IT in Saudi Arabia: Status & Trends

advertisement

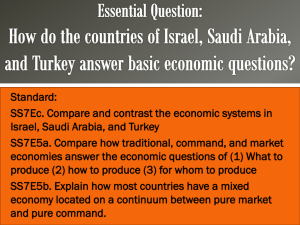

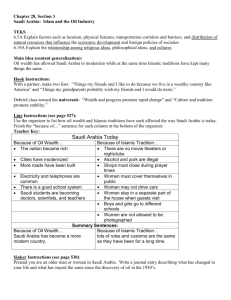

IT in Saudi Arabia: Status & Trends Dr. Sadiq M. Sait College of Computer Sciences & Engineering King Fahd University of Petroleum & Minerals Dhahran, Saudi Arabia October 2002 Outline Introduction Infrastructure IT Industry Human Resources Development eReadiness (eBusiness & eCommerce) eGovernment eLearning Comparative Status 2 Introduction IT in Saudi Arabia is in its developing stages. Government in working in certain directions to ameliorate the status of IT in the country. These directions will help in making ICT (Information & Communication Technologies) a major contributor to GDP (Gross Domestic Product) as well as moving Saudi Arabia from an IT-consumer to IT-producer country in the region. 3 Directions Developing a feasible Infrastructure Managing the IT Industry Improving Human Resources Integrating IT in education Expanding eCommerce & eBusiness 4 Vision To envision the Kingdom of Saudi Arabia at the forefront in the development and exploitation of Information Technology (IT), and the adoption of IT as the basis and the drive for the development of industry, commerce, education, public sector, and the society-at-large in accordance with Islamic values. 5 Infrastructure Infrastructure is one of the major factors that affects IT and its growth. It comprises issues like Easy and affordable access Regulations Security aspects, and Required human resources Investment in IT infrastructure will aid the development of industry and commerce provide opportunities in areas such as education and training 6 Current IT Infrastructure Dimensions for analyzing the development and status of the Internet infrastructure within the Kingdom are (on a scale of 0-4 with 4 being the best): Pervasiveness (number of users per capita) Geographic Dispersion (physical dispersion of infrastructure & access) Sectoral Absorption (connectivity in various social sectors) Sophistication of Use (integration and innovation) Connectivity Infrastructure (capacity and robustness) Organizational Infrastructure (degree of competition) Source: Global Information Technology Assessment Group (formerly MOSAIC group) 7 Comparison of IT Infrastructure Source: ITU, 2001 8 Status of Infrastructure STC (Saudi Telecom Co.) says that Saudi Arabia’s telecommunication infrastructure will be capable of supporting potentially 1.3 Million Internet users by the end of this year. In recent months, STC secured a $657 Million loan from a consortium of Saudi Arabia’s banks that will help finance the work. Source: ITP 9 Infrastructure: Access Presently the most common telecommunication access method in the Kingdom is the fixed telephone line The number of fixed access lines stood at 3.2 Million at the end of second quarter of 2001 (i.e., 15.2% of the population) and is expected to reach around 5 Million in 2005. The increase in the size of the PSTNs (Public Switched Telephone Network) is a direct result of a double-digit compound annual growth since 1996. Source: STC Data, 2001 10 Infrastructure: Teledensity Teledensity (number of standard access lines per 100 inhabitants) started out with about 7 in 1990 and progressed to 13 in 2001. The graph shows the growth and its prediction Standard access lines per 100 inhabitants 25 20 15 10 5 0 1990 1997 Source: STC Data, US Census Bureau 1998 1999 2000 2001* 2003* 2005* 11 Infrastructure: Mobile Services The number of subscribers to mobile services in the Kingdom reached 2.5 Million in 2001 and is expected to reach around 6 Million by 2003. The graph below shows the number of mobile subscribers per 100 inhabitants. Year 1999 Year 2000 50 40 30 20 Yemen UAE Syria Sudan Saudi Arabia Qatar Oman Morocco Lebanon Kuwait Jordan Iran Egypt 0 Bahrain 10 Algeria Mobile Subscribers per 100 inhabitants 60 12 Infrastructure: Other Statistics The number of Internet subscribers (those paying for access to the Internet) rather than users is a precise indicator of access Until March 2001, the number of Internet subscribers was 275,000 (user to subscriber ratio is estimated to be 2.5) A measure of the Internet user market is the Internet coverage - the portion of the population of a country within easy access of the Internet. Coverage in Saudi Arabia is low and stands at 3-4%. Over 75% of the Internet users are male, and most of them are under the age of 35 years. Source: Saudi Network Information Center, Paul Budde Communication Report, March 2001 13 Infrastructure: Tariffs In Saudi Arabia, current Internet dial-up access prices for 30 hours range from SR 175 ($45) to SR 280 ($75). The relative increase in cost is attributed to the adoption of pricing model that includes both ISP charges and call usage charges. Moreover, the charges of international bandwidth are very high. This is reflected in the monthly charges for a 2 Mbps connection to ISP that costs SR 274,860 ($73,296) per month. Internet dial-up access prices in some OECD countries Source: ITU 14 Infrastructure: Security Strong encryption servers use encryption which is greater than 40 bits. Such servers are not hackable, even by intelligent hacking tools. A survey conducted by Netcraft on the number of secure servers (weak and strong) in 166 countries of the world showed that Saudi Arabia stands at 87th position in the strong encryption group. The table summarizes the survey. 15 Infrastructure: Initiatives The government in the Kingdom is working on improving the IT infrastructure, as success of various other IT related aspects, like IT Industry, eBusiness, eCommerce and eLearning is directly dependent on it. Some of the initiatives that could be taken and are being considered include: Opening up competition in all telecommunication services sector to expand access Issuance of licenses for different wireless services to provide connectivity Establishment of community & edutainment centers Establishment of a very high-speed network to link research institutions, universities, and Science Parks (under development) Development of a national IT security policy and a mechanism to counter cyber crime 16 IT Industry IT industry is one of the largest and fastest growing sectors in the world. The major industries that comprise the IT sector are generally acknowledged as: Manufacturing • Computer Hardware • Telecommunication Equipment Services • IT Professional Services • Computer Software • Telecommunication Services 17 Growth in IT Industry Saudi Arabia, Egypt and the UAE Rest of the Arab Middle East and North Africa 10000 8000 6000 4000 2000 0 2000 2001 2002 2003 2004 2005 Sales of IT Hardware, Software, & Support services in the Arab Middle East & North Africa Source: Pyramid Research 2000 18 IT Industry Challenges The high competition in the IT sector from the developed as well as the developing countries Supporting traditional practices of investment in land and infrastructure assets with investment in intellectual assets The availability of an infrastructure that is necessary to support the IT industry 19 Human Resources for IT The success of a nation today will highly depend upon the education, training, productivity, and competitiveness of its IT workforce. A well-thought planning process and commitment are the most needed ingredients to develop and retain a reasonable level of IT workforce in the Kingdom. 20 Human Resources: Status Surveys conducted showed that there is a serious dearth of human resources in the IT public sector of the Kingdom. The latest survey is in agreement with the 1994 study on the need to adopt a national IT human resources development strategy that coordinates national IT programs and directs Saudi education institutions to satisfy IT human resources requirements. 21 Human Resources: Funding The importance of human resources in the development of the Kingdom is very much reflected in the national development plans There has been a steady increase in the share of expenditure on human resources development in the previous five consecutive national development plans: SR 115 Billion (18.4%) of the total expenditure in the third plan SR 115.1 Billion (33%) during the fourth plan SR 164.6 Billion (33%) during the fifth plan SR 222.2 Billion (53.8%) during the sixth plan, and currently it is SR 276.9 Billion (56.7%) in the seventh development plan Source: www.planning.gov.sa/Planning 22 eReadiness Definition: The extent of presence of an environment that empowers individuals and organization for the utilization of IT and the availability of necessary technologies measures how e-ready an organization or a country at large is to participate in digital economy. This is termed as eReadiness. Key factors for readiness are innovation and impact of telecommunication infrastructure current connectivity governmental human resources and budget resources 23 eReadiness: KSA Status eBusiness Leaders eBusiness Contenders eBusiness Followers eBusiness Laggards US(8.73) Australia UK Canada Norway Singapore Finland Denmark Netherlands Switzerland Germany Hong Kong(7.45) Ireland(7.28) France Austria Taiwan Japan Belgium New Zealand South Korea Italy Israel Portugal(6.21) Greece Czech Republic Hungary Chile Poland Argentina Slovakia Malaysia South Africa Brazil Turkey Colombia Philippines Egypt(3.88) Peru Russia Sri Lanka Saudi Arabia(3.80) India Thailand Venezuela Bulgaria(3.38) China Ecuador Iran Romania Ukraine Algeria Indonesia Nigeria Kazakhstan Vietnam Azerbijan Pakistan(2.66) Ranking is based on country’s score out of 10 Source: The Economist Intelligent Unit, 2001 24 eBusiness Definition: eBusiness is about enabling organizations to cohesively bring together their processes and the Internet technologies for cost effectiveness, efficiency and better relationships among partners These partners could be business organizations, customers, suppliers, government departments or citizens The main thrusts of the eBusiness are eCommerce & eGovernment sectors 25 eBusiness: Status The strength of the Saudi eBusiness market lies in the Kingdom being the center of the Islamic World with the largest economy (over $168 Billion) in the Arab world with virtually no direct taxes The large Saudi population compared to other Arabian Gulf Countries and the presence of large IT companies based in Saudi Arabia gives Saudi eBusiness an advantage and competitive strength in the region Source: Saudi American Bank Report, 2001 26 Computer usage: Business sector Saudi Aramco, the Kingdom’s oil company, is considered to be the largest buyer and user of computers in the whole Arabian gulf region It has about 10,000 computer units and the annual budget spent on purchasing and updating the systems crosses SR 3 Million Saudi Arabian Airlines is another major buyer of computers. In private sector, banks are considered to be the largest users of computers. There are 11 banks operating with a total of 1200 branches operating throughout the Kingdom. Source: Icon Group International, Inc. 27 eBusiness: Challenges The success of eBusiness in Saudi Arabia requires substantial improvements in IT infrastructure easy and affordable Internet access supported by trained and skilled local IT professionals Admission to WTO will lower the legal barriers, thus local firms will be exposed to higher international competition. 28 IT in Public Sector: Challenges A recent survey conducted showed that there are great challenges in the public sector. These include: (in the order of importance) inappropriate IT plans insufficient user training lack of user involvement inadequate top management involvement high levels of organizational rigidity insufficient IT human resources low IT management power 29 eCommerce eCommerce in Saudi Arabia can be traced to the mid 90’s when SAMA (Saudi Arabian Monetary agency), successfully carried out two financial projects relating to eCommerce. The SPAN (Saudi Payment Network), which became operational in 1993, allowed commercial banks to use online EFT (Electronic Funds Transfer) capabilities for their ATM (Automatic Teller Machines) and another points of sale terminals. Another EFT mechanism, SARIE was launched in 1997 for inter-bank settlement, and was implemented with the help of Logica. Source: Icon Group International, Inc. 30 eCommerce: Directions A permanent high-level committee addressing electronic and technical issues has been established at the Ministry of Commerce, whose tasks are to: Track market developments Fulfill ethical and legal requirements Review procedures for common code of conduct on documentation verification, digital signatures and assurances necessary for execution of contracts Formulate standard policies to regulate eCommerce transactions and for related arbitration, credit system and legal liability problems Source: Icon Group International, Inc. 31 eCommerce: Directions Saudi Telecom Company (STC) is aware that eCommerce in Saudi Arabia requires an Internet infrastructure with national coverage at a high bandwidth. Efforts are underway to install a highly reliable ATM core that will increase the number of switches from 8 to 61. Saudi Aramco, the national oil company, is spearheading the use of eCommerce and also compelling local vendors to do the same in order to expedite and streamline procurement Although still in its initial stages, industry sources have also disclosed that electronic virtual cards will be used for secure online transactions in the near future Source: Icon Group International, Inc. 32 eCommerce: Directions KACST (King Abdulaziz City for Science & Technology) is planning to place a PKI (Public Key Infrastructure) that will enable secure Kingdom-wide eCommerce SAMA (Saudi Arabia Monetary Agency) is working online payment system for B2B eCommerce STC expects that the number of leased lines will surpass 30,000 shortly Ministry of Commerce is planning to come up with the rules and regulations to govern eCommerce in the Kingdom. 33 eGovernment Definition: eGovernment is the transformation of public sector internal and external relationship through Internetenabled operations, information and communication technology in order to optimize government service delivery and governance. It is about transforming organizations: Individuals/Citizens: Government-to-citizen (G2C). Businesses: Government-to-Business (G2B). Intergovernmental: Government-to-Government (G2G). Government-to-Employee (G2E). Intra-governmental: Internal Efficiency and Effectiveness (IEE). 34 eGovernment Driving Forces Internet access tariffs are being brought down Growth in IT Industry and increase in IT expenditure 2002 Global eCommerce spending > $ 1 Trillion Saudi IT spending is approximately 1.6% Source: Global Reach. 35 Integrating IT in Education eLearning enhances the quality of student understanding through the use of a interactive and lively learning approach with multimedia, graphics, simulations, videos, etc Compared to conventional Instructor-Led Classroom (ILC) education, eLearning resulted in about 30% greater learning in up to 40% less time Performance of computer-based training (CBT) learners on examinations was found to be higher by about 26% to 37% on the average Likewise, long-term retention was also found to be an average of 15% higher for CBT Source: Effectiveness of Computer-Based Training and PLATO software 36 eLearning For eLearning “The Watani” project, a huge investment of potentially SR 5 Billion over the next five years, is underway to connect all of Kingdoms’ school, which is supported by HRH, Crown Prince Abdullah. This will provide access to millions of students all over the country. The aim is to make technology, an integral part of student’s everyday life. 37 General Comparative Status World Bank Institute’s (WBI) program on ‘Knowledge for Development’ uses a knowledge assessment methodology (KAM) which consists of a set of 69 structural and qualitative variables These variables provides the current status of a country’s economy, human resources, communication infrastructure and knowledge-based activities It helps to identify the problems and opportunities that a country faces, and where it may need to focus attention or future investments The comparison is undertaken for a group of 100 countries which include most of the developed OECD (Organization for Economic Cooperation and Development) economies and about 60 developing economies 38 Saudi Arabia: Status Source: © Knowledge for Development, WBI, 2002 39 WBI results: Saudi Arabia Over time, based on the knowledge based indices, following are the conclusions: Incentive regime has declined Innovation is still stagnant Education enrollment has improved ICT improved (relatively, but not enough to catch-up with the rest of the world) High investments in Education and ICT do not have the full expected impact seemingly, because of poor business environment 40 Recommendations Before planning, it is worthwhile to look at others plan, as to know in which direction we are going National plans for IT has to be developed and implemented by higher authorities (government) Promotion of IT will speedup, if and only if, it is regulated by higher authorities (government) Extensive emphasis had to be laid on IT training Coordination with related ministries is a must Action program from common issues is required National level security policy must be defined. And others. 41