F&D Costs

advertisement

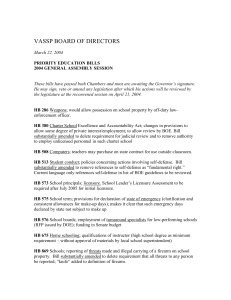

APRIL 2012 CIBC 2012 ENERGY CONFERENCE CORPORATE PRESENTATION DISCLAIMER Certain information regarding RMP Energy Inc. (“RMP”) (the “Company”) contained within this corporate presentation may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include internal estimates and forecasts and may also include estimates, plans, expectations, opinions, forecasts, projections, indications, targets, guidance or other similar statements that are not statements of fact. The forward-looking statements contained within this corporate presentation are based on Management’s assessments of future plans that involve geological, engineering, operational and financial estimates or expectations of future production, reserves, capital expenditures, well project economics, cash flow and earnings. Although the Company believes that such estimates or expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. A number of risks and uncertainties that may or may not be within the control of the Company may cause these results to vary materially from those predicted herein and the reader and/or viewer is therefore cautioned that such information is speculative in nature. Please refer to the Risk Factors outlined in RMP’s Annual Information Form for the year ended December 31, 2010, which is available on the System for Electronic Document Analysis and Retrieval (“SEDAR”). The disclosed and presented net present value of future net revenue or cash flows attributable to the Company’s reserves are stated without provision for interest costs and general and administrative costs, but after providing for estimated royalties, production/operating and transportation costs, future development costs, other income, and well abandonment costs. It should not be assumed that the undiscounted or discounted net present value of future net revenue or cash flows attributable to the Company’s reserves, as estimated or evaluated by the Company or their independent qualified reserves evaluators, represents the fair market value of those reserves. Actual reserves may be greater than or less than the estimates provided herein. 2 DISCLAIMER The well economics provided in this presentation are based on the average historical estimates of reserves for wells drilled in the respective areas in which RMP has an interest and there is no certainty that future wells will have similar economics. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation. Finding and development costs have been prepared in accordance with National Instrument 51-101. The aggregate of the exploration and development costs incurred in the most recent financial year and the change during that year in estimated future development costs generally will not reflect total finding and development costs related to reserves additions for that year. The estimates of original oil in place ("OOIP") and original gas in place ("OGIP") with respect to the Montney Growth Fairway in this presentation are estimates prepared by the Alberta Energy Resources Conservation Board. Such estimates have been provided to highlight the resource potential in the Montney Growth Fairway in which RMP has an interest. RMP cannot confirm whether such estimates have been prepared by a qualified reserves evaluator or whether such estimates have been prepared in accordance with the Canadian Oil and Gas Evaluation Handbook. Reserves and production data are commonly stated in barrels of oil equivalent (“BOE”) using a six to one conversion ratio when converting thousands of cubic feet of natural gas (“MCF”) to barrels of oil (“BBL”) and a one to one conversion ratio for natural gas liquids (“NGLs”). Such conversion may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 mcf: 1 bbl is based on energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. 3 FORMATION OF COMPANY Formed May 11, 2011 with the combination of Orleans Energy Ltd. and RMP Energy Ltd. Trading Symbol RMP.TO Shares Outstanding 96.7 million Options 8.2 million Warrants 2.9 million Directors’ & Officers’ ownership (fully diluted) 12% 4 COMPANY Significant Waskahigan and Ante Creek light oil development opportunity • Near-term focus Excellent natural gas resource potential Strong balance sheet • Line of credit of $80 million • Drawn $45 million (as of March 31, 2012) Large tax pool balance • $305 million of tax pools 5 MANAGEMENT TRACK RECORD Senior management team has worked together for over 20 years Successfully grown and managed companies from 1,000 boe/d to 120,000 boe/d Team has invested over $5.0 billion in WCSB since 1992 Team is a proven value creator throughout commodity price cycles 6 2012 FORECAST E&D Capital Spending Production: Annual Avg. (boe/d) December 2011(boe/d) Cash Flow Per basic share Assumptions: Crude Oil ($WTI/bbl) Natural Gas ($AECO/GJ) Net Debt Line of Credit 2011 Actual 2012 Budget % Change $ 100 million $ 75 million (25) 3,472 5,000 5,000-5,500 44-58 $ 24.4 million $ 0.30 $ 55-$ 65 million $ 0.57 - $ 0.67 125-166 90-123 $ 95.05 $ 3.50 $ 94.00 $ 3.00 (1) (14) $ 49.1 million $60 - $70 million 22-43 $ 80 million $ 80 million 7 RESERVES SUMMARY Total proved plus probable oil and gas reserves increased to 22.68 million boe, 36% increase over the 16.68 million boe at Dec. 31, 2010 Total crude oil reserves increased by 814% to 9.41 million bbls from 1.03 million bbls (proved plus probable) 2011 F&D costs of $23.34/boe, prior to natural gas revisions (proved plus probable) Replaced 573% of 2011 annual production on a proved plus probable basis and 405% on a proved basis, net of revisions Year-end net asset value of $3.93 per share (discounted 8%) and $3.47 per share (discounted 10%) (fully diluted) 8 CORE AREAS Light oil exploration and development • Waskahigan • Ante Creek • Big Muddy Natural gas potential • Kaybob • Pine Creek • Ricinus 9 MONTNEY OIL FAIRWAY Significant land position in the Montney oil fairway Estimated 416 Mstb OOIP* on RMP acreage 59.6 net (63.25 gross) Montney sections in fairway; 94% working interest 215 locations Significant low risk development inventory * Internal estimates combined with independent engineering. 10 WASKAHIGAN MONTNEY OIL Top tier light oil play in WCSB Large accumulation: initial resource study of oil estimate 264 Mstb OOIP with potential to significantly grow Three years of low risk infill drilling inventory (40+ locations) • Up to 130 additional locations with step out drilling High netbacks ~$50/boe; low operating costs ~$5/boe Exceptional economics 11 WASKAHIGAN MONTNEY OIL 51.25 gross sections (47.6 net) 93% W.I. Drilled wells: 22 Open Range, Harvest and Athabasca Oil locations have significantly de-risked the northern and eastern part of property and increased development program. Recent land acquisition significantly increases exposure to play. Potential for up to 170 additional locations. Pool details • Avg. OOIP/Section: 8,000 MBOE • 40o API Light Oil • GOR: 2,500 scf/bbl 12 WASKAHIGAN MONTNEY OIL Development Over 40 locations in licensing process 130+ incremental locations in full development scenario Pad drilling configuration will significantly reduce surface access and tie-in costs Infrastructure is in place for 2012 drilling program. 10 pads are built and pipelines are in the ground Evaluating smaller fracs to reduce costs Optimizing production infrastructure 13 WASKAHIGAN MONTNEY OIL Oil Battery Design capacity: • 2,500 bbl/d oil • 10 mmcf/d natural gas • $18.5 million for battery and gathering line Has significantly reduced transportation and operating costs Water disposal permit to inject approved • $100,000 per month savings Expansion: • Future capacity ~ 6,000 bbls/day • Oil expansion ~ $4 million 14 WASKAHIGAN MONTNEY OIL 15 WASKAHIGAN MONTNEY OIL 16 WASKAHIGAN MONTNEY OIL 17 ANTE CREEK MONTNEY OIL Development 6 sections 100% W.I. Extension of Ante Creek oil pool Drilled 4-35 well: • Tested 1,900 boe/d, 1,620 bbl/d • 85% oil (38˚ API) On-stream Q4 2012 Significant resource: • ~ $4 million per well • 23 potential locations • 280,000 boe (proved plus probable) • 130% rate of return 18 CONCLUSION Strong production growth through oil development at Waskahigan and Ante Creek • Focus on costs Tremendous natural gas potential at: • Kaybob • Pine Creek • Ricinus 19 APPENDIX 20 DIRECTORS Craig Stewart Executive Chairman of RMP Energy Inc. Doug Baker Independent Businessman John Brussa Partner, Burnet Duckworth & Palmer LLP John Ferguson President and CEO of RMP Energy Inc. Andrew Hogg President and CEO of Coda Petroleum Inc. Jim Saunders President and CEO of Twin Butte Energy Ltd. Lloyd Swift Independent Businessman 21 MANAGEMENT TEAM Craig Stewart Executive Chairman John Ferguson President and CEO Dean Bernhard Vice President, Finance and CFO Brent DesBrisay Vice President, Geosciences Jon Grimwood Vice President, Exploration Ross MacDonald Vice President, Engineering Bruce McFarlane Vice President, Business Development Derek Riddell Vice President, Operations 22 PINE CREEK WILRICH NATURAL GAS 6.25 net sections, 56% W.I. Wilrich development 5 wells currently producing from Wilrich, 1 well drilled in 2012 (40% W.I.; Peyto operated) Currently producing ~ 700 boe/d 23 KAYBOB MONTNEY NATURAL GAS 28 sections 92% W.I. Significant low risk gas inventory 60 locations; 90 BCF Infrastructure is established; quick tie-in and onstream projects Industry is still very active in area; i.e TQN, TET, CLT Very attractive play when gas prices recover 24 RICINUS LIQUID RICH NATURAL GAS 52 sections, 64% W.I. “Deep Basin” stratigraphy provides a “resource style” area Reviewing 3-D seismic Potential zones: • Cardium • Viking • Glauconite • Ellerslie • Cadomin 25 BIG MUDDY BAKKEN OIL PROSPECT 26 RESERVES SUMMARY December 31, 2011 Reserves Summary (1) (Company interest before royalties) Natural Gas (Bcf) Light Crude Oil (Mbbls) NGLs (Mbbls) Oil Equivalent (Mboe) (6:1) 29.295 1,596.7 532.1 7,011.3 0.561 207.4 1.5 302.5 Proved undeveloped 21.395 3,232.2 285.8 7,083.8 Total Proved 51.252 5,036.3 819.4 14,397.6 Probable 21.904 4,370.2 258.3 8,279.3 Total Proved plus Probable 73.156 9,406.5 1,077.7 22,676.9 54% 41% 5% (Columns may not add due to rounding) Proved developed producing Proved developed non-producing Commodity Weighting Note (1) Estimated using InSite’s forecast prices and costs as of December 31, 2011. 27 NET PRESENT VALUE SUMMARY December 31, 2011 Net Present Value Summary (Company interest before royalties) (Columns may not add due to rounding) 0% 8% 10% 15% 20% $ 214,478 $ 150,980 $ 141,124 $ 122,094 $ 108,423 12,534 7,876 7,191 5,908 5,021 Proved undeveloped 193,905 71,779 56,073 28,506 11,113 Total Proved 420,917 230,636 204,388 156,508 124,557 Probable 342,428 132,241 109,017 70,402 47,435 $ 763,345 $ 362,877 $ 313,405 $ 226,910 $ 171,991 Discount factor: Proved developed producing Proved developed non-producing Total Proved plus Probable Note (1) Estimated using InSite’s forecast prices and costs as of December 31, 2011. 28 F&D COSTS F&D Costs (amounts in $000s except reserve units and unit costs) Fiscal 2011 Proved Proved + Probable $ 86,596 $ 86,596 Waskahigan oil battery and gathering lines infrastructure 18,531 18,531 Net land dispositions (5,163) (5,163) 1,037 1,037 $ 101,001 $ 101,001 Future development cost - ending period 149,734 239,855 Less: Future development cost - beginning period (81,953) (97,573) $ 168,782 $ 243,283 6,683.9 11,737.6 (1,523.5) (4,483.0) Net reserve additions - including revisions (Mboe) 5,160.4 7,254.6 F&D Costs - excluding natural gas technical revisions ($/boe) F&D Costs - including natural gas technical revisions ($/boe) $ 28.81 $ 32.71 $ 23.34 $ 33.53 Exploration and development expenditures Capitalized general and administrative and office costs Total finding and development expenditures All-in total, including change in future development cost Reserve additions - excluding acquisitions / dispositions and natural gas technical revisions (Mboe) Natural gas technical revisions - (Mboe) 29 FOURTH QUARTER 2011 FINANCIAL RESULTS Three Months ended December 31, 2011 2010 % Change Cash flow from operations $ 11,558 $ 7,134 62 Per share – basic and diluted $ (thousands except share data) Net Income (loss) Net debt – period end 0.12 $ 0.11 9 $ (70,980) $ 20,153 - $ 49,087 $ 8,449 481 30 FOURTH QUARTER 2011 OPERATING RESULTS Three months ended December 31, (6:1 oil equivalent conversion) E&D Capital Spending ($ thousands) 2011 2010 % Change $ 42,157 $ (25,546) - 1,496 856 75 19,337 15,278 27 4,719 3,402 39 Average Daily Production: Crude Oil & NGLS(bbls/d) Natural Gas (mcf/d) Oil Equivalent (boe/d) 31 FISCAL 2011 FINANCIAL RESULTS Year ended December 31, 2011 2010 % Change Cash flow from operations $ 49,511 $ 47,770 4 Per share – basic and diluted $ $ (thousands except share data) Net Income (loss) Net debt – period end 0.30 0.41 (27) $ (74,974) $ 20,001 - $ 49,087 $ 8,449 481 32 FISCAL 2011 OPERATING RESULTS Year ended December 31, (6:1 oil equivalent conversion) E&D Capital Spending ($ thousands) 2011 2010 % Change $ 99,964 $ 15,874 530 877 681 29 15,568 18,321 (15) 3,472 3,734 (7) Average Daily Production: Crude Oil & NGLS(bbls/d) Natural Gas (mcf/d) Oil Equivalent (boe/d) 33