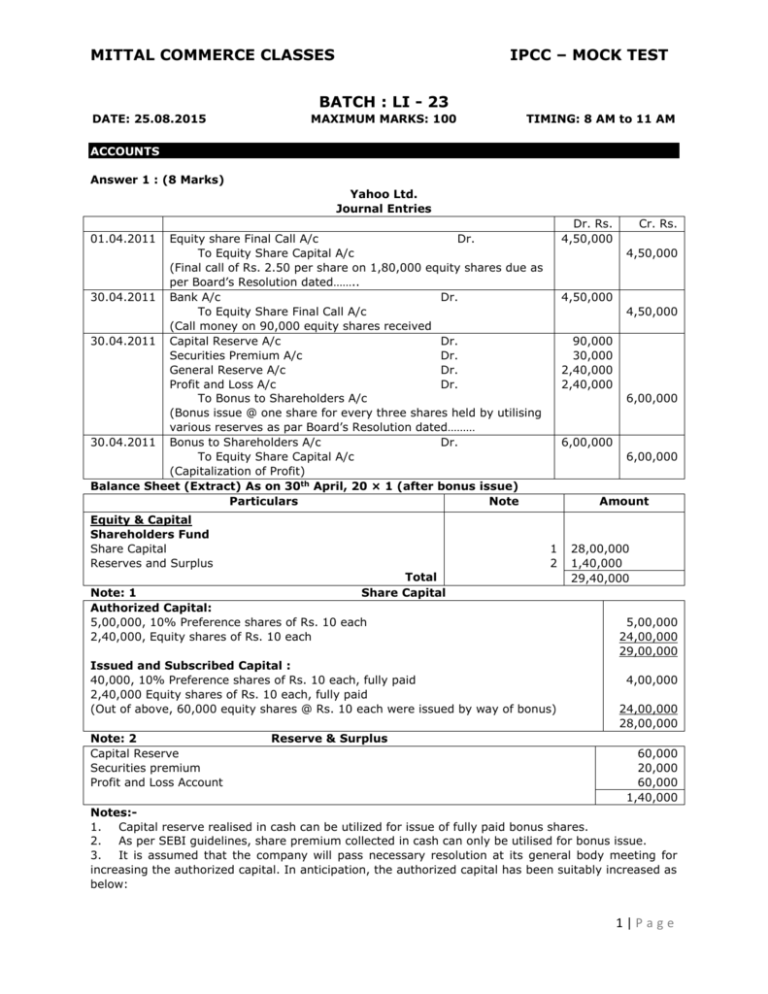

MITTAL COMMERCE CLASSES IPCC – MOCK TEST BATCH : LI - 23 DATE: 25.08.2015 MAXIMUM MARKS: 100 TIMING: 8 AM to 11 AM ACCOUNTS Answer 1 : (8 Marks) Yahoo Ltd. Journal Entries Dr. Rs. 4,50,000 01.04.2011 Equity share Final Call A/c Dr. To Equity Share Capital A/c (Final call of Rs. 2.50 per share on 1,80,000 equity shares due as per Board’s Resolution dated…….. 30.04.2011 Bank A/c Dr. To Equity Share Final Call A/c (Call money on 90,000 equity shares received 30.04.2011 Capital Reserve A/c Dr. Securities Premium A/c Dr. General Reserve A/c Dr. Profit and Loss A/c Dr. To Bonus to Shareholders A/c (Bonus issue @ one share for every three shares held by utilising various reserves as par Board’s Resolution dated……… 30.04.2011 Bonus to Shareholders A/c Dr. To Equity Share Capital A/c (Capitalization of Profit) Balance Sheet (Extract) As on 30th April, 20 × 1 (after bonus issue) Particulars Note Equity & Capital Shareholders Fund Share Capital Reserves and Surplus 4,50,000 4,50,000 4,50,000 90,000 30,000 2,40,000 2,40,000 6,00,000 6,00,000 6,00,000 Amount 1 2 Total Share Capital Note: 1 Authorized Capital: 5,00,000, 10% Preference shares of Rs. 10 each 2,40,000, Equity shares of Rs. 10 each Issued and Subscribed Capital : 40,000, 10% Preference shares of Rs. 10 each, fully paid 2,40,000 Equity shares of Rs. 10 each, fully paid (Out of above, 60,000 equity shares @ Rs. 10 each were issued by way of bonus) Note: 2 Capital Reserve Securities premium Profit and Loss Account Cr. Rs. 28,00,000 1,40,000 29,40,000 5,00,000 24,00,000 29,00,000 4,00,000 24,00,000 28,00,000 Reserve & Surplus 60,000 20,000 60,000 1,40,000 Notes:1. Capital reserve realised in cash can be utilized for issue of fully paid bonus shares. 2. As per SEBI guidelines, share premium collected in cash can only be utilised for bonus issue. 3. It is assumed that the company will pass necessary resolution at its general body meeting for increasing the authorized capital. In anticipation, the authorized capital has been suitably increased as below: 1|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Existing number of equity shares as authorized Add: Issue of bonus shares to equity shareholders 2,00,000 60,000 2,60,000 Answer 2 :(12 Marks) 2012 Apr. 1 Apr. 30 Apr. 30 Apr. 30 To To To To Apr. 30 To Balance c/d (R) Balance b/d Credit Sales Bills Receivable A/c Cash (Noting Charges) 2012 May 1 To Balance b/d Working Notes: Total Debtors Accounts Rs. 2012 41,000 Apr. 1 By Balance b/d (Advance) 44,100 Apr. 30 By Cash 1,000 Apr. 30 By Discount Account 10 Apr. 30 By Bad Debts Account (2100-450) 1,800 Apr. 30 By Returns Inwards A/c (Om) Apr. 30 By Bills Receivable A/c Apr. 30 By Total Creditor A/c (Transfer) (Sohan) Apr. 30 By Balance c/d 87,910 2012 40,710 May 1 To Balance b/d Rs. (i) Cash Received: From Ram From R (Advance) Ex sales before April 1 (700) Ex sales during April (ii) (iii) Rs. 2,000 39,300 950 1,650 500 1,000 1,800 40,710 87,910 1,800 Rs. 450 1,800 2,250 27,300 9,750 37,050 39,300 Discount : Rs. 37,050 x 2½ / 97½ = Rs. 950 The creation of the Provision for Doubtful Debts will not affect the Total Debtors Account. Answer 3: (5 Marks) In Debtors Ledger General Ledger Adjustment Account Date Particulars Rs. Date Particulars 1.4.2008 To Balance b/d 3,400 1.4.2008 By Balance b/d 1.4.2008 To Debtors ledger adj. 1.4.2008 By Debtors ledger adj. to A/c: to A/c: 30.4.2008 Sales return 21,700 30.4.2008 Sales Cash received 8,62,100 30.4.2008 B/R dishonoured Discount Allowed 39,200 By Balance c/d 30.4.2008 B/R received 51,200 To Balance c/d (Bal. fig.) 2,52,200 12,29,800 In General Ledger Debtors Ledger Adjustment A/c Date Particulars Rs. Date Particulars 1.4.08 To Balance b/d 2,46,200 1.4.08 By Balance b/d 1.4.2008 To General ledger adj. 1.4.2008 By General ledger adj. A/c: to A/c: to Sales return 30.4.08 Sales 9,74,900 30.4.08 Cash received B/R dishonoured 3,500 Discount allowed Rs. 2,46,200 9,74,900 3,500 5,200 12,29,800 Rs. 3,400 21,700 8,62,100 39,200 2|Page MITTAL COMMERCE CLASSES 30.4.08 To Balance c/d IPCC – MOCK TEST 5,200 30.4.08 12,29,800 B/R received By Balance c/d (Bal.fig.) 51,200 2,52,200 12,29,800 LAW Answer : 1 (7 Marks) Incorrect: The concept of corporate personality is not absolute in nature because it can be disregard in following cases:1. Protection of revenue: (To prevent evasion of taxation) The Courts may ignore the corporate entity of a company where it is used for tax evasion. (Juggilal V. Commissioner of Income Tax, B.F. Guzdar v. Commissioner of Income Tax Bombay). 2. Prevention of fraud or improper conduct: The legal personality of a company may also be disregarded in the interest of justice where the machinery of incorporation has been used for some fraudulent purpose like defrauding creditors or defeating or circumventing law. Professor Gower has rightly observed in this regard that the veil of a corporate body will be lifted where the 'corporate personality is being blatantly used as a cloak for fraud or improper conduct'. Thus where a company was incorporated as a device to conceal the identity of the perpetrator of the fraud, the Court disregarded the corporate personality (Jones v. Lipman) (Gilford Motor Co. v. Home). 3. Determination of character of a company whether it is enemy: A company may assume an enemy character when persons in de facto control of its affairs are residents in an enemy country. In such a case, the Court may examine the character of persons in real control of the company and declare the company to be an enemy company. (Daimler co. Ltd. v. Continental Tyer & Rubber co. Ltd). 4. Where the company is sham: The Courts also lift the veil or disregard the corporate personality of a company where a company is a mere cloak or sham (hoax). (Gilford Motor Co. Ltd. v. Home). 5. Company avoiding legal obligation: Where the use of an incorporated company is being made to avoid legal obligations, the Court may disregard the legal personality of the company and proceed on the assumption as if no company existed. 6. Company acting as agent or trustee of the shareholders: Where a company is acting as agent for its shareholders, the shareholders will be liable for the acts of the company (F.G. Films Ltd., In re.) 7. Avoidance of welfare legislation: Where the courts find that there is avoidance of welfare legislation, it will be free to lift the corporate veil. (Workmen of Associated Rubber Industry Ltd. v. Associated Rubber Industry Ltd.). 8. Protecting public policy: The courts invariably lift the corporate veil or a disregard the corporate personality of a company to protect the public policy and prevent transactions country to public policy. (Connors v. Connors Ltd.). 9. In quasi-criminal cases: The courts pierce the corporate veil in quasi-criminal cases in order to look behind the legal person and punish the real persons who have violated the law. 10. Trading with enemy country. 11. Evasion of taxes. 12. Forming a subsidiary company to act as its agent. 13. The benefit of limited liability is destroyed by reducing the number of members below 7 in the case of public company and 2 in the case of private company for more than six months. 14. Under law relating to exchange control. 15. Device of incorporation is adopted to defraud creditors or to avoid legal obligations. Answer : 2 (6 Marks) Members who are aware of the fact are personally and severally liable for the whole of the debts contracted after 6 months of such reduction. 3|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Answer : 3 (6 Marks) According to Section 3 of the Payment Bonus Act, 1965, where an establishment consists of departments or undertakings or has branches irrespective of whether they are situated in the same place or in different places, all such departments or undertakings or branches are to be treated as part of the same establishment for the purpose of computation of bonus under the Act. But proviso to the section states that where for any accounting year a separate balance sheet and profit and loss account are prepared and maintained in respect of any such department or undertaking or branch, then, such department or undertaking or branch shall be treated as a separate establishment for the purpose of computation of bonus under this Act for that year, unless such department or undertaking or branch was, immediately before the commencement of that accounting year treated as part of the establishment for the purpose of computation of bonus. Referring to the provisions of Section 3, Company is engaged at three different units located at three separate places in the country where separate balance sheet and profit & loss account are being maintained for the three units separately and hence the proviso to Section 3 will be applicable in this case. For the purpose of Bonus under the Act, the units will be treated as three separate establishments and accordingly, the employees of the unit incurring losses cannot claim bonus on the ground that the unit incurring loss is a part of one single establishment. However, the employees of the loss making unit can claim the minimum bonus as per section 10 of the Payment of Bonus Act, 1965. Answer : 4 (6 Marks) (1) A probationer is an employee within the meaning under section 2(13) and as such is entitled to bonus per Section 8 of the Payment of Bonus Act [Bank of Madura Ltd. vs. Employee's Union, 1970]. It is important to understand the difference between a probationer and an apprentice. A probationer is an employee who is not yet permanent but is under the probation. If he performs well, he will get to be permanent in his employment. On the other hand an apprentice is a person who is a trainee in a factory learning work on a machine and he is excluded from the definition of "employee". (2) An apprentice, is not included in the definition of "employee" under section 2(13) and hence is not entitled to bonus per Section 8 of the Payment of Bonus Act. [Wheel & RIM Co. v. Government of T.N. (1971) 2 LLJ 299 40 FJR 18] (3) According to Section 14, when an employee had been laid off under: (i) an agreement; or (ii) as permitted by the standing orders under the Industrial Employment (Standing Orders) Act; or (iii) under the Industrial Disputes Act, or (iv) under any other applicable law then the days on which he has been laid-off shall be deemed to be the lays on which the employee has worked during the accounting year. In the given case, the employee had been laid off for 20 days and had attended work for 22 days in the entire accounting year equaling to 42 total working days. An employee is entitled to bonus when he has worked in the establishment for not less than thirty working days in the year (Section-13). So, in this case, the employee is entitled to get bonus provided his lay off is covered in one of the above mentioned grounds. COSTING Answer : 1 (3 × 2 = 6 Marks) (a) Bills of material 1. It is document by the drawing office 2. It is a complete schedule of component parts and raw materials required for a particular job or work order. Material Requisition Note 1. it is prepared by the foreman of the consuming department 2. It is a document authorizing Store-keepr to issue Material to the consuming department. 4|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST 3. It often serves the purpose of a Store Requisition as it shown the complete schedule of materials required for a particular job i.e. it can replace stores requisition 4. It can be used for the purpose of quotation 5. It helps in keeping a quantitative control on materials draw through stores Requisition. 3. It cannot replace a bill of material. 4. It is useful in arriving historical cost only. 5. It shows the materials actually drawn from stores. (b) Gantt Task and Bonus System: This system is a combination of time and piecework system. According to this system a high standard or task is set and payment is made at time rate to a worker for production below the set standard. Wages payable to workers under the plan are calculated as under: Output Payment (i) Guaranteed time rate Output below standard (ii) Output at standard (iii) Output over standard Time rate plus bonus of 20% (usually) of time rate High piece rate on worker’s output. (It is so fixed so as to include a bonus of 20% of time rate) Answer : 2 (6 Marks) Std. time per piece Efficiency of worker Time taken before use of Jig. Std time per piece offer use of Jig. Time to be taken offer use of Jig. Saving in time per piece = = = = = = Saving in time (in Hrs.) on total output = 15000 10 60 = 20 per hour Wage rate per hour = 160 8 Total saving (in Amt.) = Award to employee (1½ month saving in labour cost) 80 minute 80% 100 minute 72 minute 90 minute 10 minute = 2500 Hrs. 2500 × 20 = 50000 Answer : 3 (6 Marks): Total Cost for 1250 kg. 25000.00 6250.00 2500.00 33750.00 (2500.00) Cost per kg. 20.00 5.00 2.00 27.00 (2.00) Add: Delivery charges Cost of container @ Rs. 60 for 50 kg. 31250.00 312.50 31561.50 250.00 1500.00 25.00 0.25 25.25 0.20 1.20 Less: Cost of material returned (33312 = 50 ÷ 1250) × 50 33312.50 (3132.50) 26.65 - Add: Cost of handling @ 0.25% 31980.00 79.95 26.65 0.07 32059.95 26.72 Invoice Price Add: Excise duty Add: Sales tax Less: Trade discount @ 10% on service price Add: Insurance @ 1% on above 5|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Less: Credit for container returnable Total Landed cost (960.00) (0.80) 31099.95 25.92 Credit for Containers = (40 ÷ 50) × 12 = 960. Answer: 4 (7 Marks): (a) output per worker (b) No of workers (c) Total output (d) Selling Price (e) variable cost/ unit (f) contribution per unit (g) Total contribution (h) Increased contribution (i) Increase n capital cost Present 300 160 48000 12.5 7.5 5 240000 - Proposed 480 120 57600 12 7.5+.30 (30% of 1) = 7.8 4.2 241920 1920 16000 IDT Answer 1: (8 Marks) ‘Consideration’ means everything received or recoverable in return for a provision of service which includes monetary payment and any consideration of non- monetary nature or deferred consideration as well as recharges between establishments located in a non-taxable territory and taxable territory. In the backdrop of this definition, given situations are examined hereunder: (i) No, as the donation is not given in return for provision of any service. (ii) No, as in this case also gifts are given out of free will and not in lieu of any provision of service. (iii) Yes, as there is a direction to carry out a specific activity, i.e., a research in a particular field in this case. (iv) Yes. Though grants given for a research where the researcher is under no obligation to carry out a particular research is not a consideration, grant given with counter obligation on the researcher to provide IPR rights on the outcome of research undertaken with the help of such grants is a consideration for the provision of service of research. Answer 2: (8 Marks) Computation of service tax payable by Big Agro Handlers for June, 2014 Sl. Particulars No. (i) Supply of farm labour (ii) Warehousing of biscuits (iii) Sale of rice on commission basis (iv) Training of farmers on use of new pesticides and fertilizers developed through scientific research (v) Renting of vacant land to a stud farm (vi) Testing undertaken for soil of a farm land (vii) Leasing of vacant land to a dairy farm Total Service tax @ 14% Amount (Rs.) 1,65,000 68,000 1,31,500 3,64,500 51030 Answer 3: (9 Marks) As per section 66D of Finance Act, 1994, service of transportation of passengers, with or without accompanied belongings, by inter aliarailways in a class other than an air conditioned coach; metro, monorail or tramway; metered cabs or auto rickshaws. are included in the negative list of services. 6|Page MITTAL COMMERCE CLASSES IPCC – MOCK TEST Therefore in the given case, service tax leviability on the various passenger transportation services used by Mr. A will be determined as under: Rail travel in AC train – Not covered under negative list and thus, liable to service tax. Travel in a car rented for the whole day on a lumpsum consideration – Since travel by only metered cabs is covered in negative list, travel in a car rented for the whole day on a lumpsum consideration will be liable to service tax. Metro travel – Covered in negative list and hence, not taxable. Air travel – Not covered under negative list and thus, liable to service tax. Radio taxi travel – Not covered in negative list and thus, liable to service tax. Rail travel in sleeper class - Covered in negative list and hence, not taxable. 7|Page